We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Meandering to mortgage free

Comments

-

March ended with a larger payment of tax credits due to me now getting PIP, which meant another mortgage overpayment.

April's balance is now £59,605.31. This makes the current mortgage year the most productive ever with a current change from last year's balance of -£4769.85. I hope we can continue with a few more ad hoc overpayments this year.

I think I might ask dw to call mortgage provider and check how much overpayment we still have left. Undoubtedly we will have more overpayment left than we've paid, but it will be nice to know as we can then track overpayments properly in future..Old Mortgage: [STRIKE]2009:£78500 2010:£76951.71 2011:£74414.49 2012:£71961.35 2013:£67813.54 2014:£64375.16 Current: £55,480.27[/STRIKE]

New Mortgage: 2016: £92795 Current: £87999.990 -

Old Mortgage: [STRIKE]2009:£78500 2010:£76951.71 2011:£74414.49 2012:£71961.35 2013:£67813.54 2014:£64375.16 Current: £55,480.27[/STRIKE]

Old Mortgage: [STRIKE]2009:£78500 2010:£76951.71 2011:£74414.49 2012:£71961.35 2013:£67813.54 2014:£64375.16 Current: £55,480.27[/STRIKE]

New Mortgage: 2016: £92795 Current: £87999.990 -

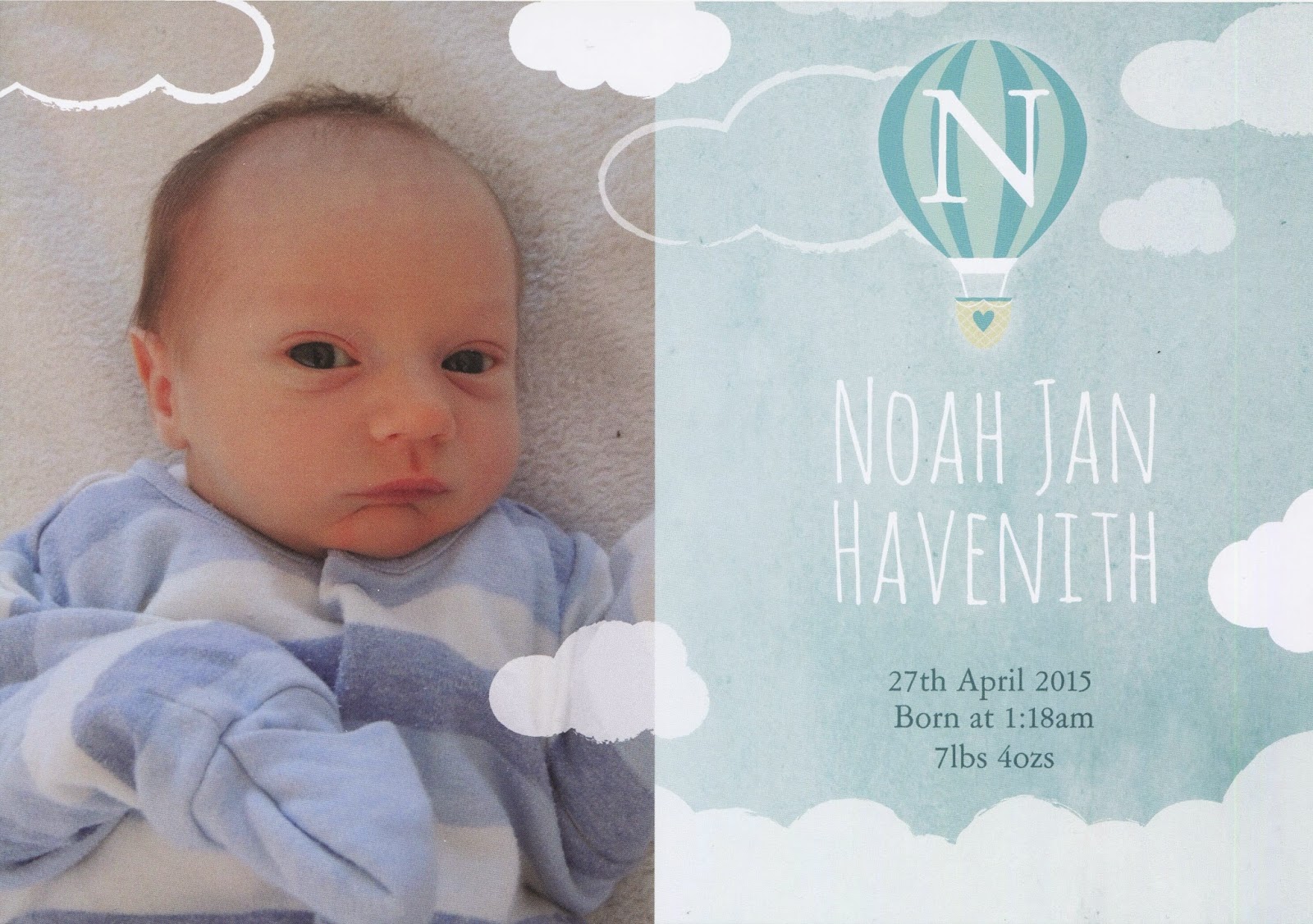

Congratulations! :beer:0

-

Good name!0

-

Was just thinking you must be due. Congratulations - here's hoping for lots of this

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

He's a cutie!!!!Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5000 -

Thanks everyone! Been quite active with the overpayments too, so will post an update on that soon.Old Mortgage: [STRIKE]2009:£78500 2010:£76951.71 2011:£74414.49 2012:£71961.35 2013:£67813.54 2014:£64375.16 Current: £55,480.27[/STRIKE]

New Mortgage: 2016: £92795 Current: £87999.990 -

How does parenthood suit you?

0

0 -

Awesome stuff well done :]

Over payment news will be interesting to :]Mortgage--- [STRIKE]£67700 March 15[/STRIKE] [STRIKE]£65221 April 15[/STRIKE] [STRIKE]£64983 July 15[/STRIKE] [STRIKE]£64780 sept 15[/STRIKE] Remortgage [STRIKE]£67295 oct 15[/STRIKE] [STRIKE]£66599 Nov 15[/STRIKE] [STRIKE]£65878.73 Dec 15[/STRIKE][STRIKE] £64834 1st Jan 16[/STRIKE] [STRIKE]Feb 16 £64,511.89[/STRIKE][STRIKE] March 16 £64,056.40[/STRIKE] [STRIKE]April 16 £62550[/STRIKE] [STRIKE]May 16 £62,396.20[/STRIKE] Feb 17 £60.800

Emergency fund 23k0 -

Congratulations

As a relative new parent and mfw I have been reading your diary with great interest and admiration.

Good luck with your journey

FLCMortgage: 01/02/14 - £108k

Mortgage: Current - £97k

Mission: MF by 500

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards