We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Stoozing: Make Free Cash from Credit Cards article discussion

Comments

-

Hi, hopefully some of the regulars on this thread can help me with a few quick questions on the egg money card...

Firstly | need to get £8000 off my barclaycard into my current account to pay for a new car using barclays 6.9% balance offer.

I plan to use my egg money card as mule to do this but my credit limit is only £3200 on this card.

Has anyone used the egg card to do multiple transfers over the period of a month. I'm thinking of doing - 3000, 3000, 2000.

I realise it takes around 7 days at a time so should take about a month. But are Egg likely to red flag this?

Also I have read on here that egg money have recently changed their t&cs (I've had the card over 3 years)....Have they introduced any fees for transfers to your bank account or maximum transfer amounts?

Really appreciate any help on these Qs. Thanks.

The credit limit on your Egg Money card is irrelevant. You would speak to Barclaycard and arrange the transfer to your Egg Money card giving you a positive balance. You then contact Egg Money and ask them to transfer the positive balance to your current account.

You do know that Barclaycard promotions are capped at 5K so you won't be able to get 8K off at 6.9%.

And from a stoozing point of view, 6.9% isn't profitable, you'd be better spending your own cash. If you don't have the cash then you're not stoozing. "A child of five could understand this. Fetch me a child of five." - Groucho Marx0

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

The credit limit on your Egg Money card is irrelevant. You would speak to Barclaycard and arrange the transfer to your Egg Money card giving you a positive balance. You then contact Egg Money and ask them to transfer the positive balance to your current account.

You do know that Barclaycard promotions are capped at 5K so you won't be able to get 8K off at 6.9%.

And from a stoozing point of view, 6.9% isn't profitable, you'd be better spending your own cash. If you don't have the cash then you're not stoozing.

Thanks, I'm aware it's not stoozing, but you stoozers seemed to be the best peeps too ask regards the egg card. And it seems you were

Seems I was a being a bit dim as it obviously doesn't matter how much your credit limit is if you're transferring in a positive balance.

I had read about the barclays 5k cap but I thought I might be able to get away with doing two transfers over a 10 day period. From your experience are barclays quite hot on this kind of thing then?

Finally you made reference to contacting egg to get the balance transfered over to your bank account. Can you not just transfer the money direct via the online balance transfer to current account option? Are you also aware of any new fees being introduced for this?

Sorry for all the questions it's just quite a large junk of cash so I'm nervous about getting clobbered with any extra fees...0 -

I had read about the barclays 5k cap but I thought I might be able to get away with doing two transfers over a 10 day period. From your experience are barclays quite hot on this kind of thing then?

Finally you made reference to contacting egg to get the balance transfered over to your bank account. Can you not just transfer the money direct via the online balance transfer to current account option? Are you also aware of any new fees being introduced for this?

The 5K is the maximum balance transfer they do at promotional rates, as soon as you request it it's recorded on their systems. If they did a 2nd transfer any amount over the 5K it wouldn't be at the promotional rate.

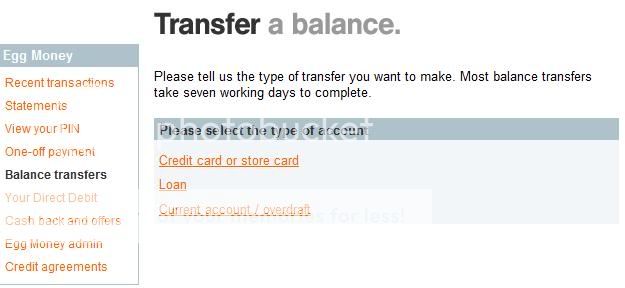

Egg Money Balance transfer option has an option to transfer a balance:

But personally, I prefer to send them a secure message asking them to confirm that there are no fees for the transfer.

So long as you don't create a credit balance there's no fees."A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

I see what your saying now. It's £5000 total, not at a time. Good to know.

Thanks for the screenshot, that was what I was referring to. I'll be !!!!!!ed if they do refuse to transfer without any fee attached as I wouldn't be able to get the money out any other way! Apart from a lavish spending spree that is.0 -

Hi,

I appreciate the reply to this is most likely within the thread, however I'm afraid I don't have time to go through all 26 pages!

I owe about £2k on one overdraft and £2.5k on another student overdraft. They are being paid off quite quickly, however I'm really not liking the massive interest charged.

So I read that I can apply for a Virgin CC and they will allow a transfer to my bank account. I cannot clarify how much this will cost me, though I think i'm right to say they want at least 1% back each month?

If I borrowed £4k (subject to credit limit obviously) how do I work out how much it will cost me to pay back over a period of time? The one thing I don't understand at all is on the MSE page about 'plastic loans' it says that the APR to pay back £3,000 over 3 months is 25% yet 5.6% over 16 months. This makes no sense at all. If the Virgin card offers 0% for 16 months and just a 4% upfront fee, the 4% is £120 on £3k so at 0% surely it should only cost me £120 provided I pay back within 16 months, right?

Also, I happen to own an Egg Money card and it seems I could right now transfer money to my bank account. What is the fee for doing that and is it applicable to all Egg Money Card holders as I've had mine for years.

Many thanks and I really am sorry if these answers have already been provided.0 -

I see what your saying now. It's £5000 total, not at a time. Good to know.

Have you seen the mse weekly email dated 20 Jan? If you take out a credit card with Santander (opening an A&L account first if you don't already have one) you could use this one to pass the money through Egg to make up the extra you need. May not be suitable if your credit score isn't good, but otherwise you should be ok.0 -

Technically you are not looking at stoozing, so this is the wrong place to post. But the tricks we use here are close to what you are looking for, so I see no reason not to answer.I owe about £2k on one overdraft and £2.5k on another student overdraft.

(But if you want further help, probably best to copy and paste your question and this answer into a new thread. And PM me a link, if you want.)

It will cost you 4% of the balance in fees, which I believe will have to be paid when your first statement comes in (i.e. after about a month).So I read that I can apply for a Virgin CC and they will allow a transfer to my bank account. I cannot clarify how much this will cost me

After the first month, minimum payments will be £25 a month until the 0% runs out. You can pay off more than this if you want, though. We would suggest that you set up a DD for at least £25 a month, so you don't miss a payment.though I think i'm right to say they want at least 1% back each month?

If you can pay it back before the 0% runs out then it will cost you 4% of £4k = £160. So you will pay back £4160 in total. This would be £260 a month over 16 months. Do you think this is affordable?If I borrowed £4k (subject to credit limit obviously) how do I work out how much it will cost me to pay back over a period of time?

Yes, everything that you have said is correct.The one thing I don't understand at all is on the MSE page about 'plastic loans' it says that the APR to pay back £3,000 over 3 months is 25% yet 5.6% over 16 months. This makes no sense at all. If the Virgin card offers 0% for 16 months and just a 4% upfront fee, the 4% is £120 on £3k so at 0% surely it should only cost me £120 provided I pay back within 16 months, right?

I know that this doesn't seem to make sense, but it is.

APR is about how much a loan would cost you if you did it at the same terms throughout the year. With this credit card, the amount is costs is fixed, so the shorter the term means the higher the APR. If you want more detail then please ask, but I don't want to bombard you!

What it means in practice is that _if_ you could afford to pay back this money in 3 months there may be cheaper ways of doing so.

You need to decide how quickly you can pay the money off. Look up the APR for this timeframe in the table in the MSE article and compare that to what you are currently paying.

There are two answers to this question...Also, I happen to own an Egg Money card and it seems I could right now transfer money to my bank account. What is the fee for doing that and is it applicable to all Egg Money Card holders as I've had mine for years.

1. If you transfer money from Egg Money to your current account, creating a debt on your Egg Money card you may well pay a fee and will _not_ get a good interest rate. So don't do this!

2. If you had a positive balance on your Egg Money card and transfered that to your current account then you would pay no fee and (as there is no debt) no interest. So what you could do is apply for the Virgin card and do a balance transfer to Egg Money. Virgin will charge you 3% for this, which is better than 4% for a SBT. You will then have a positive balance on Egg Money, which you can transfer to your current account for free. This is called using Egg Money as a mule card and would save you £40 if you are borrowing £4k from Virgin.

Before you do this please ensure that you have an Egg Money card rather than a standard Egg card. There is a difference.0 -

JimmyTheWig wrote: »After the first month, minimum payments will be £25 a month until the 0% runs out.

Minimum payment is 1% of balance or £25 whichever is greater. If OP uses SBT to clear £4.5K of overdraft, minimum will be closer to £45 for a few months.

Setting up DD for the minimum is definitely the way to go - be sure when you call to activate the card and setup the DD to ask that your statement date is set to "yesterday" to give you a full month before you receive your first statement - you'll effectively squeeze an extra month out of the promotion and give time for the DD to be setup."A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

Thanks CannyJock. I guess http://www.moneysavingexpert.com/loans/plastic-loans#virgin (where I got my info) is out of date?Minimum payment is 1% of balance or £25 whichever is greater. If OP uses SBT to clear £4.5K of overdraft, minimum will be closer to £45 for a few months.0 -

JimmyTheWig wrote: »Thanks CannyJock. I guess http://www.moneysavingexpert.com/loans/plastic-loans#virgin (where I got my info) is out of date?

Think so, current summary box at http://uk.virginmoney.com/virgin/credit-cards-v3/popup/summary.jsp"A child of five could understand this. Fetch me a child of five." - Groucho Marx0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards