We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Previous ISA's and what to do now

Comments

-

Yes this is my only pension work for a small company so probably wont have the option for a work place pension for another few years.

You said you "probably wont have the option for a work place pension for another few years". I would make sure they don't already have something in place. Some employers will pay a part of your salary into a pension. Some will match what you contribute up to a percentage. If you have the option of doing this, you really should take them up on this free money

You're probably aware of something called automatic enrolment which forces all employers to eventually be paying into pensions for their employees? AFAIK, all employers will be doing doing this by 1 April 2017. Definitely don't count on that keeping you in the style you're accustomed to after your working life!Had a quick look at S&S ISA's and SIPPS but they do look daunting...

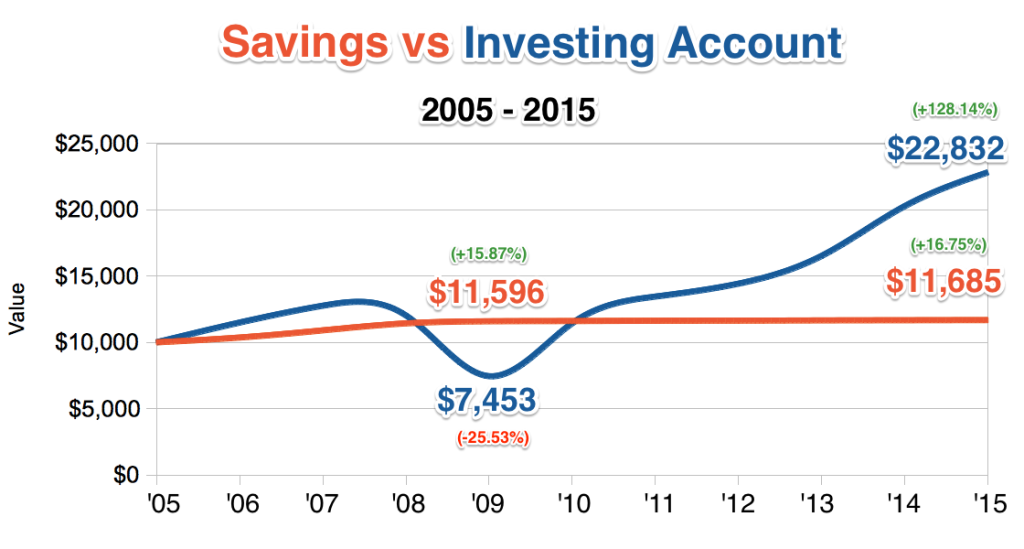

Step 1 is to be comfortable with the reason why holding cash and S&S ISAs and your own pension (be that a SIPP or a personal pension) is preferable to only holding cash for long-term saving/investing. Once you're happy with the rationale, then this will help drive your research into S&S ISAs and pensions. What's the reason? It's basically the purchasing power of your money over time (remember we're talking longer terms) is going to be much less in cash than in the stock market. This graph from this page hopefully provides the gist:

The author of the page has only given cash the interest of 1.5%, so the final result after 10 years in cash might be a little more as you can get more than 1.5%, but you get the idea. The stock market figures he's given gives the average growth rate at 8.6%, so you might want to assume lower over a long time frame (e.g. 7%), but again, you hopefully get the idea.

If there was another line on that graph for inflation, then you'd probably see it outstripping the cash line, therefore you'd have less purchasing power if you just held cash....whats more daunting than potentially losing all your money!

As you see from that graph (caveat: data not verified), the crash of 2008 is included there and still S&S did far better than cash. When investing in S&S ISAs, you invest in funds which internally invest in hundreds of companies. This spreads the risk across all of those companies. If one goes bust, it doesn't matter.

You would only lose all your money if you invested in one or two companies and those companies went bust, so don't do that!

For you to lose all your money when invested in hundreds of companies would mean some armageddon scenario has happened and you have bigger worries

My partner is not interested at all in S&S ISAs, but last week she was convinced to open her first S&S ISA. We decided upon the Vanguard LifeStrategy 80 fund. This invests 80% in stocks/shares and 20% in bonds (also called fixed income). The shares are spread around the world. It's largely a "fire and forget" fund. Perhaps something like this would be suitable for you and as your investment grows and you learn more then you can see if you want to control more yourself.

As mentioned previously, it is recommended to put money under investment, only when you have built up an emergency cash fund, so you'd definitely want to keep some of that cash. This emergency fund will help you with unforseen emergency expenses, and unpredicted falls in your income without having to dip into your investments (as they might be in a trough at that time).

How old are you and when would you like to retire? How much in total have you in your cash ISAs?0 -

Yes this is my only pension work for a small company so probably wont have the option for a work place pension for another few years.

Had a quick look at S&S ISA's and SIPPS but they do look daunting, whats more daunting than potentially losing all your money! Ill have to do more research on them

If you don't get individual shares the risk of losing all your money is absolutely tiny and if it ever did happen you wouldn't be worrying about pension but where to find food.

Over the sort of timescales you're looking at the bigger risk is not matching inflation so just saving in cash for pension is not a good idea.Remember the saying: if it looks too good to be true it almost certainly is.0 -

I'm early 30's and have £4-5K in ISA's and ATM save £120 a month (I know its not enough but better than nothing)

Looking at S&S ISA's and SIPPS just frys my brain really. I assume picking a fund like the Vanguard LifeStrategy 80 fund and then leaving it for 15 years is the worst thing that you could do, I wouldn't have the foggiest what fund to change to if that one was not looking so good.0 -

Looking at S&S ISA's and SIPPS just frys my brain really. I assume picking a fund like the Vanguard LifeStrategy 80 fund and then leaving it for 15 years is the worst thing that you could do, I wouldn't have the foggiest what fund to change to if that one was not looking so good.

Personally I'd say leaving it in cash is the worst thing you can do long term.

Investing in LS80 for 15 years or more would be a fairly good option as it rebalances for you.Remember the saying: if it looks too good to be true it almost certainly is.0 -

I'm early 30's and have £4-5K in ISA's and ATM save £120 a month (I know its not enough but better than nothing)

Looking at S&S ISA's and SIPPS just frys my brain really. I assume picking a fund like the Vanguard LifeStrategy 80 fund and then leaving it for 15 years is the worst thing that you could do, I wouldn't have the foggiest what fund to change to if that one was not looking so good.

The Vanguard LifeStrategy 80 fund has only been in existence since 2011, but if you had (say) put £1000 in it at launch, it would now be worth £1450.

If you'd invested in the fund via a sipp then you'd have only had to put in £800 of your own money as the tax man would have topped it up with another £200. So your £800 would have grown to £1450. If you'd put your £800 in a cash isa at 2% for four years you'd have £866, a difference of £584!

I started my pension 12 years ago. Since then I have paid from my wages a total of £16750, which was bumped up by the tax man to £21200 (ish). My employer has paid in £31670. Total of £52850 (ish) paid in, actual worth is £77500 due to investment growth.

Pension is the way to go if you're saving for your pension!;)0 -

I think i would like to take up the option of a workplace pension when it is available but my company would be one of the last batch of companies that would be made to offer one as they are small.

I think it would be a better idea until then to put what little i have in an S&S ISA and pay into that and then possibly take up a workplace pension when available.0 -

I think i would like to take up the option of a workplace pension when it is available but my company would be one of the last batch of companies that would be made to offer one as they are small.

I think it would be a better idea until then to put what little i have in an S&S ISA and pay into that and then possibly take up a workplace pension when available.

I'd disagree. I think your best bet is to start a SIPP now and pay in what you have in your isas. This will get you your tax benefit. You never have to pay anything else into your SIPP ever if you don't want to. Then when your company pension is available pay into that if you want. If you have to make a minimum payment to get your employer to pay in then do so and pay more into your SIPP if you want. Its up to you if you want a SIPP and a company pension.

Of course is you want to keep access to your isa money then a pension is not the way to go as you can't access the cash until you're 58.0 -

I would like the option to take the money out so I think an S&S ISA would be best for me ATM.

One thing i dont understand about S&S ISA's is the charges with some platforms. For me I would be transferring my old cash ISA's into the S&S ISA which would sit in my account doing nothing until I invest it in a fund and be charged for this (possibly dependent on platform) Then I also want to do a regular saving option so £120 would be going into my S&S account every month and then I would be charged for putting that £120 into a fund every month, isnt that going to be a lot of charges or have i got it wrong?0 -

As the investment amounts are currently low, you should go with a platform that charges based upon a fraction of the amount you have invested with them. As your investment grows to the tens of thousands, then consider transferring to platforms that have a different charging structure.

I would suggest that you avoid Hargreaves Lansdown (HL) as their platform fee is considered high at 0.45% and go with either Charles Stanley Direct (CSD) at 0.25% or Cavendish Online also at 0.25%. I'm with the Cavendish Online. They don't have any exit fees, so if you later wanted to transfer you'd not be penalised. For CSD, the fees are here and they list Stock Withdrawal as £10 per holding, so you'd pay £10 to move your LifeStrategy 80 elsewhere once it was in the tens of thousands.

N.B. Cavendish Online are agents for Fidelity. If you went direct with Fidelity you'd pay 0.35% (plus a small annual investor fee), but by simply using Cavendish as an agent, that drops to 0.25% with no investor fee

See here for a table of platform charges. As you see on page 27, for CSD and Cavendish Online, you'll pay £13 per annum in platform charges for your £5k which I suggest is good value for money. BTW, when you get over £100k, you can go skip the platform and go direct to Vanguard!

EDIT: You might also want to look at http://www.comparefundplatforms.com/ where you can enter your lump sum and monthly contributions and it'll show you platforms that it considers cheap.

For your £120 monthly contribution, you'll not pay any transaction fees to the platform to have that money invested. The platform fees will probably be collected monthly, so for that month they'll charge you roughly one twelfth of a quarter of a percent (i.e. one forty-eighth of a percent) of the amount you have invested which on £5k is £1.04. My platform collects this automatically by selling a portion of my holding every month. I would ignore this part right now. When you have a lot more you might want to pay charges differently.

So that's the platform fees. You also have the fees to the fund manager (i.e. Vanguard). This is 0.24% per annum and the fund manager collects this automatically without you seeing the details. 0.24% is great to get access to global stock market automatically balanced with fixed income (bonds/cash). For this particular fund, there's also a 0.1% dilution levy on your incoming money which I won't go into details about right now but you can research or ask about separately if you are interested in it, but basically it protects existing holders of the VLS80 from bearing the costs of you entering the fund. It's a one-off cost (i.e. not annual) cost.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards