We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Avoiding Second Property Tax

MathewK

Posts: 1 Newbie

Hello everyone,

I'm desperate for some help as I'm constantly getting different answers!

I bought a property in 2012 which I originally lived in and then rented out when I met my girlfriend and moved in to her house in 2014. The mortgage and deeds are only in her name and my rented property is only in my name. We are now looking to buy a property together and we are going to sell her house and keep mine, but we thought we might be liable for the extra 3% surcharge.

I've done some research and reading around online and the impression that I received was that if you are selling your "main residence" and purchasing a property to replace it, then you would be exempt from the additional tax. For the past 2 years or so, my girlfriend's property has been my main residence and I'm registered to vote there, have bills in my name etc. However, I've also been informed that we would actually be liable to pay the tax because:

Thanks in advance for any help!

Mathew

I'm desperate for some help as I'm constantly getting different answers!

I bought a property in 2012 which I originally lived in and then rented out when I met my girlfriend and moved in to her house in 2014. The mortgage and deeds are only in her name and my rented property is only in my name. We are now looking to buy a property together and we are going to sell her house and keep mine, but we thought we might be liable for the extra 3% surcharge.

I've done some research and reading around online and the impression that I received was that if you are selling your "main residence" and purchasing a property to replace it, then you would be exempt from the additional tax. For the past 2 years or so, my girlfriend's property has been my main residence and I'm registered to vote there, have bills in my name etc. However, I've also been informed that we would actually be liable to pay the tax because:

- We are not married or in a civil partnership and as such are not classed as one unit

- My name isn't on the mortgage/deeds, so the replacement of a main residence doesn't apply to me, just my girlfriend

Thanks in advance for any help!

Mathew

0

Comments

-

You're going to be paying 3% extra. Deal with it.0

-

It's hard to get the pertinent information from your post - all the stuff about bills is irrelevant. You own 1 property. Soon you will own 2. You are liable for the 3% surcharge. The only possible caveat does not apply to you - you cannot sell your main residence as you do not own it.

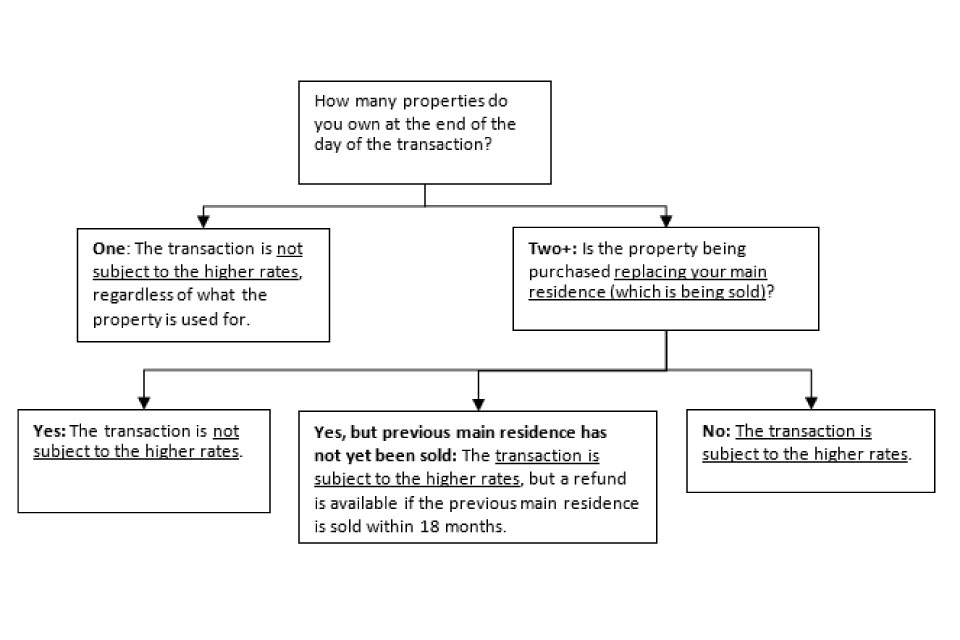

The image below is out of date in that it is now 36, not 18 months, but everything else is accurate. 0

0 -

You are not selling and replacing your main residence because you do not own a main residence so you will pay the full 3% surcharge rate0

-

Hello everyone,

I'm desperate for some help as I'm constantly getting different answers!

Does anyone know the right answer!? Could anyone advise what the best thing to do is? Would it be worth me adding my name to the deeds/mortgage and is there a cost involved? Is it a timely process too? Her house goes on the market this weekend and we have a place ready to go to once it is sold, so we're looking at moving around February 2017 - I'm concerned that the time we have is a bit short to start amending things.

Thanks in advance for any help!

If only HMRC had produced some kind of guidance note.

You are not selling your main residence and you will own two properties at the end of the transaction so you will pay the additional 3% SDLT. The way to avoid that is by selling both your investment properties.0 -

so you have been very correctly told why you are liable for the higher rate- We are not married or in a civil partnership and as such are not classed as one unit

- My name isn't on the mortgage/deeds, so the replacement of a main residence doesn't apply to me, just my girlfriend

your thoughts on how to evade paying tax are so obvious the legislation prevents them even before anyone thought of the word loophole

adding you to the deeds of a property about to be sold would fall within the terms of the general anti abuse legislation since the only reason for so doing would be to evade tax. It would therefore be ignored by HMRC leaving you in the start position, you own one place which is not your home, you are buying a new property which is not replacing an existing home. QED higher rate applies since you then own an additional property0 -

If only HMRC had produced some kind of guidance note.

You are not selling your main residence and you will own two properties at the end of the transaction so you will pay the additional 3% SDLT. The way to avoid that is by selling both your investment properties.

Page 9 of the guidance notes:3.20 There is a replacement of a main residence if, in the three years ending with the purchase, the purchaser disposed of a major interest in another dwelling24 and that other dwelling was, at some time in the three year period, the only or main residence of the purchaser25.

3.21 There is also a replacement of a main residence if in the three years ending with the purchase, the purchaser’s spouse or civil partner disposed of a major interest in another dwelling and that other dwelling was, at some time in the three year period, the only or main residence of the purchaser.

So OP has time to sell his owned property.I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

pay up like everyone else"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

Surely the patriotic citizen cheerfully & promptly pays taxes due. Who, adhering to those good old British values of decency & fair-play, would do other?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards