We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Shared Ownership

Comments

-

Wickedkitten wrote: »If you had bought 100% of the entire flat for 110k, and put down a 10% deposit which would have left you with a 99k mortgage, without even overpaying you would be sitting on 26k if you sold right now.

Spot on, however at the time i was earning about 8k less a year and my other half was still in full time training. She has noe qualified as a nurse so our income has basically doubled since i purchased it.Mortgage overpayment01/05/11 - 31/12/2011£5000/£7000End of 2012 target£84000 -

So you don't think the housing bubble will continue to deflate to normal levels?

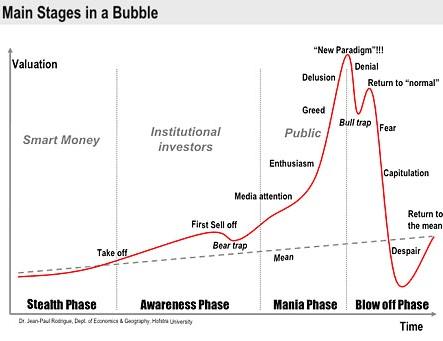

2009 was the bull trap above.

So what your saying is your house has gone up about 17% in 2 years despite that beating national averages by miles and despite house prices falling for about 6 months till present.

Please give us some credit, we are not stupid. I am a key worker with many friends with these scam schemes. I have seen a wide range of problems these cause from criminal neighbours terrorising them, trapped unable to sell to move to bigger home for growing family or how about crippling costs or structural failings effecting whole block.

Shared ownership is a scam to get you to over pay it is not your friend.

No but I have common sense, back ground in risk and an in depth study of macro economics and housing issues.

A home is likely to be your most expensive purchase ever, so it is worth doing your home work.

I think we summed this one up earlier when we stated i was shared equity not shared ownership and I purchased on the open market. I dont diasagree with the issues you highlighted for SO schemes. It really does help if people read the posts fully though.

.....and yes it appears my price has risen by 17%! purely because I PURCHASED ON THE OPEN MARKET AND NEGOTIATED THE PRICE! hence not artificially supporting the housing market! (is this clear enough for you yet?) The developer was desperate for cashflow, simple as that! This was not my excellent judgement or superior knowledge, simply luck - i was looking at the right time in the right area!

Im an now in a position to pay off my mortgage quickly due to the low LTV (60%) interest rate - saving me 000's! Yes ill have to pay back slightly more on the 40% (not if prices drop like you think they will however) I can sell anytime.Mortgage overpayment01/05/11 - 31/12/2011£5000/£7000End of 2012 target£84000 -

Hi all.

I'm very interested in this thread. I came on here about a year ago looking into shared ownership, and remembered how anti-SO this forum was. I'm very strongly looking into it myself, so I'd like to understand further your reasons for being against it, so I can make an informed decision.

I'll be honest, I still don't fully understand why its considered so bad. It would be really helpful to see a list of concise bullet points of the disadvantages of Shared Ownership. Thus far what I've managed to pull out from this thread is:- There are some dodgey schemes such as you being liable for negative equity on the whole property

- House prices might fall

- They are often over-valued

- You may be contributing to the housing bubble (I don't really understand this point to be honest).

They're the facts that I've pulled out from the many opinions in the thread. Please feel free to add to this list to help others.

The thing is though:- I've asked questions whenever I've viewed a SO property, and none of them have had these dodgey stipulations (such as being responsible for 100% negative equity)

- House prices will fall even if you own a property outright

- Overvaluation is a big problem for new builds, but some resales seem to be in-line or even below the market

So given that, the risks seem much the same as owning any property to me. The way I've been viewing SO is:- Unless you fall into serious negative equity, ownership is better than renting (which again, this risk is possible when planning to own any property)

- The market is very low at the moment and is starting to pick up, so it is a good time to buy. Although, as I've learnt, opinions are clearly mixed about this point!! (would be very interesting to know how much the drop would be, if it does happen!!).

- If you get a good price on an SO property, then that decreases the likelihood of negative equity (ie priced less than the average market value in that area). This is unlikely with New Builds, but possible with Resales.

- SO housing seems to fly off the market, I've been caught out when viewing a number of properties. So you'll not have difficulty coming to sell.

- If you choose to own a smaller share, essentially your risk is smaller than if you owned a house outright.

- Buying in London is really not affordable, without having a very good wage (or unless you want to live in an undesirable area, or a very run-down house)

- All this, points to SO seeming like a good option providing you're not on a scheme with dodgey stipulations.

My situation is:I'm looking to live in Central London. I want a 2+ bedroom flat or house (preferably house, obviously!!).I don't walk into this blindly, but neither do I want to disregard SO as an option all together. As I say, it'd be really helpful to get some fuller facts on the issue, and I'd really appreciate people's input.

I have viewed a £240k 2 bed house with garden in South Bermondsey, a 3 bed flat in Limehouse (that I thought was £270k) and a 2 bed flat in N1 for £260k. The house and Limehouse flat were 40% share of that full market value (so about 100k share and 120k share), and the N1 flat was any share amount that I could afford.

All of thse seem like good priced deals, and none of them seemed to have dodgey stipulations attached to them, and none of them are brand new builds (resales from new builds from between 3-15 years ago).

Now I can't see the market falling enough for these prices to drop drastically, and even then, I'm sure they'd recover back to those prices in the future. Is this wishful thinking?? Or am I missing some other points??

Best,

Steve

:beer::money:

EDIT: I should also mention there has been a lot of talk about "growing families" in this thread. As a single guy, this obviously doesn't concern me much. However, I didn't add it to that list of negative facts about shared ownership, as this issue seemed more to do with negative equity than being a family concern... all small families start off in small properties, and try to climb the ladder. If they fall into negative equity, moving upwards and onwards is not possible - but again, this is a downfall of ownership generally, not Shared ownership (because they overpaid for a house, or because of a falling market).0 -

Steve

You missed off the

- not being able to sublet

- always leasehold

- paying for 100% of repairs

- having to ask permission to do improvements

- restrictions on various things you'd not have if you owned 100%

Plus the

You may be contributing to the housing bubble (I don't really understand this point to be honest).

Well, if no one bought at todays high prices, then house prices would fall.

A shared ownership scheme is evidence by it's own existance that prices are too high.

How do you plan on increasing the amount you buy?

Do you think your children and grandchildren will somehow manage to afford to buy 100% or is the UK destined to buy smaller and smaller % of houses?

affordable in my book means being able to afford to buy 100% of at the time of sale. not putting off 25% in a freebie loan from the developer, or buying 25% or 50% now...

The UK is killing ambitition amongst the young - who are increasingly jobless, and homeless and hopeless!0 -

I wanted to add a more positive spin on this thread. I bought a SO flat as a teacher in West London, after renting for years. I absolutely loved the flat, it enabled me finally to have somewhere of my own. When the time came for me to leave the Housing association gave me permission to let out the property until I bought in my new location (outside London). It was a win win situation for everyone! I had 4 happy years at my flat and was able to make a small profit when i sold. I am now of course no longer a first time buyer. I am very happy with my decision to buy a SO property and would recommend it to anyone, especially in London where you might otherwise not be able to afford a place.

Good luck to anyone intending to buy SO.0 -

poppysarah wrote: »Steve

You missed off the

Plus the

You may be contributing to the housing bubble (I don't really understand this point to be honest).Well, if no one bought at todays high prices, then house prices would fall.

A shared ownership scheme is evidence by it's own existance that prices are too high.

How do you plan on increasing the amount you buy?

Do you think your children and grandchildren will somehow manage to afford to buy 100% or is the UK destined to buy smaller and smaller % of houses?

affordable in my book means being able to afford to buy 100% of at the time of sale. not putting off 25% in a freebie loan from the developer, or buying 25% or 50% now...

The UK is killing ambitition amongst the young - who are increasingly jobless, and homeless and hopeless!

Cheers for clearing this up - I figured thats what was meant by contributing to the housing bubble. I guess my feelings on that are, anyone who buys a house, SO or not, is contributing to this if the market has increased. There's no way around it! Even before SO existed, house prices increased, but I do agree they must contribute.

With regard to these points you added:

- not being able to sublet this certainly applies to most SO properties. However, out of 10 that I've viewed, maybe 3 have said I'm allowed to sublet providing I am living there. Another 3/4 have said I'm not allowed to do it, but a lot of people do and the housing association won't check up on it if you do.

- always leasehold This is common to any flat you buy, SO or not. If you buy a SO house, almost certainly you will get the freehold if you ever upscale to 100% ownership.

- paying for 100% of repairs If you are paying a service charge (which you almost certainly will be), you should be covered by this.

- having to ask permission to do improvements Again, this is typical to all leasehold properties, its not a SO thing. Funny enough, most SO flats/houses I've viewed, have specifically said you can make most typical home improvements, and you generally have the same right as any leaseholder.

- restrictions on various things you'd not have if you owned 100% Obviously this does apply to SO!

I think most of these are issues related to buying a flat, not buying into Shared Ownership.

For instance, my brother owns a flat in SW London. He can probably sublet legally (if his mortgage allows him to), unlike in many shared ownership places. However, its leasehold (as are over 90% of flats in the UK), his repairs are normally covered in the service charge unless caused by someone damaging, and he has to get permission to do any major improvements.

The bubble really is an issue though, but there's just no way around it unless you rent I guess.0 -

I guess many view it as the worst of both worlds, with neither the flexibility that renters have of moving quickly and easily (away from problem neighbours or to a new job or bigger property for example) nor the flexibility of owners to sell/rent out when circumstances change.

I may be an old cynic, but what you are told about subletting, service charges and sale restrictions by those nice agents as you're taken round a show home may not be quite how it's worded in the small print.

Most people seem to be happy with SO until the time comes to move on, when they discover a world of pain in their contract.They are an EYESORES!!!!0 -

Just to put things into perspective. Many people can sublet their SO properties. I can. 3 doors up is doing that right now.

You are responsible for repairs that are not covered under the building insurance, covered in the service fees. I.e. if the roof blows off, you are not responsible in any way for that, but you are responsible for maintaining the property. Had a spate of dodgy render on some of the houses. It's all been sorted out and re-rendered, and not at our cost.

I enquired about my windows, as they could do with replacing. If i can wait approx 2 years, they will be replacing the windows in the HA owned houses on the estate. If I wanted to join that, windows all round would cost £1600. Or I can go to the open market. £1,600 is a massive saving over open market. Decided to wait. So, there are opportunities, completely depending on your scheme. Just need to ask.

No problems with changing stuff, have fitted a kitchen and am currently looking at ripping out the bathroom. People have put conservatories on theirs etc. I wouldn't personally do that as it's a waste of money, but if they are looking to stay for 10 years...

The scheme DOES have flaws, everyone whos honest with themselves will admit that. But all this "its a scam" and "you cant do x y and z" is often hysteria and an over reaction.0 -

poppysarah wrote: »But that also means every other house has increased in price too?

True, but my situation has changed, I am able to afford a bigger mortgage, and due to the dip in house prices I am able to move to a 3 bed house from a 2 bed flat, so it has worked out for me. That may not be the same for everyone but as long as people don't view it as some kind of 'quick fix' and look at buy their 'home' it works for many.:rotfl:Ahahah got my signature removed for claiming MSE thought it was too boring :rotfl:0 -

poppysarah wrote: »Steve

You missed off the

- not being able to sublet

- always leasehold

- paying for 100% of repairs

- having to ask permission to do improvements

- restrictions on various things you'd not have if you owned 100%

Plus the

You may be contributing to the housing bubble (I don't really understand this point to be honest).

Well, if no one bought at todays high prices, then house prices would fall.

A shared ownership scheme is evidence by it's own existance that prices are too high.

How do you plan on increasing the amount you buy?

Do you think your children and grandchildren will somehow manage to afford to buy 100% or is the UK destined to buy smaller and smaller % of houses?

affordable in my book means being able to afford to buy 100% of at the time of sale. not putting off 25% in a freebie loan from the developer, or buying 25% or 50% now...

The UK is killing ambitition amongst the young - who are increasingly jobless, and homeless and hopeless!

This is the second post of yours that i have quoted today so i think we must be likeminded;).

I was saying what you said years ago to all my friends who told me in a nice way that i was rather stupid to not buy a home because the prices will never come back to normal.

One of the main reasons i chose to hold off from buying was because i couldnt believe that people were now signing up for mortgages that required 60 to 70 percent of their wage to service it. this may sound a bit silly but i just couldnt bring myself to take that much debt on knowing full well it was all a scam, it would have been pointless for me to buy a home and spend my time sat in it feeling unhappy and angry that a bank had just taken a certain amount of control on how my standard of life would be.

I could have quite easily gone the shared ownership route but it was so obvious to me even back then that its just a scheme to prop up the housing market. If a single working man on a half decent wage (well sometimes its half decent:rotfl:) cant buy a starter home in the area he lives in then obviously somethings going on, ie the banks throwing hundreds of thousands of pounds at people who couldnt afford to pay it back which enabled house prices to increase which means the banks borrow more money to people who then have to pay them even more in interest back, and those who took the money have done themselves absolutely no favours at all if they want to move up the property ladder because they made the rungs even further apart by paying the initial ridiculous price on their first home

If those who didnt absolutely 100 percent need to buy a home at the start of the boom then the boom would have died a long time ago, if people keep paying it then sellers keep raising prices its that simple, thankfully it also works the other way round so if people wont pay it then sellers must lower the prices.

I have no children myself but i do have a niece and a nephew who are one day going to want to buy their own home and i didnt want to play a part in the housing bubble that would have a very drastic affect on their lives. and now the government are throwing 250 million pounds into (HELPING) ftbs to get on the ladder. If they really wanted to help you then they would give you a plot of land to build your own home on and then you would pay a builder a lot lot less than 100k to build you a very nice detached house.

The government dont want to help FTBs they just want the housing market propped up for as long as possible in my opinion.

Not a bad scheme the new one is it, your taxes go to the government and then they let you have some of it back so that you can buy a vastly overpriced house.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards