We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

Also worth an occasional look at the Building Societies Association website under members to see if some of he members have good rates, often with restricted access that don't get included in best buy tables as a result. It is a bit cumbersome as you have to click on each member society separately. I found Swansea Building Society paying 3.25% instant access a which beat others at the time. Restricted to residents in Wales and existing members. Customer service excellent.1

-

If you make a debit card deposit into the NSandI Direct Saver, on a weekend in the morning, what should the ‘interest date’ be please? NSandI told me it’d be the same day for those done before 8pm, regardless of weekends and bank holidays.

The website is showing Thursday for those done on Thursday, but it is showing today (Monday) for transactions made on Saturday (I didn’t do any on Sunday).Just trying to figure out which route to go down, general CS for a tech error, or complaints for misinformation.Thanks

Edit: I suppose the potential negative too could be if I contact them, I draw their attention to the large number of £1.01 round up transactions, and they close the accountIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

To be fair, it wasn't him that told me to Do my own research. I was doing that already. I happen to see that particular video where he was saying the offers and products are always changing and that some offers can be pulled at any time. Apparently, a bank or fintech will introduce a offer (an unbeatable rate - one that stands out from the crowd), then once they have sufficient numbers signing up for it, they will pull the offer.RG2015 said:

Yes indeed. This is very good advice.OceanSound said:How often is this MSE webpage updated:

https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/?&source=GOO-0X0000042AADF6152B&gclsrc=ds#easyaccess

Reason I ask is, I remember watching a video by Andy webb (a.k.a. Andy CleverCash) and he was saying that these days products and offers are changing constantly, so sometimes he'd update his webpage more than once on the same day!

Maybe it's prudent to do a cross check. I e check MSE site then check other sites to corroborate and read this thread of course 😊

Many on here do this. DYOR has become the mantra for those seeking accuracy and being totally up to date.

I am not sure though that I needed Andy Webb or any other self proclaimed guru to tell me this.

He sometimes drops little hints and tips on his videos (may be to keep people interested in coming back to his videos). For example, he said with Starling you can get a debit card (a virtual one maybe - I don't remember TBH) immediately upon opening account. So, it is a handy account for burner current accounts (a current account that can be used for switching). I looked on his website if the same info was there, but couldn't find it. So it seems its exclusive to his videos.

On topic: About the banks, bs's and fintech's instant access saver rates, I noticed the MSE link has Chip at the top with 3.40%, then Cynergy Bank with 3.25%. if I look at this comparison website:

https://savings-accounts.comparethemarket.com/instant-access?AFFCLIE=CM01&apuid=undefined

it puts Chip at top with 3.40% (I'm ignoring Barclays Rainy Day saver which is exclusive to Barclays Blue Rewards members and Newbury Building Society Existing Members Account (EMA) which is available to those living at certain post codes . i.e. you need to be very local ) then it has the Yorkshire Rainy Day Account Issue 2 at 3.35%.

) then it has the Yorkshire Rainy Day Account Issue 2 at 3.35%.

I wonder how come the Yorkshire Rainy Day Account Issue 2 doesn't feature in the MSE web page?

They've certainly had that rate for long enough. I mean, they didn't introduce it today (in which case MSE may not have updated the website).

See this post by a forumite on another thread posted on 7 February 2023:11 Yorkshire BS Rainy Day SVR iss2; Dbl access*; (see trail 04/01) wef 17/01 3.35% to £5k, then 2.85%; blended rate for £50k - 2.90% View our Easy Access Savings Accounts | SavingsI was thinking maybe it's the 2 withdrawals per year that disqualifies it from appearing in MSE web page, but then Sainsbury's Bank feature on the MSE web page with 3.07% and maximum of three withdrawals a year.

1 -

@OceanSound,

Sorry, I misunderstood your post that Andy quoted specific deals, hints and tips.

This sounds very interesting.1 -

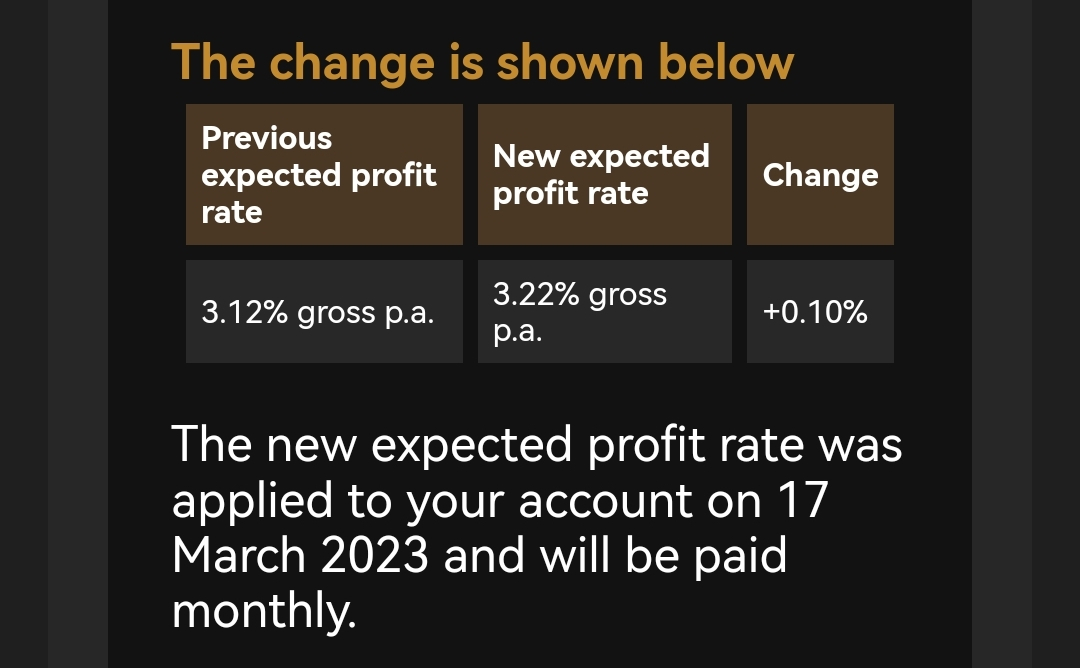

Al Rayan have increased again

1 -

Regarding Newbury Postcode Restrictions:

"Good morning ForumUser7Thank you for your email, and for bringing to our attention the unclear wording on our Website concerning the change of postcodes on our Savings Accounts from 30th March. I have notified our Marketing Dept, and the wording is currently being changed to make it clearer.

I can confirm the postcode changes is for new members only, and all our current products are available to existing members, as long as they are resident in England or Wales.

Kind regards

A Senior Customer Service Adviser"

Update: They've now made it clear on the website:

'From 30th March 2023 we will only be accepting new savings applications from new customers who live in the following postcodes: AL, BA, BH, BN, BS, DT, EX, GL, GU, HA, HP, HR, KT, LU, MK, NN, OX, PO, RG, RH, SG, SL, SM, SN, SP, SO, TA, TW, UB, WD, WR. Existing customers/members are unaffected by this change.'

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.4 -

It's probably the 5k limit, and if you have say 50k the rate is below 3% which isn't competitive.I wonder how come the Yorkshire Rainy Day Account Issue 2 doesn't feature in the MSE web page?

They've certainly had that rate for long enough. I mean, they didn't introduce it today (in which case MSE may not have updated the website).

See this post by a forumite on another thread posted on 7 February 2023:11 Yorkshire BS Rainy Day SVR iss2; Dbl access*; (see trail 04/01) wef 17/01 3.35% to £5k, then 2.85%; blended rate for £50k - 2.90% View our Easy Access Savings Accounts | SavingsI was thinking maybe it's the 2 withdrawals per year that disqualifies it from appearing in MSE web page, but then Sainsbury's Bank feature on the MSE web page with 3.07% and maximum of three withdrawals a year.

Realistically if your savings pot is below 5k then you can probably use a combination of regular savers which offer 5-7% - most limit £250 per month (some up to £400), but open 4 of them and you can put £1k per month away.

There's no right or wrong answer, the varying T+Cs of different accounts make them hard to compare like for like as you have so many different sorts of accounts.0 -

The sainsbury's one has a 500k limit. So, how come that one appears and the one that has 50k limit doesn't? Is it because of the higher limit? How was this decided? i.e. If a bank has a product with 500k limit it will feature on our website but if it's 50k then it won't.cwep2 said:

It's probably the 5k limit, and if you have say 50k the rate is below 3% which isn't competitive.I wonder how come the Yorkshire Rainy Day Account Issue 2 doesn't feature in the MSE web page?

They've certainly had that rate for long enough. I mean, they didn't introduce it today (in which case MSE may not have updated the website).

See this post by a forumite on another thread posted on 7 February 2023:11 Yorkshire BS Rainy Day SVR iss2; Dbl access*; (see trail 04/01) wef 17/01 3.35% to £5k, then 2.85%; blended rate for £50k - 2.90% View our Easy Access Savings Accounts | SavingsI was thinking maybe it's the 2 withdrawals per year that disqualifies it from appearing in MSE web page, but then Sainsbury's Bank feature on the MSE web page with 3.07% and maximum of three withdrawals a year.

Realistically if your savings pot is below 5k then you can probably use a combination of regular savers which offer 5-7% - most limit £250 per month (some up to £400), but open 4 of them and you can put £1k per month away.

There's no right or wrong answer, the varying T+Cs of different accounts make them hard to compare like for like as you have so many different sorts of accounts.

0 -

How worried should we be about the banking crisis in US and now Switzerland? What effect could this have on savings accounts in the UK? Obviously your savings are protected up to 85k per institution.0

-

Not worried at all.patpalloon said:How worried should we be about the banking crisis in US and now Switzerland? What effect could this have on savings accounts in the UK? Obviously your savings are protected up to 85k per institution.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards