We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

marbles - credit limit increase - should I accept it?

Comments

-

The giffgaff report shows the history not changing. A newbie looking only at MSE report would be unaware of a 'credit limit history' entry (and if such a history is recorded upon changing - because his/her history hasn't changed yet, so MSE report dosen't have the entry).If there’s no limit change there’s no reason to report it or show the history of it not changing.0 -

Yes, but reducing the limit increases utilisation on that card (if you have a balance) and the total utilisation..... limit reduction is reducing risk, so no need to report outside the normal monthly update.

.......

I've read on many a sites. e.g. https://www.experian.com/blogs/ask-experian/how-utilization-rate-affects-credit-scores/A high utilization rate is a sign that you may be experiencing financial difficulty and is a strong indicator of lending risk. As a result, high utilization hurts credit scores and can cause lenders to be reluctant to extend additional credit.

that increased utilization is not seen favourably. Especially, if it's over 50%:0 -

OceanSound wrote: »

I've read on many a sites. e.g. https://www.experian.com/blogs/ask-experian/how-utilization-rate-affects-credit-scores/A high utilization rate is a sign that you may be experiencing financial difficulty and is a strong indicator of lending risk. As a result, high utilization hurts credit scores and can cause lenders to be reluctant to extend additional credit.

I think you're reading too many blogs.

Let's take two people, 'A' and 'B', who both earn £40,000 a year.

'A' has one credit card with a limit of £1,000, pays their balance in full every month, but their utilisation is always between 50% and 75% (£500 to £750).

'B' has two credit cards with limits totalling £60,000. Their utilisation is always about 30% (about £18,000). They pay over the minimum every month, but never clear their balances.

According to Experian and the blogs you read, 'A' may be 'experiencing financial difficulty', has injured 'credit scores' and lenders would be 'reluctant to extend additional credit' them.

In the real world, 'A' would probably find it easy to get extra credit, whereas 'B' would probably struggle.0 -

OceanSound wrote: »The giffgaff report shows the history not changing. A newbie looking only at MSE report would be unaware of a 'credit limit history' entry (and if such a history is recorded upon changing - because his/her history hasn't changed yet, so MSE report dosen't have the entry).

MSE will show it once one happens.

All mine are on there.0 -

I know yours would be on there. You probably have a long credit history, with many increases (and some or no decreases).MSE will show it once one happens.

All mine are on there.

However, a 19 year old (someone who's started taking out credit when they turned 18) or someone who's just moved to U.K from say France, would be unaware of the 'credit limit history' entry until they experience their first credit limit increase or decrease. Which could be some time.

Also, if they experience a decrease, it could take a while to appear on the report. For example, if the lender reports in the first week of every month, and the limit decrease happens in the second week. It could be 3+ weeks before he/she sees the 'Credit Limit History' entry in the MSE report.

Until he/she sees the entry on the MSE report, he/she may be unaware that the lender reports it every month, or that a Credit limit history record is kept by this CRA (he/she may think only the current limit is reported or kept on file by CRA). This is why it's always good to check the reports of multiple CRA's.0 -

Accepted increased credit limit end of last month (29 March 2019). It became effective immediately. Today, I received an email from clearscore saying 'the credit limit of your newday credit or store card will change on your april report'. It then goes on to say although this is the case for clearscore report, the limit is actually updated on the equifax report right now.

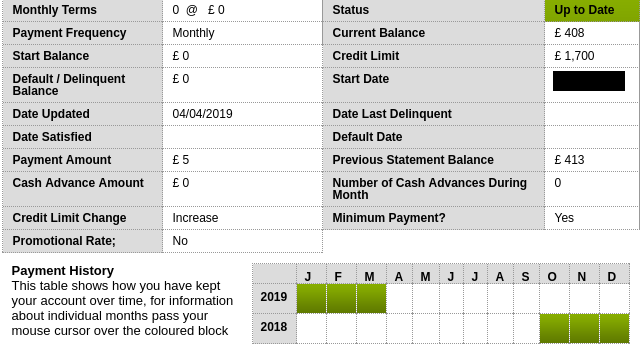

So I login to Equifax and check. The credit limit has definitely been updated (see screen shot below).

As you can see the last update was carried out on 04/04/2019. Presumably that was the date when the credit limit was updated (or maybe even before?. i.e. between 29 March and 04 April. While the monthly update was done on 04 April. I cannot tell from the report when the update before the current update was done).

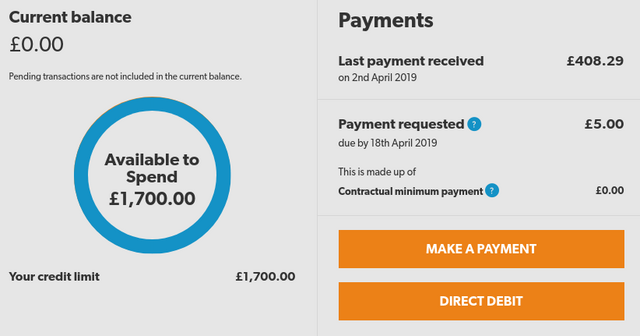

Although, the credit limit increase has been updated, I noticed that my current balance is still showing as £408.00. I did make a payment for £408.29 on Tuesday 02 April. This payment is showing on marbles online banking, with balance: £0.00. The date of payment is also correctly showing as 02 April 2019 (See screen shot below). Seems crazy that the equifax report should continue to show a balance of £408.00 until the 04 May, when I have cleared the full balance already. i.e. before the update date.

Suffice to say, if you're applying for mortgage (or similar), it's probably worth clearing balances a week or two before the usual update date. So in my case I would have needed to clear balance on 28 March (or maybe even before) for it to be included with the 04 April update. If not, it may be a case of waiting a month, checking credit file (to ensure update has happened) then applying for mortgage.

edit: I checked the experian report (signed-up for 30 day credit expert trial). It has 'updated to' = 31/03/2019. The credit limit is showing as £1700. Which is all good. balance is showing as £408. Which is nothing unusual, since the payment was made on 02 April.

With equifax, it does seem that if I had made the payment say on Friday 29 March it may have snuck in with the 04 April update.0 -

You can show a lender a statement to show it’s been paid.

The balances on your credit files are the reported balances at the time of the lender updating the CRA.

No need to clear balances any earlier than scheduled.0 -

Do you do this (show a lender a statement) before applying or only if you are rejected?...You can show a lender a statement to show it’s been paid.

How about if you are approved the loan/credit card, but the higher than what it should be credit used (due to the recent payment not showing in credit file) leads the lender to give you a lower loan/credit limit.

Edit: the credit used will be £408 more than what it should be in this particular instance. However, what if, instead of £408 it was a £5000 debt you paid off and your total credit is £20,000. You may have reduced your debt from £10,000 to £5,000, but the CRA record is still showing as owing £10,000. This is happening for a whole full month.0 -

I hesitate to say this, in case it sounds harsher than I want it to, but maybe some people spend too much time on this.

The account is with the credit card firm, not Clearscore Equifax or Experian, and keeping track of that one account version is enough for most of us.

I would imagine, but I don't actually know (and don't care) that any search for the purpose of a new mortgage can obtain up to the same or previous day information instead of the quantum uncertainty what counts before or after some ambiguous cutoff point 2 to 7 weeks earlier, and I'd also imagine the mortgage decision or quality won't turn on tiny nuances like whether a normal monthly spend of £400 was fully repaid a week earlier than usual.0 -

Just to be clear, my reply will be be keeping the focus on facts, as opposed to subjective opinions and conjecture.

The point is, the lender does not always update the CRA with accurate up-to-date info. Keeping track of only the lenders version could land you in a pickle. That's how come it's advisable to check your credit file(s) before applying for something major like a mortgage. If there are errors/inconsistencies, we can contact the CRA and request correction. (I think this is the best course of action, rather than applying, then contacting the mortgage lender and say you've already paid x,y,z debt even though your credit file shows that you haven't)

To give you another example, just now, I saw another inconsistency on the equifax report. My Tesco Bank credit card balance on statement date 09 March 2019 was £2007.73. Equifax report has the entry for TEsco Bank Cards with 'date updated 01/04/2019' and current balance is showing as £2030. I'm on a 0% introductory purchases offer until July 2019 (so it can't be something to do with balance being different due to interest). My balance has never been £2030.00. The balance on statement date 09 February was £2032.73. Equifax report has entry 'previous statement balance' as £2032. However, it's completely unaware of the DD payment for £25.00 made on 06 March 2019, which bought down the balance to £2007.73.

The report should state current balance = £2008. Not £2030.

TO re-iterate what I've said in post #39, you could have cleared a balance of £5000 a month before applying for a mortgage/credit card/loan and your credit file could still be showing that you owe that amount. To make matters worse, the credit file will tell you it was 'last updated' only last week!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards