We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The so called "housing ladder"

Comments

-

HAMISH_MCTAVISH wrote: »House prices are not falling, for most people in most areas.

Up 4%, or around £7,000, since January, and pretty much flat year on year. (nationwide)

Ahem.

Halifax -3.5%

Nationwide -1.1%

Land Reg -2.5%

Hometrak -3.9%

Home.co.uk -0.8%

FT House Price Index -1.4%

Rightmove +0.1%

Communities & Local Government +0.7%

I suppose you have a "but but but if you ignore the measures we have always used and were quite happy to use when prices were rising, and very happy to use in the quieter months...." lined up to suggest prices are indeed, rising, and that everything is rosy...

...and even that you cannot see any problems in the world economy, which was a new one you came up with yesterday.0 -

Graham_Devon wrote: »to suggest prices are indeed, rising, and that everything is rosy...

.

Never said that.

In fact, prices are only rising in 10% of areas.

Stable in 58% of areas.

And falling in 32% of areas.

But for most people, in most areas, prices are stable or rising.

Therefore, NOT falling.

Which makes the entire OP pointless.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Never said that.

In fact, prices are only rising in 10% of areas.

Stable in 58% of areas.

And falling in 32% of areas.

But for most people, in most areas, prices are stable or rising.

Naturally the regional averages are still averages, so even that statement is suspect.0 -

Why 25 years of no ladder? Are you saying that house prices have been falling continuously for 25 years in Japan?

If it helps, don't picture it as a ladder, which is linear, picture it as a steep hill that turns into a mountain during booms and then back to a hill in busts and flatlines.

Japan...so far has 25 years of static/falling prices. Lets look at how people afford the next "rung".... usually by the fact that they have equity in their property ? We haven't hit a bust either. This current cycle is very different to the ones that gone before. When have we had such a long period of near 0% base rate ? I'm 30 and have owned (mortgaged) 3 properties to date, so I'm not some kid with no experience. Every pointer I see in both the wider ecnonmic press points to this period of the housing market being markedly different to any boom/bust cycle that has gone before.

And by virtute of providing the mountains/hills analogy, you could say you've contradicted your view point somewhat.0 -

People do build up equity in their homes by paying off their mortgage (assuming they aren't IO). And, as I said, over the long term wages will rise for most people as they manage some form of progression. How many people retire from exactly the same job that they started their career in? Even those who stay with one company, how many stay in exactly the same entry level job and therefore see no increase in earnings over their lifetime?

Therefore, they build up equity as they pay down their mortgage, inflation (general, not HPI) decreases their mortgage repayment in real terms and they earn more. They can then afford to sell up and buy a bigger property.0 -

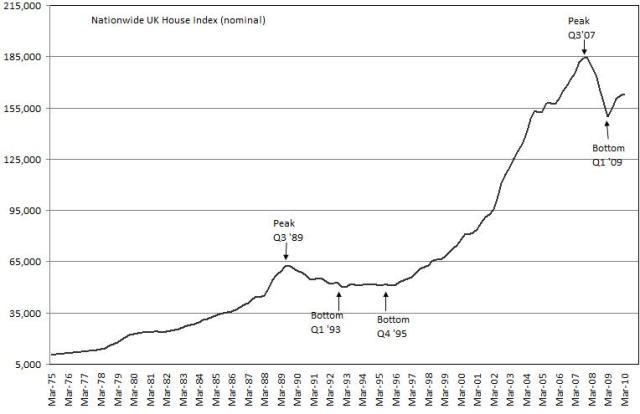

The reality in the UK, and those of us who are older than 15 will have seen this all before, is that we have a boom, then a bust and then a long flatline until the next boom.

Exactly. “The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

There is a ladder, regardless of inflation. When i started working i earnt 12k pa. I now earn more than twice that. This is not inlfation, this is getting a qualification and doing a different job to that i started with. Therefore, i can afford a bigger house. Aside from the no deposit issue.saving up another deposit as we've lost all our equity.

We're 29% of the way there...0 -

No, for most people, prices are stable or fallingHAMISH_MCTAVISH wrote: »But for most people, in most areas, prices are stable or rising.

(my most is bigger than your most)

edit:

would you still be saying the same if it were

prices are only rising in 1% of areas.

Stable in 51% of areas.

And falling in 48% of areas?0 -

Of course there's a housing ladder. Those who don't get on it end up missing the boat and can be priced out forever if they wait too long.Day to day, little things we can all do to tackle the Credit Crunch.0

-

Do you ever get the impression that everyone on this board is obsessed by money.

And as for you Devon, I'm keeping my eye on you.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards