We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Houses are affordable!

Comments

-

chrissie57 wrote: »

And for those who don't party, don't upgrade their phones and take pack lunch - any bright ideas?0 -

and the comments from the above article said:chrissie57 wrote: »

I am a millennial home owner, but I was still very much agreeing with this article until I got to the point where the reporter says: but why SHOULD we have to make these sacrifices when the older generation didn’t have to?

Err two points:

(1) My mum bought her first flat in her 20s. She worked two jobs and ate cabbage soup and coffee for the best part of a year (no joke! She must have been fun to be around...!) to save up a deposit. She certainly didn’t have any holidays etc.

(2) Following on from that, the reporter sounds so utterly entitled that she is giving the rest of us a bad name. YES the housing market is insane. NO it’s not our fault. YES the Gov should assist. However, saying ‘why should we sacrifice the stuff we like’ is so grating. I didn’t eat out or go on holiday when I saved up for my flat. I now earn a lot more so I can afford to have nice holidays etc., but if there is a possibility of you owning a property, accept the fact that it might be a bit !!!! for a year or two - as it was for me, as it was for my mum in the 60s - and stop expecting it to land in your lap without any sacrifice.

Reply

Share

126 Likes

Olive

Totally agree👍🏼

Reply

Share

5 Likes

Well said.

Reply

Share

4 Likes

Couldn't agree more. What I would like to see is articles from people like yourself who have managed it and prove it is possible.

Something proactive and aspirational.

Reply

Share

17 Likes

100% agree. You work hard for what you want. No one is gonna give it away for free. Gobsmacked at the last paragraph of this article.

Reply

Share

2 Likes

"It's the responsibility of politicians and others in power to solve the housing crisis..." Ugh. When you write a sentence and start with, "It's the responsibility of anyone-but-yourself," you should re-evaluate you life.

Reply

Share

2 Likes

:T:T:T:T:T:T:T:T:T:T:T:T:T:T:T:beer:0 -

chrissie57 wrote: »

This implies that older generations didn't give up on the things mentioned in order to get a house when in fact they did.0 -

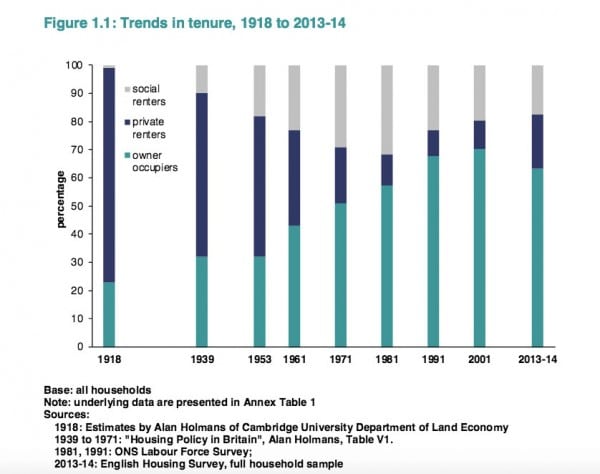

getmore4less wrote: »a good indicator of affordability is home ownership changes.

If you look at that data average people were not buying house in the 50s(with only 40% of households owning houses) that came later the real affordability period was 60s upto the end of the 90s, helped by the council house sell off started in the 80's.

Since then affordability has clearly been an issues as house ownership is declining.

What will be interesting is the breakdown of the historical FTB data to see which demographic brought the numbers up from 40% to 70%

If you were born in the 50s/60s and your parents and grandparents owned and you followed by owning your family should be self sufficient in property by now unless there has been some spending of inheritance rather than keeping it in property.

This graph proves that it is easier to buy a house NOW than it was in the 50s, 60s 70s and 80s as a bigger percentage of the population have managed to do it.

All those people now who think boomers had it easier need to look at this graph. The people who have had it easiest are those born after 1970. They are not boomers. The easiest age for people to buy was for those born in the 1980s who were in their 20s in the early 2000s. Also not boomers.

This graph shows changes tenure so the increase in owners is owner occupiers not landlords. So basically if you can't buy a house now you are living in an area and doing a job in that area that would never have allowed you to buy a house.0 -

I've just had a quick look on Rightmove in the area I bought in back in the 1970's, North London to Cambridge max price £110,000 was my only criteria, and many 2 bed properties came up that would have suited me at that time and just as affordable on a £20k salary.

A quick check on the Halifax mortgage page said with a £6,000 deposit, my mortgage would be about £500/month - about 1/3 take home pay when earning £20k - far more affordable then the 2 bed terrace I bought back in 1975 on a salary of £2.4k and 15% interest.0 -

You're just going to come back and repeat this garbage, despite multiple people pointing out the (obvious) logical flaw?capital0ne wrote: »In 1957 the average wage was £7 10s - equates to £390 per year

The average house cost £2,000 - 5 times salary

Fast forward to now

2 bed dwelling £100,000 Salary £20,000 = 5 times salary for a property - nothing has changed, just a few fluctations in the middle.

And don't forget the interest rate in 1976 was between 10-15% - just imagine what size house you could have afforded at 1%!

I guess whoever said you were a troll was wise, and I should have listened.0 -

I’m in Bristol and you can’t buy fur £100,000. Nearer £150,000 for a 2 bed in a rough area0

-

Wanderingpomm wrote: »I’m in Bristol and you can’t buy fur £100,000. Nearer £150,000 for a 2 bed in a rough area

So you are one of the people who would always have rented because your salary in the area that you want to live is not enough to buy somewhere. There have always been people in your position. It wasn't any easier in the 1950s. If you had been around then you would still have been someone who rented. There are people who can afford to buy in Bristol but you are not one of them.

The cost of a house includes the cost of the plot it is on it also includes the cost to build it. So someone's salary isn't enough to pay for the cost of the plot, the materials and the builders to build it they still wouldn't be able to buy even if there were more new houses built.0 -

This graph proves that it is easier to buy a house NOW than it was in the 50s, 60s 70s and 80s as a bigger percentage of the population have managed to do it.

All those people now who think boomers had it easier need to look at this graph. The people who have had it easiest are those born after 1970. They are not boomers. The easiest age for people to buy was for those born in the 1980s who were in their 20s in the early 2000s. Also not boomers.

This graph shows changes tenure so the increase in owners is owner occupiers not landlords. So basically if you can't buy a house now you are living in an area and doing a job in that area that would never have allowed you to buy a house.

Do you think it's a coincidence that the number of owner-occupiers increases from 1981 to 2001 whilst the number of social renters decreases?0 -

SDLT was introduced in 2003 (thank you Jobby Brown). What tax did previous generations have to pay when purchasing land and/or property? In fact couldn't home owners use mortgage interest to reduce their income tax liability under MIRAS from 1983 to 2000 when it was scrapped Jobby Brown?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards