We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

inherited property and stamp duty

NationalElfService

Posts: 13 Forumite

Hi all,

I was recently lucky enough to have inherited a property that my parents had rented out to a lovely family in Hampshire (which I continue to rent out to the same family). My partner and I still rent in Oxford and we've been trying desperately to save up fro a deposit to buy our own house to live in.

Now that I own a house I was wondering if anyone knew if I had to pay the extended stamp duty since we'd be pruchasing our main residence?

If so the extended stamp duty would put a serious dampner on what we could afford (or even make it unaffordable entirely).

Any advice would be greatly appreciated.

NationalElfService

I was recently lucky enough to have inherited a property that my parents had rented out to a lovely family in Hampshire (which I continue to rent out to the same family). My partner and I still rent in Oxford and we've been trying desperately to save up fro a deposit to buy our own house to live in.

Now that I own a house I was wondering if anyone knew if I had to pay the extended stamp duty since we'd be pruchasing our main residence?

If so the extended stamp duty would put a serious dampner on what we could afford (or even make it unaffordable entirely).

Any advice would be greatly appreciated.

NationalElfService

0

Comments

-

NationalElfService wrote: »

Now that I own a house I was wondering if anyone knew if I had to pay the extended stamp duty since we'd be pruchasing our main residence?

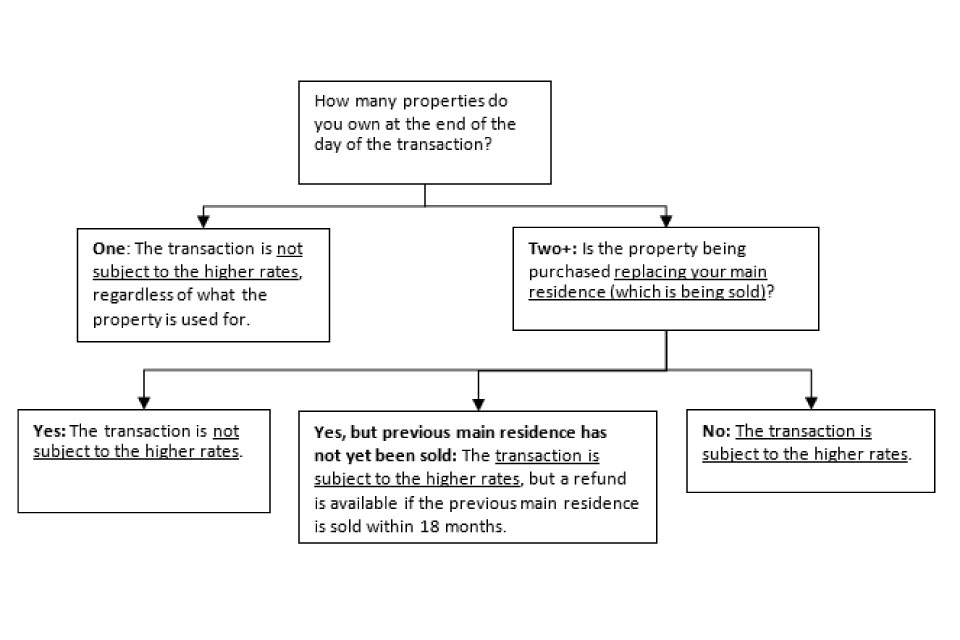

Yes you do, as you will be going from owning one property to two: 0

0 -

Yes, you would.

Sell it, use the money to need a smaller mortgage / get a bigger house / in better area / obtain a better mortgage rate.

Why are even contemplating keeping it? The "profit" you presumably think its making needs to be traded off against the cost of a larger mortgage at a higher rate whilst living in a smaller house in a worse area.

And if you are struggling to save a deposit how would you expect to afford repairs on two houses. Not to mention the hassle and legal requirements of being a landlord.

Tough luck for the "lovely family" but you need to look after your also presumably lovely family first.0 -

Good points thank you! My main concern was paying capital gains tax and/or inheritance tax (should the worst happen).

P.S They really are a very lovely family though, if I can help it I'd like to ensure they stay where they are.0 -

you do not pay inheritance tax. The estate of person who died does, if, and only if, the estate's value is above the IHT threshold. Since you have already inherited the property then the IHT position must have already been dealt with or else the executors got something very wrongNationalElfService wrote: »Good points thank you! My main concern was paying capital gains tax and/or inheritance tax (should the worst happen).

P.S They really are a very lovely family though, if I can help it I'd like to ensure they stay where they are.

as an owner of a property which is not your main home you absolutely will be liable to CGT. How much you actually have to pay will depend on the details of the calculation of course.

and as already mentioned, yes you are liable to pay the higher rate SDLT because it appears you are the sole inheritor the the property so you own more than 50% of it. Properties inherited within 3 years of you buying somewhere are ignored if, but only if, the inheritor owns 50% of less. You own 100% so that dispensation does not apply.0 -

as an owner of a property which is not your main home you absolutely will be liable to CGT. How much you actually have to pay will depend on the details of the calculation of course.

The starting point for the CGT calculation will be its probate value.I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

Well you'll certainly have to pay CGT when you sell it.

Plus other taxes as a landlord with income.

Are you complying with all the laws regarding being a LL?

Have you had to fill your first tax return in yet as a LL?

If you are a high rate tax payer you may find all sorts of gotchas arising with regard to income. Or you may find you become a HRT just because of the new income.

Inheritance tax would/should have been dealt with at the point of probate.0 -

So basically, you are putting the 'lovely family' before yourself and your partner - how very nobleNationalElfService wrote: »If so the extended stamp duty would put a serious dampner on what we could afford (or even make it unaffordable entirely)0 -

NationalElfService wrote: »They really are a very lovely family though, if I can help it I'd like to ensure they stay where they are.

Would they be able to buy it - a direct sale would save you money so you could knock that off the sale price.0 -

* inhertance tax - this should have been paid by the executors before probate was granted and the property transferred to you

* Capital Gains Tax - it's not your main residence so yes you'll be liable when you sell. Any increase between the probate value when you inherited and the eventual sale price

* additional SDLT. If you keep it and buy a 2nd property to live in you'l have to pay the additional SDLT

* income tax. You should be paying this on the rental income0 -

Sorry I think I phrased things confusingly.

I was gifted a property, that is subject to the 7 year rule. So IHT may be subject, if my parents pass away in that period (shudder).0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards