We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

It's ok up to £1m and for 6 months under the FSCS temporary high balance ruleCheekyMikey said:£250k with one institution is an interesting choice in itself…0 -

Ah - fair enough, but it isn't mentioned in either the Chase Saver Account T&Cs (1.0.0) or the General Account T&Cs (1.2.0) documents (which are made available to you in the 'Legal' section of the app) and I think it probably ought to be.Daliah said:

Afraid, it seems you didn't look very hardrefluxer said:

The general Chase T&Cs state "We may also apply spending limits, such as a daily limit on the amount you can withdraw in cash with your card, as well as transaction limits. If we apply these limits, we will let you know what they are."

...but I haven't seen the limits written down anywhere ?

0 -

What Chase are saying is perfectly accurate.MartusJK said:... their own blurb says "You can take out some or all of your money anytime with no fees. "

If you have more than £25k with them, you can take some of your money out. If you have less than £25k, you can take all your money out!0 -

(1.2.0) documents (which are made available to you in the 'Legal' section of the app) and I think it probably ought to be.refluxer said:

Ah - fair enough, but it isn't mentioned in either the Chase Saver Account T&Cs (1.0.0) or the General Account T&Cs (1.2.0) documents (which are made available to you in the 'Legal' section of the app) and I think it probably ought to be.Daliah said:

Afraid, it seems you didn't look very hardrefluxer said:

The general Chase T&Cs state "We may also apply spending limits, such as a daily limit on the amount you can withdraw in cash with your card, as well as transaction limits. If we apply these limits, we will let you know what they are."

...but I haven't seen the limits written down anywhere ?

"it probably ought to be" I think thats probably a major understatement - it absolutely should be included in there - its a "condition" and those are the terms and conditions? If any sort of "condition" isnt included in the T&Cs then it obviously cannot apply, IF any bits from other specialised sets of conditions do apply then they have to be specifically referred to?

0 -

Nick_C said:

What Chase are saying is perfectly accurate.MartusJK said:... their own blurb says "You can take out some or all of your money anytime with no fees. "

If you have more than £25k with them, you can take some of your money out. If you have less than £25k, you can take all your money out!thats one hell of a big inferred IF in there Nick!ANyway my complaint has gone into Chase so will see what they say, maybe they will use "Nicks defence"! In which case it will be financial ombudsman time0 -

If needed faster could use the Chase current account to deposit into an instant access savings account that accepts payment by debit card …..although don’t think there are too many around these days.MartusJK said:HI there, hope its ok if I jump on here about this but I was seriously shocked and inconvenienced today when I discovered theres a hard, non-negotiable £25K daily limit on moving funds out of the 1.5% Chase account, when MSE states Yes to Unlimited withdrawals, and their own blurb says "You can take out some or all of your money anytime with no fees. You can't spend with your card from this account, so you'll need to transfer money to another Chase or UK bank account.". So what is going on here, I put a £250K stash in there on the main assumption it was instantly withdrawable, in part or whole, now it seems that will take 10 days of withdrawal payments, are they allowed to say such seemingly contradictory/misleading wording and is MSE aware??0 -

NS&I saver accepts debit card paymentstg99 said:

If needed faster could use the Chase current account to deposit into an instant access savings account that accepts payment by debit card …..although don’t think there are too many around these days.MartusJK said:HI there, hope its ok if I jump on here about this but I was seriously shocked and inconvenienced today when I discovered theres a hard, non-negotiable £25K daily limit on moving funds out of the 1.5% Chase account, when MSE states Yes to Unlimited withdrawals, and their own blurb says "You can take out some or all of your money anytime with no fees. You can't spend with your card from this account, so you'll need to transfer money to another Chase or UK bank account.". So what is going on here, I put a £250K stash in there on the main assumption it was instantly withdrawable, in part or whole, now it seems that will take 10 days of withdrawal payments, are they allowed to say such seemingly contradictory/misleading wording and is MSE aware??0 -

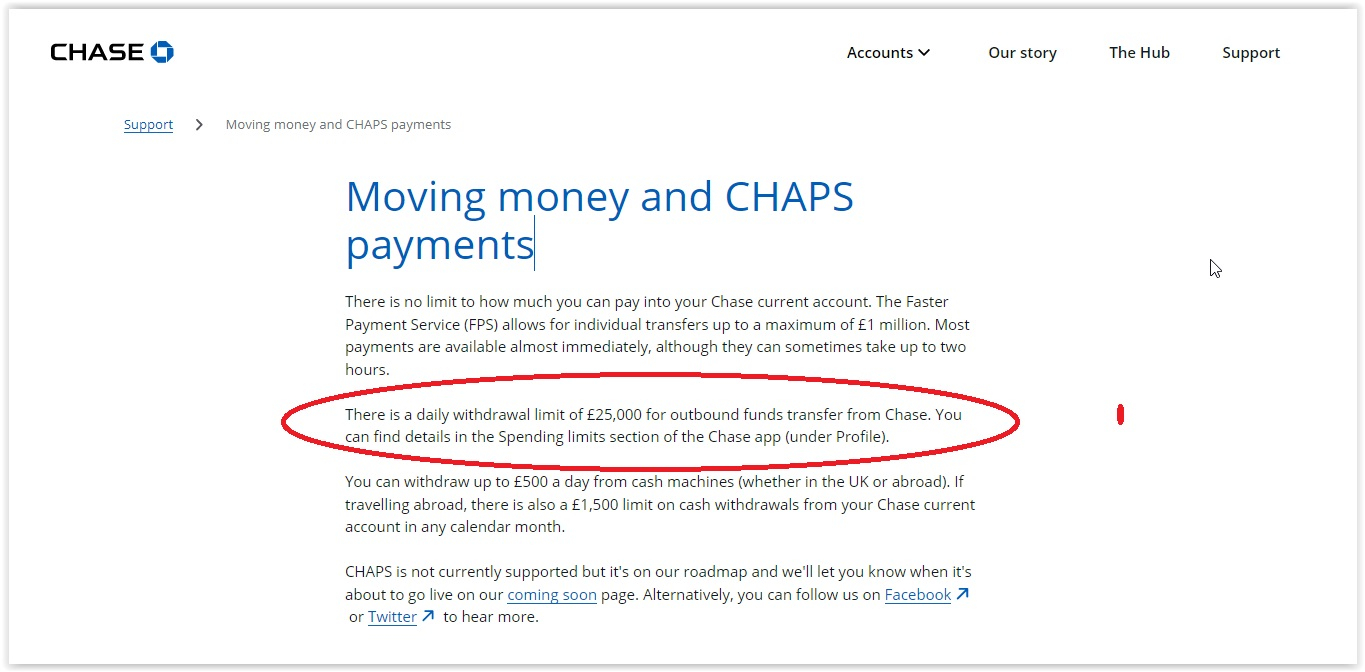

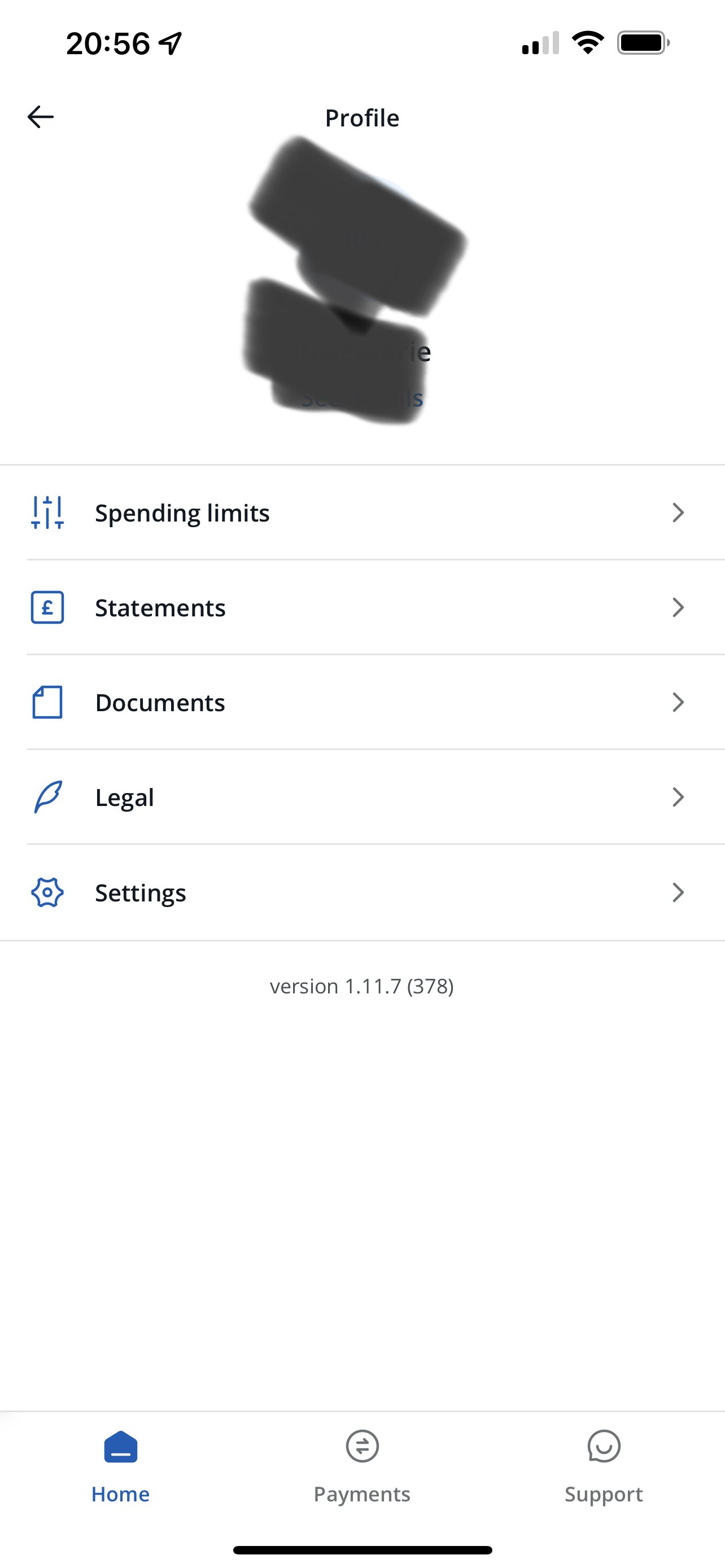

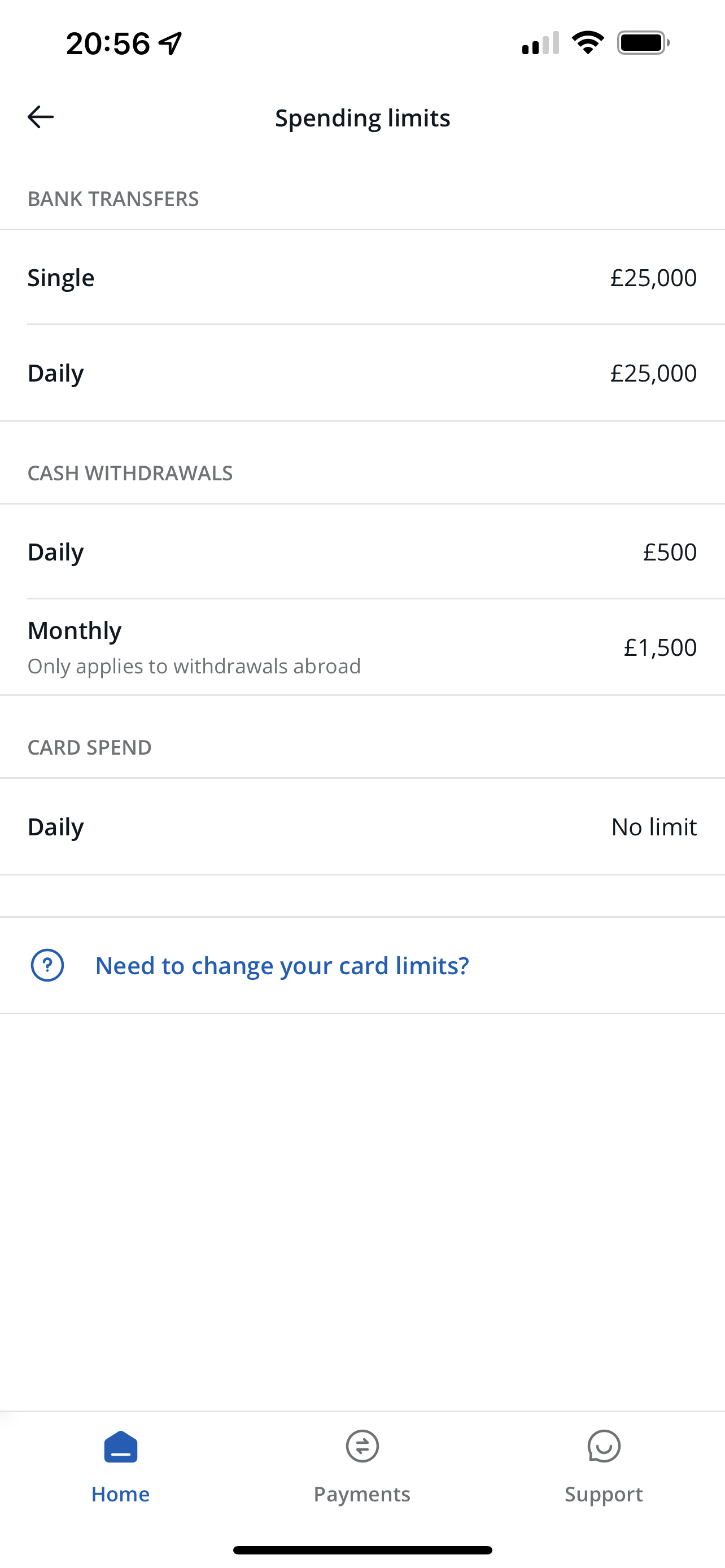

Having reduced my Chase balance to near zero after they annoyed me once too often, I am not really one of their unconditional fan club (which is actually a thing). But I don’t think they can be criticised for hiding the transaction limits. If you tap the person icon in the top left of the app, you get a whole lot of useful information pertaining to your account as followsrefluxer said:

Ah - fair enough, but it isn't mentioned in either the Chase Saver Account T&Cs (1.0.0) or the General Account T&Cs (1.2.0) documents (which are made available to you in the 'Legal' section of the app) and I think it probably ought to be.Daliah said:

Afraid, it seems you didn't look very hardrefluxer said:

The general Chase T&Cs state "We may also apply spending limits, such as a daily limit on the amount you can withdraw in cash with your card, as well as transaction limits. If we apply these limits, we will let you know what they are."

...but I haven't seen the limits written down anywhere ?

If you don’t have the app yet, googling “Chase UK payment limits” will give you the information I posted previously. It’s not dissimilar to how you find out payment limits for other UK banks, and the Chase FP limits compare quite favourably with other current accounts (ignoring their overzealous extra checks many of us were made to endure recently).So the only, major, criticism I have for Chase UK about payment limits is that they don’t do CHAPS. An unforgivable ommission.2

If you don’t have the app yet, googling “Chase UK payment limits” will give you the information I posted previously. It’s not dissimilar to how you find out payment limits for other UK banks, and the Chase FP limits compare quite favourably with other current accounts (ignoring their overzealous extra checks many of us were made to endure recently).So the only, major, criticism I have for Chase UK about payment limits is that they don’t do CHAPS. An unforgivable ommission.2 -

jaypers said:I’ve personally stopped depositing into Chase. Too limiting and by the end of this month I suspect many savings institutions will have easy access rates above 1.5%

Me too, I'm now building a backup fund with Marcus again. I haven't experience any issues with Chase withdrawals so far and I have no plans to remove the bulk of my savings from my Chase saver account at the moment, but I'd rather have accessible funds elsewhere in case of any (further) drama

0 -

There are at least two 'cos I have them - but using a debit card deposit won't give you instant access to those funds from an instant access account; it usually needs 3 working days to be showing as 'available'.tg99 said:

If needed faster could use the Chase current account to deposit into an instant access savings account that accepts payment by debit card …..although don’t think there are too many around these days.MartusJK said:HI there, hope its ok if I jump on here about this but I was seriously shocked and inconvenienced today when I discovered theres a hard, non-negotiable £25K daily limit on moving funds out of the 1.5% Chase account, when MSE states Yes to Unlimited withdrawals, and their own blurb says "You can take out some or all of your money anytime with no fees. You can't spend with your card from this account, so you'll need to transfer money to another Chase or UK bank account.". So what is going on here, I put a £250K stash in there on the main assumption it was instantly withdrawable, in part or whole, now it seems that will take 10 days of withdrawal payments, are they allowed to say such seemingly contradictory/misleading wording and is MSE aware??1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards