We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Deceaseds money in an AXA Elevate account ...?

Nine_Lives

Posts: 3,031 Forumite

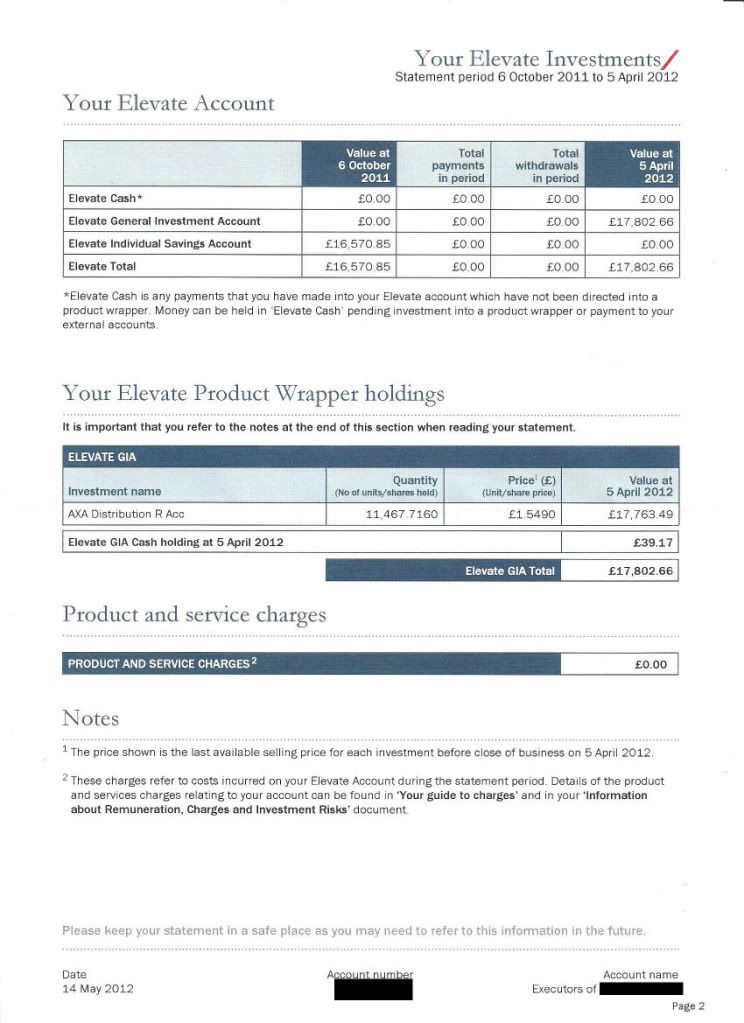

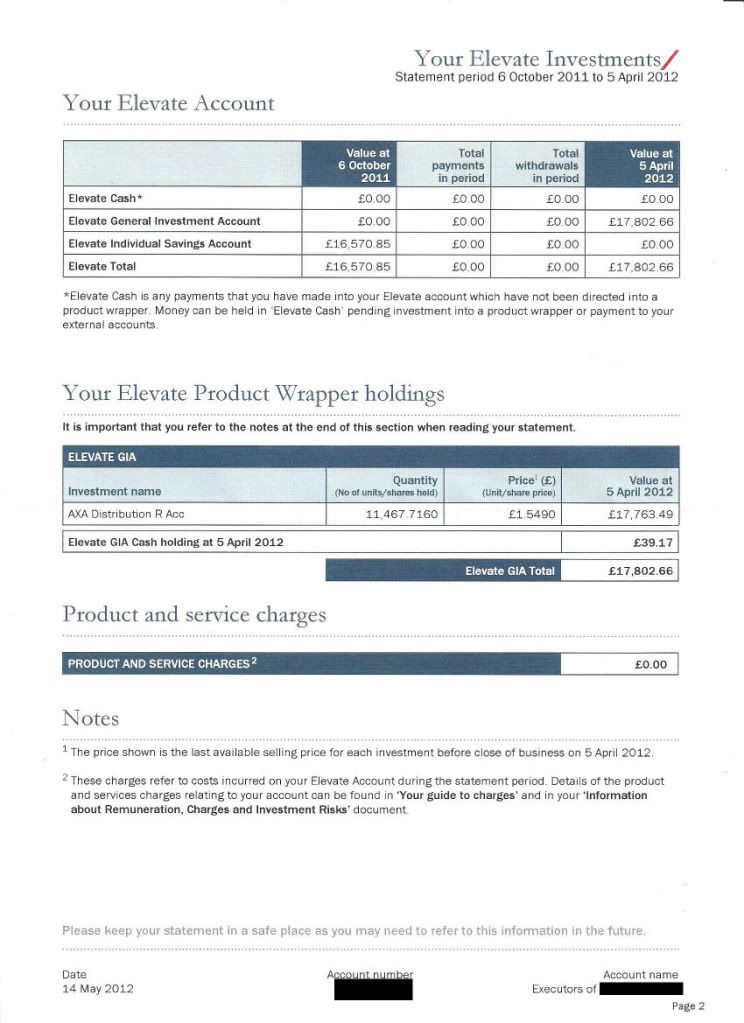

When my dad was alive, he was advised to take his money out of his cash ISAs by an advisor at Yorkshire Bank & put it into an AXA Elevate account. He was shown progression charts & the growth (on the chart they showed him at least) hammered cash ISAs, so he took their advice.

I think he had the money in there for about a year before he died (last Sept). My mum recently received a letter detailing his account, but doesn't really know what to do with it.

Is the account any good?

Is this sort of thing something my mum could continue, but in her own name?

Why would his money seem to be in an Elevate ISA on 6th Oct, yet in a GIA on 5th April 2012?

£1,300 in 6 months does seem quite appealing & far outweighs the £500 for 12 months i got on my £17.7k ISA with Halifax at just over 3%. For those familiar with the account, what's your view on it?

My mum as yet still can't do anything with his money as this probate thing is really dragging out. It was supposed to be granted months ago & then when she pressed them the latest update was a month ago.

I think he had the money in there for about a year before he died (last Sept). My mum recently received a letter detailing his account, but doesn't really know what to do with it.

Is the account any good?

Is this sort of thing something my mum could continue, but in her own name?

Why would his money seem to be in an Elevate ISA on 6th Oct, yet in a GIA on 5th April 2012?

£1,300 in 6 months does seem quite appealing & far outweighs the £500 for 12 months i got on my £17.7k ISA with Halifax at just over 3%. For those familiar with the account, what's your view on it?

My mum as yet still can't do anything with his money as this probate thing is really dragging out. It was supposed to be granted months ago & then when she pressed them the latest update was a month ago.

0

Comments

-

Who are the executors?

They should advise on the options,

What is causing the delays usualy it is a straightforward process if spouce inherits everything.

The account looses ISA status at Date of death.

They should have told you the options.

usualy

1. Transfer to a benifitiary

2. Cash in.

If solicitors are involved and mums will has them as executors get it changed ASAP0 -

Elevate is just a platform. The assets can be transferred in situ to beneficiary or sold to cash. The executor needs to deal with it in the same way as other investments or bank accounts.

edit: Getmore4less beat me to it.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

As far as I can see your late father held a stocks and shares ISA on the Elevate platform and his money was invested in Axa Distribution R Account. The ISA status was lost on death.

The money is now a General Investment Account on the Elevate platform. The fund held is still the Axa Distribution R

I think they must be Acc units judging by the price.

Your mother and her brother are the executors as I recollect but they brought in a solicitor to help?

What is the delay in granting probate? Did there turn out to be a problem with the house willed to your half-sister? https://forums.moneysavingexpert.com/discussion/38581730 -

Thanks a lot guys. Xylophone - yes you're right with everything you said. Good memory there.

We really don't know what the hold up is. My mum took the advice from MSE & went & chased up the solicitor who was (the classic...) "just about to call you...". Aye right.

I then get lost in what's going on. Something about a woman being on holiday & will get back in touch when she returns. She called about 2-3 days after she said she would. Everything seems so disorganised to me.

My mum & uncle (both executors) have been sworn in now, so they're just waiting on the grant of probate IIRC, which should've been about 2 weeks ago (the expected date).

Obviously it's not yet happened. If it was me then i would've been in there by now asking what is going on, but my mum said that she would let May pass before she does that. Without finding out the specific date that this was all actioned ... i think we're now 7 months in.

As my mum is in town on Thu 31 May & not Friday, it'll likely be next week now before she chases them up. Obviously we just want the end of it all so we can draw a line under it & move on.

This Axa Distribution R ..... is this any different to a S&S ISA that i'm currently doing (through Skandia) or my brother is doing (through HL)? £1300 progression in 6 months is quite appealing to me.0 -

This Axa Distribution R ..... is this any different to a S&S ISA that i'm currently doing (through Skandia) or my brother is doing (through HL)? £1300 progression in 6 months is quite appealing to me.

It is a fund that should be available on most platforms.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

The executors may want to argue this was mis-sold depending on whether it was suitable for your late father.

This would be a standard question for them to think about these days in these circumstances.0 -

How would you (the executor) know whether it was mis-sold or not?

My dad never really discussed finances with my mum (old school mentality i guess), but he would discuss with me as he knew i had an interest in the area.

He told me that he went into Yorkshire Bank (would only ever bank with them) & someone approached him (from the bank) asking if he was interested in investments & such. He mentioned he had an ISA & he was told well ISAs aren't doing so great.

The woman mentioned AXA to which he shut it down instantly (the conversation) & said he'd only deal with Yorkshire Bank. He was told that this was through Yorkshire Bank, so he started listening again.

Anyway, he was shown progression figures on the current ISA rates (around 3%) & then he was shown something like a 30 year progression on this AXA investment plan, which transformed something like £30k into £500k over 30 years (i'm likely off with the numbers, but i wont be off by much - i do remember the increase being huge & the final figure being approx 500-600k).

Obviously, this growth would appeal to anyone, so he ditched the ISA he had for this AXA plan.

I don't know what he was promised, if he was indeed promised anything. All i know is the above which is what he told me.0 -

http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/a/axa-im-distribution-class-r-accumulation

It is available through Hargreaves Lansdown.

The fund holds FTSE shares and also gilts - presumably the adviser was saying that the fund was likely to do better than cash over the long term.

It doesn't appear to have done too badly over the short term - the OP's mother can stay in the fund, change to another fund, sell and put the money in a building society account etc once probate is granted.

As I understand it she was the sole beneficiary apart from her step daughter?0 -

Correct. The house my dad had from a previous marriage - he signed his shout in that house to the daughter he had in that marriage.

The house that WE live in, he signed to my mum & that was basically the jist of his will. My mum has already been in & signed the paper for the (first) house to go to my half-sister.

I think my mum is waiting on this whole affair to be sorted before she draws up her own will. Not the best of ideas i know, but i've spoken to her numerous times about drawing her own will up & all she says is she promises she'll do it this year. That's all well & good, but as we found with my dad's sudden death - you never know what the next 24 hours will bring.0 -

How would you (the executor) know whether it was mis-sold or not?

They dont necessarily. They can just try it on sometimes. I had a "professional" executor about two years ago try to get a client of mine to complain about the investment advice I had given his mum before she had died. The client showed me the letter the executor sent him and it made incorrect assumptions about the tax wrapper used and a number of allegations that could have been considered libel. In the end, it turned out that the executor charged a percentage of the estate and the way I had set up the investments kept them out of the estate and the executor was getting nearly £6,000 less than he thought.I don't know what he was promised, if he was indeed promised anything.

Documentation is King. The actual fund used is particularly common for retired people looking to derive an income now or in the future. Nothing said on this thread even hints at wrong doing.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards