We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Shared Ownership

Comments

-

thriftychap wrote: »You must take all SO schemes on merit as they all offer different things. I’m happy with mine. I purchased my flat at the bottom of the market in 2009 (lucky i know) costing 110k (open market). Initial share purchased is 60% (66k, - the 4k i put down = 61k = mortgage of £296 pm) which got me a fab mortgage rate due to the LTV ratio. This means i am able to make massive overpayments each month. In nearly 2 years i have paid off 5k in my mortgage as well as save for our wedding and invest. The flat was valued at 125k to 130k on Friday which means if i sold now on the open market (which i can) for 125k my 60% is worth 75k, this leaves me with 11k. Not bad for SO i think you would agree.

If you had bought 100% of the entire flat for 110k, and put down a 10% deposit which would have left you with a 99k mortgage, without even overpaying you would be sitting on 26k if you sold right now.It's not easy having a good time. Even smiling makes my face ache.0 -

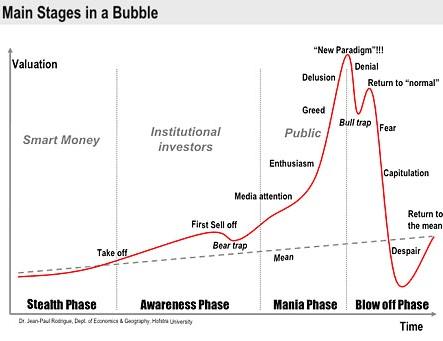

thriftychap wrote: »looking at the graphs I purchased just at the right time so i find your animations strange as its me that fels a little smug about that(March 2009). This was complete luck i conceed. My scheme suits me and my circumstances.

So you don't think the housing bubble will continue to deflate to normal levels?

2009 was the bull trap above.thriftychap wrote: »Its also wishful thinking to expect prices to drop 15% (thats how much they would need to drop for my flat to return to 2009 price)

So what your saying is your house has gone up about 17% in 2 years despite that beating national averages by miles and despite house prices falling for about 6 months till present.

Please give us some credit, we are not stupid. I am a key worker with many friends with these scam schemes. I have seen a wide range of problems these cause from criminal neighbours terrorising them, trapped unable to sell to move to bigger home for growing family or how about crippling costs or structural failings effecting whole block.

Shared ownership is a scam to get you to over pay it is not your friend.thriftychap wrote: »But i guess you have a crystal ball?

No but I have common sense, back ground in risk and an in depth study of macro economics and housing issues.

A home is likely to be your most expensive purchase ever, so it is worth doing your home work.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

Shared Ownership & Shared Equity schemes exist for one purpose only - to sell property that is overpriced. If you can't afford to buy without using a scheme then please go in with your eyes open and do your homework very carefully beforehand.

And work out what % you hope your children to buy ... and what even smaller % your grandchildren will...0 -

i expect my children, and certainly my grandchildren, to get their own roofs over their heads.0

-

-

i expect my children, and certainly my grandchildren, to get their own roofs over their heads.

Not if guliable people continue with shared equity scams pumping up the housing bubble. Your kids will have to buy a 3% stake with a 97% rent and the way service charges go up with RPI a£15,000 a month service charge.

The scheme is a scam to inflate the property bubble.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

THE_GHOULS_BEDSIT wrote: »It'd be prudent not to listen to the advice of people like Brit. Sadly for him, he is destined to live in a smelly bedsit for the rest of his days.

Better than bangkok eh sibley?0 -

HAMISH_MCTAVISH wrote: »Yes.

It's over.

It lasted from late 07 until early 09, and prices have since risen by around 10%, then fell back a couple of percent, and are now rising again. We are in the post-crash bumping-along-the-bottom phase.

Sure, you'll see minor fluctuations both up and down for the next couple of years, but nothing dramatic either way.

Rising again? lol By how much? And this is the famous 'Spring Bounce'

Except the 'Spring Bounce' will be flat because mortgage approvals are nose diving big time.0 -

Not if guliable people continue with shared equity scams pumping up the housing bubble. Your kids will have to buy a 3% stake with a 97% rent and the way service charges go up with RPI a£15,000 a month service charge.

The scheme is a scam to inflate the property bubble.

i agree it's ridiculous....but i honestly don't believe the market is going to correct itself. basic economics: decent housing is a scarcity in densely populated britain. scarce things = high price (for houses anyway, flats might see values drop)

if renting were more friendly and not so inflated (how many people profit off my rent? let's see....there's the bank, of course....and the landlord....and the letting agency--3 people! hence the high rent) people wouldn't care so much. laws are not as tenant friendly as other places i've lived. i can't even hang a picture on the wall without clearning it with the letting agency (who takes months to get to me on anything)!

a house is still a good investment. as long as you go into these shared euqity schemes knowing that you're not just taking out a mortgage, but a loan as well, then i don't see what the big deal. besides, SE is only available on a select number of plots in any development so i'd like to see how much they really contribute to keeping house prices inflated.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards