We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Vanguard Life Strategy

Comments

-

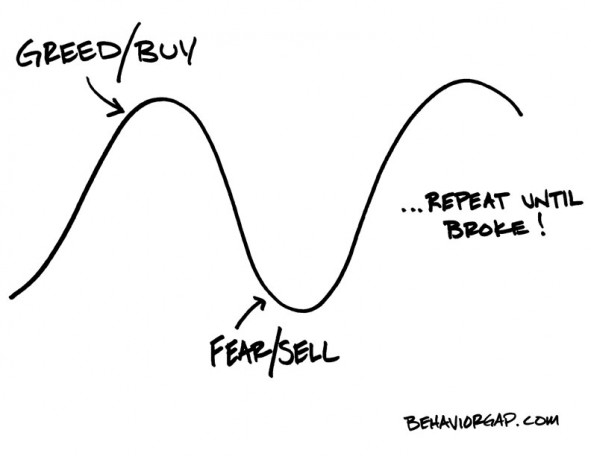

An interesting read for those debating whether it is a good time to jump into stocks now or later:

http://www.thereformedbroker.com/2013/03/06/wrong-question/

This link was taken from another thread, well worth a read to remind people.

Very good read! Really does put a good angle on it! the biggest mistake we can make is to freak out if a drop comes and sell and steer off the long term plan, it has happened in history and come back again. If we are in it for the long term it is better to increase our chances as in the smarter investing book

I have a simple mind set philosophy for taking a type of decision related to any money and risk hense my user name choice

"You pays your money and you takes your chances"

So if doing anything that involves risk with money, we cannot control the result but being smart about it and thinking of the long term and simple rules we increase our chances 0

0 -

All you need to know and avoid

I think I saw you in an ice cream parlour

I think I saw you in an ice cream parlour

Drinking milk shakes, cold and long

Smiling and waving and looking so fine0 -

takesyourchances wrote: »Keep us posted on here on your side fund ideas, as you can see I have done a lot of thinking on them and like the Asian potential. I think if one region of the world is going to grow in the long term it is Asia, some quality manufacturing there, rising middle class and some excellent regions. Singapore for example as one, one the reasons why I selected the Small Companies fund in Asia.

I wonder when we will stop thinking of Asia and China as emerging markets and places with "potential"? I've had loads of EM funds over the last 10 years and they have steadily paid off -- usually better than the traditional markets.

IMO, they are not to be thought of as slightly risky peripheral choices. They have seen fantastic growth by our standards over a long period now. For me, "potential" is in places like Africa and the Middle East and even Spain/Greece if you want risk. Investing in the Far East and BRIC is pretty much mainstream these days."I don't mind if a chap talks rot. But I really must draw the line at utter rot." - PG Wodehouse0 -

I mostly just see the orient as a regional antidote to the west, that said globalisation means they'll probably all crash and burn at slightly different rates should the big correction some are predicting happen.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0

-

I wonder when we will stop thinking of Asia and China as emerging markets and places with "potential"? I've had loads of EM funds over the last 10 years and they have steadily paid off -- usually better than the traditional markets.

IMO, they are not to be thought of as slightly risky peripheral choices. They have seen fantastic growth by our standards over a long period now. For me, "potential" is in places like Africa and the Middle East and even Spain/Greece if you want risk. Investing in the Far East and BRIC is pretty much mainstream these days.

I agree with you, much of Asia shouldn't be thought of as emerging and is established and world class and I don't see these main regions as high risk like other places in the world that is high, just a better global region to invest in. Also they produce some of the highest demand products and daily use products people use and have a good work ethic.

Some parts of Asia I would tend to think as emerging, but I agree that the main areas that are being invested in emerging would be the wrong label. I have more faith in having money invested in some of the quality Asia regions than Europe personally and the UK.

Africa and the Middle East is more risky and agree with Greece and Spain etc after what they have gone through in the Euro Crisis and also Latin America as well I think would be more risky and emerging.

If Singapore is emerging what is developed :)

:)

What are your thoughts on the Japanese Small Cap investment? I have my eye on the Aberdeen fund for some point.

http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/a/aberdeen-global-japanese-smaller-cos-d2-gbp-accumulation

Thanks0 -

I mostly just see the orient as a regional antidote to the west, that said globalisation means they'll probably all crash and burn at slightly different rates should the big correction some are predicting happen.

The west buys so much from Asia, electrical goods and a lot of exports to the west so if the west does well we will consume Asian made products and if the west slows and crash's it will have a knock on affect on the amount being bought from Asia.

Along with that Asia is supplying it's own people and growing middle class who are buying.

The quality manufacturing that goes global and is used every day is what Asia has over the UK as the UK has lost it's industry and global manufacturing and Asia has this over the west in my opinion.

The amount of vast products coming out of China a lone used and bought in the UK and global is huge and brands like Samsung in Asia, high tech equipment, latest micro chip tech, daily products like washing machines, TV's, DVD players, smart phones. Sony I think is mostly produced in Japan, I feel there is value to be had in some companies here.

I feel that Asia is servicing the global market for our consumer demands like this as well as their own.0 -

Oriental goods have been flowing west in increasing quantities for well over 30 years. Japan, Korea, and now China which is about ten times the size of the other two.Along with that Asia is supplying it's own people and growing middle class who are buying.

Yep, that's why I see the region as an antidote, they've far more potential and opportunity for continued development with or without export to other regions, than the already developed, expensive and quite heavily de-industrialised countries in Europe and NA.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

takesyourchances wrote: »One idea I was thinking of which I was going to ask about on here for possibly transferring to an SIPP was the VLS 100 being an all in one basket with a bit more mixture within one VLS fee base and then adding a second bond type fund holding which could be increased in the portfolio percentage in line with age towards retirement, like Old Mutual Global Strategic Bond Class A Accumulation.

http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/o/old-mutual-global-strategic-bond-accumulation

Any thoughts on this and it could be ran at 80% VLS 100 and 20% Old Mutual Global Strategic Bonds and the bond percentage increased as the years when on accordingly.

Thanks.

I think this is well worth considering. I was intending to hold two separate VGLS funds: the 20% and either the 80% or 100%, and gradually move towards the 20% over many years. However, there would be two platform fees to pay, and a lot of overlap in holdings, so your idea might be better0 -

calling market direction any given time is impossible

http://www.businessinsider.com/dow-jones-idiot-maker-rally-2013-3?op=1£48515 interest £181 (2009)debt/mortgage-MFIT/T2/T3

debt/mortgage free 28/11/14

vanguard shares index isa £1000

credit union £400

emergency fund£500

#81 save 2018£42000 -

Yep, that's why I see the region as an antidote, they've far more potential and opportunity for continued development with or without export to other regions, than the already developed, expensive and quite heavily de-industrialised countries in Europe and NA.

Yes fully agree with this, with or without export they are also supplying there own people.

Europe is more expensive and also as you said many countries are de-industrialised.

It is a very interesting part of the world.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards