We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

financialbliss

Posts: 1,952 Forumite

OK. Where do I start? A quick hello I guess. Hello !!!

Anyone following the mortgage free in three MFiT thread may have noticed the occasional post there by me. I’m #20. Until now, I’ve been more of an observer than a poster on these MFW forums.

Recently, however, feeling a bit down in the dumps, I decided to play around with some numbers and see if I could arrive at a realistic mortgage free date. Previously, I’d gave myself various woolly targets that I wanted to achieve, e.g. clear current mortgage in less than my first mortgage term, in < 15 years, in < 12 years, at 10 years etc. etc.

I’ve decided that I want to be mortgage free by 12/12/12. This is just over 5 years (60 months) away, plus I like this date! This gives a fixed and published goal to focus on.

I’m intentionally leaving this first post quite short, but intending to follow up with further information along the way.

Mortgage spreadsheets.

1. Monthly mortgage reduction spreadsheet. See post no's 534 and 536 linked directly below:

http://forums.moneysavingexpert.com/showpost.html?p=14965035&postcount=534

http://forums.moneysavingexpert.com/showpost.html?p=14966029&postcount=536

2. Annual mortgage reduction to monthly payment. See post no. 712 linked directly below:

http://forums.moneysavingexpert.com/showpost.html?p=16772703&postcount=712

Aims for:

2008... (5 of 6 - 83%)

2009... (4 of 6 - 67%)

2010... (4 of 6 - 67%)

2011... (4 of 4 - 100%)

2012... (0 of 7 - 0%)

In numbers...

Mortgage free goal : 12/12/12

Months elapsed : 48/60 (80.0 %)

Months remaining : 12/60 (20.0 %)

Current monthly amount towards mortgage : £887.41 + £200 - see final push spreadsheet:

The last 100 steps: Countdown to being mortgage free...

The final push: The final push...

Nationwide estimate to be mortgage free : March 2014

My own current estimate to be mortgage free : August 2013

Graphically...

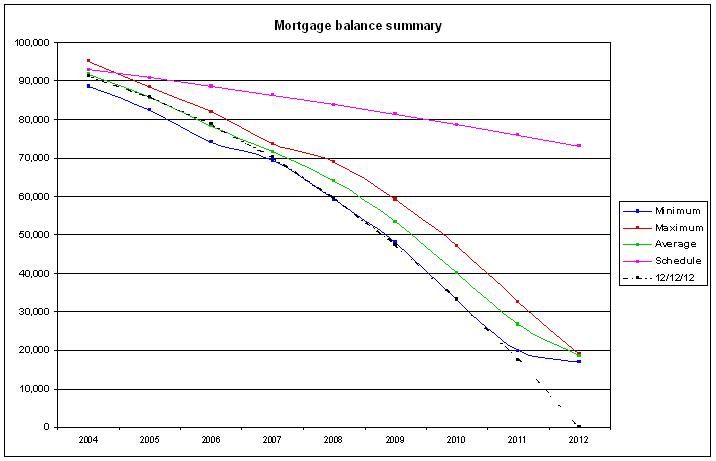

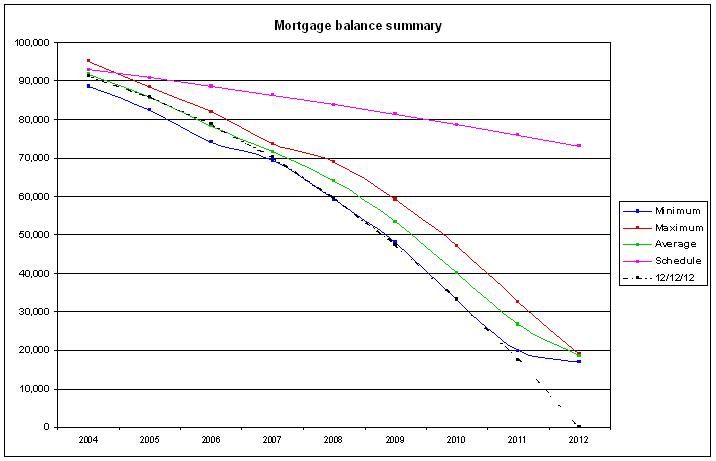

1) Mortgage balance summary - 12/12/12 schedule.

Snapshot of the mortgage balance over the course of a year, showing minimum, maximum and average mortgage balances. I've also plotted an example 12/12/12 time line and the original schedule up to 12/12/12 that I got when I signed up to the mortgage.

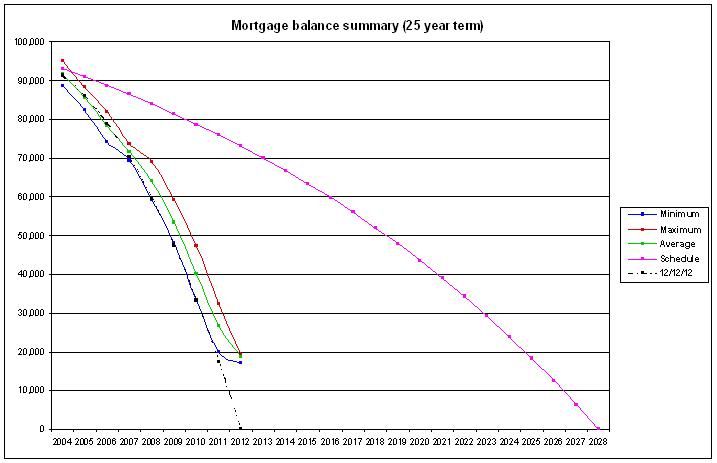

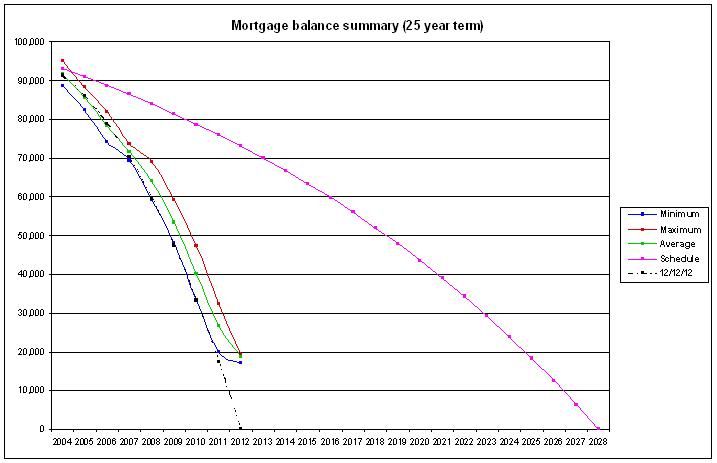

2) Mortgage balance summary - 25 year schedule.

Snapshot of the mortgage balance over the course of a year, showing minimum, maximum and average mortgage balances. I've also plotted an example 12/12/12 time line and the full 25 year schedule that we signed up for when we took out the mortgage.

Explanation (see post #153 - page 8 for further info):

Minimum (Blue): Minimum mortgage balance for the year.

Maximum (Red): Maximum mortgage balance for the year.

Average (Green): Average mortgage balance for the year.

Schedule (Pink): Original repayment schedule without any overpayments.

12/12/12 (Dotted Black): An example repayment schedule to clear by 12/12/12.

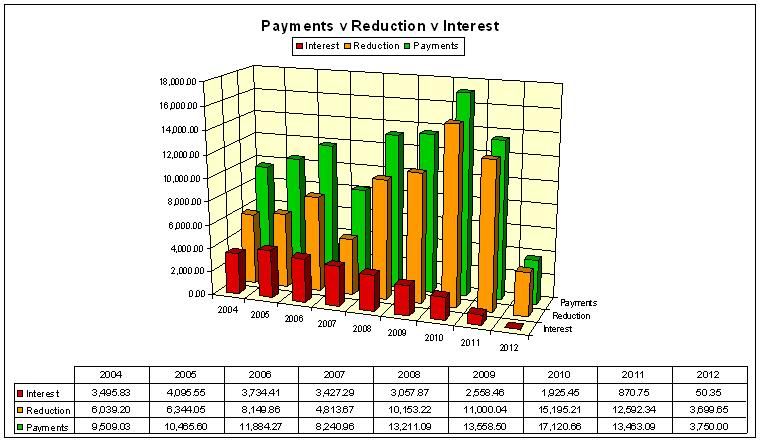

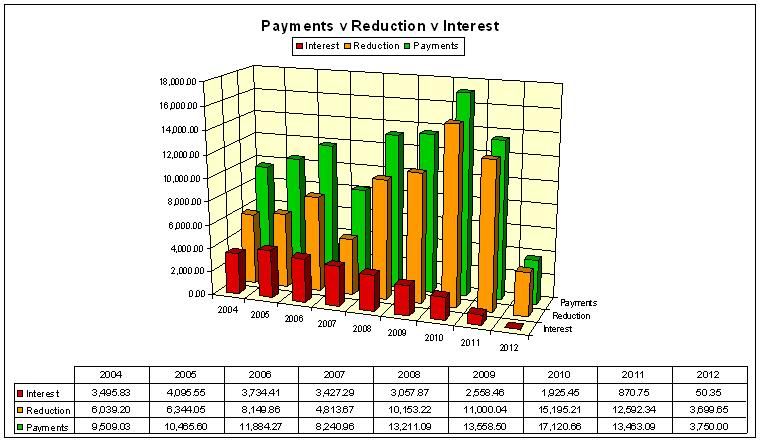

3) Payments, interest and net reduction.

Year by year comparison of payments made towards the mortgage, interest charged and the net reduction (payments - interest).

Explanation (see post #666 - page 34 for further info):

Green: Shows total payments I've made to the mortgage in any one year.

Orange: Net reduction of the mortgage balance for any one year.

Red: Interest charged to the mortgage for any one year.

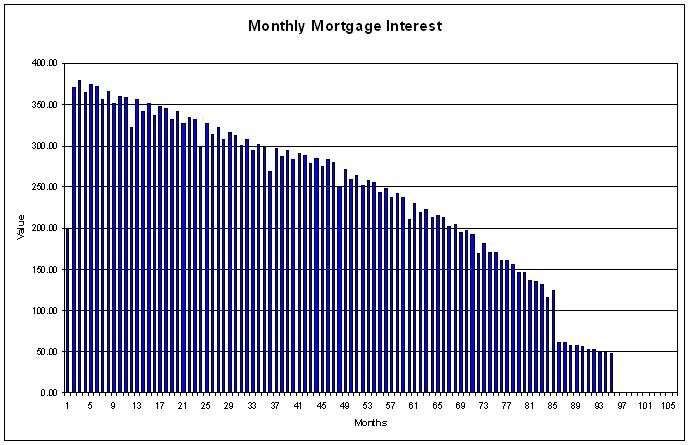

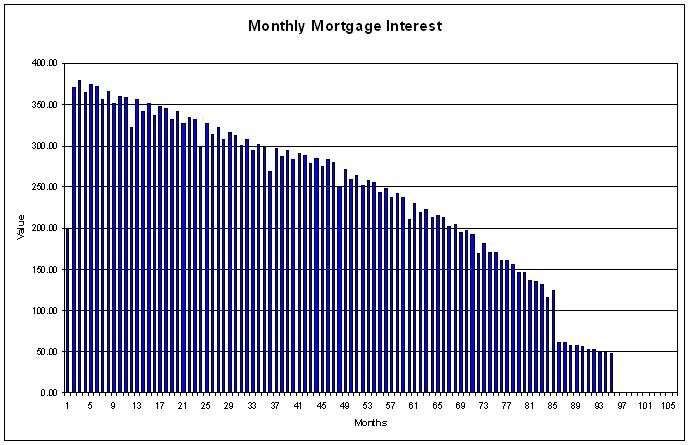

4) Monthly mortgage interest.

This is the monthly mortgage interest, for each month since the mortgage started.

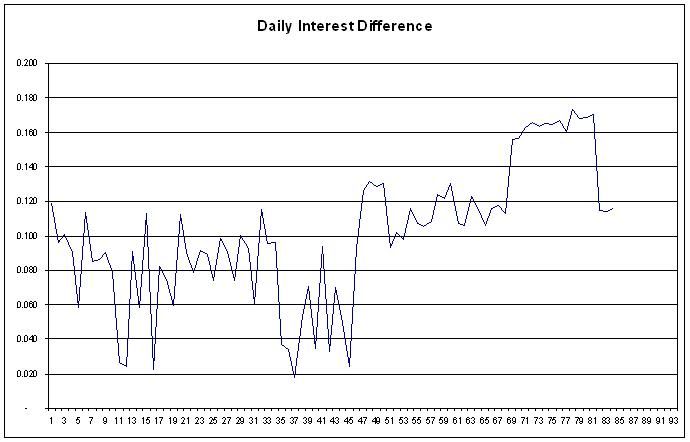

5) Daily mortgage interest.

This is the monthly mortgage interest divided by the days in that month, ie the daily mortgage interest per month for each month since the mortgage started.

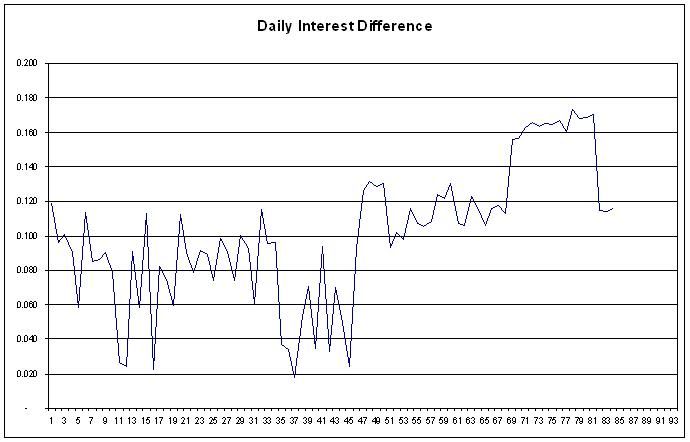

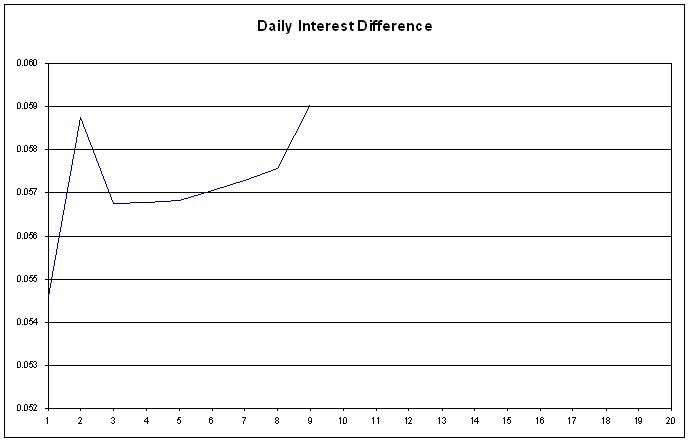

6) Daily mortgage interest difference.

This is the difference between the daily interest in graph '5' for each month of the mortgage and clearly shows where the mortgage is dropping slowing (low daily interest difference) and where the mortgage is dropping quickly (higher daily interest difference).

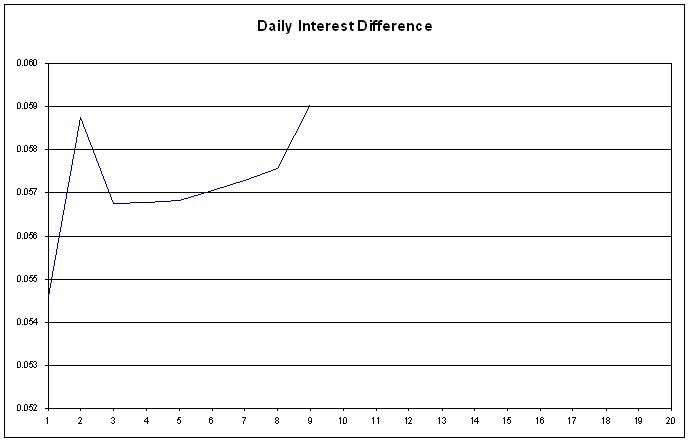

When we dropped off the fixed rate, this had the effect of flatteing this daily interest difference graph. Added a second graph in which runs from April 2011 onwards and just shows the daily interest difference for our variable rate.

Other useful stuff...

BoE base rate analysis. http://forums.moneysavingexpert.com/showpost.html?p=18699353&postcount=896

I’ll update the above numbers and graphs each month throughout my journey.

This diary follows my progress towards my mortgage free goal...

Thanks,

Financial Bliss.

Anyone following the mortgage free in three MFiT thread may have noticed the occasional post there by me. I’m #20. Until now, I’ve been more of an observer than a poster on these MFW forums.

Recently, however, feeling a bit down in the dumps, I decided to play around with some numbers and see if I could arrive at a realistic mortgage free date. Previously, I’d gave myself various woolly targets that I wanted to achieve, e.g. clear current mortgage in less than my first mortgage term, in < 15 years, in < 12 years, at 10 years etc. etc.

I’ve decided that I want to be mortgage free by 12/12/12. This is just over 5 years (60 months) away, plus I like this date! This gives a fixed and published goal to focus on.

I’m intentionally leaving this first post quite short, but intending to follow up with further information along the way.

Mortgage spreadsheets.

1. Monthly mortgage reduction spreadsheet. See post no's 534 and 536 linked directly below:

http://forums.moneysavingexpert.com/showpost.html?p=14965035&postcount=534

http://forums.moneysavingexpert.com/showpost.html?p=14966029&postcount=536

2. Annual mortgage reduction to monthly payment. See post no. 712 linked directly below:

http://forums.moneysavingexpert.com/showpost.html?p=16772703&postcount=712

Aims for:

2008... (5 of 6 - 83%)

2009... (4 of 6 - 67%)

2010... (4 of 6 - 67%)

2011... (4 of 4 - 100%)

2012... (0 of 7 - 0%)

In numbers...

Mortgage free goal : 12/12/12

Months elapsed : 48/60 (80.0 %)

Months remaining : 12/60 (20.0 %)

Current monthly amount towards mortgage : £887.41 + £200 - see final push spreadsheet:

The last 100 steps: Countdown to being mortgage free...

The final push: The final push...

Nationwide estimate to be mortgage free : March 2014

My own current estimate to be mortgage free : August 2013

Graphically...

1) Mortgage balance summary - 12/12/12 schedule.

Snapshot of the mortgage balance over the course of a year, showing minimum, maximum and average mortgage balances. I've also plotted an example 12/12/12 time line and the original schedule up to 12/12/12 that I got when I signed up to the mortgage.

2) Mortgage balance summary - 25 year schedule.

Snapshot of the mortgage balance over the course of a year, showing minimum, maximum and average mortgage balances. I've also plotted an example 12/12/12 time line and the full 25 year schedule that we signed up for when we took out the mortgage.

Explanation (see post #153 - page 8 for further info):

Minimum (Blue): Minimum mortgage balance for the year.

Maximum (Red): Maximum mortgage balance for the year.

Average (Green): Average mortgage balance for the year.

Schedule (Pink): Original repayment schedule without any overpayments.

12/12/12 (Dotted Black): An example repayment schedule to clear by 12/12/12.

3) Payments, interest and net reduction.

Year by year comparison of payments made towards the mortgage, interest charged and the net reduction (payments - interest).

Explanation (see post #666 - page 34 for further info):

Green: Shows total payments I've made to the mortgage in any one year.

Orange: Net reduction of the mortgage balance for any one year.

Red: Interest charged to the mortgage for any one year.

4) Monthly mortgage interest.

This is the monthly mortgage interest, for each month since the mortgage started.

5) Daily mortgage interest.

This is the monthly mortgage interest divided by the days in that month, ie the daily mortgage interest per month for each month since the mortgage started.

6) Daily mortgage interest difference.

This is the difference between the daily interest in graph '5' for each month of the mortgage and clearly shows where the mortgage is dropping slowing (low daily interest difference) and where the mortgage is dropping quickly (higher daily interest difference).

When we dropped off the fixed rate, this had the effect of flatteing this daily interest difference graph. Added a second graph in which runs from April 2011 onwards and just shows the daily interest difference for our variable rate.

Other useful stuff...

BoE base rate analysis. http://forums.moneysavingexpert.com/showpost.html?p=18699353&postcount=896

I’ll update the above numbers and graphs each month throughout my journey.

This diary follows my progress towards my mortgage free goal...

Thanks,

Financial Bliss.

Mortgage and debt free. Building up savings...

0

Comments

-

A bit more about 12/12/12.

Despite the MFiT challenge focusing my mind, attempting to be mortgage free by April 2010 is unachievable (for me). I’d have to pay out 2,637 per month on my mortgage – this is more than my take home pay!

Aiming for 11/11/11 is, I believe equally unachievable – I’d have to pay out 1,632 per month on my mortgage – over 80% of my take home pay.

Pushing back another year to 12/12/12 gives an approximate repayment of 1,318 per month. While this is a much more manageable figure, I’m going to initially be budgeting around 1,250 per month on my mortgage from January 2008. Reason to follow in a future post.

Come December 2012 – depending on how I’ve varied the monthly payments either side of 1,250 – this should leave me around 6k short. This isn’t really a large amount to be short in the grand scheme of things – I’ve also a decision or two along the way to make that may reduce this deficit.

I think it’s achievable / realistic. Plus, I like the date 12/12/12 written with a 2 digit year!

Mortgage should have completed in 2029 – (2004 start), so if I’m successful, that’s a reduction from 25 years to 8 years and 9 months!

I’ve got everything to win and nothing at all to loose by trying…-=oOo=-

Ok, further to recent posts (ie, 19/02/2008 - page 9) regarding budgets, mortgage commitments etc, I thought I'd try and bash out a statement of affairs or SOA. This also puts a tick in one of the aims for 2008 box.

So, I’m going to add the income part of my SOA to this post as:- Post #2 talks about money

- It’s at an easily accessible location within my diary

- Should theoretically motivate me to complete our full SOA

Our Statement of affairs (SOA)

Monthly Income:

My salary: 2,076.65

Mrs Bliss: 0.00

Child Benefit: 130.87

Child tax credit: 43.53

Total Income: 2,251.05

Monthly expenditure:

Nothing happening here just yet - watch this space

Net result: You need to sort out your budget...:rotfl:

FB.Mortgage and debt free. Building up savings...0 -

financialbliss wrote: »A bit more about 12/12/12.

Mortgage should have completed in 2029 – (2004 start), so if I’m successful, that’s a reduction from 25 years to 8 years and 9 months!

I’ve got everything to win and nothing at all to loose by trying…

FB.

Just wanted to say well done.

By focussing on being mortgage free, you have shown your eyes tobe open and the benefits to be saved upon.

Remember you still have to enjoy yourself as 5 years is a long time

I take it that you are very happy with your home and can envisage staying there for much longer than in 5 years time:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

Good Luck :j:j:j:j:j:j:j:j:j

- I too want to be MFI5. 12/12/12 That's the date for a party:rotfl:0 -

Good luck

MFi3 member 105 - MFW date Oct 2023 - 12 years 9 months more0

MFi3 member 105 - MFW date Oct 2023 - 12 years 9 months more0 -

Do you mind if I tag along wth you at your pace as you have a similar mortgage end date to me?

At present my mortgage should be cleared by 22/12/12 with a payment of £167.37.

I then have 8 months more that it will take me to save enough to clear what I owe my Mum and will have to make sure that our savings are up to date.

I find it quite exciting that I will only have a mortgage for another 5 years and 2 months. It doesn't quite seem real that we are that close to our goal (although I don't think it's going to feel that close for the next 5 years haha!)

TTFN, Kaz.Debt: 16/04/2007:TOTAL DEBT [strike]£92727.75[/strike] £49395.47:eek: :eek: :eek: £43332.28 repaid 100.77% of £43000 target.MFiT T2: Debt [STRIKE]£52856.59[/STRIKE] £6316.14 £46540.45 repaid 101.17% of £46000 target.2013 Target: completely clear my [STRIKE]£6316.14[/STRIKE] £0 mortgage debt. £6316.14 100% repaid.0 -

Wow! Thanks for the replies so far. This thread is barely 24 hours old!

Rather than give you my life history in one long post, I’ve ear marked some further short posts to give some more details about myself, why the diary, details about my current mortgage product etc, I’ll not list them all - but first I’ll answer the questions so far:

@IveSeenTheLight

Yes, we’re very happy with our current home. We only moved here in 2004 and started our current (second) mortgage at the same time, trading up from a 3 bedroom terraced to a 4 bedroom detached.

@Kaz2904

Sure you can tag along. 22/12/12 – 12/12/12 what’s a few days among friends. I see you also joined in October 2006 too, although you’ve been a tad busier than me with those there posts!

Thanks,

FB.Mortgage and debt free. Building up savings...0 -

Mr Bliss.

I’m 37, so far my entire career has been in IT working as a software developer. I’ve been in a relationship with Mrs Bliss for, ahem, 18 (no that’s not a typo) years, university studies keeping us apart for a good few years, but getting married in 2002.

Mrs Bliss.

Mrs bliss is from New Zealand, 36 and has spent her very short career to date as a cartographer. Unfortunately, she’s been made redundant more times that I can remember. Think it’s 3 now. The month we decided to have kids she was made redundant for the third time!

Mrs Bliss currently stays at home and looks after our two blisslings and is the unsung hero in this relationship. I’ve got the easy part going to work!

Blissling #1 – dear son.

Aged 3 ½. Placid, reasonably quiet, can hold a good conversation with you and is very inquisitive. Has recently started quoting back sayings we use on him, eg “… dad, I’m getting old”, when I'm telling him to hurry up.

Blissling #2 – dear daughter.

Aged 15 months. Doesn’t always sleep for full nights, noisy and eating us out of house and home! Recently starting to say the odd word, but a really effective communicator via nods and gestures.

Not planning on having any more kids!

FBMortgage and debt free. Building up savings...0 -

Hiya fb

Awww, this is so sweet, with the little blisslings on board too.... Your MFI date is two months after my mortgage is supposed to finish anyway, in October 2012. In October 1987 (3 weeks before the hurricane in the south east) that seemed a very long time away, I can tell you right now! So I'd *better* be mortgage-free by the time you are!

I have lots of plans before then: a lot of renovation, getting my savings up to speed, all sorts, but it will depend on a second income stream I've been working on but that hasn't come to fruition yet.

I'll be keeping up to date on your thread. Good luck!2023: the year I get to buy a car0 -

Three reasons mainly: choices, choices and choices.

Quick rule of thumb when borrowing – borrow as little as possible any pay it off as quickly as possible.

I’ve previously been labeled as “strange” when mentioning I wanted to pay my mortgage off early – my reply to that is you’d be strange not wanting to.

In fact, providing you’ve no high credit card debts or loans (I’ve got two credit cards used for various purposes – each paid off in full each month, plus I’ve got a car loan with 4 payments left on it), I think you’d be mad to not look into paying something off your mortgage.

Had to revert to an initial 25 year term for this house for the numbers to work, as we budgeted everything on one wage. I’ve already taken 8 years off my current mortgage – my mortgage should end when I’m 59, and in my opinion that was too late.

Addressing the mortgage gives me the choices I’m looking for. Mrs bliss could end up not needing to return to work, although I suspect she will eventually return once #2 starts school – I could switch career without too much worry about salary, less financial worries etc, etc.

FB.Mortgage and debt free. Building up savings...0 -

I was working to be mortgage free and loan free by December 2012 but I really like the 12/12/12. Hope you don't mind if I tag along too and I have changed my signature from December 2012 to 12/12/12. It has nice ring to it

Thank you for this site :jNow OH and I are both retired, MSE is a Godsend0

Thank you for this site :jNow OH and I are both retired, MSE is a Godsend0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards