We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

P60 change in tax code for pension?

Comments

-

Very true.0

-

It says these are your tax codes for 6th April 2019 to 6th April 2010

I got sent screen shots of it, that cut off the top section, so maybe you are right?0 -

Sounds like a tax code notice (issued by HMRC) rather than a P60 (issued by an employer or pension payer).0

-

I'm sorry, at the risk of sounding a bit dim, what is the difference in a practical sense?0

-

A tax code notice explains how HMRC have calculated each tax code - in your dad's case for three different pensions.

A P60 is provided by an employer or pension payer and shows the taxable income paid in a particular tax year and any tax deducted. If employed it also has National Insurance information on as well.0 -

This is an example P2:

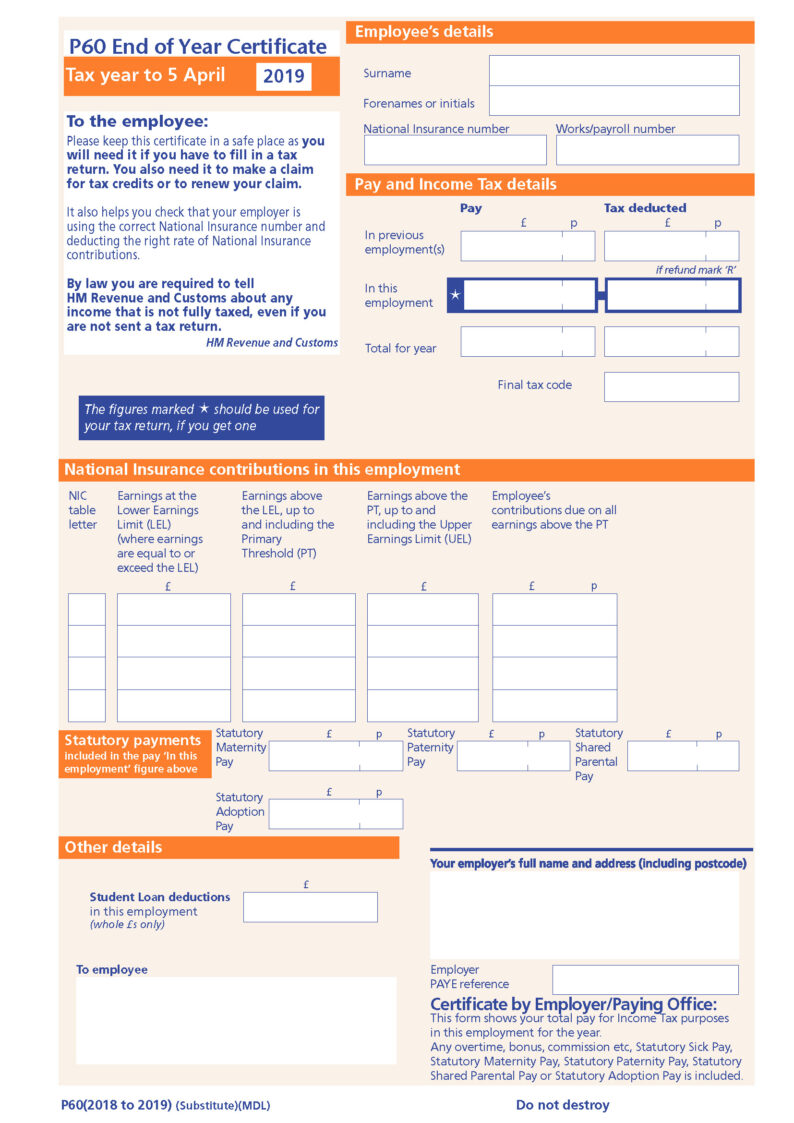

And this is an example P60 (although employers can produce them to their own format as long as they contain the statutory information): 0

0 -

Its the P2 form.

Pensions guy, spoke to his accountant who told my dad to contact HMRC and find out why they have changed his tax code. Which is hugely useful 0

0 -

To be honest this is really nothing to do with the pension companies.

Only your dad knows how much income he will have and until he settles on some figures it is pointless contacting HMRC. In fact he would likely only complicate things even more if he isn't fully prepared.

Two figures seem straightforward for him to calculate, it is only one which is more problematic. But all he can do is think ahead to what he might take from that pension as taxable income during the 2019:20 tax year. That is his estimate.

At the end of the day it is only an estimate, he just needs to provide a more informed one than HMRC have used. If he cannot do that then he needs to accept the tax codes are correct (based on HMRC's estimates of his pension income).0 -

Ballyholme wrote: »Its the P2 form.

Pensions guy, spoke to his accountant who told my dad to contact HMRC and find out why they have changed his tax code. Which is hugely useful

Thanks for confirming the P2.

It is in fact hugely useful as the allocation of tax codes is entirely a matter for HMRC, and it is only by speaking to them that your dad can sort this out.0 -

I meant as in that he pays both a pensions advisor and I presume the accountant who looked at it to deal with this so, ideally they could have made a phonecall to HMRC and come back with option in terms of the draw down withdrawl amount etc.

I'll get him or someone to call HMRC and report back.

Thanks for the replies, even if I sound a bit fed up. Much appreciated.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards