We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

Need a jump to 4.5% (or near as dam it) from someone get the ball rolling…1

-

jaypers said:Just had email from Charter:-

The Bank of England Base Rate has increased

Good news! We’ll be increasing interest rates on all variable rate accounts that are no longer on-sale on our website, following today’s Bank of England Base Rate increase.

The increased rates will be effective from 7 July 2023 and will be applied automatically to eligible accounts.

There’s no need to call us, as we’ll contact you soon with further details if your account is due a rate increase.

Similar message on the Kent Reliance website now - although the increase will be applied later. No details present as of yet when 'find out more' is clicked, and no indication of the percentage increase eitherIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

I think charter / Kent giving themselves time to monitor the markets over the next 2 weeks , need a bank now to pass on the increase.1

-

Chase saving to 3.8% as per the message in the app, at least they passed on the full base rate increase this time.10

-

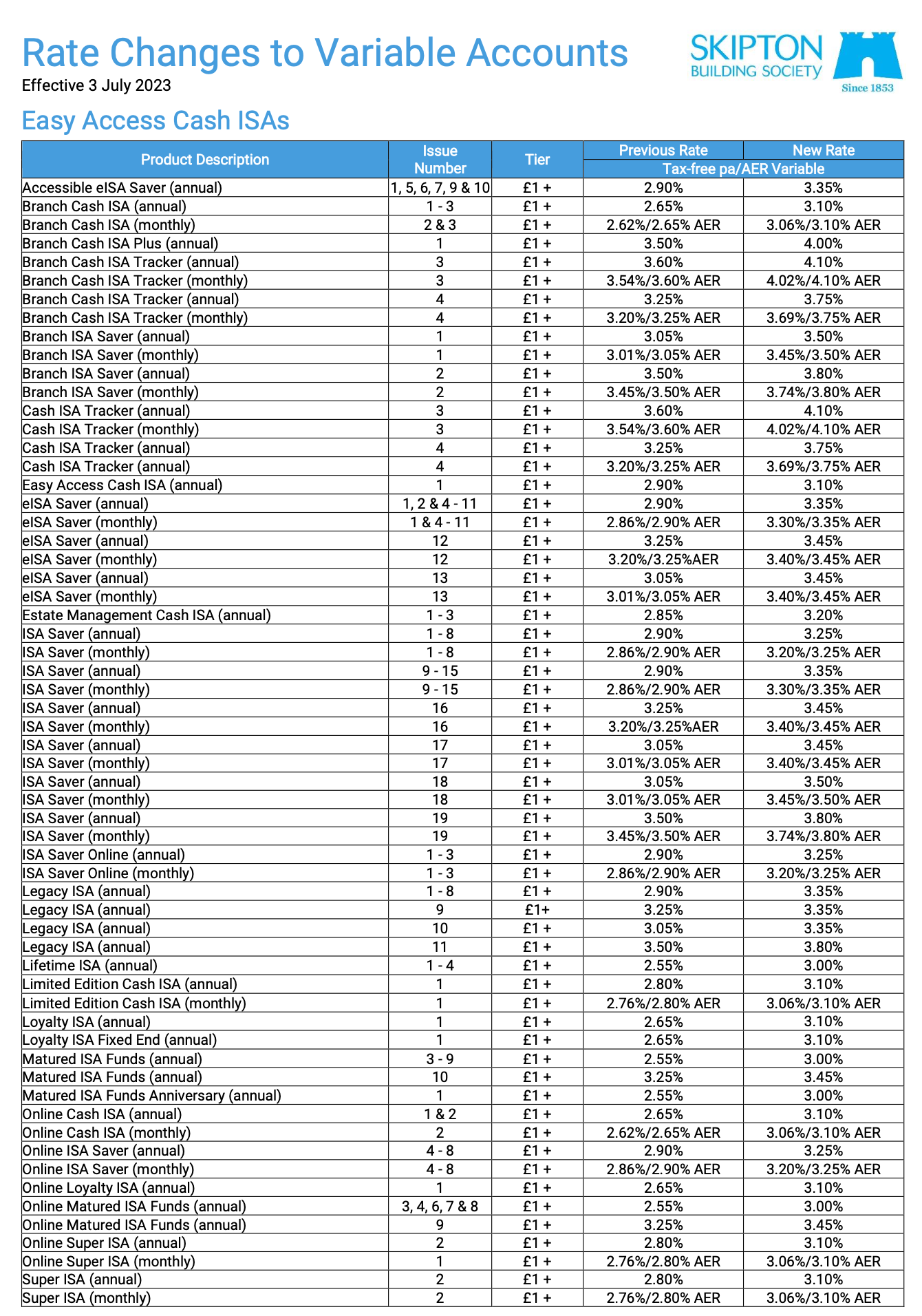

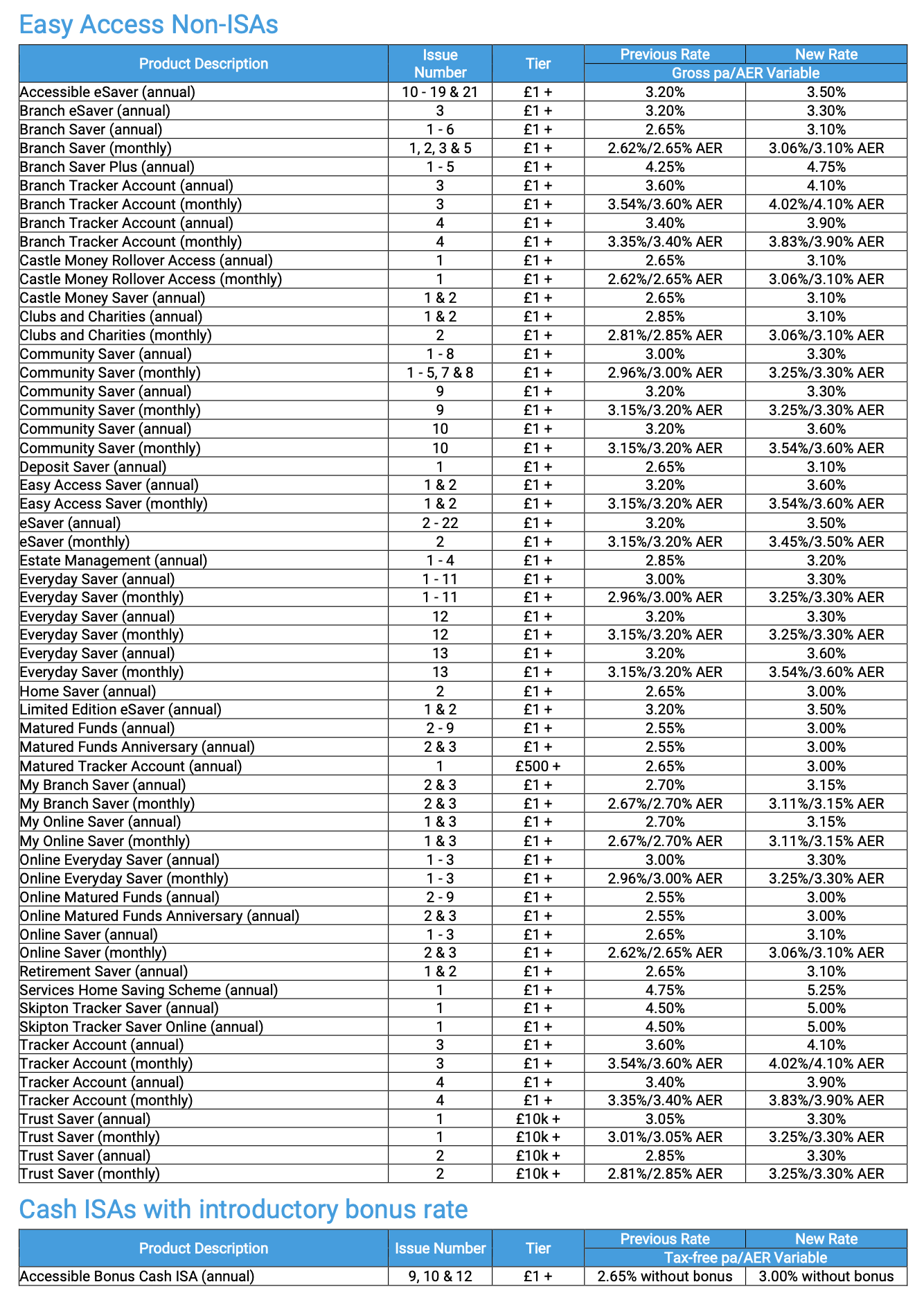

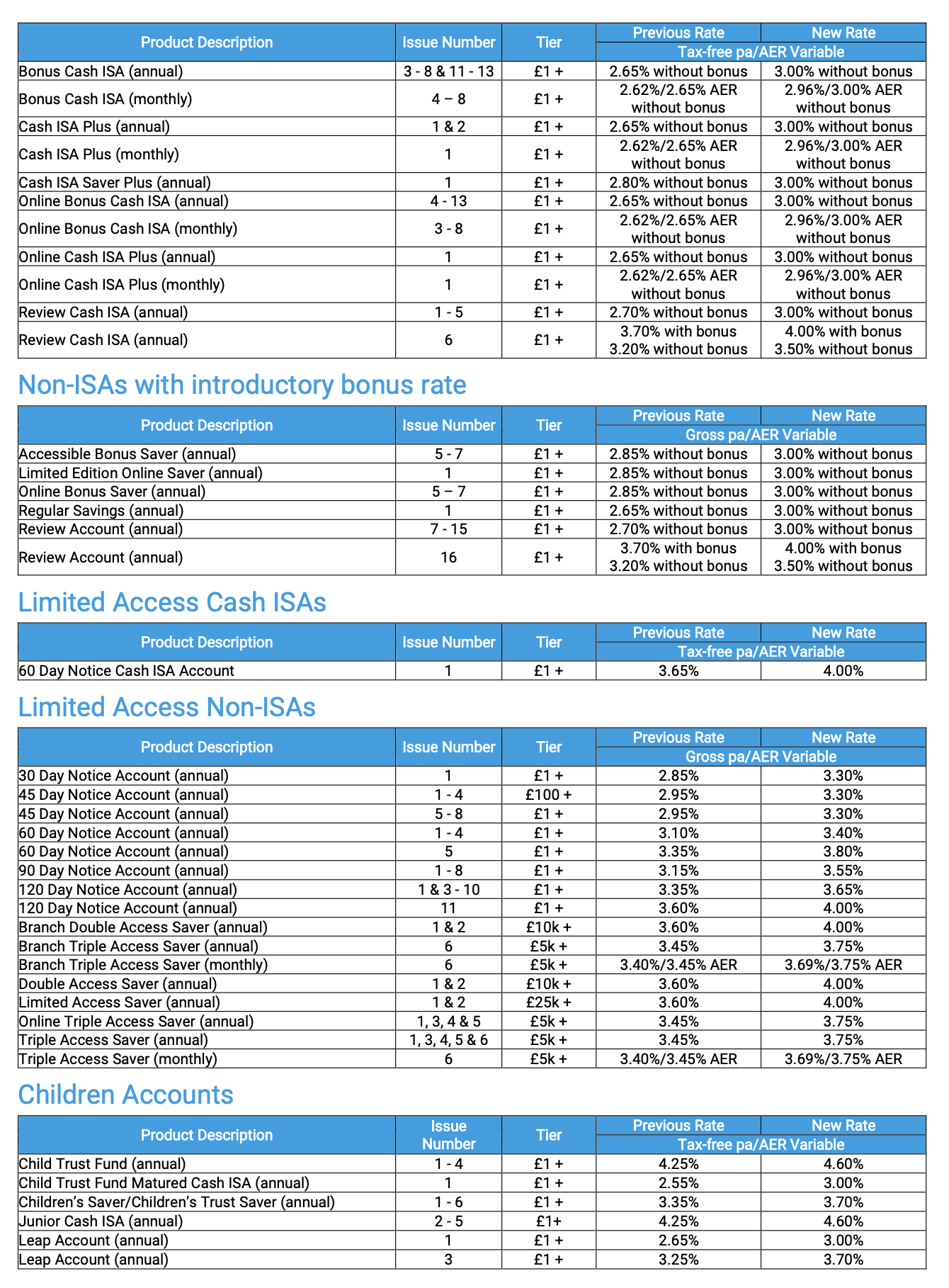

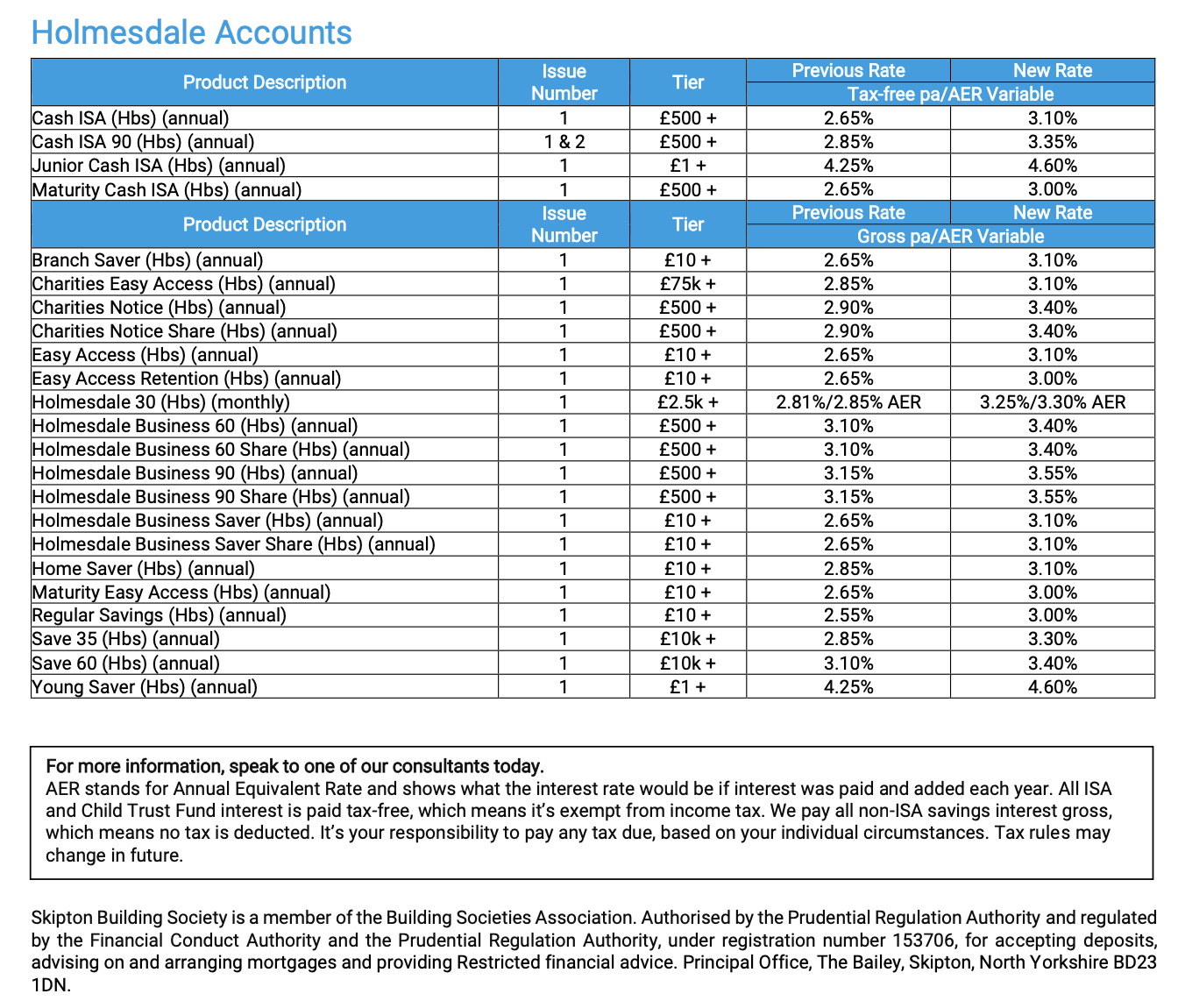

Skipton BS increases effective 3rd July

https://www.skipton.co.uk/base-rate-change?utm_source=twitter&utm_medium=organicsocial&utm_term=&utm_content=&utm_campaign=baseratesocial

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.13 -

As a long term member of Nationwide, I know not to expect them to top savings league tables, but they really do continue to underwhelm.Section62 said:km1500 said:Don't forget Nationwide raising savings rates by 0.1% in anticipation.Worse than that - the 0.1% increase on a handful of accounts was a response to the previous BoE increase which Nationwide hadn't yet passed on.

You're absolutely correct that their 1st April increase to 3.2% on some accounts followed the BoE committee meeting in March.

NW then did nothing until their notification yesterday of 0.1% increases on the same accounts starting 1st July.

Rather poor, I only keep a small amount in a Triple Access Saver, which I'll be moving out when it matures in a couple of weeks.

They must've blown the budget on the Fairer Share payments.3 -

KR not moving for another 2.5 weeks ?... so that's my funds moving this afternoonForumUser7 said:jaypers said:Just had email from Charter:-

The Bank of England Base Rate has increased

Good news! We’ll be increasing interest rates on all variable rate accounts that are no longer on-sale on our website, following today’s Bank of England Base Rate increase.

The increased rates will be effective from 7 July 2023 and will be applied automatically to eligible accounts.

There’s no need to call us, as we’ll contact you soon with further details if your account is due a rate increase.

Similar message on the Kent Reliance website now - although the increase will be applied later. No details present as of yet when 'find out more' is clicked, and no indication of the percentage increase either2 -

Keep your eye on Investec. They usually update on the 1st of the month I think. No issue nonsense and very quick withdrawalsjanusdesign said:

if there had been a 0.25% rise, i'd have moved money out of my SBS tracker today, but no need now... the only one I need serious reaction from now is Cynergy @ 3.71% - so over 0.4% behind the leaders, but I like them cos they're quick for withdrawals.wiseonesomeofthetime said:So my Skipton Tracker should be moving to 4.10% soon, but I already have my money in a 4.10% account, so no incentive to move anything to them still 🤷♂️0 -

Ive still got 2 zopa pots left to mature, wonder if they will get back up near the top before I withdraw?

Its going to need +0.75% min so looking unlikely.Ex Sg27 (long forgotten log in details)Massive thank you to those on the long since defunct Matched Betting board.0 -

I dont think you need to wait till it matures... I've closed Trip Access accounts recently and they get paid up to the closure date - just double check with them that is the case, but cant see a reason to give them another 2 weeks when they are taking the proverbialscottishstu said:

As a long term member of Nationwide, I know not to expect them to top savings league tables, but they really do continue to underwhelm.Section62 said:km1500 said:Don't forget Nationwide raising savings rates by 0.1% in anticipation.Worse than that - the 0.1% increase on a handful of accounts was a response to the previous BoE increase which Nationwide hadn't yet passed on.

You're absolutely correct that their 1st April increase to 3.2% on some accounts followed the BoE committee meeting in March.

NW then did nothing until their notification yesterday of 0.1% increases on the same accounts starting 1st July.

Rather poor, I only keep a small amount in a Triple Access Saver, which I'll be moving out when it matures in a couple of weeks.

They must've blown the budget on the Fairer Share payments.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards