We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Rent vs buy

Comments

-

They are very useful statistics. Thanks for that. Certainly backs up the argument that buying has been slightly cheaper than renting on average over the last five years.HAMISH_MCTAVISH wrote: »On average, house prices have fallen around 10% from peak over the last 5 years in actual cash terms according to Land Registry.

The average mortgage interest payment is 3.4%.

The average rent is 5.5%.

So the average owner has lost 10% of capital value since peak, but saved 10.5% through owning instead of renting.

Not much relevance to the national average, I agree.I'm happy to take on board your anecdotal about some areas doing worse, and I could just as easily point out that my area is now above previous peak, has gained 4% in the last year alone, and has rents typically at 7% or so yields. So a buyer in 2007 here would be some £60,000 to £80,000 better off than a renter since then.

But neither of these examples are of much relevance to the national average, so better we stick to discussing that I think.

But the OP is a real person with a real question.

The average comes out fairly close to break even (10.0% vs 10.5%) so if there are areas like yours where buyers are doing well there must be other areas (as you say) where renters are doing better.

If the OP is in one of those areas (of, more accurately, if the OP thinks he will be in one of those areas for the next 5 years) then he is better off renting.0 -

JimmyTheWig wrote: »They are very useful statistics. Thanks for that. Certainly backs up the argument that buying has been slightly cheaper than renting on average over the last five years.

.

It does indeed....“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

At the moment my husband and myself rent a 2 bedroom house with our two children and two dogs. Although it was fine when we moved in 5 years ago with one child and one dog things are feeling a bit cramped.

We've been planning on buying a house for a long time now, but we're still another 5 years away from being able to buy a house the same size as the one we're already in, much much further from being able to buy one as big as we'd like. So we could have children at the end of high school before we have a big enough house.

It seems to be drilled in that when you grow up you by a house, you don't rent a house. But I don't know how it would affect things later in life. We wouldn't have a house to sell to pay for care home bills, and we'd never have a paid off mortgage, we'd always pay rent.

But at the same time, we can afford to rent a nice four bedroom house in our area without stretching ourselves. I don't know if we should keep going with the no holidays, skrimping and saving to buy something the same that we're already renting. The mortgage would cost roughly £130 a month more than our rent at the moment. We wouldn't need to save as hard so the costs would probably cancel out, but then there's extra insurance and maintenance costs.

I've just no idea. I don't want to go down the renting route then find out in 30 years I'll be retiring into poverty! But at the same time, we'd have a much better standard of living for the next 5-10 years if we rented. I can figure out past that.

I'm mid twneties, my husband is mid thirties and we're both in okay paid jobs. Not enough to afford the big house anytime soon, but too much to qualify for any help schemes.

My head really is spinning trying to figure out how the decision will effect us 30 or 40 years down the line.

Thanks to anyone who managed to read all that and can help :rotfl:

Interesting read of the thread, I was on my 2nd house in my late 20s, now paid off, but it's no palace and I could spend as much again on the purchase towards home improvements,there are pro's n cons to rent vs purchasing, in the long term you maybe better off buying, in reality it is early days to have a positive conclusion, since as you get older health is priority. To buy, naturally there will be sacrifices to be made. I do remember a period of time where I would have been much better off renting and purchasing shares, but things have turned around now, my GF purchased her house 5 years ago and it is worth less than what she paid, but the 'loss' would have been less than rent , the time you finally pay off a mortgage (assuming now recieved windfall) the mortgage is probably much less than the water rates and council tax, so there is no great gain in disposable income (which is where we want to feel it most).0 -

Just remember that "Everyone is a genius in a rising market". So all you have to do is fix it so that the market always rises.Free the dunston one next time too.0

-

fix it so that the market always rises.

No need.

In the long term, it always does.....;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »No need.

In the long term, it always does.....;)

As Keynes said, in the long term we're all dead.Free the dunston one next time too.0 -

Adding in your maintenance and allowing for 2% inflation after 25 years the renter will have paid £280k in rent compare to the buyers £277k in mortgage payments and maintenance. allowing 2% growth on renters £32k he will have £53k while the buyer will have a house worth £160k if it didn't increase in value or £335k if it increases in line with inflation.

Wage inflation isn't growing at 2% after tax. So rent payable is unlikely to reach this level.

FTSE 100 yields 3.5% currently. With potential for dividends to grow.

So the figures are far closer than your assumptions suggest.

Past performance is no guarantee of future performance. Wise words to consider in these different times.0 -

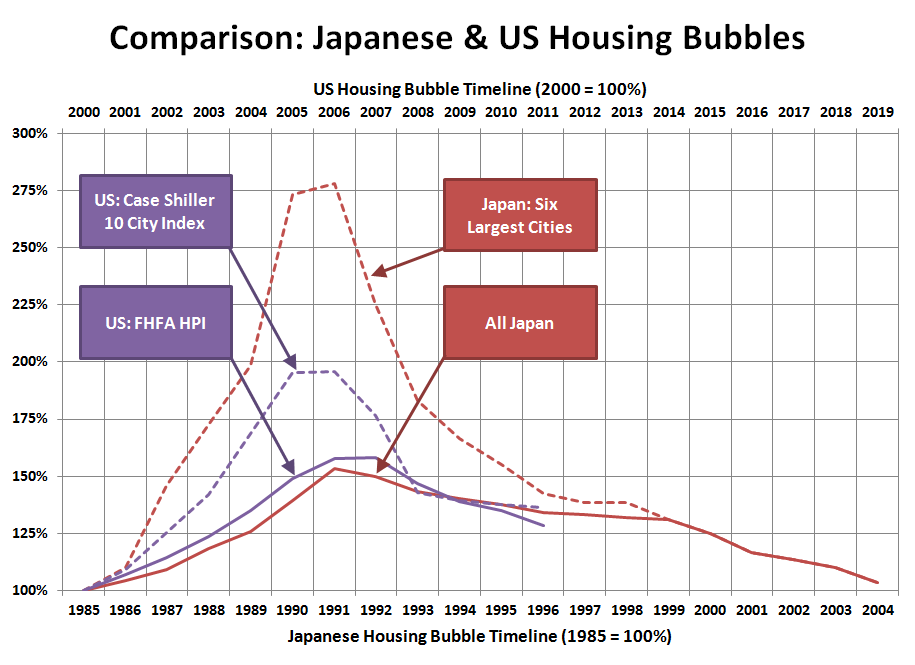

Guys, please look at this chart on the properties value in US and Japan:

There was a housing bubble and properties can loose 50% of their value in few years time.

And what is insightful on the chart is that after the bubble the properties value returned to their original value from 1985.....

Now, think about how much money you would loose when your house will return to his value from 1985??? You could die before the money from rent pay off the money lost!

When you use your property as security to apply for a mortgage, bank only use 60% of the property value as deposit... Because they know your property can loose a LOT of its value!!0 -

Thrugelmir wrote: »Wage inflation isn't growing at 2% after tax. So rent payable is unlikely to reach this level. .

You don't half talk some rot....

Average wage inflation has little relevance to rent inflation in the short to medium term, as given the now critical housing shortage and rapidly increasing population, increasing density of occupation in the rental stock will ensure more earners per house on average than has been the case.

Or in terms that are hopefully simple enough for you to understand.....

The housing shortage forces more people to share, and 4 earners in a house can pay 4 times as much rent as one earner in a house.

Rents will rise, and rise, and rise some more until sufficient people are forced into sharing through increased prices so that supply once again reaches equilibrium with demand.

And we're nowhere near that point yet.....:cool:“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

properties can loose

how much money you would loose

property can loose a LOT

Really?

I'm fascinated. Please do explain....:D“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards