We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

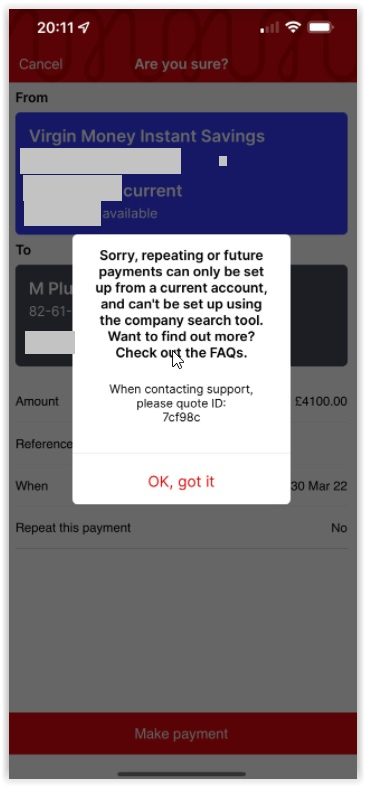

Daliah said:I wanted to set up a scheduled payment from a Virgin M Plus Saver to a Virgin M Plus current account to a Santander 123 Lite, ready for my monthly 'ritual' of feeding numerous regular savers which happens by SOs from my Santander account.

No such luck. Even though it looks as if you can set up a future payment, or even an SO, from your M Plus Saver to your M Plus Current, you actually can't. Not impressed. But I will get over it.

But I will get over it.

As you've found VM only allow immediate funds transfers on savings accounts.

This has been the case since CYBG days as they strangely also align future dated FPs with Standing Orders.0 -

Another quirk, is that Virgin MP Current accounts have a transaction limit of £500 and daily limit of £1000 when making online payments with a one time passcode via SMS. However, with the mobile app or security token authentication these limits rise to £30,000.I did like being able to set up scheduled payments from Tesco Internet Saver to my hub current account to fund Regular Savers.Using Virgin MP Saver to Virgin MP Current account to my hub current account and then onto RS`s via standing orders is something I will put up with to gain the extra interest.0

-

Yep I used the wrong words should have said saving rather than investing and maybe unusual rather than barmy.Daliah said:

Why barmy? This isn't about investing but about saving. Which other instant access or regular saver account will pay you 3.04% AER? Where do you keep your emergency funds?murphydavid said:

Sounds barmy to me. You would not want to invest more than £1000 and for that you get £30 a year in interest!djpailo said:I checked a few pages and could not see this posted (sorry if I missed it):aver:

Natwest Digital Regular Saver (email dated 16 March 22):Hello XXXXXXX,

From today, instead of saving up to £50 a month into your Digital Regular Saver account, you can save up to £150. So, if you’ve been wanting to save more, you can. If you’re using Round Ups, they don't count towards your monthly limit.

That’s not the only change. We’ve added a new interest rate tier for balances over £1,000, so you can save up to £5,000 at a higher rate.Existing interest rates Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% Over £1,000 0.01% 0.01% Earn 3.00% interest on your first £1,000, and 0.01% on any amount over £1,000 in your account. New interest rates from 15th March 2022 Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% £1,001-£5,000 0.25% 0.25% Over £5,000 0.01% 0.01% Earn 3.00% interest on your first £1,000. Then 0.25% on anything between £1,001 and £5,000. And 0.01% on anything over £5,000. If you want to make the most of the increased monthly amount, it’s easy to change your standing order with Online Banking or the Mobile App.

Thanks,

The Savings Team

3% on £1000 and now it is even quicker to reach the £1000 is not bad at all.

Unusual because its name says regular when all other regular savings I have seen have a completely different structure.

Not quite sure how you define emergency? My regular monthly movement of funds (bills etc) is greater than £1000 so an emergency would be a bit outside £1000.

If I tried using it like an instant access I would not be able to top it up fast enough to store my monthly bills money in it.

However having said that I do have a Natwest current account and I see I can cancel the direct debit I have to set up to open it and still get the interest and it also says "There's no minimum deposit to open the account" very unusual compared to other regular saver accounts. I presume there is no maturity date either.

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.0 -

murphydavid said:Daliah said:

Why barmy? This isn't about investing but about saving. Which other instant access or regular saver account will pay you 3.04% AER? Where do you keep your emergency funds?murphydavid said:

Sounds barmy to me. You would not want to invest more than £1000 and for that you get £30 a year in interest!djpailo said:I checked a few pages and could not see this posted (sorry if I missed it):aver:

Natwest Digital Regular Saver (email dated 16 March 22):Hello XXXXXXX,

From today, instead of saving up to £50 a month into your Digital Regular Saver account, you can save up to £150. So, if you’ve been wanting to save more, you can. If you’re using Round Ups, they don't count towards your monthly limit.

That’s not the only change. We’ve added a new interest rate tier for balances over £1,000, so you can save up to £5,000 at a higher rate.Existing interest rates Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% Over £1,000 0.01% 0.01% Earn 3.00% interest on your first £1,000, and 0.01% on any amount over £1,000 in your account. New interest rates from 15th March 2022 Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% £1,001-£5,000 0.25% 0.25% Over £5,000 0.01% 0.01% Earn 3.00% interest on your first £1,000. Then 0.25% on anything between £1,001 and £5,000. And 0.01% on anything over £5,000. If you want to make the most of the increased monthly amount, it’s easy to change your standing order with Online Banking or the Mobile App.

Thanks,

The Savings Team

3% on £1000 and now it is even quicker to reach the £1000 is not bad at all.

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.

@murphydavid,

If you are still talking about the NatWest (or RBS) digital regular saver, you cannot make an initial deposit of £1,000.

The maximum monthly deposit is now £150.00. Therefore it will take 7 months to reach £1,000.

Edit. Also, it is a standing order, not a direct debit, that needs to be set up for the initial deposit.1 -

Whilst might still be possible (it used to be) to dump £1,000 into the account in one go, I would not do so myself. To start with, it's against the T&Cs, which explicitly state "Any amount over this limit may be automatically moved to your current account. If you repeatedly try to pay more than £150 each month into the account, you will be given 60 days’ notice to close the account." But more importantly, Natwest are known for blocking/closing your accounts for lesser reasons.murphydavid said:

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.

If you stick to the T&Cs, you can fill your account in 7 months (potentially a tad faster if you use roundups), and make around £23.50 in interest in the first year. Trying to outsmart Natwest for £6.50 is like punching yourself in the face to find out whether it hurts.

You can delete the SO (not DD) that you have to set up during the application for the Saver immediately, and set up an SO from another bank, or just make your deposits manually.2 -

Thanks.RG2015 said:murphydavid said:Daliah said:

Why barmy? This isn't about investing but about saving. Which other instant access or regular saver account will pay you 3.04% AER? Where do you keep your emergency funds?murphydavid said:

Sounds barmy to me. You would not want to invest more than £1000 and for that you get £30 a year in interest!djpailo said:I checked a few pages and could not see this posted (sorry if I missed it):aver:

Natwest Digital Regular Saver (email dated 16 March 22):Hello XXXXXXX,

From today, instead of saving up to £50 a month into your Digital Regular Saver account, you can save up to £150. So, if you’ve been wanting to save more, you can. If you’re using Round Ups, they don't count towards your monthly limit.

That’s not the only change. We’ve added a new interest rate tier for balances over £1,000, so you can save up to £5,000 at a higher rate.Existing interest rates Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% Over £1,000 0.01% 0.01% Earn 3.00% interest on your first £1,000, and 0.01% on any amount over £1,000 in your account. New interest rates from 15th March 2022 Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% £1,001-£5,000 0.25% 0.25% Over £5,000 0.01% 0.01% Earn 3.00% interest on your first £1,000. Then 0.25% on anything between £1,001 and £5,000. And 0.01% on anything over £5,000. If you want to make the most of the increased monthly amount, it’s easy to change your standing order with Online Banking or the Mobile App.

Thanks,

The Savings Team

3% on £1000 and now it is even quicker to reach the £1000 is not bad at all.

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.

@murphydavid,

If you are still talking about the NatWest (or RBS) digital regular saver, you cannot make an initial deposit of £1,000.

The maximum monthly deposit is now £150.00. Therefore it will take 7 months to reach £1,000.

Edit. Also, it is a standing order, not a direct debit, that needs to be set up for the initial deposit.

Its a bit naughty of them to say on their summary page "There's no minimum deposit to open the account"0 -

It's not naughty but absolutely true that no minimum deposit is required. In fact, you never need to deposit anything.murphydavid said:

Thanks.RG2015 said:murphydavid said:Daliah said:

Why barmy? This isn't about investing but about saving. Which other instant access or regular saver account will pay you 3.04% AER? Where do you keep your emergency funds?murphydavid said:

Sounds barmy to me. You would not want to invest more than £1000 and for that you get £30 a year in interest!djpailo said:I checked a few pages and could not see this posted (sorry if I missed it):aver:

Natwest Digital Regular Saver (email dated 16 March 22):Hello XXXXXXX,

From today, instead of saving up to £50 a month into your Digital Regular Saver account, you can save up to £150. So, if you’ve been wanting to save more, you can. If you’re using Round Ups, they don't count towards your monthly limit.

That’s not the only change. We’ve added a new interest rate tier for balances over £1,000, so you can save up to £5,000 at a higher rate.Existing interest rates Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% Over £1,000 0.01% 0.01% Earn 3.00% interest on your first £1,000, and 0.01% on any amount over £1,000 in your account. New interest rates from 15th March 2022 Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% £1,001-£5,000 0.25% 0.25% Over £5,000 0.01% 0.01% Earn 3.00% interest on your first £1,000. Then 0.25% on anything between £1,001 and £5,000. And 0.01% on anything over £5,000. If you want to make the most of the increased monthly amount, it’s easy to change your standing order with Online Banking or the Mobile App.

Thanks,

The Savings Team

3% on £1000 and now it is even quicker to reach the £1000 is not bad at all.

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.

@murphydavid,

If you are still talking about the NatWest (or RBS) digital regular saver, you cannot make an initial deposit of £1,000.

The maximum monthly deposit is now £150.00. Therefore it will take 7 months to reach £1,000.

Edit. Also, it is a standing order, not a direct debit, that needs to be set up for the initial deposit.

Its a bit naughty of them to say on their summary page "There's no minimum deposit to open the account"0 -

Now that would be barmy. But less painful than punching yourself in the face to find out whether it hurts.Daliah said:

It's not naughty but absolutely true that no minimum deposit is required. In fact, you never need to deposit anything.murphydavid said:

Thanks.RG2015 said:murphydavid said:Daliah said:

Why barmy? This isn't about investing but about saving. Which other instant access or regular saver account will pay you 3.04% AER? Where do you keep your emergency funds?murphydavid said:

Sounds barmy to me. You would not want to invest more than £1000 and for that you get £30 a year in interest!djpailo said:I checked a few pages and could not see this posted (sorry if I missed it):aver:

Natwest Digital Regular Saver (email dated 16 March 22):Hello XXXXXXX,

From today, instead of saving up to £50 a month into your Digital Regular Saver account, you can save up to £150. So, if you’ve been wanting to save more, you can. If you’re using Round Ups, they don't count towards your monthly limit.

That’s not the only change. We’ve added a new interest rate tier for balances over £1,000, so you can save up to £5,000 at a higher rate.Existing interest rates Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% Over £1,000 0.01% 0.01% Earn 3.00% interest on your first £1,000, and 0.01% on any amount over £1,000 in your account. New interest rates from 15th March 2022 Balance Gross p.a. (variable) AER p.a. (variable) £1-£1,000 3.00% 3.04% £1,001-£5,000 0.25% 0.25% Over £5,000 0.01% 0.01% Earn 3.00% interest on your first £1,000. Then 0.25% on anything between £1,001 and £5,000. And 0.01% on anything over £5,000. If you want to make the most of the increased monthly amount, it’s easy to change your standing order with Online Banking or the Mobile App.

Thanks,

The Savings Team

3% on £1000 and now it is even quicker to reach the £1000 is not bad at all.

So for what its worth I will give it a go and initial deposit £1000 and cancel the DD as soon as possible. £30 a year ain't much but every little counts.

@murphydavid,

If you are still talking about the NatWest (or RBS) digital regular saver, you cannot make an initial deposit of £1,000.

The maximum monthly deposit is now £150.00. Therefore it will take 7 months to reach £1,000.

Edit. Also, it is a standing order, not a direct debit, that needs to be set up for the initial deposit.

Its a bit naughty of them to say on their summary page "There's no minimum deposit to open the account" 1

1 -

I doubt the already top ISA will increase by the full .25% but we live in hopeMalchester said:

Thanks for this. Recently opened the cash ISA paying up to .82% which should now increase. Have opened the non ISA equivalent this afternoon to take advantage of the increase when it happens.cheesemason said:On the BoE rate increase news page on the main site it says:Yorkshire BS: will increase rates by up to 0.65 percentage points from 12 April.Does anyone have details of what products are going up by what please?

0 -

The Atom Bank Instant Saver is now paying 0.90% (as of 23rd March 2022).

https://www.atombank.co.uk/instant-saver/

Please call me 'Kazza'.3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards