We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

Ex-civil servant here.subjecttocontract said:This situation has all the hallmarks of a rushed change of policy by the Gov'. You would have thought they would have consulted with financial institutions, established the feasibility, what would be needed, the lead time, how many were prepared to adopt etc etc. But it seems very little of that was done just so they could make an announcement to grab the headlines. Appalling.

My thoughts exactly!

The necessary regulations were made on 11th March 2024 - https://www.legislation.gov.uk/uksi/2024/350/made - so no certainty or clarity for providers until that date.3 -

Yes......insufficient time to implement but I guess they didn't want to wait another year.........totally political, as the announcement wouldn't have benefited the Tory party this time next year ! It's fairly obvious to me what's going to happen going forward. Lots of savers are going to disregard declarations with banks and building societies and go ahead and open multi ISA accounts with different institutions.

Fortunately I won't be one of them as I don't need to spread my ISA money around, I will be putting it all in the same place. It's going to be fun seeing how this mess unfolds.2 -

Ex-SI drafter for HMT here.RetSol said:

Ex-civil servant here.subjecttocontract said:This situation has all the hallmarks of a rushed change of policy by the Gov'. You would have thought they would have consulted with financial institutions, established the feasibility, what would be needed, the lead time, how many were prepared to adopt etc etc. But it seems very little of that was done just so they could make an announcement to grab the headlines. Appalling.

My thoughts exactly!

The necessary regulations were made on 11th March 2024 - https://www.legislation.gov.uk/uksi/2024/350/made - so no certainty or clarity for providers until that date.For someone who claims to have been a civil servant you’d hope that you would be aware that HMG publishes a document alongside the SI that discusses the consultation carried out. The EM confirms HMRC did exactly what subjecttocontract thinks they should have done.But that is beside the point. This policy is simple enough that banks don’t need to see those final regs to know what they need to do.2 -

Sussex_Green_Man said:Umiamz said:

How would they even know if you've opened another Cash ISA elsewhere? I'd just be ignoring it if it were me.Sussex_Green_Man said:If opening a new Cash ISA, I would advise checking the T&C to ensure you are not agreeing to limit your newly acquired ISA benefits

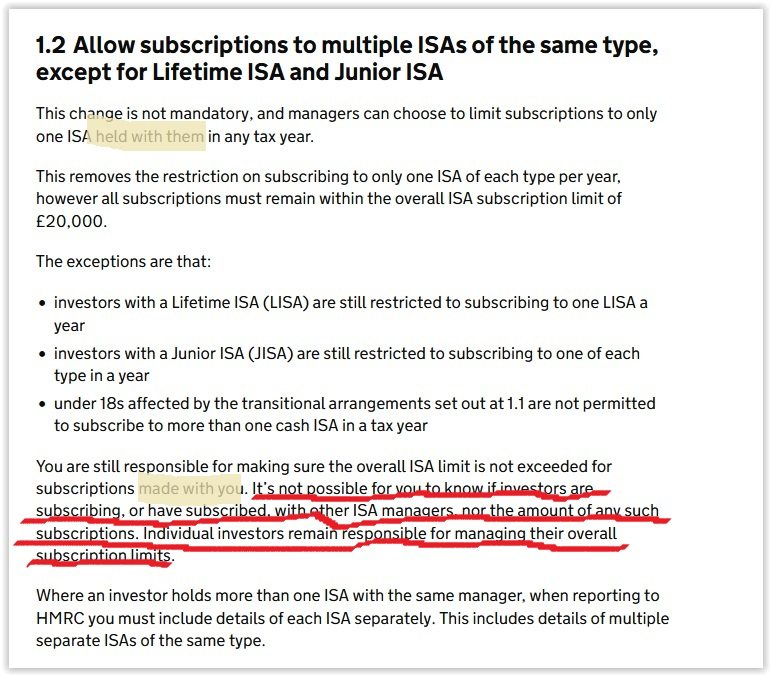

The person I spoke with at KRBS implied the revenue might withdraw ISA status from my ISA account if it was flagged up in their (the revenue's) system. But I guess if you're willing to take the risk, you could ignore.I feel they have just made this up, or you were talking x purpose. The HMRC rules are clear, and it's none of KRBS's business whether I have paid into a cash ISA in the same year at a different provider. Nor would they know about it unless I tell them. What they are allowed to do is limit you to one ISA of the same type with them. It's my responsibility to make sure I don't deposit more than £20k in a single tax year9 -

What they mean is that you cannot have, and pay into, more than one of their cash ISAs in the same year.Sussex_Green_Man said:Malchester said:

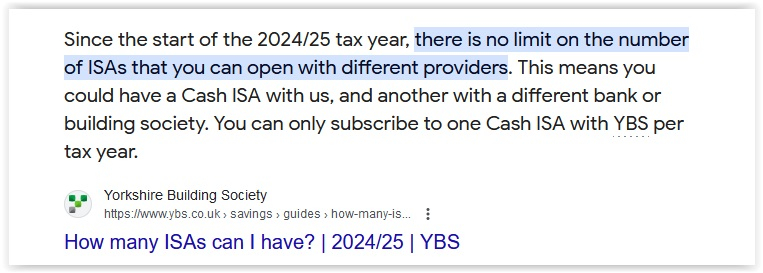

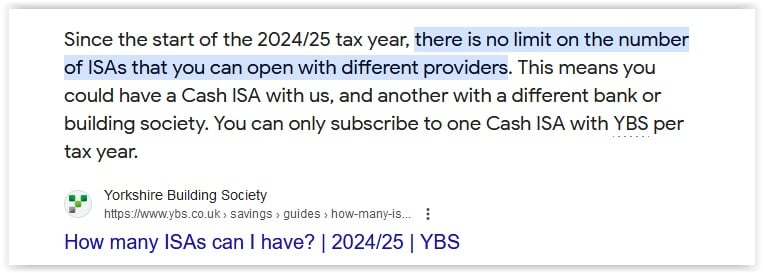

Banks are allowed to not allow more than one cash ISA being funded with them. That would account for the comment earlier about updating systems being difficult and costly. I was told by Lloyds Bank that they were not implementing the new rule as it was voluntary. However there is no way that any financial institution can force someone not to open and fund a second cash isa with another institution as it is clearly within HMRC rules.Sussex_Green_Man said:So why do you think the KRBS person I spoke with said this? Do you think he was turing away business just to cover for their not updating the website? I did push him about when they might 'sign up' to the revenue's new rules but he was very vague. As there are plenty of options, I'd prefer not to take the risk so KRBS lost my custom in this instance because of what he said but each to their own.The YBS eligibility criteria stateYou may only subscribe to one Cash ISA in a single tax year with us.

They do not mean that you cannot have, and pay into, one or more other cash ISAs with other providers in the same year.

1 -

Exactly what I’ve been saying across various threads over the past 48h. It’s truly unclear and in some cases the summary box, longer Ts&Cs and ISA declarations are inconsistent with one another - they don’t always appear to have been updated as a suite.It’s really unclear also whether some providers are obfuscating slightly. Some blurbs tell you about the new rules but don’t explain how they benefit you - i.e. is this permitted with them or not (because it’s not mandatory) and if it is, I get the sense that they are not necessarily making it clear that you can choose other providers, i.e. is this deliberate ambiguity so other providers don’t benefit at their expense? It feels like a whiff of this in a few cases.And it’s important to have this spelt out in plain English for the customer.I’m one of those wanting to exercise their new rights - a fixed at a good rate in its niche and an easy access at a better rate than the fixed (for now) so that when an 18 month ISA matures I’ve got one set up to transfer in to - I know that I could have just opened one to transfer ‘old money’ in further down the line, but I wouldn’t have got the rate on this year’s sub and rates might have gone down by then.For peace of mind I’ve gone with two providers who have explicitly and very clearly told the customer their rights and that it is possible with them to open part of this year’s subscription elsewhere. So I can point to watertight Ts&Cs in case of any query.Bear in mind that I’m deaf so I can’t phone up to clarify things, and I don’t want to have a painful phone conversation with HMRC either (my experience of their Extra Support webchat for people with disabilities a few months ago to sort out a minor query wasn’t actually very helpful - we went round in circles until I had a breakthrough and tried another tack and elicited the information I wanted).We can already see on these threads the impact on customers who don’t have disabilities, but for those that do, there are extra barriers in the way when there’s this lack of clarity and information spelt out in plain, clear, accessible, jargon-free English. I don’t struggle with English, but many deaf people (for example) do through no fault of their own, and navigating their rights, responsibilities and entitlements, and access to the best rates with the best access support in the financial sphere is difficult enough without this ambiguous mess.5

-

pecunianonolet said:The government isn't even able to follow their own interest reporting rules, nor do the financial institutions with some not reporting interest at all (own experience).

Why the heck would HMRC suddenly change course and penalise thousands of people who now read rules have been relaxed and they open accounts here, there and everywhere when that is exactly what the new policy is for.

An institution may decline you to put 10k in an easy access and 10k in a fix, meaning 2 different accounts with them. However, this imho has nothing to do with following the law, this is simply a testament of unwillingness to update or incapable IT systems to handle this. None of the providers is obliged to offer any ISA product in the first place.

Anyhow, the market is large and everyone offering certain products to more or less attractive rates is interested in your cash in one way or another. I have not subscribed any penny of this years allowance yet but should I end up with 20 accounts of 1k each, well, so it be. The law doesn't stop me from doing this.

I guess at the end of the day HMRC will only check that you have not sheltered more than 20k from tax. Also, let's think logically, there are millions of ISA accounts across the country and I am sure there are a) not enough advisors available and b) not enough budget to pay them all, to go through each and every record. If somebody is over or other things are showing suspicious IT will spit out those for manual checks. Everything else will sail through the system just fine.

The cost to check that all would far outstrip the additional gain by identifying deliberate rule breakers or those who act in good intent but lost it with the many rules and exceptions in place.I agree with your assessment.HMRC have had processes for donkeys' years to check that people (identified by their NI numbers) have not deposited more than their annual ISA allowance in the same year. They also used to pull people and providers up if anyone deposited into more than one of the same type in the same year, but this has now been relaxed for cash ISAs (but not for LISAs and JISAs).

3 -

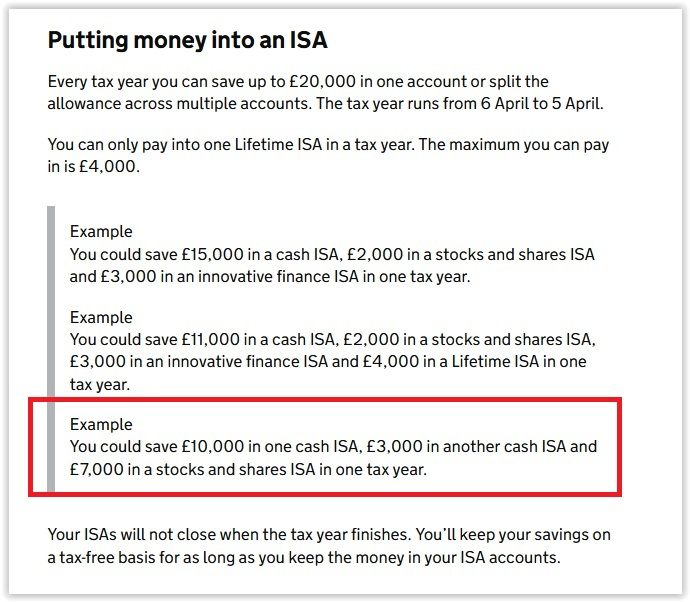

YBS are quite clear (although they don't cover LISAs and JISAs)

So are AJ Bell

So are AJ Bell And Which?

And Which? HMRC are slightly less clear on their main site but still also confirm the above

HMRC are slightly less clear on their main site but still also confirm the above

4 -

Thanks for all the above. As someone noted above, it is very simple. Any attempt by a bank to give the impression given that by opening a Cash ISA with them stops you opening one with someone else can safely be ignored.2

-

This, of course, was the case before the start of this tax year, provided that you didn't pay into more than one of them!

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards