We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Reading my credit file, please help

backontrack83

Posts: 26 Forumite

Comments

-

Was the account sold to a DCA in August 2013?

Did you pay a DCA partial settlement or did you pay CapitalOne direct?I work within the voluntary sector, supporting vulnerable people to rebuild their lives.

I love my job 0

0 -

Thank you.

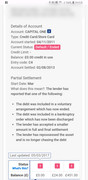

Yes the account is defaulted. Im aware that the 6 years is from either settlement or date of first default bit

I just dont understand how the account can show as settled in 2013 but not paid off until 2017? Is there something I am missing?

Again thank you for replying.0 -

Just seen the second reply. In all honesty i cant remember if I paid Capital one or if it was sold on.0

-

Added to say it was in a DMP.0

-

I would expect it to drop off on the 2/8/2019. So if that's your only bad mark - and if you can wait until August - that;s when I'd make my application.0

-

Just wanted to add that I recently applied for a mortgage and had historic credit agreement defaults that had dropped off my credit files. However, many mortgage applications still ask specific questions about these sorts of historic financial misdemeanors such as 'Have you ever defaulted on a credit agreement, had an IVA, DMP, CCJ etc'.

The view of my broker at the time was that as my defaulted credit agreements were paid in full and no longer appeared on any of my three credit reports it was not necessary to declare them. I felt that doing that would be lying and if discovered could be perceived as mortgage fraud (possible Cifas marker risk) and so was completely honest and answered the question directly and fully. I got the mortgage anyway with the bonus of a clear conscience.0 -

Thanks everyone. I can assure you I am not out to 'get away with anything' I love that peoppe think this is what is happening when you ask certain questions.some of us are just curious how it all works. I have been honest with my broker from day one and will continue to do so, I was just curious how to read the file. The question I still have of 'How can it be shown as settled in 2013 when it wasnt fully paid until 2017?'

Im guessing because it might have been sold on to a DCA and so Capital One according to them meant it was paid in 2013 but I continued to pay the DCA till 2017 and it was updated.

Thanks for the replies though much appreciated.0 -

Apologies backontrack83 if my post came across in that way. I genuinely wasn't suggesting you were trying to get away with anything and hope that you manage to resolve your query and that your mortgage application is successful.

I was really just trying to highlight something from personal experience that I had never appreciated when I applied for a mortgage. In my naivety I had always thought that once you had served your time in the credit wilderness for financial difficulties (self-inflicted or otherwise) of the past and your recorded credit history was once again clean, healthy and positive then you would be considered to be rehabilitated by credit providers. I had no idea that questions could be asked about events that were no longer recorded by the CRAs. As I said, I was very naive at the time.0 -

HeCh gosh no need to apologise. I take your point this mortgage lark is a minefield and any help/guidance is much appreciated.

You have to be thick skinned in these types of forums as many people seem to think little of others. Then there are those trying to help and those bumbling along.

I was not offended in any way, its not the first question I genuinely asked about mortgages and a process that I was seemingly accused of trying to deceive the lender lol.

Again thanks for the info very helpful.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards