We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

First Time House Purchase - Can we affort to live?

k18dan

Posts: 295 Forumite

My Partner and I are looking into buying our first house together, We both still live at home.

I am someone who wants to look at everything as I don’t want to go into this 'Blind'

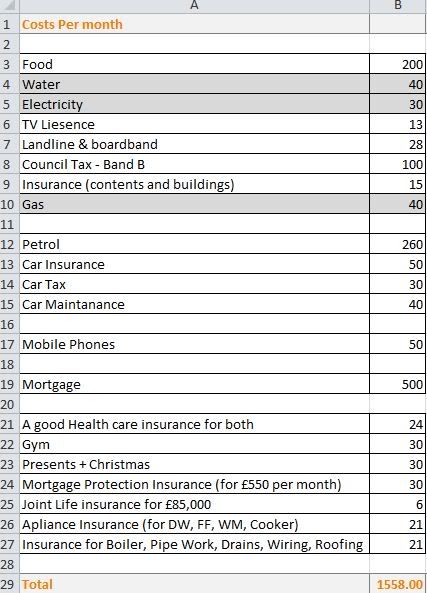

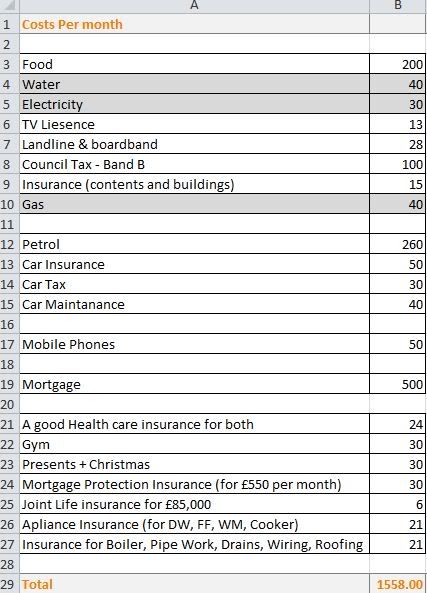

So my partner and I have done a expenses list of everything we would have to pay out each month so we can judge if this is possible?

I think I have added everything? But if you guys would be so kind to have a look at my table and point out anything I have missed or anything thing that you think is incorrect?

We are both fairly low earners with a combined income of £1886 per Month, So taking in to account the Monthly spend below (£1558) we would have just over £320 per month after the bills were paid for Clothes, Going out and savings.

I am someone who wants to look at everything as I don’t want to go into this 'Blind'

So my partner and I have done a expenses list of everything we would have to pay out each month so we can judge if this is possible?

I think I have added everything? But if you guys would be so kind to have a look at my table and point out anything I have missed or anything thing that you think is incorrect?

We are both fairly low earners with a combined income of £1886 per Month, So taking in to account the Monthly spend below (£1558) we would have just over £320 per month after the bills were paid for Clothes, Going out and savings.

0

Comments

-

The bits that stick out the most are Petrol,landline/broadband,food and mobile phone as well as appliance/boiler insurance.

Those areas you could prob make a saving in, but other than that id say your calculations were correct but you may want to set aside say £50 a month towards savings as well.0 -

Thanks..

That makes sense.. The Petrol calculations are basses on us having to have a car each (work 20 miles away from each other) but its something we can work on and hopefully lose one car?

Mobile phone is very high, mine is £15 per month but the other half’s is £35 per month so we plan to reduce hers when we can according to her contract

I'm unsure about the appliance/boiler insurance but I’ve put it in to plan for all eventuality’s0 -

It depends how far ahead you're planning using those figures.

You might want to increase the figures for gas/electric just to cover you for future increases in prices.

Also mortgage, I don't know if you're going fixed rate or variable but with rates so low at the moment an increase in base rates will make a much bigger change to your payments than it would a few years ago (proportional to the original payment) so you should possibly work out what your payments would be if base rate went up by 2-3% (which would still be really low historically). I've no reason to think it will go up that much quickly, but it's better to be safe than sorry).

Your £320 a month for clothes, going out, etc should more than cover them (especially if you take advantage of the coupons and things in the other sections), but it depends how important those things are to you, whether you'd be prepared to cut them or not. You have to make sure you have something you can 'waste' your money on just to enjoy yourself otherwise you'll go batty.0 -

TV licence will be double that in the first 6 months; you pay for the full year's licence in the first 6 months; thereafter you're paying in advance and in arrears for 6 months each of the following year's licence.0

-

If it is your first place and you don't have any no claim discount on a building&content insurance, I'd expect it to be at the very least of £20 but very likely more. Joint Life insurance £85,000 for £6 - DON'T THINK SO0

-

First of all I can't see the monthly spend!?Mishomeister wrote: »If it is your first place and you don't have any no claim discount on a building&content insurance, I'd expect it to be at the very least of £20 but very likely more. Joint Life insurance £85,000 for £6 - DON'T THINK SO

You get a discount on building insurance if you have no no claim bonus but are a first time buyer. I got a quote for 15£ a month on a 185k property.

Joint life cover can also be very cheap, I have been offered 110£ a year (not increasing over the years) for my property. 165k mortgaged.0 -

You've got appliance insurance for all the appliances but have you actually got them? - Also you're showing Mortgage Protection insurance for £550 per month, but Mortgage of £500 - a typo?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards