We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Higher rate stamp duty

Capricorn43

Posts: 14 Forumite

Hi

I wonder if anyone is able to offer some advice re the higher rate stamp duty. My house is currently on the market. The plan is to pool resources with my fianc! who has recently inherited 50% share of his parents home and buy a home together. Our estate agent has advised that as my fianc! is still listed on a mortgage with his ex wife, we will be liable to the higher stamp duty charge as he will be classed as having two homes. Points to note are:

1. His consent order states that he relinquished all rights to the marital home and received or will receive no equity from it.

2. He is still on the mortgage as the bank will not allow his ex wife to take over the mortgage due to low salary. She does however have another man living with her and has done for two years but refuses to add him to,the mortgage to release my fianc!.

3. My fianc! is listed on the electoral register as living at my address for the past three years.

Surely his main residence is my house and therefore if I sell and buy a new home with him, we won't have to pay the higher rate? Any help,would be much appreciated.

Thank you

I wonder if anyone is able to offer some advice re the higher rate stamp duty. My house is currently on the market. The plan is to pool resources with my fianc! who has recently inherited 50% share of his parents home and buy a home together. Our estate agent has advised that as my fianc! is still listed on a mortgage with his ex wife, we will be liable to the higher stamp duty charge as he will be classed as having two homes. Points to note are:

1. His consent order states that he relinquished all rights to the marital home and received or will receive no equity from it.

2. He is still on the mortgage as the bank will not allow his ex wife to take over the mortgage due to low salary. She does however have another man living with her and has done for two years but refuses to add him to,the mortgage to release my fianc!.

3. My fianc! is listed on the electoral register as living at my address for the past three years.

Surely his main residence is my house and therefore if I sell and buy a new home with him, we won't have to pay the higher rate? Any help,would be much appreciated.

Thank you

0

Comments

-

I'm not very bright:. On what basis does he not own more than 1 property, please?0

-

0

0 -

To theartfullodger ... He has no stake in his previous marital home according to the consent order. He handed over all equity to his ex wife and will not get a lump sum when the mortgage is paid off. Bank will not remove his name from the mortgage so effectively isn't he just guarantor for his ex wife?0

-

The mortgage situation doesn't matter. If his name is on the deed of any property then he is considered to own it (regardless of the agreement resulting from his divorce), and is liable for the 3% surcharge when buying another property.0

-

Ah, so if his name is on mortgage it will still be on the deeds? Not good. It appears that his ex is in breach of the consent order in not using best endeavours to get his name off the mortgage even though she is cohabiting with another man. Guess it's another conversation with the solicitor then. I will post on another forum page to see what can legally be done about that situation.

Only solution is to put new house in my sole name....0 -

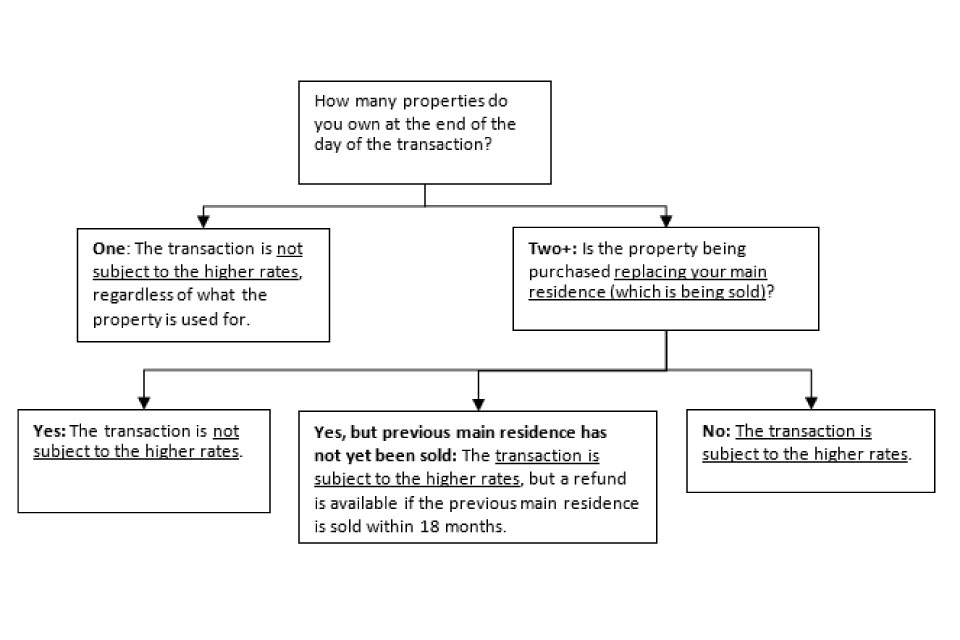

He currently owns one property. He will own two at the end of this deal.

He does not own his current primary residence, so he cannot be replacing it.

He's due to pay the SDLT increase. It's a no-brainer.

While he's still on the LR/mortgage for the ex's property, he's still liable for the full debt. I presume she can't get a mortgage for it in her own name?0 -

Thought experiment for the experts here.

Fiance buys a percentage of the OPs house. Lets say a £35k stake.

It is a second house, but under £40k, so no extra SDLT.

OP and fiance then sell their joint main residence and buy another.

No SDLT due.

???0 -

AnotherJoe .... apologies, but OP ... is that me???0

-

Yep. Original Poster.0

-

not how I understand itAnotherJoe wrote: »Fianc!e buys a percentage of the OPs house. Lets say a £35k stake.

It is a second house, but under £40k, so no extra SDLT.

3.42 Where a transaction is entered into by joint purchasers the higher rates will apply

if the transaction would be a higher rate transaction for any of the purchasers

considered individually. So if there are two individual purchasers and

Conditions A to D are all met for one of them only, the transaction will be

charged at the higher rates.

3.43 This rules applies whether an interest in a dwelling is purchased as joint tenants

or tenants in common. It does not matter how small the interest of a particular

purchaser is, the test is applied in the same manner.

agreed, but subject to the replacement rule regarding timing of the transactions, they would not be liable for higher rate on the new place as it would be a replacement main home.AnotherJoe wrote: »OP and fiancee then sell their joint main residence and buy another.

No SDLT due.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards