We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

VWRL ETF - dividends?

george4064

Posts: 2,948 Forumite

I've been tracking the VWRL ETF closely as a substitute for an entire ISA portfolio, and just have a few questions about it's dividend policy..

1. Am I right in saying it pays out the dividend to shareholders? (As opposed to automatically re-investing the income).

2. Are the dividends paid in GBP to shareholders of the GBP share class of the ETF?

Any other comments/views of existing holders welcome.

Thanks in advance.

1. Am I right in saying it pays out the dividend to shareholders? (As opposed to automatically re-investing the income).

2. Are the dividends paid in GBP to shareholders of the GBP share class of the ETF?

Any other comments/views of existing holders welcome.

Thanks in advance.

"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)

0

Comments

-

Answers are yes and yes

Glad to assist fj0 -

1. Yes G it distributes a dividend to share holders quarterly.

2. Market cap, NAV and distributions report in $, share price in £ as it's listed on LSE.

The dividends are paid gross in GBP at the prevailing USD conversion rate less what seems like a 1.xxx % fee.

My last distribution payment on 30/12/2016 was 0.224247 GBP

VWRL declared dividend payable on 30/12/2016 of 0.28058 USD

I have vague recollections of Glen Clark monitoring this a while back but that might have been another Vanguard ETF.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

1. Yes G it distributes a dividend to share holders quarterly.

2. Market cap, NAV and distributions report in $, share price in £ as it's listed on LSE.

The dividends are paid gross in GBP at the prevailing USD conversion rate less what seems like a 1.xxx % fee.

My last distribution payment on 30/12/2016 was 0.224247 GBP

VWRL declared dividend payable on 30/12/2016 of 0.28058 USD

I have vague recollections of Glen Clark monitoring this a while back but that might have been another Vanguard ETF.

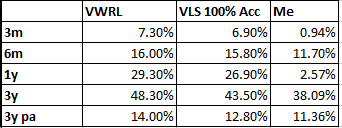

Thanks for the helpful answers, I've been comparing my portfolio performance vs VWRL and VLS 100% acc.

My portfolio dividend yield is 3.47%

I wish I had started with everything in VWRL from the start! I have 15 holdings currently, so it would cost me £179.95 (15 x £11.95) to sell them all and £11.95 to buy VWRL. On the other hand it would be very boring if my portfolio was entirely in VWRL, I do enjoy managing my portfolio.

I have also been underweight in US, which has cost me. That's my aim for the new year to switch some money into VUSA."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

You have to do what's right for you. I'm not prepared to get hung up on what my other investments might be doing if they were all VWRL or something else instead.

I'm fully aware VWRL has had a good overall performance for the last few years but that may not necessarily be the case for the next few.

I took a decision at the start to have three pots with different strategies, managed growth, global index tracking and my pet global income project.

VWRL is hard to argue against imho, especially when it's on the up but I think you have to accept, and be prepared to experience, some pretty stomach churning dips along the way which may not be felt to quite the same extent overall with a portfolio of separate diversified allocations being regularly rebalanced.

Who knows...

VWRL lost 20% by 2016 from it's 2015 peak, as an example, though clearly it's now recovered all of that and more.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

VWRL is designed to track the FTSE All-World index. As per the index factsheet (http://www.ftse.com/Analytics/FactSheets/Home/DownloadSingleIssue/GAE?issueName=AWORLDS), the largest peak-to-trough drawdown that the index experienced in the last decade was 57.9% in USD terms. So, over 59% after the fees that Vanguard would have charged during that period.VWRL is hard to argue against imho, especially when it's on the up but I think you have to accept, and be prepared to experience, some pretty stomach churning dips along the way which may not be felt to quite the same extent overall with a portfolio of separate diversified allocations being regularly rebalanced.

Who knows...

VWRL lost 20% by 2016 from it's 2015 peak, as an example, though clearly it's now recovered all of that and more.

So, if you are the OP considering substituting your entire ISA portfolio with this one ETF, you obviously have to be happy to take a paper loss of 60%+ and not merely "the odd 20% here or there, quickly recovered" as some might assume from looking at a five year chart. And there is no reason that a full recovery from a big crash should necessarily occur within a year or three or five. Every so often, there is a seismic shift in national or global economies, or a significant sea-change in stockmarkets.

An ISA allocation entirely to a fund that can lose over 50%, is way above the risk tolerance of the average UK investor. That is why professional portfolios use multiple asset classes and rebalance them from time to time. The advice dispensed casually here that the only sensible allocation is a global equities tracker, or that a portfolio should only have a single equities tracker and a bonds tracker - sometimes coupled with a comment that bonds are poor value so just use equities only if you're a way off from retirement - can be dangerous IMO.

Not necessarily dangerous to people like you JohnRo, or to the other experienced investors who have heard all the arguments a hundred times and done plenty of their own research. Just to the less-experienced people who seek easy answers on the internet and happen across threads like these.

I agree with you that "you have to do what's right for you".0 -

1. Yes G it distributes a dividend to share holders quarterly.

2. Market cap, NAV and distributions report in $, share price in £ as it's listed on LSE.

The dividends are paid gross in GBP at the prevailing USD conversion rate less what seems like a 1.xxx % fee.

My last distribution payment on 30/12/2016 was 0.224247 GBP

VWRL declared dividend payable on 30/12/2016 of 0.28058 USD

I have vague recollections of Glen Clark monitoring this a while back but that might have been another Vanguard ETF.

Thanks for your reply JohnRo.

Does anyone know if this is the same with VUSA and IUSA? (Both are S&P 500 ETFs)"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

george4064 wrote: »Thanks for your reply JohnRo.

Does anyone know if this is the same with VUSA and IUSA? (Both are S&P 500 ETFs)

VUSA also pays dividends in $ which your platform charges a fee to convert to sterling, some platforms more than others. You can avoid this , and the cost of dividend reinvestment, with an accumulator like CSP1 http://funds.ft.com/uk/Tearsheet/Summary?s=CSP1:LSE:GBX (or SWDA for world tracker http://funds.ft.com/uk/Tearsheet/Summary?s=SWDA:LSE:GBX )

PS: I don't know about IUSA because I don't hold that one.- looks like another version of the IShares S&P500 ETF CSP1 that I hold quoted above?“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

Glen_Clark wrote: »VUSA also pays dividends in $ which your platform charges a fee to convert to sterling, some platforms more than others. You can avoid this , and the cost of dividend reinvestment, with an accumulator like CSP1 http://funds.ft.com/uk/Tearsheet/Summary?s=CSP1:LSE:GBX (or SWDA for world tracker http://funds.ft.com/uk/Tearsheet/Summary?s=SWDA:LSE:GBX )

PS: I don't know about IUSA because I don't hold that one.- looks like another version of the IShares S&P500 ETF CSP1 that I hold quoted above?

Thanks for pointing these out, CSP1 looks good."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards