We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

There won't be a crash

Comments

-

I am not sure that it is correct, I have never heard anyone say that they have done that. If people had done that in the past we would never had crashes then.

So what? Do you associate with idiots who don't consider their future finances?

Even the BBC mortgage calculator gives a warning of potential interest rates at 12%http://www.bbc.co.uk/homes/property/mortgagecalculator.shtm

All mortgage lenders have been applying affordability tests with increased interest rates for several years, so even if the people you associate with haven't considered the future, the banks have on their behalf.0 -

Yes I have worked with people who have an IO mortgage and no clue about how to pay it off, or concerns about interest rates, we all have different circles of friends and colleagues etc.Jack_Johnson_the_acorn wrote: »So what? Do you associate with idiots who don't consider their future finances?

Even the BBC mortgage calculator gives a warning of potential interest rates at 12%http://www.bbc.co.uk/homes/property/mortgagecalculator.shtm

All mortgage lenders have been applying affordability tests with increased interest rates for several years, so even if the people you associate with haven't considered the future, the banks have on their behalf.0 -

Yes I have worked with people who have an IO mortgage and no clue about how to pay it off, or concerns about interest rates, we all have different circles of friends and colleagues etc.

I can't believe that you don't know anyone who has planned for interest rate rises!!! Did you not plan for any at any point in your life?0 -

I said that I have never heard anyone say that. I planned for a rise but not to 12%. Surely many people in the 1980s did not plan for interest rate rises otherwise we would not have the early 90s crash.Jack_Johnson_the_acorn wrote: »I can't believe that you don't know anyone who has planned for interest rate rises!!! Did you not plan for any at any point in your life?

Sadly some people don't even know how they are going to pay the capital!!!0 -

Kayalana99 wrote: »Interest rates going up affect everything, discourages businesses from popping up everywhere using cheap lending facilities, most likey will have a detrimental effect on house prices (and commercial property too)

You sound like you were really smart about your purchase, but in reality a huge percentage of people are eyeballed in debt and living month to month.

Not saying if a crash is going to happen or not, but I think it's a bit naive to say their 100% won't be either.

They're not, they're eyeballed in equity.Proudly voted remain. A global union of countries is the only way to commit global capital to the rule of law.0 -

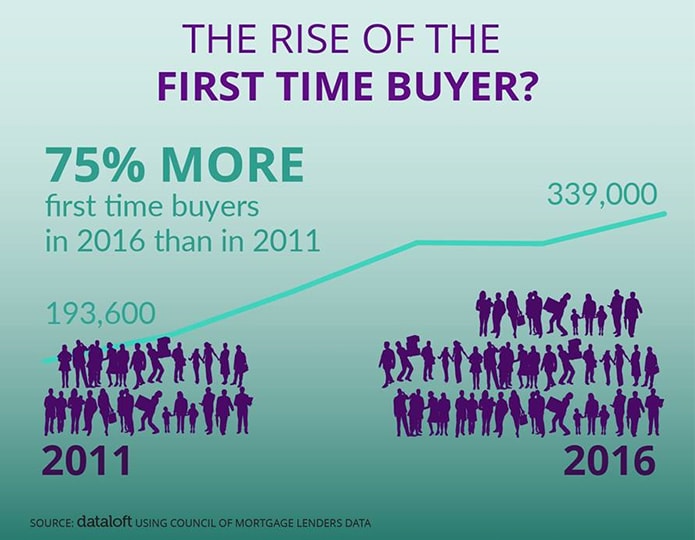

FTB numbers highest they have been for a decade

The bears must be hating it, dam traitor FTBs did they not get the message dont buy until houses are two ha penny!0 -

Yes I have worked with people who have an IO mortgage and no clue about how to pay it off, or concerns about interest rates, we all have different circles of friends and colleagues etc.

At absolutely worst case scenario, IO mortgages should be compared to local rents.

Often I see IO mortgages about half the rent, so still a better option to have an IO mortgage than to rent and pay someone elses mortgage off for them.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

Owner mortgages are cheap, five year fixes for less than 2%

Compare that to renting at 5.5% yield and you need a crash of more than 17.5% over 5 years to make renting a smart idea.

Or for the ultra risk averse there are 10 year fixes for 2.7% so you would need a 28% house price crash over 10 years to make renting the smart decision........ how many people truly believe there will be a 28% nominal crash over 10 years?

Whats more is that in much of the country a terrace costs less than £150k which at 2% interest is only £250 per month in interest. That means buying a house is about half the cost of renting a crappy flat in a council sink estate.

No wonder FTB numbers are booming they are looking at reality rather than the wishful thinking of hpc-nuts 0

0 -

Thoe people aren't realists, they're apostates; heretics; traitors.0

-

IveSeenTheLight wrote: »At absolutely worst case scenario, IO mortgages should be compared to local rents.

Often I see IO mortgages about half the rent, so still a better option to have an IO mortgage than to rent and pay someone elses mortgage off for them.

Oh dear...

Given the super low interest rates, monthly payments can easily double even with marginal interest rate increase from BOE, you won't see these kind of increase on your rent...

As this IR increase will most likely kick in some price falls, the IO owner, possibly forced seller st this point will also have a fairly large negative equity over their head,

In the meantime, the renter will cruise nicely through the storm with no capital at risk and possibly a much lower rent to pay along these tormented years for the economy.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards