We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Private health ins/Benefit in kind - Help!

buel

Posts: 674 Forumite

Hi all.

My wife has been offered private health insurance by her employer (with the option of adding me for about £24 per month). However, we are both confused by the 'benefit in kind'/paying tax on this. I have tried Googling it but I'm still failing to grasp how or why she will be taxed on this (I'm not complaining and neither is she but we would both like to understand this), or if private health insurance really is worth it?

Please could someone offer to help?

My wife has been offered private health insurance by her employer (with the option of adding me for about £24 per month). However, we are both confused by the 'benefit in kind'/paying tax on this. I have tried Googling it but I'm still failing to grasp how or why she will be taxed on this (I'm not complaining and neither is she but we would both like to understand this), or if private health insurance really is worth it?

Please could someone offer to help?

Not yet a total moneysaving expert...but im trying!!

0

Comments

-

How much would it be? You say adding you would be £24 per month but how much for her?

Is she a basic rate or higher rate taxpayer?0 -

See http://taxaid.org.uk/guides/information/issues-for-employees/employee/benefits-in-kind

Your wife should find out from her employer if "payrolling" is being used.0 -

Hi and thank you for the replies.

My wife is a basic rate taxpayer.

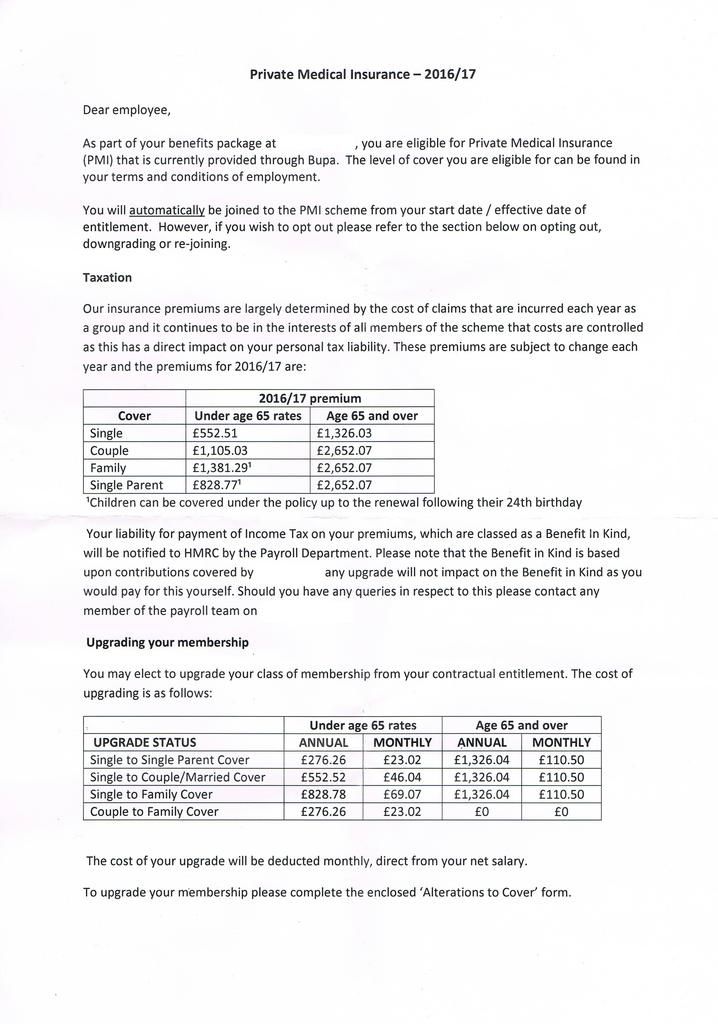

Regarding costs, this edited scan of one of the pages she received may help: 0

0 -

Sorry my eye sight isn't good enough to read that on my phone.

If she's basic rate then she'll basically pay 20% on the value of the benefit.

So if it costs the employer £2000, it will cost her £400. Whether that's worth it will depend on how she uses it.0 -

Darksparkle wrote: »Sorry my eye sight isn't good enough to read that on my phone.

If she's basic rate then she'll basically pay 20% on the value of the benefit.

So if it costs the employer £2000, it will cost her £400. Whether that's worth it will depend on how she uses it.

Ahhhhh.....now I've got it...finally! Phew!! Thank you for that, this is why forums are so good - explaining things in layperson terms to....well, laypeople!:)

So.....next on the list is 'Payrolling'....anyone want to help with that one?0 -

Very simply, it's when a Company employs another to deal with the payroll.

0

0 -

So.....next on the list is 'Payrolling'....anyone want to help with that one?

It is explained in the link in my post above.

"Tax is due on company cars, medical insurance, free or reduced interest loans and other perks provided because of employment. This tax is usually collected via PAYE. Unless the benefit is payrolled, the code number of the PAYE tax code is reduced to reflect the benefits. This means that more tax is deducted from the employee’s pay each pay day. At the end of the tax year, the employer should give the employee a summary of the taxable benefits provided on a form P11D. Where a benefit in kind has been payrolled, you will not normally receive a P11D.

Some employers now tax benefits in kind through the payroll – called ‘payrolling’ the benefits. To do this, the employer includes the cash equivalent of the benefit in the employee’s pay on a month by month or week by week basis. This can have implications for both Universal Credit (where payrolled benefits are included as income, but ones reported only on form P11D may not be included as income) and tax codes (as payrolling benefits is an alternative to adjusting the benefit in a tax code)."

Your wife should check with her company whether the benefit is "payrolled" as above or whether her tax code will be adjusted to take account of the benefit.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards