We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Investing £850k in property

Options

Legacy_user

Posts: 0 Newbie

Options for investing £850k in property?

0

Comments

-

Wrong forum, infact I would steer clear of internet forums for investment advice period.

Qualifaction; DipPFS0 -

1. What type of property to go for

Personal preference surely - but the usual detached / garage etc are what id look for - USPs for families etc

2. South Vs North debate what does the prevailing wisdom of the crowd say about this now?

again personal preference - north is cheaper so id go there personally, more bang for your buck

3. To borrow money and leverage or to borrow nothing and sleep soundly

dont need to borrow if you have 850K - that will buy you 2-3 very nice 4 bed homes in the north if thats what you want - but are you planning to rent out or flip for a profit?

4. Is there anything else apart from Land that can offer the same type of peace of mind that I crave. I'm naturally drawn to either property or land

sounds like you want land or property, so why look elsewhere

5. On the subject of financial advisers s I don't know much about them and am far more comfortable with hands on UK based investments.

id speak to an adviser personally, your post screams uncertainty

6. I have an A level in business studies

no idea how this is valid or relevant - are you saying you want to open a business now?0 -

Wrong forum, infact I would steer clear of internet forums for investment advice period.

Qualifaction; DipPFS

I'm not sure what relevance your qualification (whatever it is, and if you even have it) has, but it's certainly led you to give a very odd opinion that the House Buying, Selling & Renting board is not the right one to ask a question about buying property - where would you suggest is any better?0 -

charlottesometimes wrote: »My questions are as follows:

6. I have an A level in business studies

Not really a question is it.

I would spend what you have and not borrow anything.

Good luck0 -

In your place, I'd move the money into NS&I immediately - https://www.nsandi.com/

The Direct Saver/Income Bonds might suit.

Then, as you are uncertain as to how best to proceed, take qualified advice from an Independent Financial Adviser.

https://adviserbook.co.uk/

https://www.moneysavingexpert.com/savings/best-financial-advisers/

https://www.moneyadviceservice.org.uk/en/articles/investing-in-property0 -

are you saying you want to open a business now?

If the OP plans on buying and renting out properties then he is contemplating starting a property letting business.

https://www.gov.uk/renting-out-a-property0 -

I'm not sure what relevance your qualification (whatever it is, and if you even have it) has, but it's certainly led you to give a very odd opinion that the House Buying, Selling & Renting board is not the right one to ask a question about buying property - where would you suggest is any better?

This forum is about processes/issues relating to the above mentioned - not investment advice of if they should invest in property or not, that is in the realm of financial advice/portfolio management.0 -

Either you're not REALLY looking for the lowest risk possible, or you're wrong.charlottesometimes wrote: »it fits my temperament of wanting the lowest risk possible.

Property isn't hugely volatile, but it still has its ups and downs.

If you're genuinely looking for the lowest risk possible, you want cash savings spread across eleven different banks. Of course, you won't see much return on the money, but "lowest risk possible" equals lowest returns.0 -

Like you, I feel more comfortable with property and have done really well with all the flats or houses I've bought (5 ones bought one after the other for my own occupation over the years since 1975; 5 BTLs or second/holiday homes, three of which we still have).

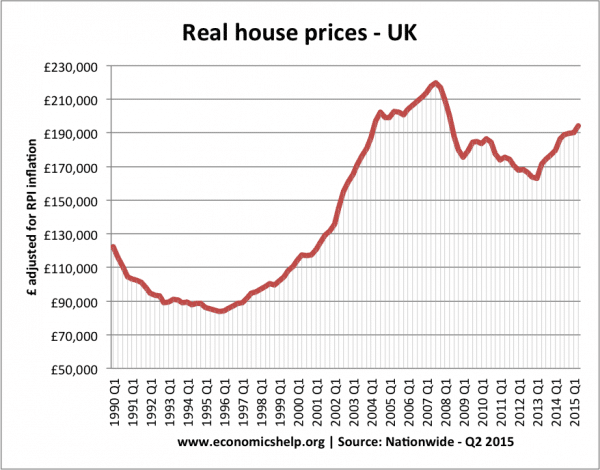

Generally, more by luck than judgement, these have appreciated in capital value far more than even the national average shown in the graph above; with one exception. That was a seaside flat on the Kent coast bought at the peak of the market in 2007 (where prices fell 20%+ after the 2008 crash charted above!). We didn't actually lose money on that, but only because we bought a wreck, tightly controlled refurb costs, and then, when it became obvious that there was a danger of it losing money, let it out for a couple of years so it washed its face by the time we sold in 2011.

You don't say whether, if buying property, you plan to use an £850k pile as your primary residence (which is simple and tax-efficient) or as rental investment(s) (which means you have to decide wheter you've got what it takes to be a landlord?).

Either way, location is the big variable. We've only done so well on our own homes by living in bits of London which have risen, Phoenix -like , from bust to bourgeois (Brixton SW4 and Charlton SE7) or areas which have held value while other suburbs wobbled (Blackheath SE3); oh, and by buying the worst/cheapest proerty in the best street we could a fford, then putting a lot of sweat and effort into improvements on a budget. The two BTLs are cheap flats (ex-LA) in areas with good commuter links and consequently high rental yield (commanding almost twice the rent of comparably priced properties in low income areas such as where we bought the seaside flat which became an accidental rental).

So, to respond to your original Q, by generalising from my own experience;

- Don't expect the massive capital appreciation of the late 20th Century (the wreck I bought in Brixton for £10k in 1975 is probably now worth £1million, albeit blinged up beyond recognition) but look at the many recent studies and property press articles which claim to identify areas where growth is likely the beat the average.

- on investment proerties, consider areas where purchase price is reasonably low relative to rents; look at the property websites which display both rental values and purchase costs.

- £850k is a lot to spend on a rental property but consider HMOs in places like student towns if you are prepared to spend on an approprate level of robust fitting out (lots of en-suites; high ongoing mantenance cost...)

- I couldn't be bothered with an HMO, but would go for several cheaper rental flats in areas such as I describe above; aiming at upwards of 6-8% rental yield.

- and as regards leverage; whether to borrow. I's say you're young enough to take this on, especially if you have other income, but do the risk analysis. Money is cheap now; 2-4% compared with the peak rates of mortgages at 15% in my lifetime. Loan costs are only likely to creep up slowly if you believe Mark Carney's pronouncement of likely maximum 0.25% annual increases in interest rates over the next few years . But don't blame him if he's wrong in 5 years time; he's off back to Canada next year.

Either way; owner-occupation, BTLs, leveraged or not, under the mattress, Bitcoin or NSI... What a lovely dillema to have; I was nearing retirement age before I accumulated anything like your net wealth!0 -

charlottesometimes wrote: »Thank you for the warning but I I'm not asking anybody to invest my money and therefore not really asking for "investment advice" but am asking for opinions from people who have invested in property who have done it and got the t-shirt for their opinions and experiences to meld with my own to help me make a better decision.

There's a difference in asking for someone to tell you what to do and asking for someones opinions to help you adjust or rethink your own thought processes.

Your exact question was:

1. What type of property to go for

*smh*0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 350.9K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.5K Spending & Discounts

- 243.9K Work, Benefits & Business

- 598.7K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards