We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The so called "housing ladder"

Comments

-

There was a ladder but those that climbed it pulled it up behind them. There are people on the ground shouting "You're going to fall off" but, to be fair, those people have been shouting for about 8 years now and only a few who shouldn't have climbed the ladder in the first place have fallen.

Made me laugh this post. How did we pull the ladder up?We love Sarah O Grady0 -

Have my first business premises (+4th business) 01/11/2017

Quit day job to run 3 businesses 08/02/2017

Started third business 25/06/2016

Son born 13/09/2015

Started a second business 03/08/2013

Officially the owner of my own business since 13/01/20120 -

HPI has helped many up the ladder. It has increased there equity meaning they can get bigger without saving meaning they have bigger percentages to put on the next house.

As other have mentioned I do like the way Hamish always groups stable with increasing, do you care to list the 3 seperate figures (ncreasing, stable, decreasing) please?

£100k house 90% mortgage £90k mortgage amount owed after 5 years £80k equity £20k big enough for £200k houses. Limiting factor is wage inflation over that period say 12% so if 90% mortgage was max would now be able to get £100k mortgage so could buy a house for £120k. So even without HPI ladder still exists and it’s wage inflation that is the limiting factor..0 -

Have those who mentioned paying of the mortgage to release equity to get the next "bigger" house, forgotton that if the value of your house falls at the same rate as you pay off your mortgage... that you have no equity in the property for the next "rung" as so many people seem to be saying.

0 -

Caveat_Mortgagor wrote: »forbearance is when a lender agrees not to foreclose on a mortgage even though a borrower has failed to make repayments

That's not quite right, and it's shoddy journalism from the Indy.

It also includes mortgages where the lender has agreed to change the borrower to an I/O product from a full repayment product.

Such mortgages may not be in arrears at all.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

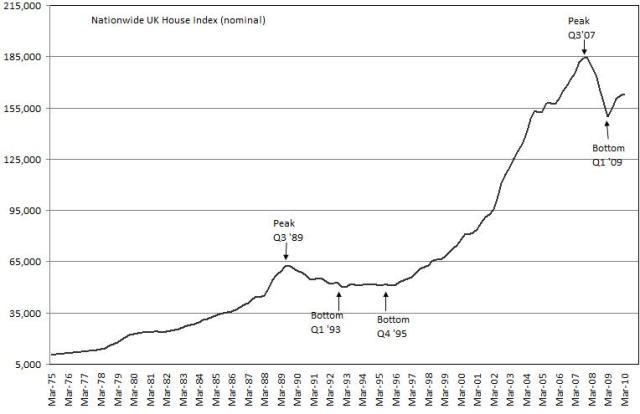

looking at this graph we are due another bottom before house prices rise again or is it different this time. Are we going to follow Japan?HAMISH_MCTAVISH wrote: »Exactly. 0

0 -

Caveat_Mortgagor wrote: »I take your point, maybe I confused the issue for you by highlighting only a small section of the text quoted.

125% mortgages were actually aimed at those who had NE and illustrated they didn't have any money problems to enable them to move in the last housing bust/flatline in the 90s.Caveat_Mortgagor wrote: »However, one in ten mortgagors are in arrears or being repo'd, they wont be able to take advantage of the shortening of the rungs on the fabled ladder.

Some of them will become long time renters, while others with a new partner will be able to get back into the housing market in a few years.I'm not cynical I'm realistic

(If a link I give opens pop ups I won't know I don't use windows)0 -

the_flying_pig wrote: »my dad 'gets' this point quite well. although not an educated man at allhe would prefer to see lower prices for this reason.

my mother doesn't get it at all though [despite having passed her eleven plus back in the day]. she just seems to think that a big new pwoperdee bubble would make the boomers so rich that they'd be able to use the proceeds to buy houses for all of their kids. or something. the idea that if one house became very expensive then it'd be incredibly expensive to buy a whole bunch of houses was just an intellectual hurdle too far for her, sadly.

They understand, they just dont really want to think about it. I believe my in laws bought their place for about £30k in the 80s. They are currently in mourning because its 'only' been valued at around £185k.

Everyone like they used to be is priced out.

Thats England though, civic minded people are not.0 -

Imagine a world in which house prices were fixed for all time, there was no inflation, and no one ever got a pay rise.

Someone would buy a house when young, and start paying off the mortgage. After a few years he might be promoted, or move to a better job because of his experience, training, or extra qualifications. He could afford a better house. On further promotion he could move up again.

Finally, when his children left home, his salary had peaked, he had accumulated many years of other savings, he might be able to buy his most expensive home ever.

Then he would retire, his mortgage paid off, and buy a cheaper smaller house for retirement.

That's how it used to work once. I think you would call it a ladder.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards