We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

FindingBBob said:

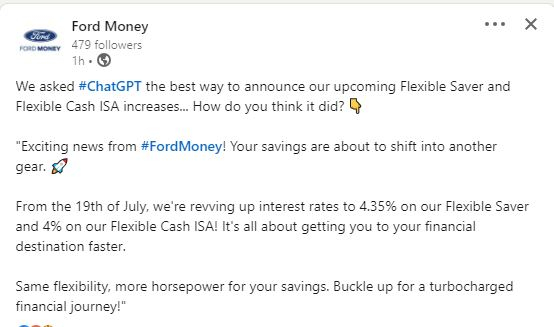

Ford Money going up again next week.. Linkedin PostOK Chip, you have until Wednesday to up your rates.3 -

I am like you. I dont have the time to constantly move money about, or faff around with different account opening requirements. Keep my money in constantly competitive providers where i dont have to jump from issue to issue..BooJewels said:

I'm not a habitual rate tart and don't bother moving money for rates (I admire those that have the nerve), but I am happy when the place I have it stays up there and holds its own.FindingBBob said:

Yup they seem to be keeping themselves competitive at least, on less move I have to worry about, just need to chip to be a bit braver..BooJewels said:Woohoo! That's good with Ford. I see they've added an 18 month fixed saver since yesterday too.0 -

Interesting. I recently opened Santander account and have found them excellent and I am impressed with their website. Knowing their reputation for stopping payments I kept my Nationwide account and use it for all transfers as I have never had any problems with Nationwide.Eirambler said:I gave up on Santander a few months ago because of the security hassle. I wouldn't go back to them now even if they were offering the best rate again, it's just not worth the effort. So the balance sits at zero and hopefully at some point they might notice that I've given up on them and just close the account.

Wouldn't consider them for a current account now after my experience with them either.0 -

I have been with Santander 10 years and never had a problemMalchester said:

Interesting. I recently opened Santander account and have found them excellent and I am impressed with their website. Knowing their reputation for stopping payments I kept my Nationwide account and use it for all transfers as I have never had any problems with Nationwide.Eirambler said:I gave up on Santander a few months ago because of the security hassle. I wouldn't go back to them now even if they were offering the best rate again, it's just not worth the effort. So the balance sits at zero and hopefully at some point they might notice that I've given up on them and just close the account.

Wouldn't consider them for a current account now after my experience with them either.

Have done many switches and transfers in the last 6 months with no issue

I am aware of bank closures so I have a secondary account with another high street bank also0 -

Anyone going for Oxbury?1

-

I think this has completely nailed it. If Chip were a bank they could go all the way to 4.9 and still make a tiny profit, but I'm not sure how it works when Clearbank have to somehow profit too in the middle.TiVo_Lad said:I think the problem for CHIP is that average rates are getting closer to the Base Rate which means their profit margin is getting squeezed. Having an Instant Access product makes the funds very flighty, so the only way they can keep funds is to keep the rates higher which are less profitable. It's basically where their business model starts to fall apart. We've seen Atom and Zopa drop out of the Instant Access market and move more into Bonds and more restricted products. I can see CHIP going the same way.1 -

Tempted as I find them to be excellent but I’m with Tandem currently and they just upped to 4.36 so will stick at the moment[Deleted User] said:Anyone going for Oxbury?0 -

Intrigued to know what you find excellent and secondly how quick the transfer times are!VNX said:

Tempted as I find them to be excellent but I’m with Tandem currently and they just upped to 4.36 so will stick at the moment[Deleted User] said:Anyone going for Oxbury?0 -

Ooof! That really is the worst, when you don't even get a message to confirm that the payment hasn't worked. Sorry to hear that it can still be overly aggressive for some. I do still have some hope though that it's not as bad as it was. I think some people value the fact they are vigilant. Whether this approach is truly keeping our money safer or not is unclear.lcooper said:

[...] I got my OTP from Santander, and completed the payment. The payment didn't show in the transaction list, and neither my available nor my pending balance had changed. No message from Santander, no block on my account. Nothing had arrived in Tandem, either. So I made the payment again. Same process, same result.Mr._H_2 said:A note for any Santander customers wary of moving large amounts of money via their Santander account (i.e. using Santander CA as a "conduit" when chasing rates):

Santander's anti-fraud systems used to be rather "trigger happy" making it a bit of a pain - I would often get frozen out of my Santander account after setting up a new payee and trying to transfer a large amount, even when that new payee was in my own name. This would necessitate a phone call, often waiting in a long queue, and then having to go through the standard anti-fraud checklist with the customer support person before they OKed the transaction and re-enabled my access.

Anyway, lately this situation appears to have improved significantly, for me at least. I just opened a Coventry four-access account and transferred £14k from Chip via Santander. When setting up the payee in Santander, I was taken through a series of those standard “anti-fraud” questions inside the app (that’s a first for me), and then the payment went through just fine. I imagine that the fact that Coventry support COP and the account was in my name helped here.

I then rang Santander Security [...] Another hour of my life wasted.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards