We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

Comments

-

Thanks very much for the holiday suggestions to date - I've only briefly skimmed over them while on lunch.

Foreign holidays - think we need to give 4 weeks notice to the school and we're allowed 10 school days off per year. Two things that put me off a foreign holiday at present is the potential greater cost than a UK holiday and that our son has a peanut allergy.

Still, pleanty of info in the replies to date - I'll need to re-read them this evening!

FB.Mortgage and debt free. Building up savings...0 -

Cottage Holidays are great we went to whitby this year (taking our two dogs) and have two holidays booked there next year. Have you looked at Holiday Lodges there are some really nice ones around and a few owned by the forestry commission with plenty to do and you can do guided walks with the rangers.0

-

First time we took DD abroad she was 18months and we popped over to Brussels, then to Turkey (Bodrum) 3.5yrs, and Side5.5 (outside Euro and the Turks love kids very welcoming in restaurants) she learnt about call to prayer and new culture, (UK at 4.5, awful weather, costs etc in contrast - never again for main holiday), Tunisia (Sousse) 6.5, Northern Cyprus 7.5, Morocco 8.5, Rhodes 9.5, Crete 10.5 and Mexico this year.

We have always had great weather, DD met children to play with (she swims like a fish so no concerns for safety with us in 2.5m deep pools) and always, always combine relaxation with cultural visits in all the above.

So FB, avoid Euro (parity predicted to £ soon :eek:) and take them abroad (if worried about temperature in Jul/Aug try Sousse, lovely cool breeze from the sea), it really does expand their horizons and you can still do UK culture on day trips and short breaks.

Provided you tell them it's a very very long trip etc they'll be fine.

HTH and enjoy researching it!0 -

About 5 weeks ago, I reported I had looked into our existing savings rates and that I'd opened a number of new accounts.

One of these was the Halifax regular saver @ 5%:

http://www.halifax.co.uk/savings/regularsaver.asp

For various rasons, probably only known to Halifax, this has finally become properly open and active, despite me looking to get this opened for the end of August. Paperwork lost, proof of identity again - don't go there :mad:

The first payment needs to be funder by 28th of the month and as it's now looking tight to set up a standing order to feed this account by 28th, we're going to make an initial £500 cash deposit on Monday 28th and then start funding with £500 by SO on the first of every month for the 12 months.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Regular followers will note that I post the mortgage payments and interest at the end of the month. Here's how it's looking for January to September:

Mortgage at start of year: 59,500.00

Overpayments in Blue.

Interest in Red.

Balance in Green.

Month: Payment (Std / OP) / Interest (per day) / Net reduction / Balance

January: 1,200.00 (898.03 / 301.97) / 237.37 (7.66) / 962.63 / 58,537.37

February: 1,200.00 (898.03 / 301.97) / 210.99 (7.54) / 989.01 / 57,548.36

March: 1,200.00 (898.03 / 301.97) / 229.56 (7.41) / 970.44 / 56,577.92

April: 1,025.00 (898.03 / 126.97) / 218.94 (7.30) / 806.06 / 55,771.86

May: 1,025.00 (898.03 / 126.97) / 222.96 (7.19) / 802.04 / 54,969.82

June: 1,200.00 (898.03 / 301.97) / 212.08 (7.07) / 987.92 / 53,981.90

July: 1,025.00 (898.03 / 126.97) / 215.58 (6.95) / 809.42 / 53,172.48

August: 1,025.00 (898.03 / 126.97) / 212.28 (6.85) / 812.72 / 52,359.76

September: 1,100.00 (898.03 / 201.97) / 201.95 (6.73) / 898.05 / 51,461.71

Totals: Payment / Interest / Net reduction.

Minimum: 1,025.00 / 210.99 / 802.04

Maximum: 1,200.00 / 237.37 / 989.01

Average: 1,111.11 / 217.97 / 893.14

Grand Total: 10,000.00 / 1,961.71 / 8,038.29

Still on track to break through the 50k barrier in November. Mortgage interest for the year sitting at £1961.71 - should break through 2k on Sunday. Monthly interest should also drop below £200 per month in November.

Funds now in place for a mortgage payment of £1,100 tomorrow (898.03 and 201.97 OP).

FB.Mortgage and debt free. Building up savings...0 -

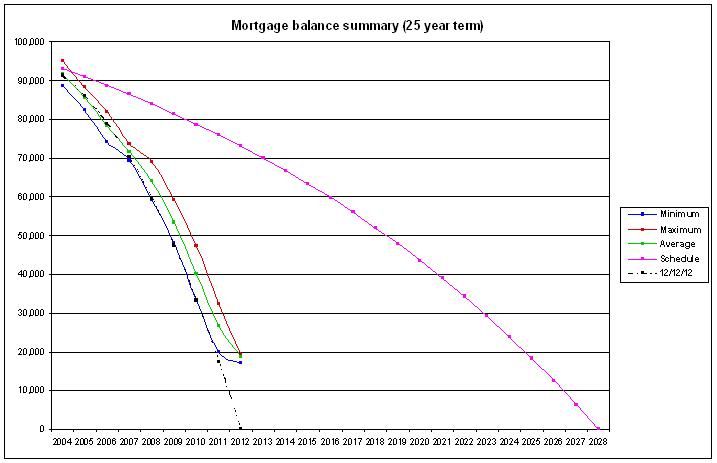

Mortgage balance summary. I've got a mortgage balance summary chart on post #1, which is calculated by taking a weekly note of the outstanding mortgage balance and doing a min, max and average calculation and using just these 3 values per year.

I've now added a second mortgage balance summary chart showing the full 25 year term - labelled in each chart as 'schedule', but the 12/12/12 chart just shows it until December 2012, while this new one shows the full 25 year term.

I think this paints a vivid picture of how for ahead of schedule we are. We should have broke through the 50k mark in 2019 and we will actually do this next month - 10 years early :eek:

Chart also shown here, but I think it's best if the two are shown together!

Think I'll leave that second chart in place on post #1, as both charts get generated automatically from the same base data.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Funny how we stress over being 2 months behind our targets etc, that graph really puts it all in perspective. Well done :beer:A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

Well done FB

0

0 -

Wow, that really does bring it home doesn't it? Great achievement, well done!

Caz0 -

Grrr. I’m annoyed at myself. :mad::mad::mad:

We have an ASDA credit card. We get 1p (used to be 2p) off each litre of fuel at ASDA petrol stations and use this card just for fuel to get the 1p saving.

It’s been an incredibly hectic week this week and I completely forgot to pay the ASDA credit card. The payment due date is today, and I realised yesterday I’d forgot to make a payment.

Trouble is that the ASDA CC site was experiencing “technical difficulties” and I couldn’t successfully make a payment until today. Bill was just £54.46 by the way and I paid £55.00

Worried that I’m going to incur a £12 late payment charge, I phoned their “helpline” as soon as it opened at 8am today. First time I’ve had to use their helpline – they were worse than useless and sounded like they were reading from a script. Bottom line from them was wait until the next credit card statement and if I’ve had a late payment charge, then call them up and they would review this.

I’ve had their standard payment email. This says: “Your payment of £55.00. has been authorised, you should allow up to 48 hours for the payment to be received by us and to show against your account balance.”

So based on that, the payment is going to be late. Technically, I’ve made the payment too late anyway (should have been done 48 hours before today, ie Friday), but if I do get charged, I’m hoping that they will take the fact that I couldn’t make payments via their website into consideration and drop the charge.

Oh, well – I’ll have to keep logging in to the ASDA CC site over the next few days to keep an eye on what is going on. Perhaps I should set up a direct debit to pay the bill in full, but I like to be in control of what is leaving our current account and when.

Do you pay your credit cards via direct debit, or pay them manually? If via direct debit, how far ahead of the due date to they take the money, or do they take it on the due date? Something I may have to look into...

Financial Bliss.Mortgage and debt free. Building up savings...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards