We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

London Capital and Finance

Comments

-

Malthusian wrote: »They are. Most tax payers have home insurance (and car insurance if applicable). When you claim for a robbery on your insurance you are compensated by the general population via their premiums.

Hahaha if you choose to buy the insurance. It is totally the same.

It is not general taxation at all.0 -

"they were not authorized to deal with retail investors" but presumably feigned having covered themselves by getting us to sign up to those categories of investor. Didn't look like something we should have been drawn into.0

-

The FCA have already had a preliminary look, of course. They are only responsible for regulating the sale of regulated products and/or advice by regulated firms. This was, supposedly, neither.

The FCA are reluctant about investigating more thoroughly, because they think the investigation will just show that any malfeasance was outside their remit.

The FCA has to put a limit on their responsibility, as otherwise it could be endless. (Should they be responsible because a regulated individual causes a car crash, for example?)

Some individual investors may have received what amounts to advice, and they will be protected by FSCS, if they can prove their case, and there's no need for FCA to investigate.

I'm not saying the FCA is right in all this, but roughly speaking that is their case.

It is possible though to believe both that non-advised investors should not be compensated by the FSCS, and that the FCA has fallen short by not shutting down LC&F much earlier.0 -

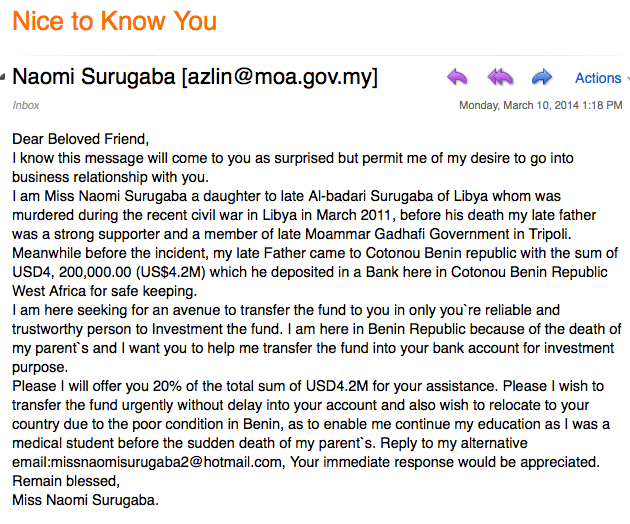

What would you say about an email like this one?I posted the email in response to

"To regulars on here it was obvious from the start it should be avoided, but to the average punter it was not."

Yet, that email came in yesterday. I assume that it must be effective, as otherwise the senders would not bother. The FCA definitely can't be everywhere, so perhaps they are right that their best approach is to educate people.

The trouble with judging what is effective and what is obviously a scam is that there is a whole continuum of knowledge, understanding and common sense. Just where do you draw the line?0 -

There's precedent for the FCA being found partially responsible for, and ordered to pay partial redress relating to, frauds that were perpetrated because of false information it published on the Financial Services Register. So I would say bondholders have a chance at partial redress in this instance.AnotherJoe wrote: »To me the issue is, was FCA complicit in this fraud by allowing the misleading adverts to run for so many years and not taking action for all that time?0 -

So. If we were now to take a test on the lcf subject,as we should all surely be experts by now, could we now answer these half-term questions...

1.Who has commited a crime

A. Lcf directors

B. Surge

C. Fca

D. All of the above

E. None of the above

2. Will the investors receive:

A. Up to 20 pc of investment

B.More than 20 pc of investment

C. None of the investment

3. If anyone is found culpable, will it be

A. Criminal Case

B. Civil Case

4. If anyone is found culpable , will they

A. Have their assetts seized as proceeds of crime

B. Receive jail time

C. All of the above

D, none of the above

5, Was LC and F

A. Permitted to sell their product to retail investors

B. Deliberately ensnaring by adverts andcall centre saying one thing, then paperwork saying something else so it was overlooked

C. Quite frank about the risk involved

D. Deliberately set up to fail

6. Will Blackmore Bonds

A. Pay out on maturity

B. Not pay out on maturity

C. Be investigated by fca/sfo

Answers on a postcard please, .....0 -

Q1 - F (not yet known, though I'm surprised you've not mentioned the 4 individuals who had money lent by LCF deposited in their personal accounts), Q2 - D (not yet known), Q3 - C (not yet known), Q4 - E (not yet known)Supercalafragalistic wrote: »Answers on a postcard please, and if you could all agree that would be great!

Hardly surprising that at such an early stage in the process, there are lots of questions without answers. Check in again in a couple of years and some might be answerable.0 -

Q1 - F (not yet known, though I'm surprised you've not mentioned the 4 individuals who had money lent by LCF deposited in their personal accounts), Q2 - D (not yet known), Q3 - C (not yet known), Q4 - E (not yet known)

Hardly surprising that at such an early stage in the process, there are lots of questions without answers. Check in again in a couple of years and some might be answerable.

Thanks for being so game Masonic,

Re q1. The four individuals who had money kent by lcf deposited in their personal account...do you mean literally? Where has that been uncovered? That one had passed me by! Presumably Elt, Spencer, Andy and Si?.....or is there a careless in there?0 -

1.Who has commited a crime

A. Lcf directors

B. Surge

C. Fca

D. All of the above

E. None of the above

2. Will the investors receive:

A. Up to 20 pc of investment

B.More than 20 pc of investment

C. None of the investment

3. If anyone is found culpable, will it be

A. Criminal Case

B. Civil Case

4. If anyone is found culpable , will they

A. Have their assetts seized as proceeds of crime

B. Receive jail time

C. All of the above

D, none of the above

5, Was LC and F

A. Permitted to sell their product to retail investors

B. Deliberately ensnaring by adverts and call centre saying one thing, then paperwork saying something else so it was overlooked

C. Quite frank about the risk involved

D. Deliberately set up to fail

E All of the above

6. Will Blackmore Bonds

A. Pay out on maturity

B. Not pay out on maturity

C. Be investigated by fca/sfo

My 2c

0 -

Supercalafragalistic wrote: »Thanks for being so game Masonic,

Re q1. The four individuals who had money kent by lcf deposited in their personal account...do you mean literally? Where has that been uncovered? That one had passed me by! Presumably Elt, Spencer, Andy and Si?.....or is there a careless in there?

Literally, money went into personal accounts.

The information was from the joint administrators' Report and Statement:

"There are a number of highly suspicious transactions involving a small group of connected people which have led to large sums of the Bondholders’ money ending up in their personal possession or control. We are pressing these people to return those funds to us for the benefit of the Bondholders and failing this we will pursue those individuals, as appropriate, for recovery of those sums"

&

"Our investigations indicate that some of LCF’s Bondholders’ monies flowed through a variety of transactions, including with regard to deferred consideration, relating to the Waterside and Dominican Republic property companies (see references to WSL, CSL and CSL2 above), which resulted in multi million pounds of those monies going into the personal possession or control of:"

and all the 4 names you suggested. No mention of captain careless.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards