We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Houses are affordable!

Comments

-

goodwithsaving wrote: »Same here. My parents (who are of the mentality that buying houses etc. is easier these days, despite having children who have struggled to buy houses) have cars on finance and encourage us all to go on expensive holidays and buy cars on finance. They don't understand why we don't 'treat ourselves' and why we would buy cars which aren't new.

Their internet bill is £50/month and phones are £25/month. By comparison, my internet bill is £15/month and my phone is £10/month. They get annoyed when I won't go out with them for dinner because of the cost and have to consider the cost of everything I do.

I know they've earned it, we had a few financial struggles when we were children and I don't begrudge them for their success - but the amount of money they waste just puzzles me. It's up to them, but it's a huge generalisation that the older generation are frugal.

Haha this reminds me of my in laws so much. They didn’t want our son to have second hand clothes, turned their noses up at each house we viewed when my DH used to email them links (particularly the one on a council estate — despite having spent several years in a council flat themselves when they were younger), told DH how much they felt sorry for him when he bought the car he has now. Always followed up with the comment “well we want you to have the best”. Their opinion, and like you I don’t begrudge them their success but I often find their attitude unhelpful and demoralising.

I think the best one was when we inherited some money. We had just bought our first home the year before and certainly didn’t want to have to move again so quickly, I was pregnant and not keen to move whilst heavily pregnant/with a newborn and also concerned about my wage dropping on maternity leave etc. Well you could have knocked them down with a feather when we explained we weren’t going to use this money towards another house just yet. I said something along the lines of “I don’t want to buy a house we can’t afford” and my MIL responded with “well everyone else does so I don’t know why you’re so worried about it” :rotfl:0 -

capital0ne wrote: »In 1957 the average wage was £7 10s - equates to £390 per year

The average house cost £2,000 - 5 times salary

Fast forward to now

The average wage is about £20,000 per year (starting point for a civil servant in their early 20's)

A quick search on Rightmove and you can find two bed terraced houses or similar for under £100,000 (not in London of course)

So where's the problem?

Apparently all of us oldies are now glorying in our 'cheap' houses we bought back in the day in our twenties. Well it was just as hard for us back then as it is now, so what's different?

The difference is that we had a bit of discipline, we wanted to get our own place, and we saved, we bought what we could afford and where we could afford, and we didn't look for our four bed detached forever home full of brand new furnishings.

We bought second hand and made do for the first few years.

Sadly youngsters today 'need' and iPhone X (£50/month), Netflix/Amazon Prime £100+/year), gym membership (£100+/yr), Costa coffee(£60/month), Takeaways (£100/month), new card (£199/month) plus others - this is all adding up to £5,000+/yr, which is your 5% deposit saved in one year.

It is doable - you just need to do it - get out of your parents house now and get on with your life while you know everything!:D

Everyone loves a boomer who doesn't realise how easy they had, and are still having it! :rotfl:0 -

Thrugelmir wrote: »Unfortunately it's the younger generations that are up to their eyeballs in insecured debt in relation to their incomes. That's not to say that high debt levels aren't an issue across the population as a whole.

I guess it's much easier to be debt free when your house has earned so much over the past 40 years that your debts are easily cleared.0 -

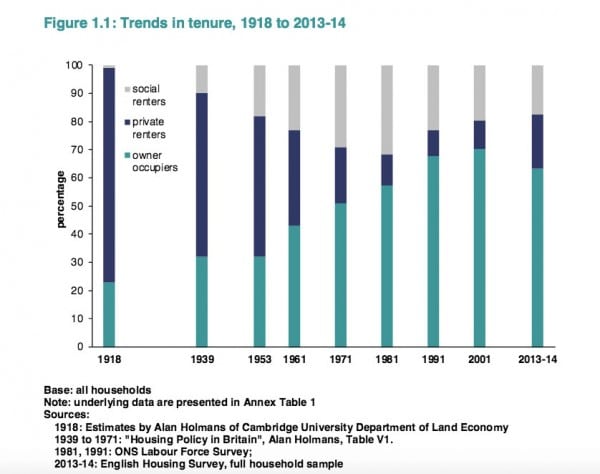

a good indicator of affordability is home ownership changes.

If you look at that data average people were not buying house in the 50s(with only 40% of households owning houses) that came later the real affordability period was 60s upto the end of the 90s, helped by the council house sell off started in the 80's.

Since then affordability has clearly been an issues as house ownership is declining.

What will be interesting is the breakdown of the historical FTB data to see which demographic brought the numbers up from 40% to 70%

If you were born in the 50s/60s and your parents and grandparents owned and you followed by owning your family should be self sufficient in property by now unless there has been some spending of inheritance rather than keeping it in property.0 -

I think earlier comments about the North/South divide are fairly accurate. I'm 28 and bought my first house on my own 4 years ago now on an £26,000 wage. 2 bed semi with garden front and back and car parking for £125k which the 5x wage works out pretty perfectly.

Public services in our area is crying out for applicants for well paid job (Doctors, public sector worker, planners, engineers) it has really brought it home that so many people are sucked into living 'in the city'.

Renting is also a lot more reasonable generally ~ £450-£500 for a one bed, ~£600 for 2 bed. Parity between city and rural and north and south may actually help everywhere as demand stabilises.

I own my 8 year old car outright and my 'commute' is only 5 minutes. Hospital is only 2 mins away, there are lots of parks, pubs and good quality independant restaurants, nightclub, food markets, cinema. Nearest retail park is 25 mins down the road, London is less than 2 1/2 hours, Endinburgh is the same so its well connected. 30 mins to the seaside. People are obsessed with living in the city and as a result the town is stagnated as it struggles to recruit.1% at a time challenge member #127

MWF: as@ Oct13 £45,917, now £43,024.560 -

I guess it's much easier to be debt free when your house has earned so much over the past 40 years that your debts are easily cleared.

Plus those with low/no mortgage payments will have more disposable income and therefore , theoretically they would be less likely to get into debt in the first place.0 -

I think you will find that there was more to it than that. It might even have been that the bank didn't expect people to not pay their mortgages. It was probably before there were a lot of repossessions. He would have to have been earnng enough to afford the mortgage repayments on the house. What did he do for work? It sounds also as if he didn't buy a house that was in good condition. Was it in a good area?

What indication have I given it wasn’t in good condition :S was in 1990 and every family member from around that time tells sAme story, walked in to bank with a basic retail / mechanics / low skilled job got a mortgage pretty much no questions asked or documents given.

He was allowed it to be a far far bigger percent of income than I would of been allowed.

Problem is the deposits (understandable) and affordability checks (understandable) have made it massively harder to buy than it used to be.

No single income 18 year old shop worker is walking into a bank in 2017 and getting a mortgage without lashings of help from family, simply a fact.0 -

We purchased our first home when i was 22, my then boyfriend ( now husband) was 28, we took 105% mortgage as we had no deposit or concept of what we were doing and were totally sucked in by a financial adviser who told us this would be a great idea ...anyway fast forward 13 years, one child and two redundancies later we have both managed to survive and i now have no debt other than mortgage and husband is working towards this...my car is 5 years old and was bought second hand, husbands is also second hand - both of us have phones which are provided from our jobs ..we both need cars as i have to commute to and from customer sites as does he ..

As for clothes i'm currently wearing hand me downs from my own mother ..we save about 600 pounds a month and over pay on the mortgage as we hope to be mortgage free in 12 years ( in our current home)

We have 10k saved for another home and have been told we can get 180K for a mortgage which means that we could possibly get a 3 bed terrace in an area we like ( that is near to sons school too) if we are lucky ...pretty much all 3 bed semi's are over the 300k mark ...0 -

I would be interested to know how many people over the age of 60 have a mobile phone costing more than £10 and how many of them buy new cars either on finance or for cash.

Well if you’re looking for anecdote my neighbours have just replaced both their financed cars with two brand new ones, also on finance. They are both over 60.

The neighbour on the other side is over 70 and has a 2 year old SUV type thing. I have no idea how he paid for it though.0 -

"If ever there is a tomorrow when we're not together... there is something you must always remember. You are braver than you believe, stronger than you seem, and smarter than you think. But the most important thing is, even if we're apart... I'll always be with you. "

A.A. Milne

We are such stuff

As dreams are made on; and our little life

Is rounded with a sleep.

Not everything that is faced can be changed, but nothing can be changed until it is faced (James Baldwin)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards