We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

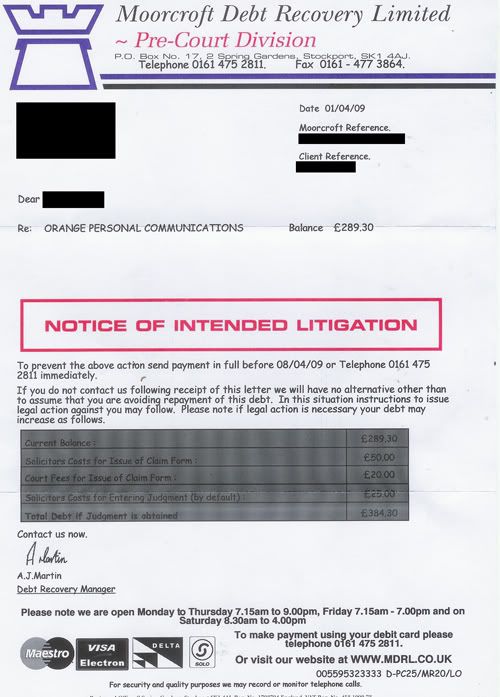

Moorcroft notice of intended litigation?

vicxzy

Posts: 273 Forumite

Can anyone help please?

I am on unpaid maternity leave & have arranged to pay creditors £1 per month for about the past year.

I found out a couple of days ago that all my £1 payments were being paid apart from one to Halifax credit card which for some reason Natwest failed have to set up incorrectly.

I rang Halifax to try & pay over the phone but they refused to speak to me & said it was 'Out of their hands'

Today I have received a letter from Moorcroft debt recovery LTD saying that if I do not pay almost £2000 immedietly they will take me to court (I only owed £700 in the first place!)

Any ideas on what I should do please?

Thank you in advance.

I am on unpaid maternity leave & have arranged to pay creditors £1 per month for about the past year.

I found out a couple of days ago that all my £1 payments were being paid apart from one to Halifax credit card which for some reason Natwest failed have to set up incorrectly.

I rang Halifax to try & pay over the phone but they refused to speak to me & said it was 'Out of their hands'

Today I have received a letter from Moorcroft debt recovery LTD saying that if I do not pay almost £2000 immedietly they will take me to court (I only owed £700 in the first place!)

Any ideas on what I should do please?

Thank you in advance.

0

Comments

-

The words "will" and "may" mean a huge amount in those letters. They "will" recommend to the client that the case goes to court. That does not mean they "will" take you to court only that they "will" recommend that course of action.

Moorcroft will not take you to court only the Halifax may and for £700 and you only paying £1 per month they may just leave the default on your credit record and leave it at that.:footie: Regular savers earn 6% interest (HSBC, First Direct, M&S)

Regular savers earn 6% interest (HSBC, First Direct, M&S)  Loans cost 2.9% per year (Nationwide) = FREE money.

Loans cost 2.9% per year (Nationwide) = FREE money.  0

0 -

If the debt is £700 then moorcroft would have great difficulty in explaining the £1300 and this could be defended as it constituting a penalty, they are only allowed to charge reasonable expenses £1300 for one letter would take some serious explanation.

If you have any details of the Halifax card, write a cheque for the balance to that account number.

If they are stupid enough to reject the payment they would loose the court case if you defended that they were suing for what they had refused.Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

The words "will" and "may" mean a huge amount in those letters. They "will" recommend to the client that the case goes to court. That does not mean they "will" take you to court only that they "will" recommend that course of action.

Moorcroft will not take you to court only the Halifax may and for £700 and you only paying £1 per month they may just leave the default on your credit record and leave it at that.

Thanks Happy do you think I should just carry on as I am then?.0 -

If the debt is £700 then moorcroft would have great difficulty in explaining the £1300 and this could be defended as it constituting a penalty, they are only allowed to charge reasonable expenses £1300 for one letter would take some serious explanation.

If you have any details of the Halifax card, write a cheque for the balance to that account number.

If they are stupid enough to reject the payment they would loose the court case if you defended that they were suing for what they had refused.

Thanks Vax the letter isnt clear but I think they are saying the 1300 has been added on for charges & interest over the past months where I thought I was paying £1 per month.

Also when you say write a cheque for the balance do you just mean the £12 in missed £1 token payments or the full balance? Obv I cant afford to pay the full balance?0 -

You need to get a breakdown of the charges and interest that have been added. You have a right to ask for that.

See: Getting information about your credit agreement

In particular ref a breakdown of the account.

Paying the £12 is not going to make any court claim fail, but if all you can afford is token payments then Halifax or Moroncroft would probably be foolish to push for court action. Not because they would lose, but because even the court can't make you pay what you don't have.

I would also check with Halifax to see whether the account has been sold to MC, or if they are just collecting on their behalf.Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

A lot of companys are not doing it to get increased payments, a lot are doing it to get ccjs preventing it from going sb for a while. Companys are catching on, also if halifax instruct the dca to act on their behalf they can apply to the courtsDon't put your trust into an Experian score - it is not a number any bank will ever use & it is generally a waste of money to purchase it. They are also selling you insurance you dont need.0

-

A lot of companys are not doing it to get increased payments, a lot are doing it to get ccjs preventing it from going sb for a while. Companys are catching on, also if halifax instruct the dca to act on their behalf they can apply to the courts

You do post some pure tripe sometimes. :rotfl:

This debt would be 5 years off being SB at the best.

Moorecroft are very unlikely to go to court off their own back, and normally they only take on debts under an equitable assignment. Meaning that they can't start legal action on their own volition. Examples of them taking legal action are very few and far between anyway.Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Thanks but sorry whats SB?0

-

Thanks but sorry whats SB?

Statute barred. i.e. when you have not paid or acknowledged a debt in over 6 years, then the creditor is barred from taking legal action.

Utterly irrelevant here, as presumably you were paying until a few years ago, and your offers of £1 a year ago would acknowledge the debt.Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

The "intended litigation" letter has long been Moorcrofts opening gambit when passed a debt, and the fraction of cases where they have gone ahead with it are mind bogglingly minuscule.

A typical "threatogram" from them. Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards