We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

Comments

-

financialbliss wrote: »Do you pay your credit cards via direct debit, or pay them manually? If via direct debit, how far ahead of the due date to they take the money, or do they take it on the due date? Something I may have to look into...

Financial Bliss.

We only use cashback credit cards and obviously pay them in full. We have one joint card and a card each. All of them are settled by DD. The chance of forgetting a payment, as you have, is just too high for me, and the benefit of the card would soon be wiped out.

They take the payments about one week before the due date.... the interest loss on what is usually about £1k for a few days (you'd pay it a few days before anyhow) is well worth it IMO.0 -

financialbliss wrote: »Do you pay your credit cards via direct debit, or pay them manually? If via direct debit, how far ahead of the due date to they take the money, or do they take it on the due date? Something I may have to look into...

Financial Bliss.

FB happened to me last year before holiday.

I would recommend you DON'T use the card now until the next bill and clear it first; they will otherwise charge you interest on the things you buy in the meantime!

I set our online payment upon generation of the bill (i.e. it is always available from NatWest on 19 of the month). As they use Fasterpayments then I schedule the transfer on the working day before it is due. My bill can be £2000-3000 in a month (latter if I have business expenses on there) but when I asked about DD payment they would take it 10 working days in advance..... I've only twice in 26yrs missed a payment so I think I'll continue with the electronic payment I set as now, but as JonnyB notes, it can be costly if you miss it.0 -

financialbliss wrote: »

Do you pay your credit cards via direct debit, or pay them manually?

Always manually.

I've a Tesco Credit card and it uses Faster Payments, as does my current account with HSBC.

I can set how many days before payment is due, I receive a reminder text and or email, and even the time of day.

I set it up a few years ago after I too ended up with a £12 charge for a late payment, but I rang them up and because it was my first time, the nice lady on the phone refunded the charge.

She then suggested I set up a text alert if I still wanted to pay manually on time instead of direct debit.

Not had a problem since.

I have mine set to 3 days before payment is due before between 08:01 and midday (it was set to 5 days before FP).0 -

ASDA credit card again. I've now made another payment today of £47.01 which is the outstanding balance on the card - monthly fuel bill isn't that huge, but 1p off / litre is 1p in my pocket.

Thanks for the quick replies on the credit card automated payment / manual front. I'm probably going to sit tight and see how this CC pans out over the next few days before I consider a direct debit payment method.

In the god knows how many years I've had various credit cards, I've only once had a "late" payment and this was in the days before the internet was widely in use. Posted a payment off via cheque, but forgot to sign the cheque. Doh! :rolleyes:

Credit card company promptly sent it back, I signed it and also promptly sent it back. As the cheque arrived on the due date, there was no possibility that it would also clear on the due date, but I'd been is discussions with the credit card company, they let me off with the late payment charge and altered the account so I'd not pay interest on the outstanding debt.

Since then, I've been very careful with loans, mortgages and credit cards until today. Guess you can't have a clear record all the time.

Watch this space - I'll let you know if I get charged...

FB.Mortgage and debt free. Building up savings...0 -

Bit of good news...

The October mortgage payment / overpayment cleared today. Our mortgage is now standing at £50,388.47. Definitely sub-£50k in November.

I have updated and uploaded the now 3 graphs on post #1, updated post #1's numbers and updated my signature.

I incorrectly reported the other day that our 2009 mortgage interest would break through the £2,000 mark on 4th October. I'd calculated it as the 6th October, but noted it down as 4th.

Our overall mortgage interest is £19,799.22 - I've calculated that this should break through £20,000 on the 4th November (2009).

In 2008 we made overall payments of £13,211,09 and with interest at £3,057.87, this was a net reduction of £10,153.22.

When the November payments clear, we will have exceeded the 2008 net reduction and should see a final 2009 net reduction of over £11,000.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

financialbliss wrote: »

In 2008 we made overall payments of £13,211,09 and with interest at £3,057.87, this was a net reduction of £10,153.22.

When the November payments clear, we will have exceeded the 2008 net reduction and should see a final 2009 net reduction of over £11,000.

Financial Bliss.

Well done! :beer:0 -

financialbliss wrote: »Watch this space - I'll let you know if I get charged...

Undoubtedly they'll try it.

Uzu is right though, they'll usually refund where it is obvious it is a one-off on an account where it is usually paid on time..... so long as you ask them to refund it that is!0 -

financialbliss wrote: »ASDA credit card again.

Watch this space - I'll let you know if I get charged...

FB.

Hopefully some good news. The payment of £55.00 I made very early yesterday morning also showed up on the CC account yesterday. Very unusual (but good) - they never normally clear the same day! Still to come through to current account, but available funds have been deducted with the same amount.

Statement date is this Friday (9th), so I guess I'll know for sure then...

FB.Mortgage and debt free. Building up savings...0 -

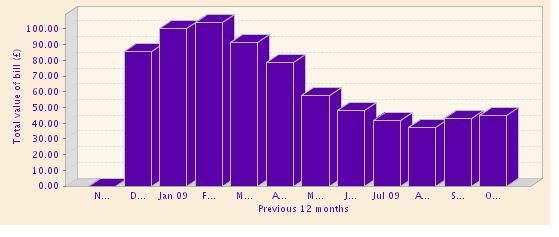

Been a bit hit 'n' miss with the energy usage recently. Looks like I didn't report it last month - probably with going away on the 31st August.

Normally I'll take the meter readings on the first of the month, enter into the Scottish Power website and report back values. I did this on the 1st October, so here's now it's looking for January to September:

Electric (Units / Cost):- January: 331 / 36.04

- February: 313 / 33.77

- March: 295 / 32.90

- April: 268 / 30.31

- May: 251 / 29.05

- June: 239 / 27.78

- July: 209 / 25.39

- August: 258 / 29.66

- September: 275 / 30.09

- January: 65 / 68.22

- February: 55 / 57.53

- March: 42 / 45.49

- April: 23 / 27.34

- May: 14 / 19.07

- June: 9 / 14.23

- July: 6 / 11.59

- August: 8 / 13.38

- September: 10 / 14.51

- January: 396 / 104.26 / 22.75

- February: 368 / 91.31 / 8.45

- March: 337 / 78.39 / 7.06

- April: 291 / 57.65 / 26.41

- May: 265 / 48.12 / 47.29

- June: 248 / 42.01 / 74.28

- July: 215 / 36.98 / 106.30

- August: 266 / 43.04 / 132.26

- September: 285 / 44.60 / 156.66

Secondly, I started making a note of our water meter readings too. Except this month I couldn't read the numbers as the inside of the meter has fogged up with water. Will get around to emailing water company this week sometime for their thoughts on the matter, as if I can't read the mater, then they won't be able to either.

Would be nice for a free meter replacement, but not too sure about paying for a replacement. Depends on the cost.

FB.Mortgage and debt free. Building up savings...0 -

well done on those energy reductions :T:T 0

well done on those energy reductions :T:T 0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards