We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

House sales drop

Graham_Devon

Posts: 58,560 Forumite

So proves those who said the higher amount of lending in August would translate to more property sales a bit wrong.The number of properties sold in the UK fell to 78,000 in August, figures from the tax authority show.

This was 6,000 fewer sales than in July - which had seen the highest total for a year - although a drop is often recorded in August during what is traditionally a quieter holiday month.

However, the figure was down 3,000 compared with August 2010, HM Revenue and Customs (HMRC) said.

At the height of the property boom in July 2007, 151,000 homes were sold.

Since 2007, sales have been weighed down by the continued rationing of mortgages and the reluctance of sellers to drop their asking prices.

Separate figures published by the Council of Mortgage Lenders (CML) on Tuesday showed that UK mortgage lending rose by 6% in August compared with July.

http://www.bbc.co.uk/news/business-15016998

0

Comments

-

78,000 houses sold in just one month, flippin' heck. That's a lot, didn't realise so many were selling. Must be lots of cash sales in there with mortgage approvals at the 50k level.0

-

Graham_Devon wrote: »So proves those who said the higher amount of lending in August would translate to more property sales a bit wrong.

http://www.bbc.co.uk/news/business-15016998

I would have thought that mortgage lending in August would feed through to sales in September and October.

By the time the conveyancing has been completed.

It's a bit of a stretch to think that mortgage lending in August would also result in completed sales in the same month.

I thought most solicitors take 4-8 weeks to complete.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

IveSeenTheLight wrote: »I would have thought that mortgage lending in August would feed through to sales in September and October.

By the time the conveyancing has been completed.

It's a bit of a stretch to think that mortgage lending in August would also result in completed sales in the same month.

I thought most solicitors take 4-8 weeks to complete.

I didn't say it, was just stating it proved others wrong, as I said pretty much what you said myself, but was told I didn't understand.0 -

IveSeenTheLight wrote: »I would have thought that mortgage lending in August would feed through to sales in September and October.

By the time the conveyancing has been completed.

It's a bit of a stretch to think that mortgage lending in August would also result in completed sales in the same month.

I thought most solicitors take 4-8 weeks to complete.

Our house sold at the end of July (buyer got mortgage offer in August) and expect to complete in October.0 -

So are we saying the CML data for lending is mortgages agreed rather than lending actually made. I was under the impression that the data related to what had been lent out in a given month, which would also relate therefore to completions that month.

If it is mortgages agreed, then presumably the actual amount lent out will be lower as many mortgages agreed will not go all the way to completion.0 -

Graham_Devon wrote: »I didn't say it, was just stating it proved others wrong, as I said pretty much what you said myself, but was told I didn't understand.

So you think that is highly possible increasing approvals could mean more sales two or three months down the line then?

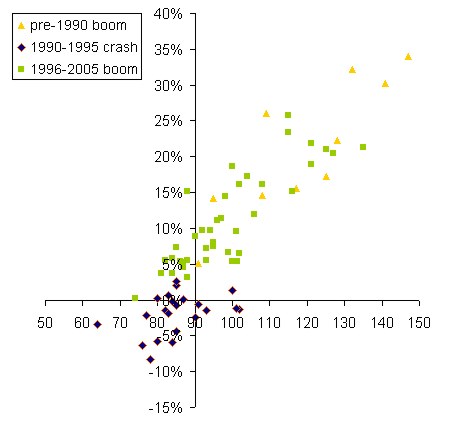

Oddly as I have pointed out before 70-90K sales is around pricing nutrality (when sales are around that point historically prices tend to spread around -5 -+5%)

Looks like those predicting crashing prices are ignoring historical data again.0 -

What if it's a month with 2 full moons?

Does that affect the numbers?"The problem with quotes on the internet is that you never know whether they are genuine or not" -

Albert Einstein0 -

So you think that is highly possible increasing approvals could mean more sales two or three months down the line then?

I think it could mean nothing if house sales fall through.

You were one that thanked the opposite of what you just said. Make your minds up bulls. You cannot keep changing your stance depending on the data released.

If you state increased approvals will mean increased sales that month, stick to it...or don't say it in your excitement.0 -

??????Graham_Devon wrote: »

You were one that thanked the opposite of what you just said. Make your minds up bulls. You cannot keep changing your stance depending on the data released.

Does that come with translation?

If you are referring to ISTL he was saying that approvals would not increase sales in the same months but in months after the increases?

Is that really different to what I asked you or did you misread?

I have never said that approvals increase sales in the same month, so provide proof I have or look like a lying troll.Graham_Devon wrote: »

If you state increased approvals will mean increased sales that month, stick to it...or don't say it in your excitement.0 -

Graham_Devon wrote: »So proves those who said the higher amount of lending in August would translate to more property sales a bit wrong.

If they fall anymore then we will be seeing more new houses being built that are sold.

Will we see all these new property's empty until prices come back down?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards