We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Big trouble ahead!

Bloomberg

Posts: 665 Forumite

As we all know the world economy is on shaky ground. In the UK we should all be concerned about the situation in Greece and Italy not to mention the other countries which are storing up problems. I think that the stock market in this country is going to take a massive hit when Greece and the others default. Even the recent uncertainty in Greece affected share prices, the subsequent bailout and the austerity measures have put the stock market back on an even keel.

I personally feel that now is a good time to off load your shares. I have done this and will be investing heavily in a natural resources fund. The rationale behind this is that long term you can only lose if you are forced to sell at the wrong time. The fund invests in base metals, oil, gas, precious stones and food. I may be wrong but I think that this is the way forward.

Contrary to what some people think we in the UK are not over the worst. We have not dealt with the underlying problems. £200 billion of qualitative easing and interest rates at 0.5% is not reality. There are many people who have houses now who will not have them when the rates rise. It would be interesting to know what other people think of the above.

I personally feel that now is a good time to off load your shares. I have done this and will be investing heavily in a natural resources fund. The rationale behind this is that long term you can only lose if you are forced to sell at the wrong time. The fund invests in base metals, oil, gas, precious stones and food. I may be wrong but I think that this is the way forward.

Contrary to what some people think we in the UK are not over the worst. We have not dealt with the underlying problems. £200 billion of qualitative easing and interest rates at 0.5% is not reality. There are many people who have houses now who will not have them when the rates rise. It would be interesting to know what other people think of the above.

Money is a wise mans religion

0

Comments

-

6 months too late. Only hold oil and miners though so yes agree.0

-

The problem with that is many natural resources are affected by the world ecomonies too.I personally feel that now is a good time to off load your shares. I have done this and will be investing heavily in a natural resources fund. The rationale behind this is that long term you can only lose if you are forced to sell at the wrong time. The fund invests in base metals, oil, gas, precious stones and food. I may be wrong but I think that this is the way forward.

For example if the west goes into recession they will buy less, which means the exporting countries of the east will suffer too. Oil is used in manufacturing and transport, both of which decline if international trade slumps. Likewise any metals used in manufacturing. Precious stones could be argued either way - a store of wealth perhaps but if people get poorer they will cut back on buying diamonds. Food is the only safe defensive bet in the ones you mention, and even that can fluctuate with the weather.0 -

Why don't you sell everything you think would be affected by what's happening in Greece/Italy and then buy it back when the price drops?0

-

.....Contrary to what some people think we in the UK are not over the worst. We have not dealt with the underlying problems. £200 billion of qualitative easing and interest rates at 0.5% is not reality. There are many people who have houses now who will not have them when the rates rise. It would be interesting to know what other people think of the above.

What is going on in today's markets has nothing to do with whether we in the UK are 'over the worst' or not. The markets are truly 'global', incestuous, and extremely fickle.

Prices of any equity or fund will ultimately correct to a 'true' value, but at times like this, any 3% movement in any value, on any day, is 99% a function of sentiment, and only 1% a function of fact, reality, or true value.0 -

I personally feel that now is a good time to off load your shares. I have done this and will be investing heavily in a natural resources fund. The rationale behind this is that long term you can only lose if you are forced to sell at the wrong time. The fund invests in base metals, oil, gas, precious stones and food. I may be wrong but I think that this is the way forward.

.

No. You are not investing in natural resources, you are investing in the *equities* of companies involved in this space. If and when there is a stock market crash these will be affected like everything else. If I was looking to focus my sole exposure to "natural resources" I would at least look at a fund which limited the downside in the last crash of 2008. And if you look at it they DID crash....this is because in general when there is a sell off in equities due to economic conditions it affects the whole lot - not equally necessarily - but the whole lot.

What seems to be happenign here is that you are making a short term based defensive decision based on a long-term justification - which imho is completely wrong. Think about it, you think there will be an equities crash in the short term so you want to get out of equities (that make some sense) but then you say that you want to get back into equities in a focussed area because natural resources are inevtibaly going up in the very long term (also make sense). The problem is that these do not make sense *together* - you see what I mean? Look at JPM Natural Resources and how volatile that is? I am not saying you are conidering this fund in particular - but you are taking risk off the table in the short term to minimise short term losses by justifying in terms of long term. Just to be clear, I agree potentially to both arguments, but *definitely* not together - that makes no sense whatsoever.

I hope that helps.

J0 -

I think that the stock market in this country is going to take a massive hit when Greece and the others default

If you believe that you have correctly judged the future - then by all means stand by your judgement.I personally feel that now is a good time to off load your shares.

Again, if that is your gut feeling then go for it!The fund invests in base metals, oil, gas, precious stones and food. I may be wrong but I think that this is the way forward

OK - follow your instincts!

Personally, I don't agree with any of your 3 views - but my opinion is no more (nor less) valid than yours. Only time will prove one of us correct.Old dog but always delighted to learn new tricks!0 -

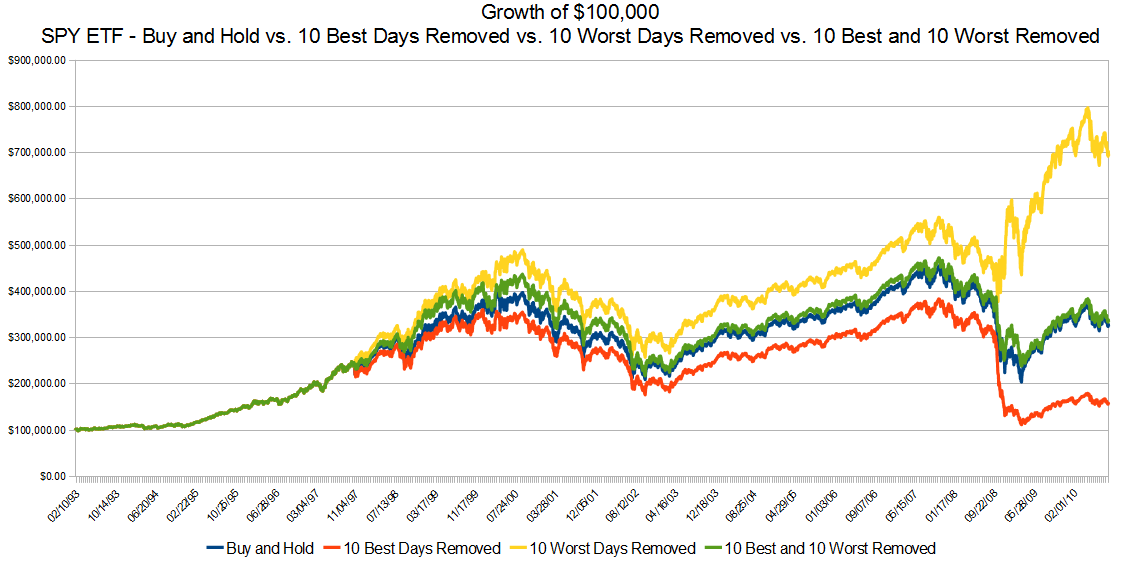

If an investor has long-term confidence in equities then selling now would be the wrong option, because when they do recover then can do so very quickly and the investor could miss out on those initial gains. There have been articles in the press over the years (which I can't find now...) that suggest that missing out on the best ten days of a stock market rise results in lower returns than selling and trying to buy back in. In the '73/74 crash, M&G had their funds remain fully invested and performed better than those that had sold out (again, can't find the relevant articles).

Uncertainty is a good deal of the problem right now. If the politicians get their finger out and allow Greece to default in a controlled manner then that would reduce the level of uncertainty in this area. Perhaps of more importance are the (non) events in the US regarding the debt ceiling and the credit-fueled property bubble in China. But even these are not enough to make me want to sell out of equities: they are reasons for me to expect bumpy times ahead and to have a portfolio that is spread over several asset classes.

OK, things are 'different this time' - they always are, and there is no reason for complacency. The following might be interesting reads.

http://en.wikipedia.org/wiki/Panic_of_1907

http://en.wikipedia.org/wiki/1973%E2%80%931974_stock_market_crash

http://en.wikipedia.org/wiki/Secondary_banking_crisis_of_1973%E2%80%931975Living for tomorrow might mean that you survive the day after.

It is always different this time. The only thing that is the same is the outcome.

Portfolios are like personalities - one that is balanced is usually preferable.

0 -

This is often quoted but there is a counter argument which is that missing the 10 worst days is also highly effective, perhaps even more so. So if you are sure a crash is on the way selling up is a valid strategy.Ark_Welder wrote: »There have been articles in the press over the years (which I can't find now...) that suggest that missing out on the best ten days of a stock market rise results in lower returns than selling and trying to buy back in.

I only had a quick search for links but here is one with a graph showing what happens when you take out the 10 best or worst days compared to buy and hold on the S&P 500:

http://www.ritholtz.com/blog/2010/09/missing-best-worst-days-of-sp500/

(sorry about the graph size, the forum post tool gives the apearance of letting you adjust the image size but it doesn't actually do anything!) 0

0 -

The problem with that is many natural resources are affected by the world ecomonies too.

For example if the west goes into recession they will buy less, which means the exporting countries of the east will suffer too. Oil is used in manufacturing and transport, both of which decline if international trade slumps. Likewise any metals used in manufacturing. Precious stones could be argued either way - a store of wealth perhaps but if people get poorer they will cut back on buying diamonds. Food is the only safe defensive bet in the ones you mention, and even that can fluctuate with the weather.

I personally believe that natural resources will shine in the long term, admittedly nothing is fool proof but it is my opinion that the investments which I have mentioned are likely to offer the best returns. For the forseeable future oil and gas will be in high demand. The world population is ever increasing, this in conjunction with the non renewable nature of the natural resources are the cornerstone of my strategy. That said other readers have made some very valid points. My predictions could be very wrong - time will tell.Money is a wise mans religion0 -

This is often quoted but there is a counter argument which is that missing the 10 worst days is also highly effective, perhaps even more so.

True, but both top-tens can only be confirmned with hindsight.

[edit]

Is there any correlation between the best and worst days? i.e. does a top-ten bounce occur the day after a top-ten fall? And vice-versa? There may be the chance that if you miss out on the one then you also miss out on the other.Living for tomorrow might mean that you survive the day after.

It is always different this time. The only thing that is the same is the outcome.

Portfolios are like personalities - one that is balanced is usually preferable.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards