We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Green, ethical, energy issues in the news

Comments

-

Nice article looking at the progress of sodium ion batts. Got to admit, they've caught me out a bit, I thought progress would be a bit slower, till cost benefits could kick in at scale, but that seems to be happening already.

Not as energy dense as LFP, but cheaper, so ideal for stationary batts, and better tolerance of cold weather.

PV panels are already becoming a semi-trivial cost in the deployment of PV systems. I wonder if the batts will follow this trend in 5yrs or so, regarding total storage system deployment costs.The Strange Time Compression of Sodium-Ion Battery Development

If you are not aware of Chinese battery technical leadership, it is probably time to take notice. As of 2025, CATL and BYD have over 50% of the world’s EV battery market share. From January to September, they accounted for 811.7 GWh. CATL and BYD are not the only battery companies in China. In total, China EV battery production hit 1,122 GWh over the same period, up 44% from the previous year.

While the two giants have specialized in LFP and NMC batteries, relatively small Beijing HiNa concentrated on sodium-ion batteries (SIB) used in JAC cars and in other areas, including utility storage.HiNa’s inroads have made waves and reverberated throughout the industry. Competition is strong. Sodium-ion batteries have been under development for many years, with a field of competitors globally. HiNa was founded in 2017, and produced sodium-ion batteries from its GWh class factory since November 29, 2022. What is interesting here is that HiNa seems to be lighting a fire under the competitors. HiNa introduced sodium-ion to the utility storage market, providing product for the world’s largest sodium-ion storage system (a 100 MWh system) in Nanning, Hubei, in July of 2024, the first stage of a planned 200 MWh system.The natural progression of battery developments is that at first, only one of a few chemistries can meet application demands, then after the first chemistry does so, later on other lower cost, lower performance chemistries continually advance until they meet minimum requirements. When that happens, the leading chemistry moves up to a higher cost tier with more stringent applications.

This has happened several times before in EVs, with NCA replaced by NMC, and NMC now by LFP, each supplanting the other at lower costs as the newer entrants advance, meet threshold requirements, and get closer to theoretical performance. While lithium has been dominant for more than a decade, advancements in other chemistries have been expected for many years, with pressure on for lower costs, better low-temperature performance, and safety. Because of the nature of development and application needs at threshold requirements, advancements tend to go unnoticed until threshold requirements are reached. So it was with solar as well, where for many years, it was always too expensive. Then suddenly it wasn’t. It quickly passed parity with fossil fuel generation, and only hydro is cheaper now. The pace in battery chemistry advancements appears slower than semiconductors or solar, but it is steady, and with the level of volume and capital involved now, the necessary investment in research is now producing fruit.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.2 -

I don't think anyone has mentioned Tesla's bricked Powerwall 2 owners and the pending class action lawsuit yet?There's been plenty of scaremongering about Chinese suppliers but here's a direct example of why having kit that relies on a supplier's cloud might not be a great idea.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.2 -

Reminds me https://www.youtube.com/watch?v=HrxX9TBj2zYQrizB said:I don't think anyone has mentioned Tesla's bricked Powerwall 2 owners and the pending class action lawsuit yet?There's been plenty of scaremongering about Chinese suppliers but here's a direct example of why having kit that relies on a supplier's cloud might not be a great idea.

Pink Floyd another brick in the wall 😎4.8kWp 12x400W Longhi 9.6 kWh battery Giv-hy 5.0 Inverter, WSW facing Essex . Aint no sunshine ☀️ Octopus gas fixed dec 24 @ 5.74 tracker again+ Octopus Intelligent Flux leccy

CEC Email energyclub@moneysavingexpert.com0 -

This week's Carbon Commentary newsletter from Chris Goodall:

1, Vehicle to Grid. Despite the obvious commercial case for V2G, progress has been slow. However we’re beginning to see signs that automakers understand the logic of allowing their customers to trade electricity (and thus help match supply and demand on the grid). Hyundai announced two experiments in the Netherlands and on an island in its home country of Korea that faces grid stability issues. Two of its cars - the Kia EV9 and the Ioniq 9 – will be able to charge and discharge electricity. Hyundai also said it would extend experimentation to the US in the near future. In Germany, BMW recently indicated it would equip one of its models, the iX3, with V2G capability and in the last few weeks, the German regulator removed the grid charges on EV batteries exporting power. There are substantial technical challenges making the EV fleet capable of V2G but the increasing need for electricity storage as renewables grow makes the case for implementation stronger by the day. In the US, Clean Technica reported that the Cadillac brand has now also embraced ‘vehicle to home’ for its new vehicles.

2, Grid investment. Electricity prices in many developed countries are increasing. One important cause is the payments for upgrades to the transmission and local distribution systems. These improvements are driven by the need to integrate renewables and to ensure better connections with international markets. One recent analysis (https://www.electricitybills.uk/2030) of likely changes in UK retail prices shows that by 2030 transmission and distribution costs alone will exceed the price of the electricity. Wholesale costs of UK electricity will fall to less than 25% of the retail price, down from almost 34% in 2025. One unrecognised implication is that consumers face stronger and stronger incentives to reduce electricity use, or to generate power themselves. This will hold down total grid demand, implying that rising transmission and distribution costs will need to be spread over smaller volumes, further increasing the price per kWh.

3, Unusual demand response. The Nostromo Ice Brick, a way of storing cooling capacity, became a formal part of the Californian demand response system. When electricity is available, the Ice Brick creates freezes water which can then be used to provide, for example, air conditioning at a later time. Nostromo also announced a product aimed at data centres, enabling cooling capacity to be stored, reducing the need for electricity at busy times. The company says that cooling needs often account for ‘10-30%’ of peak electricity use at data centres.

4, Methanol bunkering for ships. There are now over 450 ships with the capacity to fuel with methanol. However these ‘dual fuel’ vessels still travel almost exclusively using heavy fuel oil (HFO) because of a shortage of sites that bunker the methanol alternative. Singapore, one of the busiest ports in the world, reports that it has just completed the first full refuelling of a dual fuel ship by transferring methanol from a bunker ship in the port. Other suppliers are adding bunker ships over the next few weeks. The alternative fuel made using current techniques probably has a carbon cost at least as great as HFO but green methanol sources are likely to offer substantial savings in CO2, as well as other pollutants. China has invested heavily in green methanol refineries even though market prices are still roughly three times the price of HFO.

5, Degradable plastics. We know that plastics from biological sources can be engineered to break down quickly compared to conventional variants. Researchers at Rutgers University in the US have now shown that it is possible to manufacture plastics from oil that will disintegrate at a predetermined time after being used. So takeout food packaging could be given a very short life while durable plastics could be made to last decades before breaking down. Degradability will reduce the litter problem on land and at sea but doesn’t reduce the carbon cost of making plastics. Nevertheless I suspect that this research will be enthusiastically taken up by the oil industry because it will ensure more demand for petrochemical refineries whereas full recycling will cut the demand for new plastics.

6, Battery swapping for heavy trucks. Electric heavy trucks made up 22% of sales in China in the first half of 2025 and one research report estimates that battery powered units may represent as much as 60% of 2026 sales. H1 2025 sales tripled compared to the same period in 2024 with suppliers also exporting increasing numbers of vehicles. Rapid charging networks are developing fast on the main freight routes. CATL also will have installed about 300 battery swapping stations for heavy freight vehicles by the end of the year. It has introduced a standard battery pack for trucks enabling (it says) a 150 second complete battery swap.

7, Geothermal heat storage. Depleted oil fields may be good locations for seasonal storage of heat, perhaps generated by excess electricity production in summer. Germany gave permission for drilling a trial well for what is called a ‘geothermal battery’ on the campus of the Karlsruhe Institute of Technology. The drilling will go down to about 1,400 metres below the surface. If the trial works, water heated to 140 degrees will be injected into a reservoir typically at around 70 degrees. (Karlsruhe lies in the Upper Rhine Graben, an area in which underground temperatures are high, making extracting heat using conventional geothermal plants also possible). One estimate is that the Upper Rhine Graben could be used to store up to 10 TWh of heat a year in depleted oil fields.

8, Finland synthetic fuels hub. The northern Finnish port of Oulu seems likely to become the first synthetic fuels hub in the Baltic Region and possibly in Europe. Low electricity prices have pulled e-fuels developers into the area and the German producer Hy2Gen joined five other companies planning projects in the area with a proposal for a 200 MW development. The likely growth of the hub is partly due to the availability of electricity and good port access but also to the hydrogen research at the city’s university.

9, Australian domestic rooftop solar. About one third of Australian homes now have solar on the roof, generating about 8% of total national need for electricity. The Australian Bureau of Statistics estimated that this saved Australian households about US$ 2.2bn, equivalent to over US$500 for each home with solar. It also guessed that about half of all rooftop solar power is used in the home and about half is exported. As batteries fall in price, more will be consumed by the household.

10, Tidal energy. EMEC, the centre for research into marine energies, announced the successful completion of a trial that married tidal generation, hydrogen manufacture and battery storage. Based on Orkney, off the northern tip of mainland Scotland, EMEC claims that this project is the first demonstration that the three technologies can work together and thus provide reliable supplies of electricity even though tidal generation varies during the day. The experiment used the Orbital Marine Power tidal turbine, a vanadium flow battery (not a typical quick discharge lithium ion battery) and a 670 kW electrolyser from ITM Power. EMEC said the work had demonstrated that what it calls its 3 in 1 solution can help remote areas integrate variable renewables. The next part of the experiment will be to explore whether the hydrogen can be used to make synthetic fuels.

Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.4 -

Update on the review of UK RE and battery projects to clear delayed schemes and speed up those that are 'shovel ready'.

Good news and timing on the 25th anniversary of UK offshore wind. Iamkate suggests that UK wind is the single largest supplier of leccy this last year at ~32% v's 29.3% for gas.‘Zombie’ electricity projects in Britain face axe to ease quicker grid connections

Britain’s energy system operator is pulling the plug on hundreds of electricity generation projects to clear a huge backlog that is stopping “shovel-ready” schemes from connecting to the power grid.

Developers will be told on Monday whether their plans will be dismissed by the National Energy System Operator (Neso) – or whether they will be prioritised to connect by either the end of the decade or 2035.

More than half of the energy projects in the queue will be removed to make way for about £40bn-worth of schemes considered the most likely to help meet the government’s goal to build a virtually zero-carbon power system by 2030.

The milestone marks the end of a two-year process to clear the gridlock of laggard “zombie” projects awaiting connection that meant many workable proposals were facing a 15-year wait to plug into Britain’s transmission lines.The queue will be replaced by a delivery pipeline of about 283GW in energy generation and storage projects which can prove that they are “shovel-ready”; some will be fast-tracked for a connection before 2030 while the rest will aim for a 2035 connection.

Almost half of the capacity earmarked for 2030 will be solar and battery projects, according to Neso, while a third of the new capacity will be onshore and offshore windfarms. Only 3% of the capacity due to connect by 2030 will be gas-fired power, it said.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.3 -

New wind generation record of 23.825GW on the 5th Dec. Big rise from 22.711GW set on 11th Nov.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.4 -

Some news on the UK interconnectors (EGL3 & 4 and the GWNC link) which are being accelerated to come into operation sooner.

Ofgem approves early investment in three UK electricity ‘superhighways’

Three major UK electricity “superhighways” could move ahead sooner than expected to help limit the amount that households pay for windfarms to turn off during periods of high power generation.

Current grid bottlenecks mean there is not enough capacity to transport the abundance of electricity generated in periods of strong winds to areas where energy demand is highest.

The new high-voltage cable projects linking windfarms in Scotland and off the North Sea coast to densely populated areas in the south of the country could start operations by the early 2030s rather than towards the end of the decade, according to the sector regulator.Under Ofgem’s plans, National Grid and SSE will be allowed to begin early investment on two Eastern Green Link subsea power cables to transport offshore windfarm electricity to the south by 2034.

They will also be allowed earlier investment for the 75-mile (120km) GWNC electricity link between Grimsby in Lincolnshire and Walpole in Norfolk to help transport the energy to consumers from 2033.

Also:The European Commission is poised to unveil a €1.2tn (£1.05tn) plan to upgrade the EU’s electricity grids later this week, according to Euronews, including eight key projects designed to strengthen the bloc’s energy security. The commission expects to spend about €730bn on distribution networks and €477bn on transmission grids, the report said, citing a leaked document.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.2 -

This news seems to be hitting the interwires recently. The EU has given permission for Germany to subsidise some of its coal energy industry (normally a breach of EU state aid rules) - but it's good news, as the monies will help to close some of their powerstations earlier than planned. Covering lost revenue and support for workers looking for new jobs.

EU clears €1.75 billion in compensation for early coal plant closures in eastern Germany

The European Commission has approved Germany’s plan to pay energy company LEAG up to 1.75 billion euros for the early closure of lignite-fired power plants under the country’s coal exit plan. The compensation covers lost profits and social costs to support employees as they transition to new jobs.

Germany agreed to phase out coal power by 2038 at the latest. While western Germany’s coal exit is advancing faster than originally planned, with the phase-out now expected by 2030, progress in the east – where LEAG operates plants and mines – remains slower. LEAG’s plants will permanently shut down over a span of ten years, in 2028, 2029, 2035 and 2038.

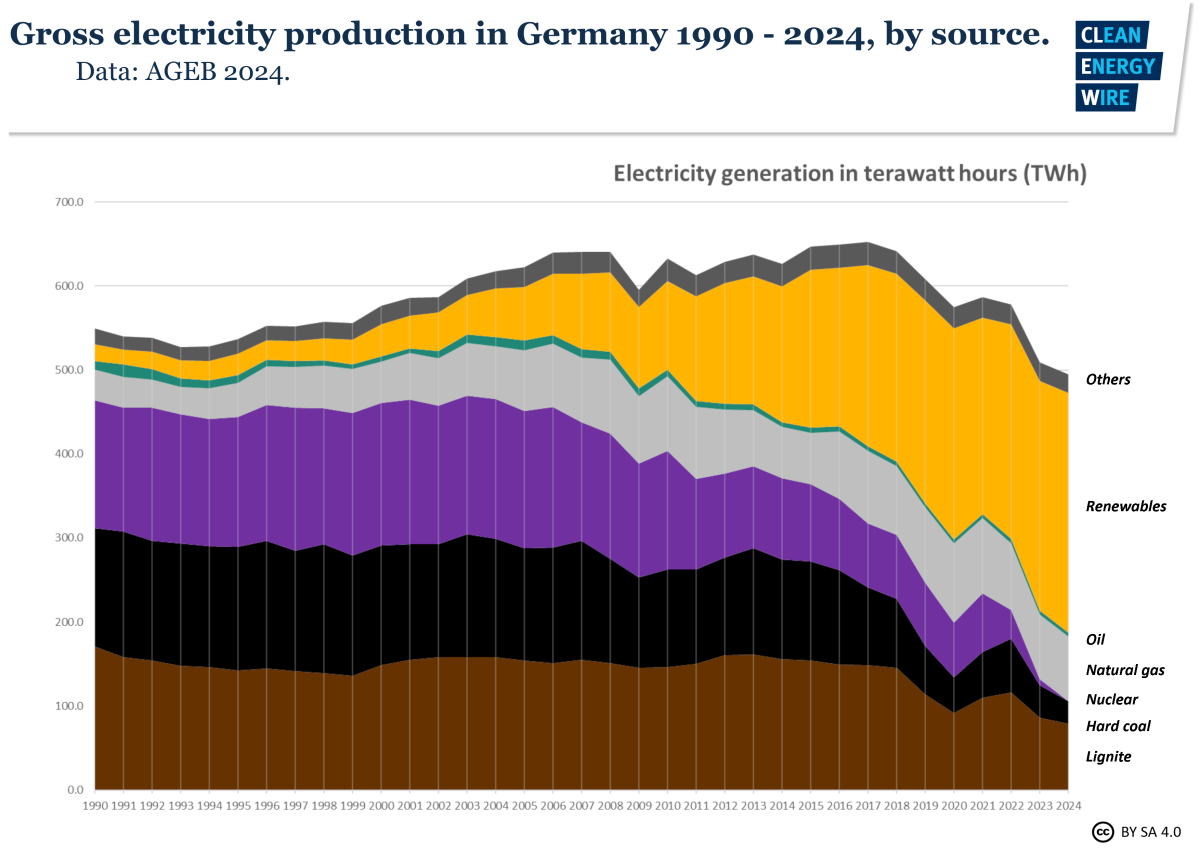

Image of German leccy production, just for reference, that I pinched from an older article, but the same source.

Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.2 -

I've been trying to find out more about the BUS (boiler upgrade scheme) expansion to include A2A units, with a £2.5k grant.

I know there's a dedicated HP board, but I think the G&E board would also find this interesting, especially as folk on here have been discussing the idea of integrating A2A units for suplemental heating (or more) for 10yrs or so.

Looking at the Government response to the consultation document, I think most of my questions have been answered (especially the biggie).

Boiler Upgrade Scheme Consultation Government Response

Page 27 covers the MCS requirement. I won't claim to fully (or even partially) understand it exactly, but it does seem to be allowing slightly more choice of qualification.

With that in mind, another big question for me, was the requirement for DHW, but that appears to be answered on page 12. Leading me nicely (as it's in the same paragraph) to 'my biggie' (oh err missus). Do the A2A unit(s) have to meet 100% of your heating needs, and in the owrst case scenario? In my case, I have some oil rads to top up in the 'upstairs corners' which are harder to reach, and a resistive leccy towel rad in the bathroom.

The good news (almost essential I believe, given the issue of trying to spread A2A heat throughout a property) is that non FF top up heat (think electric?) is OK.

The reason this means so much to me, is down to the problems and cost associated with wet ASHP's, to meet the MCS requirements of being 100% 'perfect'. Looks like A2A units have far more wiggle room:We intend to begin providing grants to support the installation of air-to-air heat pumps (AAHPs). We will do this by creating a new grant category for AAHPs with specific eligibility criteria, guidance, and a grant value of £2,500. To be eligible for BUS funding, AAHPs will need to be installed to provide space heating. They will also need to be MCS certified products, as well as meeting ecodesign requirements for heating and cooling. We will allow AAHPs to be installed alongside other electric appliances that provide supplementary space or water heating.My bold - I read that (and some other earlier mentions of water heating) to mean that DHW is not an issue for A2A grant qualification, other than choosing an electric solution (I got an immersion HW tank installed).

Again my bold, but the best news seems to be the allowance of supplemental electric space heating, giving (IMO) wiggle room on getting the A2A just right, as that may not be easy/possible. But getting it mostly right, is (again IMO) not too hard.

Hopefully this option, lets call it HP lite, will appeal to many, especially as it's much easier, simple and faster to deploy than a full wet ASHP system.

For smaller properties, maybe one A2A plus a HW tank at ~£1,500 each may suffice. In my case (3bed 1930's semi) 2x A2A plus HW tank, so maybe £4,500, minus the £2,500 grant, will work, for some.

I think this is potentially a major improvement to the HP support grant, though it may need explaining at first, since most folk will not be aware of this option/solution at all.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.4 -

Very interesting, thanks. But "we intend to begin" covers a multitude of sins so lots of people might not bother waiting..3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards