We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help with my ii confusion please

fimonkey

Posts: 1,238 Forumite

Dear All,

Please can I have your opinion/advice on my personal situation with ii and their soon to be introduced charges.

Having been away for 3 weeks I have not much time left to make a decision between transferring to another provider or selling everything.

1. ii have said they will not charge any commission if I decide to sell before the end of July, when I asked them explicitly if there were any other fee's they said "no" - however I got stung for high charges when I moved my H&L ISA to them (it was a specific charge which I didn't specifically ask about) so I don't believe them. If I sell everything, WHAT WILL I HAVE TO PAY, AND TO WHOM?

2. Is it worth transferring given that I hold so little in so much and is there another provider which has a similar thing to the portfolio builder? If not overall which provider would prove to be the cheapest for me (I buy about £150 of shares every 2 months).

As you can see, I'm no hot shot trader. All this was about was to educate myself about shares and I was going for the dividend players with a long term outlook (holding for years and years and years). If I lost all this money in a shot then hey-ho - I was always prepared for that.

Given what I have below - what would you do, sell everything or transfer everything (or just transfer the ISA and sell whats in the trading account)?

Thanks all

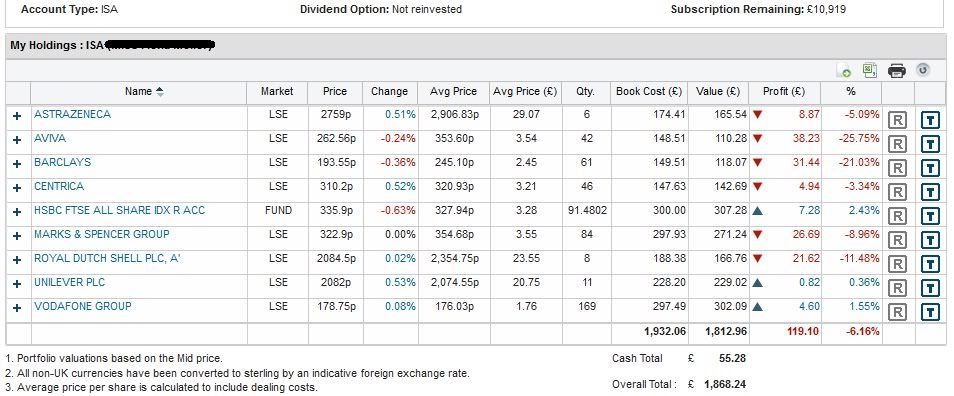

My ii ISA

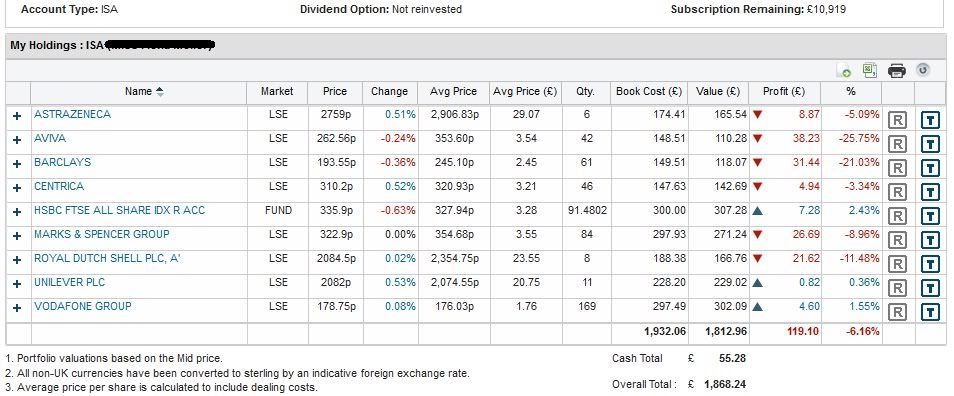

My ii trading account

My ii trading account

Please can I have your opinion/advice on my personal situation with ii and their soon to be introduced charges.

Having been away for 3 weeks I have not much time left to make a decision between transferring to another provider or selling everything.

1. ii have said they will not charge any commission if I decide to sell before the end of July, when I asked them explicitly if there were any other fee's they said "no" - however I got stung for high charges when I moved my H&L ISA to them (it was a specific charge which I didn't specifically ask about) so I don't believe them. If I sell everything, WHAT WILL I HAVE TO PAY, AND TO WHOM?

2. Is it worth transferring given that I hold so little in so much and is there another provider which has a similar thing to the portfolio builder? If not overall which provider would prove to be the cheapest for me (I buy about £150 of shares every 2 months).

As you can see, I'm no hot shot trader. All this was about was to educate myself about shares and I was going for the dividend players with a long term outlook (holding for years and years and years). If I lost all this money in a shot then hey-ho - I was always prepared for that.

Given what I have below - what would you do, sell everything or transfer everything (or just transfer the ISA and sell whats in the trading account)?

Thanks all

My ii ISA

My ii trading account

My ii trading account 0

Comments

-

So confused you forgot to ask the question?0

-

Loads of Qs there ....I have marked them in red now

Sorry, I don't know the answersDear All,

Please can I have your opinion/advice on my personal situation with ii and their soon to be introduced charges.

Having been away for 3 weeks I have not much time left to make a decision between transferring to another provider or selling everything.

1. ii have said they will not charge any commission if I decide to sell before the end of July, when I asked them explicitly if there were any other fee's they said "no" - however I got stung for high charges when I moved my H&L ISA to them (it was a specific charge which I didn't specifically ask about) so I don't believe them. If I sell everything, WHAT WILL I HAVE TO PAY, AND TO WHOM?

2. Is it worth transferring given that I hold so little in so much and is there another provider which has a similar thing to the portfolio builder? If not overall which provider would prove to be the cheapest for me (I buy about £150 of shares every 2 months).

As you can see, I'm no hot shot trader. All this was about was to educate myself about shares and I was going for the dividend players with a long term outlook (holding for years and years and years). If I lost all this money in a shot then hey-ho - I was always prepared for that.

Given what I have below - what would you do, sell everything or transfer everything (or just transfer the ISA and sell whats in the trading account)?

Thanks all0 -

Ah, that's because they edited the post after I had replied. There was just a screen print when I looked.Loads of Qs there

Not being a iii user I can't give the answers for sure, but the topic has been thoroughly discussed in the thread iii introducing quarterly £20 charge, and the iii alternatives one, so you can probably find all the answers in those.0 -

With regards to selling/transferring it depends on your new agency as to whether they can re-register your assets or whether you have to sell them and buy them back. However your new agency should take care of all that when you apply for the transfer.

According to ii's charging model they charge £15 per line of stock to transfer out and £10 to buy/sell. So it will probably be cheaper to sell. (Again your new agency should take care of that for you should you choose to leave)

In terms of new providers there are many good self-investment options around. Such as Cavendish (very cheap, but not very helpful), Hargreaves or rplan (these are not as cheap, but better service).

I hope this information helps.

0 -

I am in the process of transferring my isa and trading account from ii to sippdeal. If you decide to transfer to another broker, you need to notify ii before Friday if you wish to avoid the first £20 qarterly charge.0

-

Low cost stockbrokers such as X-O (£5.95 per trade) or SVS (£5.75 or £1 for first 30 days) will take all the shares with no problems but will not take the HSBC All Share fund. You could sell the HSBC fund whilst still with ii and then open an ISA and Trading Account with one of those suggested and then transfer the shares and the cash balance for free (before 31 July).

If you wanted to either transfer the fund or buy it again, and also transfer your shares, then you would need a platform such as H-L or BestInvest.Old dog but always delighted to learn new tricks!0 -

Ah, that's because they edited the post after I had replied. There was just a screen print when I looked.

Not being a iii user I can't give the answers for sure, but the topic has been thoroughly discussed in the thread iii introducing quarterly £20 charge, and the iii alternatives one, so you can probably find all the answers in those.

I HAVE read those threads so I'm not being lazy - nothing in those threads really covers me though as I'm such a small investor slowly trying to build up a portfolio so didn't want my investments eaten up bu dealing charges etc - so was looking for a portfolio type of builder and wondered if I'd missed anything (there's a lot to read in those threads) hence my own question.0 -

maryjanell79 wrote: »With regards to selling/transferring it depends on your new agency as to whether they can re-register your assets or whether you have to sell them and buy them back. However your new agency should take care of all that when you apply for the transfer.

According to ii's charging model they charge £15 per line of stock to transfer out and £10 to buy/sell. So it will probably be cheaper to sell. (Again your new agency should take care of that for you should you choose to leave)

In terms of new providers there are many good self-investment options around. Such as Cavendish (very cheap, but not very helpful), Hargreaves or rplan (these are not as cheap, but better service).

I hope this information helps.

Thanks, I have been told they won't charge me commission for selling before 31st July - is this the same as the £10 per line of stock or is the commission a different charge? Have also been told no charges for transfer before 31st July. Will check out Cavendish, but H&L no good cos they also charge (£2 per month I think) for holding tracker funds and I want to keep investing in the HSBC all shares tracker.0 -

Low cost stockbrokers such as X-O (£5.95 per trade) or SVS (£5.75 or £1 for first 30 days) will take all the shares with no problems but will not take the HSBC All Share fund. You could sell the HSBC fund whilst still with ii and then open an ISA and Trading Account with one of those suggested and then transfer the shares and the cash balance for free (before 31 July).

If you wanted to either transfer the fund or buy it again, and also transfer your shares, then you would need a platform such as H-L or BestInvest.

Do BestInvest charge for holding trackers? I moved my ISA away from H&L for that very reason, the charges were a LOT more than my returns with such small investments.

What do you mean by £1 for first 30 days?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards