We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

How to protect your assets under a Corbyn government

Comments

-

Why did the IFS say their manifesto "wouldn't work" then?

because the IFS are still wedded to thatcherite economic dogma. they don't seem to have noticed that it's completely stopped working since 2007/8 (not that it even worked for everybody before that) - most households have got poorer since then. and the IFS want to carry on doing the same thing.

nonsense. at the kind of rates we're talking about (40%, 50%, 60%), higher taxes raise more money. at very high rates (perhaps 80% or 90%), that would eventually break down. but not with the kind of modest tax rises labour are talking about.They proposed big increases in spending but only raising tax rates on those on over £80k and corporations. Both are likely to result in less tax revenues, not more.

corporation tax is absurdly low, at less than just about any other major economy. and because it's less than the basic rate of income tax (not to mention national insurance), it encourages small businesses to incorporate for tax-avoidance purposes.

that is entirely because more businesses have incorporated, which is itself often for reasons of tax avoidance. so far more is lost in income tax and NI revenue than is gained in CT revenue.The Tories have reduced corporation tax rates, but the amount receievd in corp tax has increased!

see the graph in this article - http://www.taxresearch.org.uk/Blog/2015/04/02/have-corporation-tax-receipts-really-risen/ - which shows that CT collected from large companies has fallen as the CT rate has been cut, while receipt from small companies have grown. showing the difference is that there are more small companies.

another important plank of labour's tax policy is cracking down on tax avoidance and evasion, instead of just pretending to.

that's entirely because wages have become more unequal. top earnings have risen massively, and have continued to do so since the GFC. lower and middle earnings grew much more slowly, and have been falling since the GFC.Similar with taxes on high earners, when the Tories chopped the higher rates of tax in the late 80's the tax revenues from high earners actually increased.

why the different growth in earnings? it's mainly about power. most workers become less powerful as union membership declined and tory anti-union legislation made them less effective. top executives' pay soared, as they set one another's pay, and governments (both tory and labour) chose to stand by.

will amazon want to make profits in the UK if they have to pay proper taxes on them, or would they prefer no profits?Multinationals and high earners have more choices than ordinary people. They can go abroad (or not come here). They can afford to work less, or retire early. Raising taxes on them can and does reduce revenue, not increase it. We see it now with the pension LTA which hits high earners like doctors, who are retiring early.

tax is a long way down the list of factors which affect where businesses locate. it won't drive away any businesses which it is worth having here anyway.

people very rarely leave because of high taxes. yes, the super-rich might, but with them the important thing is to tax their businesses, property, etc. and that will still be here, because they can't make any money by actually keeping it in the caymans (that's always just a front).

if some high earners chose to work less, and get a bit more life/work balance, that might be no bad thing. but i suspect few will.

straw man. labour aren't proposing big tax cuts for most people. they're proposing keeping taxes about the same for most people, and putting them up a bit for the better off.Point out a successful "big state" economy that has low taxes on ordinary people then.

The likes of the Scandivanian countries are big state economies. Excellent public services, excellent welfare provision etc. But taxes are high on ordinary people. Not just the wealthy and corporations. Sweden for instance has over 30% basic rate tax (with a tiny allowance, about £2k), over 30% NI, 25% VAT on almost everything, very high alcohol taxes etc.

That works. Raising taxes on just the rich and corpoartions doesn't.

and wages have fallen in real terms over the last 10 years. which is the most sustained fall in wages in 200 years. so no big deal, eh?Do you remember being constantly told by Labour that "austerity will cause a recession"? They were wrong. It didn't. Do you remember them then switching tack to claiming it's a "jobless recovery"? They were wrong there too. Unemployment is now the lowest in 40 years.

also, public services have been cut, with even deeper cuts planned. (the NHS chronically underfunded. schools begging for money from parents.)

most people are worse off. that's a huge economic failure.

the key is that: low wages, low productivity, under-employment (a disguised form of unemployment), and low investment are all linked. the way to address all those issues is to raise real wages and public investment. when people have more to spend, the private sector will also be prepared to invest more. and when employers know they can't get away with increasing profits by cutting wages, they will have to invest (in both capital goods and skills) so that they can raise productivity and make a decent profit despite paying higher wages.

the greek government has no control of their economy, because they are in the eurozone. they haven't been able to implement the (actually very mildly left-wing) policies they wanted to.The Greeks didn't like austerity, so they elected a far left govt. But it didn't change anything. They are implementing the worst austerity in Europe. Because it's an economic necessity.

thanks goodness we're not in the eurozone. (whether to be in or out of the EU is a trivial matter, in comparison.)

note that greece is (IIRC) the only OECD country with a similarly bad record to the UK of falling wages over the last 10 years. (certainly things are a lot worse in greece, because they also have very high unemployment.)

perfectly sensible to prepare for every eventuality. and having a good plan for what to do in case of a run on the pound makes it less likely to happen. because markets try to anticipate the next move.Oh really? Try telling John McDonnell that then. He's preparing for a "run on the pound" http://www.independent.co.uk/news/uk/politics/labour-pound-sterling-run-john-mcdonnell-economy-government-jeremy-corbyn-party-conference-a7968156.html

there won't be a loss of overall tax revenue. it will raise an unknown but non-trivial amount of revenue. as le loup said, look at stamp duty on shares - 0.5% is very high, compared to most countries. with a tobin tax, we're talking about a much low rate than that, applied to a much broader range of transactions.Tobin never intended it to be used to raise revenue. That wasn't its purpose, but of course, like higher taxes on the rich and corporations, Labour and others look on it as a way to raise revenue without taking account of change in behaviour/location which would likely result in loss of overall tax revenue.0 -

Personally I'd put high CGT on all housing even owner occupied but with the ability to carry foward gains to a new house, and as transition only apply it to the increase from the point it's implemented.

Supply shortage keeps house prices high. Wouldn't discouraging selling with CGT increase the shortage?“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

Fill the bath with petrol to negate inflation.

If you're fortunate enough to have a sink that too.

No need to thank me.0 -

I wish there would be a government that would tax us all more, and fund education and the NHS more. I'm not sure any of the current parties would align to my ideal though.

I don't think life is all about protecting your assets; there's a moral obligation to help others less fortunate than yourself.

MSE is great but talking about money can bring out the worst side in some people.

I would also willingly pay more tax. Putting up tax on the wealthy does not work as they pay accountants to help them avoid it. The poor need more tax breaks. Whereas the cushty middle classes could easily pay more. Whilst I tend towards supporting the Tory party, their obsession with reducing tax on the middle classes baffles me. My suspicion is that modest tax rises could help the Tories. And they should also reduce the tax avoidance schemes, such as £40,000 a year into a pension fund with basic and higher rate tax refunded.0 -

veryintrigued wrote: »Fill the bath with petrol to negate inflation.

If you're fortunate enough to have a sink that too.

No need to thank me.

That is a rather inflammatory suggestion.

And wouldn't you get rather smelly over time?0 -

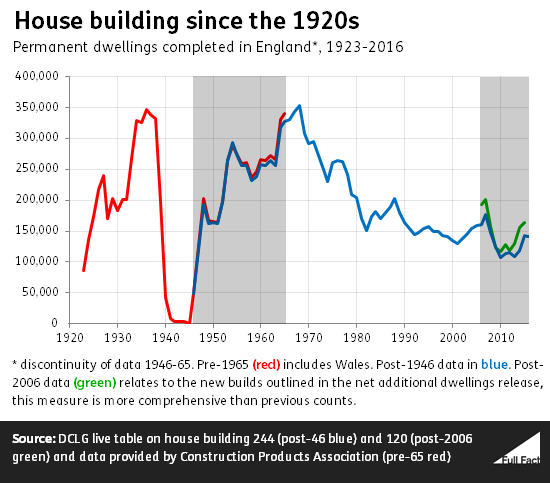

This graph of housebuilding activity (or rather lack of) makes it pretty obvious why prices have risen so much. link

But rather than tackle the obvious supply shortage the Government has stimulated demand with negative real interest rates and taxpayer subsidies like 'Help to Buy' and Housing Benefit.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

Glen_Clark wrote: »Supply shortage keeps house prices high. Wouldn't discouraging selling with CGT increase the shortage?

A two pronged approach would be:- Make BTL very tax inefficient and restrict it in certain circumstances (e.g. Australia only allows non-citizens to buy new builds)

- Also, streamline planning rules including appeals plus penalise land banking by building companies.

This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 - Make BTL very tax inefficient and restrict it in certain circumstances (e.g. Australia only allows non-citizens to buy new builds)

-

BananaRepublic wrote: »That is a rather inflammatory suggestion.

And wouldn't you get rather smelly over time?

A couple of joss sticks would sort that.....0 -

BananaRepublic wrote: »I would also willingly pay more tax. Putting up tax on the wealthy does not work as they pay accountants to help them avoid it. The poor need more tax breaks. Whereas the cushty middle classes could easily pay more. Whilst I tend towards supporting the Tory party, their obsession with reducing tax on the middle classes baffles me. My suspicion is that modest tax rises could help the Tories. And they should also reduce the tax avoidance schemes, such as £40,000 a year into a pension fund with basic and higher rate tax refunded.

I also agree that people in my position should be paying more tax.

One area where extra tax could surely be taken is in the iniquitous disparity in the taxation of earned and unearned income. NI is focussed on the middle income earner whilst those of us living on large pensions and unearned income pay nothing. I cannot see any justification for the enormous tax breaks now arising from the £20K ISA limit which further push the tax burden away from unearned income. A fairly well off couple could in say 10 years accumulate enough ISA'd investments to sustainably generate an extra £15K-£20K/year tax free. An opportunity that is denied to the vast majority of the working population.

Whilst a small elite are increasing their share of the nation's wealth the standard of living of those reliant on a moderate earned income is being reduced both through wage increases less than inflation and severe cut backs in public services.

Another area where reform is needed is the disparity of infrastructure spending between the over developed SE and the under-developed remainder of the country.

And another opportunity for a fairer distribution of tax - why should those people with a high earned only pay a marginal NI rate of 2%?

In my view we need a government with the mandate and desire to make major changes to the national economy. Would Boris and Jacob do the job? I cant see Conservative party donors liking the idea.0 -

The cgt exemption on main properties is an anomaly that should be removed, this in itself will damp down house prices given the current cgt system.

What I find odd is the whole damnation of people who express an alternative preference. Because people don't agree with you they are stupid, and whilst I don't have huge amounts of confidence in people's intelligence then they aren't necessarily stupid.

The consistent votes that are anti establishment, be that trump, Brexit, Corbyn, have happened for a reason. That reason is that many people don't feel they are benefitting under the current regimes and these are protest votes, people don't necessarily think they will be better but don't think they'll be any worse off.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards