We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Rent vs buy

Comments

-

My take is buy if you can after paying a mortgage for over 30 years which has been less than rent for equivalent property for the majority of the time. I paid my mortgage off 3 years ago and since then have been living rent free in a house that would cost £1200 a month to rent a saving of £43k and will continue to be £14k a year better off.

0 -

HAMISH_MCTAVISH wrote: »and that's despite the worst house price crash in history.

Yet to see if this one will be the worst

inflaton adjusted

We are only 5 years in and around 25% drops

http://www.housepricecrash.co.uk/indices-nationwide-national-inflation.php

The last one took 12 years to recover to peak prices with biggest drops at 7 years and 40% but that got hidden and looked like it recovered more quickly due to inflation at the time.

Inflation adjusted we are still trending down so might still be worth waiting a bit and/or driving a hard bargain there is still a lot of overpriced stock.0 -

getmore4less wrote: »Yet to see if this one will be the worst

inflaton adjusted

We are only 5 years in and around 25% drops

http://www.housepricecrash.co.uk/indices-nationwide-national-inflation.php

The last one took 12 years to recover to peak prices with biggest drops at 7 years and 40% but that got hidden and looked like it recovered more quickly due to inflation at the time.

Inflation adjusted we are still trending down so might still be worth waiting a bit and/or driving a hard bargain there is still a lot of overpriced stock.

Not worth waiting if falls are only real term in fact depending on your situation it might not be worth waiting if falls are nominal.0 -

HAMISH_MCTAVISH wrote: »

Of such little relevance it's not worth including.

The £36pm saving is wiped out within the first couple of years of rent rises, and the following 50 years of just the rent increases alone completely wipe out the £32k in the bank and then some.

.

if you are going to model you can't conveniently ignore the things that offset your headline number.

the renter starts with £32k in the bank add in bit of maintenance money say 1% of house value £133pm which is likely to be on the low side long term.

After 50 years £420k in the bank which eats into that £500k .

one other issue for real people is they don;t have the 20% some might have 10% whats the 25y rate for them.0 -

If you buy you own your house outright in 30 years then can pay into savings.rent and you will pay over your lifetime the equivalent of about 2 houses. You will have paid 2 other people's mortgage!!

Flexibility is great, security and owning an asset you can do whatever you need to do with later in life is far better.

Buy. By all means rent for a bit, but when I work out what I have paid towards equity in my house and the equivalent rent I would have paid its a no brainer.0 -

getmore4less wrote: »if you are going to model you can't conveniently ignore the things that offset your headline number.

the renter starts with £32k in the bank add in bit of maintenance money say 1% of house value £133pm which is likely to be on the low side long term.

After 50 years £420k in the bank which eats into that £500k .

one other issue for real people is they don;t have the 20% some might have 10% whats the 25y rate for them.

Adding in your maintenance and allowing for 2% inflation after 25 years the renter will have paid £280k in rent compare to the buyers £277k in mortgage payments and maintenance. allowing 2% growth on renters £32k he will have £53k while the buyer will have a house worth £160k if it didn't increase in value or £335k if it increases in line with inflation.

0 -

getmore4less wrote: »if you are going to model you can't conveniently ignore the things that offset your headline number.

the renter starts with £32k in the bank add in bit of maintenance money say 1% of house value £133pm which is likely to be on the low side long term.

After 50 years £420k in the bank which eats into that £500k .

Eh???

The renter has blown that 32K decades ago trying to keep up with crippling increases in rent.

And you're frankly bonkers if you think it takes that much to maintain the average house. I have two houses, both 100+ years old, and in 25 years of ownership have spent less than 20K for both combined, and that included optional updating. I've spent less than 1K on the smaller 3 bedroom one in the last 5 years. Looking at the scheduled maintenance and expected wear rates of major items, I'll be very, very unlucky if I spend more than 50K in total between both in my lifetime.one other issue for real people is they don;t have the 20% some might have 10% whats the 25y rate for them.

That's the thing about "averages", it's best to use the "average". Which is currently a 20% deposit.

Obviously individual circumstances may vary....;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

getmore4less wrote: »Yet to see if this one will be the worst

inflaton adjusted

.

"Inflation adjusted" is of no relevance.

If you don't have actual cash terms falls, then all that happens is houses stay expensive AND the price of everything else gets more expensive as well.

Which is of no help whatsoever to someone waiting to buy a house.

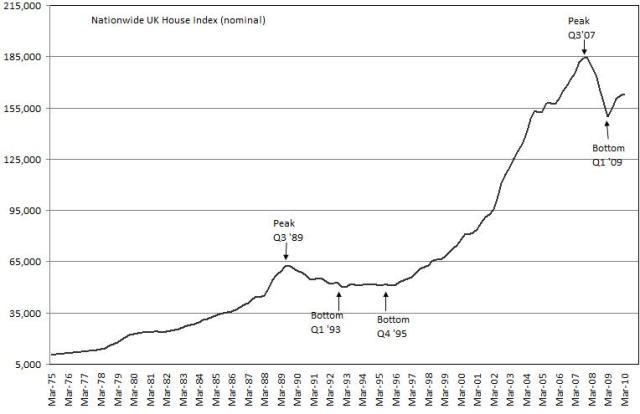

Here's what happened to prices last time around..... In actual cash terms.....;)

A circa 18% fall. Followed by years of bumping along the bottom.

And here's how it's playing out this time...... Again, in actual cash terms, not some imaginary inflation adjusted figure.....;)

A circa 20% fall, then an immediate recovery of around half those falls, followed by years of stability.....

Prices are currently forecast to increase beyond their previous peak as a national average by 2017. But those who will have waited and not purchased for those 10 years, waiting for imaginary "inflation adjusted" falls and paying soaring rents instead, will still be seriously out of pocket versus those who just got on with it and bought, then took advantage of the record low interest rates on offer.

And all the crashaholic wishing in the world won't change that fact.... “The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Basically, over a lifetime (assuming a reasonable life-span) most people would agree that it will very, very likely be much cheaper to buy which is why that is the long-term goal for so many people. Trying to argue otherwise misses the point, I think. Trying to second guess exactly how much cheaper is also a pointless exercise as there are simply too many variables. I maintain that I don't believe it is as simplistic or exaggerated as extremists on this thread would have you believe.

The problem is, that that long term security comes at a shorter term cost (both real financial and in risk and financial insecurity) and to underestimate those is very dangerous. Get caught out and you are financially ruined, as has happened to many people facing repossession and bankruptcy.

*If* you can ride out the storms, buying seems the sensible option. Just don't underestimate the storms. For those buying with the smallest %age deposits and borrowing the highest salary multiples, they are taking the biggest risks for potentially the biggest gains. They are the ones who may be either smugly patting themselves on the backs in 20 years and encouraging others to copy their 'astuteness' or full of regret in 5.

One way of adding some security to the buying option is as suggested in this thread, taking a 25 year fix (if you can afford it) but that is likely to bump up the overall costs over 25 years (otherwise banks wouldn't offer them). Another is to put down a big deposit (but this requires extreme saving beforehand which drastically puts up the short term costs unless you get help).

However you do it, security costs and risk can go both ways.0 -

The way I see it, I have a great house to live in. Its not mine, but so what? ... There are good and bad points of both housing types.

I totally agree there are good and bad points but for most people there is one huge negative in renting that eclipses every other positive: security of tenure.

To receive a letter giving you two month's notice that you need to find a new home would turn most people's world upside down. For anyone that has the opportunity to buy and avoid this, it's a no-brainer.Every generation blames the one before...

Mike + The Mechanics - The Living Years0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards