We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

MSE News: House prices up at fastest rate for three years

Comments

-

HAMISH_MCTAVISH wrote: »And that is exactly what HTB is curing.

Restoring functionality to a dysfunctional mortgage market.

The historically normal, prudent and sensible 5% deposit is returning.

A 5% deposit is not sensible when properties are overvalued and we have a bubble. All you do with a 5% deposit is enslave another generation into negative equity as house prices fall back to normal.

I can see a place for 5% deposits when house prices have bottomed out but not when the market is so rigged, it is dangerous for the borrower and now the tax payer.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

A 5% deposit is not sensible when properties are overvalued and we have a bubble. .

Properties are not overvalued and we don't have a bubble.

Prices are higher than they used to be, because of a genuine shortage of supply and a rapidly increasing population, and by definition a genuine supply/demand imbalance is not a bubble.

Therefore by your own logic, 5% deposit mortgages are eminently sensible.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Properties are not overvalued and we don't have a bubble.

Prices are higher than they used to be, because of a genuine shortage of supply and a rapidly increasing population, and by definition a genuine supply/demand imbalance is not a bubble.

Therefore by your own logic, 5% deposit mortgages are eminently sensible.

Everyone needs a roof over their head so properties will always be in demand and everything goes up in price over time, not just houses but everything else too. Food has gone up ever such a lot but because we also need to eat we have to pay what they charge.

It would be lovely if we could buy a house at 10 year old prices and it would be lovely if our food and fuel bills were the same price they were in the 90s and 00s but things get more expensive as time goes on and there's nothing that can be done about that.0 -

I can see the argument from both sides.

Mortgage repayments are very often cheaper than renting these days, so in that respect buying is much cheaper - plus you have an asset at the end of it, unlike rent which you see no return on.

But it is true that many people find it terribly hard to raise the deposit for a house. So it's a double-edged sword.

What about when interest rates go up?0 -

It would be lovely if we could buy a house at 10 year old prices and it would be lovely if our food and fuel bills were the same price they were in the 90s and 00s but things get more expensive as time goes on and there's nothing that can be done about that.

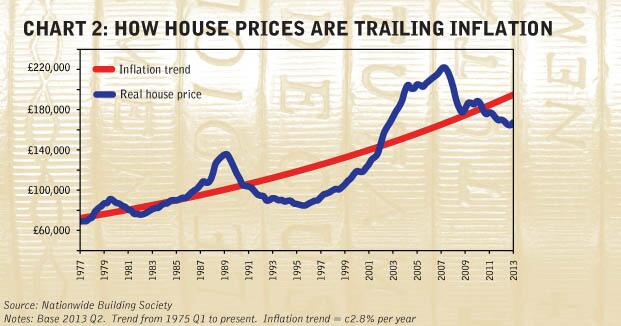

The problem is when prices rise faster than general inflation. Which they haven't been for several years. Although up to 2007 they were.0 -

always be aware that house prices can fall quickly.0

-

What about when interest rates go up?

What about it?

http://www.mirror.co.uk/money/city-news/wages-rise-squeeze-family-finances-2332633#ixzz2ggy0AR2B

In an exclusive interview with the Mirror, Fisher also reassured borrowers that the Bank’s base rate won’t spiral when it does eventually increase from the record low 0.5%

“People may have thought, when we got some growth back in the economy, we will jack up rates.

That is not the plan.

“We are not going to do this in a way that decimates the economy.

“The whole point of forward guidance is we won’t be raising rates until the economy is in a strong condition. That is why we are linking it to the decline in the unemployment rate.

“We will have to judge a rise in rates that keeps the economy growing at around its trend rate of 2% to 2.5%.

“If we thought the economy was going to be particularly sensitive to rate rises we would be taking it relatively gingerly.”

.

So just to be clear, with falling unemployment, rising wages, an improving economy, and a BOE committed to only raising rates gently once the recovery is locked in......

Why do you think this will be a problem?

The banks are already stress testing applicants to ensure they can cope with higher rates when they issue mortgages.

It's simply not going to be an issue.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

always be aware that house prices can fall quickly.

And they can rise quickly as well.;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

And also on this whole "when rates go up" malarkey, most people coped fine when rates were 6% or so back in 2007, AND house prices were higher.

What on earth makes you think it'd be a problem today?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

The problem is when prices rise faster than general inflation. Which they haven't been for several years. .

Indeed.

Now they're well below long term trend.

But starting to rise again.

Having also bottomed out in inflation adjusted terms now, as shown by the recent +6.2% Year on Year growth.

While the bottom in actual cash terms was of course way back in early 2009.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards