We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has the stock market peaked?

Comments

-

Probably an obvious point, but just looking at a graph often misses:

a) the accumulative effects of reinvested dividends

b) the adjusted impact of making regular, mainly uniform contributions ("dollar-cost averaging")0 -

Yes but that doesn't matter much when looking at peaks and troughs and presumably "cashing out" of equities before a perceived major fall as per OP.

The point I'd make is that equities haven't "peaked" recently. At least not in the UK.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

I think people are being a little unfair about quibbling with the OP's use of the word 'peak'. Sure, many markets are not as high as during the dotcom boom, but the markets were grossly overvalued then. A lot of people (including me) think that the S&P 500 is overvalued based on various metrics, and should the S&P 500 undergo a significant correction then this is impact on pretty much all global equities. There are good reasons to be worried about severe volatility in the short/medium term. I would still stay in equities though...0

-

If you are 100% equities then you (based on historic performance) will likely get 5-8% returns over the long term.

If you Google historic asset class returns you will see Monevator, Blackrock, Morningstar etc have all done studies.

You would likely need a strong tilt towards more risky small caps and emerging markets to improve your chances but from the look of this thread, are you going to be able to stomach 50% losses in bad years to get 8% long term?

Oh. Most of the equity funds I have access to have 10-15% annual growth for the last 5 years. (Hence my initial question about have things peaked).

Also I don't like using inflation adjusted figures generally, as it skews the outcome at the time. For example the house price crash of the 90's was only a crash in real terms. In nominal prices things just stagnated. Big difference when you consider that most people believe house prices reduced in that era, when actually they did not.0 -

danlightbulb wrote: »Ah I see right. No, active trading is certainly not what I want to do. But I have calculated that I want 8% average growth over the next 30 years. My current funds aren't delivering that (5 year growth at 4.8%). So I need to figure out what mix of funds I need to use, long term, to get that average 8% growth (or least try). Where can I ask lots of questions around this topic?

Looking at those growth figures I'm guessing your pension funds are invested in Multi asset funds.

The link below shows similar returns in the 40-85% class.

http://www.trustnet.com/Investments/SectorProfile.aspx?code=O:BALMAN&univ=O

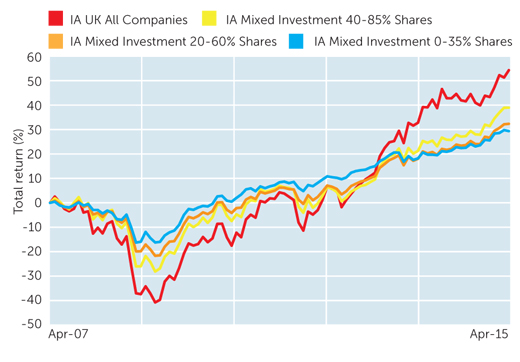

The chart below shows the performance of various Multi asset funds as well as UK All Companies.

What you can see is the effects of the 2008 downturn where the All Companies drops 40% and other Multi asset funds 10-30%.

The recovery to 2015 is also well illustrated where equites are doing much better .

To achieve an 8% pa return its looking like you'll need to take on a high equity mix. 0

0 -

There is a tale that Harry Markowitz, the Nobel Prize winning inventor of modern portfolio theory, split his real life portfolio 50:50 between equities and bonds.

Might look like:

50% Vanguard FTSE All-World ETF, OCF 0.25%

50% Vanguard UK Government Bond ETF, OCF 0.12%

Job done.

Wish I had the balls to try something so simple.0 -

I'm currently in two funds 70/30. The first is the DC Aquila Life Market Advantage which is a multi asset fund in the 20-60% shares sector. Its currently bond heavy. The second is DC Aquila 50/50 Global Equity Index which I haven't looked at in detail yet.

I have all the information about these funds including what assets they hold. And I have lots more information about 80 ish other funds which are different equity mixes or more high risk ones like pacific rim equities or small cap or gold.

I can put my pension pot in any mix of funds I choose and can swap things round as often as I want.

As I still have 30 years to go, I'd be willing to take a bit more risk presently but only if there is still growth to come, otherwise I'm investing at the top of the market which is a bad thing.

Ps the funds I'm currently in were the default funds that all employees have been put on when my employer transferred from our old provider into the Blackrock scheme. The fund mix was manufactured to meet a certain management fee (no worse than we had previously under our old provider). Hence I don't think its probably the optimum mix, because it was made to fit a certain fee.0 -

danlightbulb wrote: »Oh. Most of the equity funds I have access to have 10-15% annual growth for the last 5 years. (Hence my initial question about have things peaked).

You are still looking short term, you are looking at a 5 year recovery period after a major crash.

All the studies look at 80 to 100 odd years.0 -

danlightbulb wrote: »Also I don't like using inflation adjusted figures generally, as it skews the outcome at the time. For example the house price crash of the 90's was only a crash in real terms. In nominal prices things just stagnated. Big difference when you consider that most people believe house prices reduced in that era, when actually they did not.

If the unit of measure was a constant I'd agree with you but there has to be some sort of adjustment made for the changing unit of measure, relative to what's being measured over time, or the historic nominal numbers are meaningless as anything other than a data set.

Average house prices did fall substantially in real terms, that's why people believed they fell.

Have you looked at this site before?

http://www.starcapital.de/research/stockmarketvaluation'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

Yes but that doesn't matter much when looking at peaks and troughs and presumably "cashing out" of equities before a perceived major fall as per OP.

I understand

The OP is asking whether the markets are peaking and if it would be a good idea to sell off their equities within their pension.

My point would be that by merely looking at graphs of the indexes you may misinterpret them and believe, for example, the market hasn't delivered over the past 15 years. This is why it's important to understand the role reinvesting dividends play in overall returns, as too making regular contributions which will smooth out the volatility.

When you're talking about the length of time someone has a pension fund for I would personally suggest just being heavy in equities, in the lowest cost possible, make regular contributions and forget about it.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards