We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

MSE News: UK base rate decision looms - what it means for you

Comments

-

-

Coventry Building Society to increase variable savings rates by 0.25% from 1st December.

https://www.coventrybuildingsociety.co.uk/

N.B. Page does not display correctly for me in Firefox nor Opera. OK in Internet Explorer.

I wonder if these announcements cover all such accounts or only those currently available to open.0 -

Coventry Building Society to increase variable savings rates by 0.25% from 1st December.

https://www.coventrybuildingsociety.co.uk/

N.B. Page does not display correctly for me in Firefox nor Opera. OK in Internet Explorer.

Good news. Still have their 2.75% former Stroud & Swindon regular savings account.0 -

Nationwide BS

"We will be increasing Savings rates by 0.25% for all members who received a reduction of 0.25% following the base rate reduction in September 2016."

https://www.nationwide.co.uk/support/support-articles/rates-fees-charges/bank-of-england-base-interest-rate-announcement-savings0 -

Leeds Building Society announcement:

Base Rate change from 0.25% to 0.50%

We’re reviewing the announcement by the Bank of England’s Monetary Policy Committee on Thursday 2nd November to increase Base Rate.

The majority of Leeds Building Society savers and borrowers are on fixed rate products. Therefore, the rates will remain the same until the fixed period ends.

Bank of England tracker accounts will change automatically in accordance with the terms and conditions of the account.

0 -

Malthusian wrote: »

cash will always be eroded by inflation.

Clearly not if inflation falls to the 2% target.

Indeed Martin Lewis regularly lists inflation-busting accounts and bonds (although I concede at the moment there's hardly any because inflation is almost double the 2% target).Please be polite to OPs and remember this is a site for Claimants and Appellants to seek redress against their bank, ex-boss or retailer. If they wanted morality or the view of the IoD or Bank they'd ask them.0 -

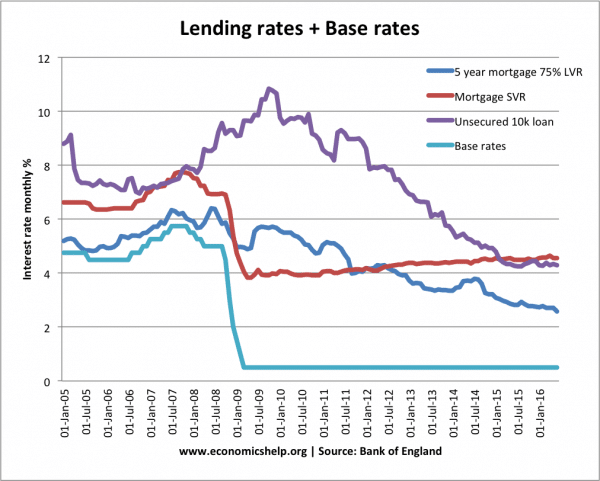

How come there is such a furore about energy 'standard variable tariffs' being a rip off but the fact that mortgage 'standard variable rates' are now 4% above the bank base rate compared to the 2% prior to the GFC is just accepted?

I think....0

I think....0 -

Seems strange that all rates are 'under review' - everyone knew the change was going to happen, surely it would be possible for banks to already have a plan....I think....0

-

So they announce the first rate rise in 10 years - but share prices rise.

Since they started QE, conventional economics seems to have been turned on its head?“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

Glen_Clark wrote: »So they announce the first rate rise in 10 years - but share prices rise.

Since they started QE, conventional economics seems to have been turned on its head?

Share prices are up because the pound is down.

The pound is down because although rates went up today the forecast for future rate rises was reduced from 2 more increases next year to two more increases by 2020.I think....0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards