We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is the stock market over heating?

Comments

-

The entire worth of the stock markets is sold and bought several times over in a 12 month period. Markets never go up or down in a stright line regardless of the gereral trend. The current trend is still upwards until proven otherwise.0

-

A_Flock_Of_Sheep wrote: »OK so after today's experience on the markets I am still not clear on reasons. I will explain what I mean.

Man in USA opens gob and china slow down = Nikkei down by over 7% :eek: and FTSE 100 down by 2.10

What I am missing is why this should cause this downturn and what caused it.

Sorry if I annoy you with my questions!

Japans up 50% this year...thats huge in a developed market...so a 10% correction isn't a wipeout although it could be the start of a further downturn.

Sometimes events move markets on a daily basis...sometimes they don't...commentators are always looking for a reason for a change in sentiment...its not always clear why moves happen.

http://finance.yahoo.com/echarts?s=%5EN225+Interactive#symbol=^n225;range=1y;compare=;indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefined ;

The world markets have had a good run since 2009 without a major correction...so it could be said some investors are expecting one shortly..

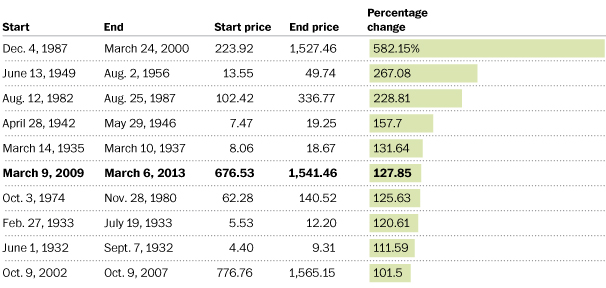

A view of the USA market and its bull runs....the chart is earlier this year so its probably now the 5th longest run.. 0

0 -

A_Flock_Of_Sheep wrote: »So basically loads of people decided to sell on the basis of an American mouthing off and china slowing down? What reasons would they have to decide to sell? This mass selling caused the downturn?

In the end it is sentiment that moves markets and they are just looking for a reason to sell then greed turns to fear as everyone hits the exits at once.

Looks like the show is over for today, the US did not really blink too much.0 -

Jegersmart wrote: »PE is a dangerous variable to use when "investing" imho....

As you point out, there are are massive growth companies on hundreds of PE ratios, and then there are others who have billions in real assets and turnover and trade on a single-digit PE. On its own, PE is pretty useless.

imho

J

Yep

And to complicate it further companies count some losses as 'exceptional items' to flatter their profits. This would be easier to accept if 'exceptional items' didn't come up with such monotoonous regularity“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

A_Flock_Of_Sheep wrote: »So basically loads of people decided to sell on the basis of an American mouthing off and china slowing down? What reasons would they have to decide to sell? This mass selling caused the downturn?

Probably. Or maybe not.

And tomorrow there will be more news, and more the day after. The winds will blow share prices this way and that, hour by hour, day by day, week by week, and so on.

I suggest you aim to look at prices year by year. Anything else is just noise.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

A_Flock_Of_Sheep wrote: »So basically loads of people decided to sell on the basis of an American mouthing off and china slowing down? What reasons would they have to decide to sell? This mass selling caused the downturn?

Loads of people decided to sell, but only those like you who panic, or those who trade on small margins/large trades.

But that is the thing, you were suppoesed to be looking at the market in a different (value) way I beleive form your earlier posts? But you are treating/reacting to the market like a newbie day trader? this was you:In the end it is sentiment that moves markets and they are just looking for a reason to sell then greed turns to fear as everyone hits the exits at once.

you need to decide a long term strategy, and not micromanage. Chill.0 -

-

Thrugelmir your sig

"The four most dangerous words in investing are 'This time it's different." John Templeton

So past performance is indeed a good ....................... :rotfl:I believe past performance is a good guide to future performance :beer:0 -

Thrugelmir wrote: »With pay rises under 1%. There'd be rioting on the streets.....

There is still plenty of time.

Many are seeing their quality of existence, or hopes and aspirations for it, eroding year on year.

As you say there is whole lot of rebalancing to take place with many taking a relatively harder hit.

Resources and assets have been squandered over the last 30+ years to keep revenue afloat, it hasn't gone into investment to keep future revenue inflows coming.We are now borrowing at higher levels and longer into the future with no repayment vehicle. Interest only mortgages and MEWing are vilified but governments are past masters at it."If you act like an illiterate man, your learning will never stop... Being uneducated, you have no fear of the future.".....

"big business is parasitic, like a mosquito, whereas I prefer the lighter touch, like that of a butterfly. "A butterfly can suck honey from the flower without damaging it," "Arunachalam Muruganantham0 -

Touche.Jegersmart wrote: »Agreed, but every correction or crash starts with some downward movement, be it 0.3%, 1.5% or 7%. I don't think we are going to tank, but one cannot ignore price movement purely because "the price is now the same again as last week".

Stick around, you might learn something.

When the market has finished up all but one day in the month, it's an eyeopener when it finally opens down and finishes down for once. But on the basis that people have been saying it is overdue a big pullback for weeks or months, the odd down day (even 100pts+) shouldn't surprise anyone.

That a change of stance on QE had been hinted at, and markets didn't like it, is worthy of consideration, but you can't run for cover every time you see a a bad day. True, it might be a beginning of the end, and if you run around saying it enough times, eventually you'll be right when you say it's the start of an x% correction. But broadly it's not helpful to act as though any pullback is doom and gloom, any more than any uptick is the start of a bull run to riches.

Based on some new Japanese guy 'opening his gob' on policy change there, their currency was significantly devalued and the Nikkei had shot up by a huge amount. So much so that it could fall 10% from its peak and give back all the gains of May, and still be 30% higher than at Christmas.A_Flock_Of_Sheep wrote: »OK so after today's experience on the markets I am still not clear on reasons. I will explain what I mean.

Man in USA opens gob and china slow down = Nikkei down by over 7% and FTSE 100 down by 2.10

What I am missing is why this should cause this downturn and what caused it.

Meanwhile the US's market increases have been closely linked to the US quantitative easing program (and other QE/ stimulus elsewhere in the world). If that free and easy cash goes away, it's not good for markets. Arguably, simply hinting that it might go away in a few months (because some Fed members consider they'd like to reduce it at some point), allows Bernanke to see a preview of what effect actually taking it away might have.

All the world economies feed off each other and all take it in turns to have their trading sessions, so the US markets changing direction might point to Japan opening down (exacerbated by the fact that other world economies which create demand for exports are slowing - it's hardly good news for markets). And then the UK sees that the other two markets are down so it goes down too; then the US sees that UK is down which creates a negative sentiment that could drive US further down etc etc.

Generally if markets are frothy it doesn't take much to push them further up or pull back sharply. Of course some of it is just noise and some of it is the end of a trend and the start of a new one. If we could spot the difference with only one or two trading sessions' data, we'd all be millionaires.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards