We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

NS&I to shaft savers again. RPI to CPI (index linked bonds)

Comments

-

They pay RPI for state pensions.

Shouldn't but they do.

Older people get the best deal because they are more likely to vote.

Fair? I dunno - if the young can't be arsed to vote perhaps they get the politicians they deserve.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

They could be accused of paying more interest than necessary to the detriment of the taxpayer.

A Good Point.

Apparently the Government intends to do what all Governments do when they can't pay their debts - default through inflation. Which is why asset prices have risen to extraordinary heights.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

"We’re changing the way we calculate index-linking on our Index-linked Savings Certificates, in line with the government’s switch to use the Consumer Prices Index (CPI) as the standard measure for UK inflation. We’re making the change to save money for taxpayers.Sorry to piggy back your thread but can someone advise if they are changing from RPI to CPI on bonds that are already running because I took a five year one in 2016 that I re invested for five years from 2011

If you have any Index-linked Savings Certificates, the change will only affect you when each Certificate reaches the end of its investment term on or after 1 May 2019. If after this date you choose to renew your Certificate for a further investment term, we will then calculate the index-linking using the CPI instead of the RPI. You will still benefit from tax-free, inflation-beating savings – we will just be using a different index."

https://www.nsandi.com/index-linked-savings-certificatesThis is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

Calm down and forget your conspiracy theories! The rates offered by NS&I are far more generous than the rates available on index-linked gilts, which is why NS&I index-linked bonds are not on general sale! You could always buy index-linked gilts if you think that they are a better deal.

As we were saying on another thread - index-linked gilts are generally yielding about -1.5% in real terms. For shorter maturities, it's even less (i.e. even more negative).

Given CPI is 0.9-1.0% below RPI, index-linked certs at CPI+0.01% would still be a pretty good deal.

I'm not really sure why the government isn't issuing gilts linked to CPI rather than RPI, but it shouldn't make a lot of difference. The issuance price is determined by what the market will pay at auction, so if the government can sell RPI linkers at a yield of -1.5%, it ought to be able to sell the same amount of CPI linkers at around -0.6% - the end result for buyers and taxpayers would be about the same.0 -

false.They pay RPI for state pensions.

the "triple lock" is the highest out of: CPI, earnings, and 2.5%.

before the triple lock was introduced, they paid the higher of: RPI and 2.5%.

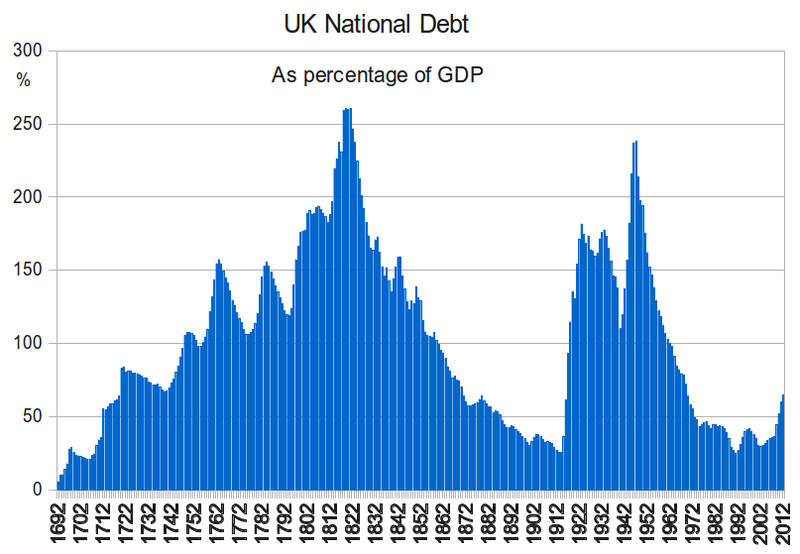

public debt in the UK is at a perfectly sensible level. right-wingers have been pretending there is a crisis in UK public finances as a cover story for the cuts in public services they want to make for other reasons.Glen_Clark wrote: »Apparently the Government intends to do what all Governments do when they can't pay their debts - default through inflation.

i think they've mainly risen because of increasing wealth inequality, and because a lot of the wealth hoarded by a few is being used to bid up the prices of existing assets (including property and shares), rather than being used to make new productive investments (which would create new assets, instead of just bidding up the prices of existing ones).Which is why asset prices have risen to extraordinary heights.

another factor is QE, which has also inflated assets prices, as the BoE has admitted.0 -

My mistake. Thanks for the correction.short_butt_sweet wrote: »false.

the "triple lock" is the highest out of: CPI, earnings, and 2.5%.0 -

short_butt_sweet wrote: »public debt in the UK is at a perfectly sensible level. .

How much debt is off balance sheet like PFI?“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

short answer: not enough to make a difference to the conclusion.Glen_Clark wrote: »How much debt is off balance sheet like PFI?

there are two corrections that we should make to the headline debt-to-GDP figures. off balance sheet PFI debt should be added on (PFI started in c. 1992). and debt bought back by the BoE under QE should be taken off (QE started in 2009).

start with the headline debt-to-GDP ratio: that graph is not quite up to date: since 2012, the headline ratio has risen to 80-something-%.

that graph is not quite up to date: since 2012, the headline ratio has risen to 80-something-%.

about 25% of that gross debt doesn't exist any more, because the BoE bought it back under QE. which (only making this one correction) would take the current figure down to 60-something-%.

then something should be added back for the capital value of PFI projects. (but not for the service element, because that is not debt, just projected future spending.) but that's now a smaller effect than the deduction for QE.

the conclusion is still that UK debt-to-GDP is historically low. and that it has been reduced from much higher levels without default (though not without inflation).

we should be worrying about high household debt, not high public debt. public debt is a good form of debt: cheap, no issue with ability to pay (as we can see from QE, where the BoE paid off 25% of it with money they pulled out of their a***). households pay much higher interest, and can get into serious problems with debt.0 -

short_butt_sweet wrote: »debt bought back by the BoE under QE should be taken off (QE started in 2009).

Do you think printing money reduces our debt?

Depends on the cost they have committed us to. I've heard stories about £100 to change a light bulb etcshort_butt_sweet wrote: »something should be added back for the capital value of PFI projects. (but not for the service element, because that is not debt, just projected future spending.)

I agree that is the biggest problem. Government intervention in the housing market has forced up housing costs, creating a rent-extracting economy posing as free enterprise. Many people cannot earn enough to pay their own rent.short_butt_sweet wrote: »we should be worrying about high household debt“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

OK so all index linked bond holders should be grateful as its still a good deal and they could refuse renewals.

Clearly they would never do that. There would be a sudden outflow of cheap cash. Im not sure how much is locked up in index linked products but it must be substantial even by national budget terms and it is real money,not fake money.

No,what they want is to keep the money but pay less for it.

But at the same time, they want to shaft consumers by using RPI when it suits them, ie on the income side of the equation.Feudal Britain needs land reform. 70% of the land is "owned" by 1 % of the population and at least 50% is unregistered (inherited by landed gentry). Thats why your slave box costs so much..0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards