We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How to protect your assets under a Corbyn government

Comments

-

Ah yes, maybe they read the Daily Mail too then? The IFS are well respected across the political spectrum, they are ofter quoted by left-wing politicians as well as right-wingers and centrists. They get commissioned to do reports into income and poverty etc by poverty charities like the CPAG and the JRF. Are they "thacherite" organisation too then?grey_gym_sock wrote: »because the IFS are still wedded to thatcherite economic dogma. they don't seem to have noticed that it's completely stopped working since 2007/8 (not that it even worked for everybody before that) - most households have got poorer since then. and the IFS want to carry on doing the same thing.

Even the recent 50% rate didn't raise anything extra. New Labour realised that, that's why they left it at 40% for 99% of their time in power - 12 years and 11 months of their 13 years in power, and only raised it in April 2010 as an elephant trap for the Tories when they knew they'd lose the election, so they could come out with the usual "Tories looking after their rich mates" propaganda when the Tories pit it back down again.nonsense. at the kind of rates we're talking about (40%, 50%, 60%), higher taxes raise more money. at very high rates (perhaps 80% or 90%), that would eventually break down. but not with the kind of modest tax rises labour are talking about.

Or it encourages multinationals to make their profits here rather than in a higher tax country.corporation tax is absurdly low, at less than just about any other major economy. and because it's less than the basic rate of income tax (not to mention national insurance), it encourages small businesses to incorporate for tax-avoidance purposes.

That graph doesn't make the point you want it to. If you ignore the misleading trend line, which is over 18 years up to 2018 (interesting that it was published in 2014 so there's guesswork for the last 4 years), you can see that corp tax receipts from large companies are higher now than they were in 2010.that is entirely because more businesses have incorporated, which is itself often for reasons of tax avoidance. so far more is lost in income tax and NI revenue than is gained in CT revenue.

see the graph in this article - http://www.taxresearch.org.uk/Blog/2015/04/02/have-corporation-tax-receipts-really-risen/ - which shows that CT collected from large companies has fallen as the CT rate has been cut, while receipt from small companies have grown. showing the difference is that there are more small companies.

All govts say they want to crack down on tax avoidance. Every single budget document I've read has some new policy to do exactly that. But implementing it is harder than it sounds. It's like "efficiency savings".another important plank of labour's tax policy is cracking down on tax avoidance and evasion, instead of just pretending to.

They'd prefer to arrange their affairs to pay the least tax they can. The idea the sort of loopholes they and others use to minimise tax can easily be closed without others being opened is naive in the extreme.that's entirely because wages have become more unequal. top earnings have risen massively, and have continued to do so since the GFC. lower and middle earnings grew much more slowly, and have been falling since the GFC.

why the different growth in earnings? it's mainly about power. most workers become less powerful as union membership declined and tory anti-union legislation made them less effective. top executives' pay soared, as they set one another's pay, and governments (both tory and labour) chose to stand by.

will amazon want to make profits in the UK if they have to pay proper taxes on them, or would they prefer no profits?

Oh really? What about labour costs? I guess that's low down too. How about red tape?tax is a long way down the list of factors which affect where businesses locate. it won't drive away any businesses which it is worth having here anyway.

So no need for tax havens then, why all the fuss about the paradise papers?people very rarely leave because of high taxes. yes, the super-rich might, but with them the important thing is to tax their businesses, property, etc. and that will still be here, because they can't make any money by actually keeping it in the caymans (that's always just a front).

So we have a shortage of doctors yet you're happy to see them retiring early, as they're doing now, because (partly) of high pension taxes on high earners?if some high earners chose to work less, and get a bit more life/work balance, that might be no bad thing. but i suspect few will.

http://www.telegraph.co.uk/news/2016/04/21/i-weep-for-gps-and-their-1-million-pension-pots/

Err...the point is they're proposing much higher public spending without raising taxes on ordinary people. They seem to want a state the size of the Scandinavian countries without their tax rates.straw man. labour aren't proposing big tax cuts for most people. they're proposing keeping taxes about the same for most people, and putting them up a bit for the better off.

No. The fall is fairly trivial despite the scaremongering. Have a look at this graph from the ONS (fig.1); https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/articles/supplementaryanalysisofaverageweeklyearnings/latestand wages have fallen in real terms over the last 10 years. which is the most sustained fall in wages in 200 years. so no big deal, eh?

If you hover over the graph you can see the numbers. Real earnings are the same now as they were in mid 2006. They went up during the boom in 2007, then fell after the GFC up to 2014, and now they're back to where they were, in real terms, 11 years ago, and higher than they were before 2006. So no, it's not a big deal.

The NHS has actually had funding increased in real terms. Though it does need more. Other public services have certainly been cut, but Labour were promising very similar cuts in 2010. Personally I'd have preferred the balance to be swung more towards tax rises than cuts, particularly now, but neither of the major parties has the guts to raise taxes on ordinary people.also, public services have been cut, with even deeper cuts planned. (the NHS chronically underfunded. schools begging for money from parents.)

Worse off than when, you mean the peak of the boom before the GFC? As the ONS chart shows, wages are now higher in real terms than 2005. That's not bad considering the GFC.most people are worse off. that's a huge economic failure.

Of course they have control of their economy, that's how they got into the mess they did.the key is that: low wages, low productivity, under-employment (a disguised form of unemployment), and low investment are all linked. the way to address all those issues is to raise real wages and public investment. when people have more to spend, the private sector will also be prepared to invest more. and when employers know they can't get away with increasing profits by cutting wages, they will have to invest (in both capital goods and skills) so that they can raise productivity and make a decent profit despite paying higher wages.

the greek government has no control of their economy, because they are in the eurozone. they haven't been able to implement the (actually very mildly left-wing) policies they wanted to.

At least most people here have wages. Look at the unemployment rate in the rest of the EU compared to the UK.thanks goodness we're not in the eurozone. (whether to be in or out of the EU is a trivial matter, in comparison.)

note that greece is (IIRC) the only OECD country with a similarly bad record to the UK of falling wages over the last 10 years. (certainly things are a lot worse in greece, because they also have very high unemployment.)

http://ec.europa.eu/eurostat/statistics-explained/index.php/File:Unemployment_rates,_seasonally_adjusted,_September_2017_(%25)_F2.png

:rotfl:yes funny how the Tories and even New Labour never had to make such plans.perfectly sensible to prepare for every eventuality. and having a good plan for what to do in case of a run on the pound makes it less likely to happen. because markets try to anticipate the next move.

It's in addition. As with all things, there are many reasons for financial services to local in London. Those reasons are starting to evaporate, since 2016.there won't be a loss of overall tax revenue. it will raise an unknown but non-trivial amount of revenue. as le loup said, look at stamp duty on shares - 0.5% is very high, compared to most countries. with a tobin tax, we're talking about a much low rate than that, applied to a much broader range of transactions.0 -

It would hopefully discourage the idea of a house as an investment rather than a place to live.Glen_Clark wrote: »Supply shortage keeps house prices high. Wouldn't discouraging selling with CGT increase the shortage?0 -

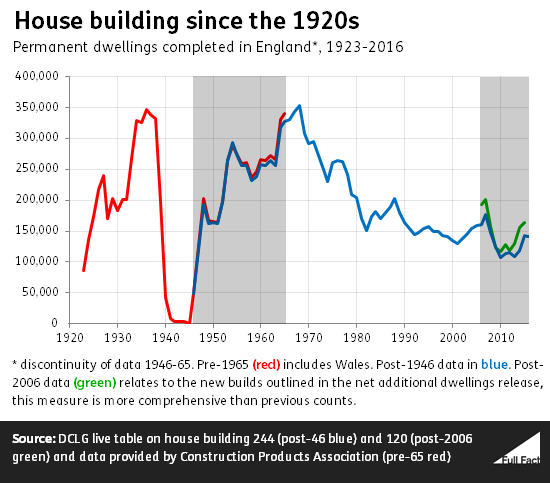

The housing supply has increased faster than the population. The problem is there are less people per property. Building more houses and thinking that'll solve the problem is like building more roads and thinking that'll reduce traffic. Policies should encourage sharing of property, and discourage wastage, so high taxes on empty homes, holiday homes, and no single person discount on council tax etc.Glen_Clark wrote: »This graph of housebuilding activity (or rather lack of) makes it pretty obvious why prices have risen so much. link

But rather than tackle the obvious supply shortage the Government has stimulated demand with negative real interest rates and taxpayer subsidies like 'Help to Buy' and Housing Benefit.0 -

Though bear in mind most of those on pensions will have already paid NI on those earnings, you can avoid it now with salary sacrifice but it's a fairly new concept.I also agree that people in my position should be paying more tax.

One area where extra tax could surely be taken is in the iniquitous disparity in the taxation of earned and unearned income. NI is focussed on the middle income earner whilst those of us living on large pensions and unearned income pay nothing.

Mainly because their tax rate goes up 20%, consider it marginal rates of 32% and 42% (tax and NI), so it is progressive when taken together.And another opportunity for a fairer distribution of tax - why should those people with a high earned only pay a marginal NI rate of 2%?

Well the coalition did hammer the top 10% harder than anyone else. But the LibDems were involved...In my view we need a government with the mandate and desire to make major changes to the national economy. Would Boris and Jacob do the job? I cant see Conservative party donors liking the idea.0 -

Yes, and if it applies from when implemented (ie not backadted to purchase date of house), it shouldn't cause a damaging plummet in prices.The cgt exemption on main properties is an anomaly that should be removed, this in itself will damp down house prices given the current cgt system.

A lot is down to propaganda and fake news on social media. Virtually the only political stuff in my social media feed is from far right, far left, and Brexiteers. Well, was till I blocked them!What I find odd is the whole damnation of people who express an alternative preference. Because people don't agree with you they are stupid, and whilst I don't have huge amounts of confidence in people's intelligence then they aren't necessarily stupid.

The consistent votes that are anti establishment, be that trump, Brexit, Corbyn, have happened for a reason. That reason is that many people don't feel they are benefitting under the current regimes and these are protest votes, people don't necessarily think they will be better but don't think they'll be any worse off.0 -

Buy loads of US Dollars and spend as much time as you can in the USA enjoying the brilliance of nice Mr Trumps second term.0

-

Surprising that in three pages no-one has said anything about infrastructure investments and PFI contracts. HICL, for instance, is looking remarkably cheap at the moment, but perhaps is higher risk than anyone had realised.0

-

The IFS are well respected across the political spectrum, they are ofter quoted by left-wing politicians as well as right-wingers and centrists.

left-wing politicians sometimes quote the IFS when they've criticized the government. it's for the same reason that corbyn sometimes quotes tories who disagree with the government's position. it suggests: if even they disagree ...

it was never given a chance, because many people with large incomes can shift income forward or backwards by a year or 2, and it was only in place for a small number of years. so people brought income forward into the last year with a 40% top rate, before 50% came in; and they postponed income when they knew the 50% was about to be cut to 45% . but having the top rate at at least 45% for a decent number of years will have brought in a fair bit of extra tax by now.Even the recent 50% rate didn't raise anything extra.

and if it were put up to 50% again, you'd initially see some income brought forward to catch the 45% top rate while it's available, but after a few years, more tax would start to come in.

you have just stated the idea that tax rises reduce tax revenue, without explaining how. that is just evidence-free assertion.

it's a stupid idea to engage in a race to the bottom, where everybody undercuts everybody else's corporation tax rates. are you seriously advocating that? that just leads to no taxation for the super-rich. it would be much more sensible for governments to get together and agree to minimum tax rates.Or it encourages multinationals to make their profits here rather than in a higher tax country.

(i didn't find more recent data, in a cursory search. yeah, could do betterThat graph doesn't make the point you want it to. If you ignore the misleading trend line, which is over 18 years up to 2018 (interesting that it was published in 2014 so there's guesswork for the last 4 years), you can see that corp tax receipts from large companies are higher now than they were in 2010. )

)

there is some recovery in CT from large companies after a trough in 2009-10, which is presumably when profits were temporarily depressed due to the aftermath of the GFC.

a long-term trend line - through both labour and tory governments - is a reasonable approach, since both governments gradually cut corporation tax.

the tories don't want to crack down on tax avoidance/evasion because it's being done by their friends (and sometimes by them). IMHO, the current labour leadership does want to.All govts say they want to crack down on tax avoidance. Every single budget document I've read has some new policy to do exactly that.

as for how, the tools needed are (and this is relatively new) known, and almost in place (but so far, with loopholes), viz.:

- automatic exchange of information (via CRS)

- disclosure of beneficial ownership

- country-by-country reporting (which is happening in secret, but needs to be on public record)

a successful crackdown is realistic, in a way that it wasn't a few years ago.

yes, there are many anti-avoidance measures in each finance act. but HMRC target relatively obscure schemes, and are hopeless at challenging the multinationals, many of which have very questionable tax structures. e.g. see this link on HMRC's failure to even try collecting VAT from uber: https://waitingfortax.com/2017/10/27/something-is-very-wrong-at-hmrc/

HMRC, who come up with most of the tax legislation, lack determination to challenge big companies. they need new leadership, as well as more funding (which would pay for itself many times over).

labour costs come into it, but then so does labour skills. and there is no point in engaging in a race to bottom for wages. do you really think that's a good idea? in some ways, that is what we're doing now, and it's why most people are getting poorer.Oh really? What about labour costs? I guess that's low down too.

certainly tax havens matter.So no need for tax havens then, why all the fuss about the paradise papers?

my point was that putting money in secrecy jurisdictions is a sham. it's recorded as being there to avoid tax and other scrutiny, but it's almost all really back in the major economies, where it can actually be invested.

and this is 1 way in which it's possible to unmask the secrecy - by tracing ownership back from businesses and real estate in the UK, and in other major economies.

if that's really anything to do with why there's a shortage of doctors, which i'm not at all sure about (and certainly, failing to train enough doctors is a bigger issue), then it's to do with the cliff-edge switch to a much higher effective tax rate on pensions over a certain size.So we have a shortage of doctors yet you're happy to see them retiring early, as they're doing now, because (partly) of high pension taxes on high earners?

it's not relevant to labour's proposals for modest tax increases on higher incomes.

increasing public spending by more than they increase taxes would be a good idea.Err...the point is they're proposing much higher public spending without raising taxes on ordinary people.

in the current situation (in which the economy is far below its potential capacity - as can be seen from the low productivity and high under-employment), it will expand the economy, making the country as whole richer. and much of the spending will be on infrastructure, or on public healthcare, both of which specifically help to make further economic activity more productive.

and when the economy expands, so will tax receipts, reducing the deficit. those indirect effects are ignored in the simplistic analyses of tax and spending which people such as the IFS come up with.

now, i haven't seen labour using this argument for higher public spending. but the higher spending will work in this way, whether or not they explain it like this.

yes, it's a small fall. the point is that any fall at all over 10 years is a dreadful performance: you'd expect a substantial rise!No. The fall is fairly trivial despite the scaremongering.

also, that is just earnings. spending on public services also contribute to households' living standards (mainly via health and education), and that has also fallen.

it's a disastrous result.

huh? the greek government is now following policies dictated to it by the EC/ECB/IMF, on tax, spending, privatizations, etc. that's what i mean by not being in control of their economy. they can hardly make any significant decisions. (how they got into the mess is another, very large topic.)Of course they have control of their economy, that's how they got into the mess they did.

of course greece is in a far worse state than the UK. mainly because they have been forced to implement vastly more extreme austerity policies than those which the UK's government has chosen to implement, without external pressure.

it's pretty simple. a lot of powerful people don't want a genuinely left-wing government to succeed, and will try to sabotage it.yes funny how the Tories and even New Labour never had to make such plans.

agreed. now try and form a sentence including the phrases: "hard brexit", "tories", and "economic competence".As with all things, there are many reasons for financial services to local in London. Those reasons are starting to evaporate, since 2016.0 -

So, quote them when they agree with you and accuse them of bias when they disagree :rotfl:You'll never be wrong that way!grey_gym_sock wrote: »left-wing politicians sometimes quote the IFS when they've criticized the government. it's for the same reason that corbyn sometimes quotes tories who disagree with the government's position. it suggests: if even they disagree ...

But the IFS don't generally get accused of bias, by left or right, except by those who have no answer to their critical analysis.

Good job the Tories decided on a higher than Labour did for 99% of their 13 years in govt then, eh?it was never given a chance, because many people with large incomes can shift income forward or backwards by a year or 2, and it was only in place for a small number of years. so people brought income forward into the last year with a 40% top rate, before 50% came in; and they postponed income when they knew the 50% was about to be cut to 45% . but having the top rate at at least 45% for a decent number of years will have brought in a fair bit of extra tax by now.

Try looking at history. 1988 would be a good start.and if it were put up to 50% again, you'd initially see some income brought forward to catch the 45% top rate while it's available, but after a few years, more tax would start to come in.

Oh, and what evidence have you supplied then? Show me evidence of a drop in the tax take when the tories cut all the higher rates in 1988.you have just stated the idea that tax rises reduce tax revenue, without explaining how. that is just evidence-free assertion.

It's already happeningit's a stupid idea to engage in a race to the bottom, where everybody undercuts everybody else's corporation tax rates. are you seriously advocating that?

It would. But inter-govt co-operation is on the wane. Brexit, Trump's "America First" policies...that just leads to no taxation for the super-rich. it would be much more sensible for governments to get together and agree to minimum tax rates.

It's a linear trend line - usual choice is poly. It's skewed by the credit-fuelled boom around 2006-7. It doesn't say what you want it to - I'm sure if you search you'll find some figures that have correctly massaged.(i didn't find more recent data, in a cursory search. yeah, could do better )

)

there is some recovery in CT from large companies after a trough in 2009-10, which is presumably when profits were temporarily depressed due to the aftermath of the GFC.

a long-term trend line - through both labour and tory governments - is a reasonable approach, since both governments gradually cut corporation tax.

Yeah, yeah, Tories helping their rich mates...New Labour were too no doubt as their record is just as bad, all a conspiracy to line the pockets of the rich as the expense of the downtrodden worker, yada yada...the tories don't want to crack down on tax avoidance/evasion because it's being done by their friends (and sometimes by them). IMHO, the current labour leadership does want to.

Requires international co-operation. Also there are genuine privacy concerns - as with health, your financial affairs desrve some privacy (from the public, not from the tax authorities).as for how, the tools needed are (and this is relatively new) known, and almost in place (but so far, with loopholes), viz.:

- automatic exchange of information (via CRS)

- disclosure of beneficial ownership

- country-by-country reporting (which is happening in secret, but needs to be on public record)

LTA and higher rate tax is a 55% tax rate. Just 5% above what Labour are proposing for £80k+ earners, which also creates a 75% tax band in the 100-120k range where the personal allowance is withdrawn.a successful crackdown is realistic, in a way that it wasn't a few years ago.

yes, there are many anti-avoidance measures in each finance act. but HMRC target relatively obscure schemes, and are hopeless at challenging the multinationals, many of which have very questionable tax structures. e.g. see this link on HMRC's failure to even try collecting VAT from uber: https://waitingfortax.com/2017/10/27/something-is-very-wrong-at-hmrc/

HMRC, who come up with most of the tax legislation, lack determination to challenge big companies. they need new leadership, as well as more funding (which would pay for itself many times over).

labour costs come into it, but then so does labour skills. and there is no point in engaging in a race to bottom for wages. do you really think that's a good idea? in some ways, that is what we're doing now, and it's why most people are getting poorer.

certainly tax havens matter.

my point was that putting money in secrecy jurisdictions is a sham. it's recorded as being there to avoid tax and other scrutiny, but it's almost all really back in the major economies, where it can actually be invested.

and this is 1 way in which it's possible to unmask the secrecy - by tracing ownership back from businesses and real estate in the UK, and in other major economies.

if that's really anything to do with why there's a shortage of doctors, which i'm not at all sure about (and certainly, failing to train enough doctors is a bigger issue), then it's to do with the cliff-edge switch to a much higher effective tax rate on pensions over a certain size

Wrong, see above.it's not relevant to labour's proposals for modest tax increases on higher incomes.

Yeah, that's what the Greeks thought.increasing public spending by more than they increase taxes would be a good idea.

Yeah right. Examples of countries where such an approach has worked well over the long term?in the current situation (in which the economy is far below its potential capacity - as can be seen from the low productivity and high under-employment), it will expand the economy, making the country as whole richer. and much of the spending will be on infrastructure, or on public healthcare, both of which specifically help to make further economic activity more productive.and when the economy expands, so will tax receipts, reducing the deficit. those indirect effects are ignored in the simplistic analyses of tax and spending which people such as the IFS come up with.

Why do govt ever bother raising taxes then? Spending more will always make as richer, just do it! Don't let Greece or Venezuela put you off.

now, i haven't seen labour using this argument for higher public spending. but the higher spending will work in this way, whether or not they explain it like this.

No it isn't. There was a "global financial crisis", don't you remember? Wages have recovered to the same real terms level as 11 years ago. That's not a "cost of living crisis" that left-wing propaganda would lead you believe, it's a good recovery from a serious financial crisis.yes, it's a small fall. the point is that any fall at all over 10 years is a dreadful performance: you'd expect a substantial rise!

Also obsession with growth and idea that we must constantly get richer and the and it's a failure if we don't, even over the short term, it just fuelled by greed. I'd prefer the poorer countries to catch us up before we selfishly steam ahead.

Gordon Brown thought he'd abolished boom and bust. So they acted as if the boom in the mid 2000's would go on forever. It didn't. There was a massive bust. We weren't as rich as we though we were. So we back down to where we were in about 2005. That wasn't a "disaster". If you think it is, have a look at the socialist paradise of Venezuela.also, that is just earnings. spending on public services also contribute to households' living standards (mainly via health and education), and that has also fallen.

it's a disastrous result.

https://www.theguardian.com/world/2016/oct/19/venezuela-crisis-hospitals-shortages-barcelona-caracas

They spent more than they raised in taxes.huh? the greek government is now following policies dictated to it by the EC/ECB/IMF, on tax, spending, privatizations, etc. that's what i mean by not being in control of their economy. they can hardly make any significant decisions. (how they got into the mess is another, very large topic.)

No the GFC was no pressure at all.of course greece is in a far worse state than the UK. mainly because they have been forced to implement vastly more extreme austerity policies than those which the UK's government has chosen to implement, without external pressure.

Yes they'll want their scapegoats when it all goes wrong. The Venezuelan govt blames everyone else for the mess they're in.it's pretty simple. a lot of powerful people don't want a genuinely left-wing government to succeed, and will try to sabotage it.

Hard brexit will be a disaster. Hard brexit followed by a Corbyn govt would be an utter unmitigated disaster. It's the worst off all worlds. We "take back control" then give that control to a neo-marxist govt.agreed. now try and form a sentence including the phrases: "hard brexit", "tories", and "economic competence".0 -

:rotfl:Amazing the arguments that Nimbys come up with to avoid the obvious simple supply and demand - increasing the supply of housing makes it more affordable.Building more houses and thinking that'll solve the problem is like building more roads and thinking that'll reduce traffic.

Building more roads doesn't reduce the overall volume of traffic. It just reduces congestion by distributing the traffic over more roads - as becomes obvious when you cross the channel and see traffic densities about one third of those in England.

Similarly building more houses doesn't reduce the number of people. It just means more of them can afford a home.

Labour mobility increases, the money spent on housing benefit and rent can be used more productively - all of which is good for the economy. But bad for the landlord vested interests controlling the Government.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards