We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Gold is not money (but it might be a good investment)

Options

Comments

-

you contradict yourself in the very next sentenceBullfighter wrote: »If they print they default through inflation.

it should be 'The bubble may burst'.Bullfighter wrote: »The bubble will burst.0 -

I suspect it might be worth putting SOME money into gold as a hedge against inflation (as inflation may be used by governments as a way out of their debt problems). However there is a risk attached if instead the world lurches into a prolonged period of deflation.

If I had 200k to spare (I don't) I'd probably prefer property - as, whatever happens, I'd have something that someone could live in (possibly me), and in the meantime, something that can generate an income. Gold can't do either.

Fair point however gold is portable, fungible and liquid. Houses are not.0 -

-

i'd invest in gold but it's not my current investment priorityBullfighter wrote: »Fair point however gold is portable, fungible and liquid. Houses are not. 0

0 -

Bullfighter wrote: »Sure, I mean we are heading for growth like it was 1999. What could possibly keep gold from increasing in value..??

Our fiat currency system is broken. The game of musical chairs has started , the last country to devalue doesn't get to sit down.

Only the economies of Europe and the US are in trouble. Things are looking very good in Asia and Australia right now.0 -

Only the economies of Europe and the US are in trouble. Things are looking very good in Asia and Australia right now.

You dont think China is heading for a big property crash? Singapore and others are also in a huge property bubble.

Dont know about Australia were they one of the first to start raising the base rate? They should have foreclosures staring before the rest of the world start raising rates.0 -

Only the economies of Europe and the US are in trouble. Things are looking very good in Asia and Australia right now.

HAHAHA

:rotfl::rotfl::rotfl::rotfl::rotfl:

http://www.nytimes.com/2010/07/15/business/global/15yuan.html?_r=1

http://www.businessinsider.com/default-fears-soar-for-australian-financials-2010-5#ixzz0nEkxEA8R

This can't be contained. The global monetary system of infinitely expanding debt based fiat money relies on infinite resources (energy etc). It may last another decade, but I doubt it.0 -

Bullfighter wrote: »HAHAHA

:rotfl::rotfl::rotfl::rotfl::rotfl:

http://www.nytimes.com/2010/07/15/business/global/15yuan.html?_r=1

http://www.businessinsider.com/default-fears-soar-for-australian-financials-2010-5#ixzz0nEkxEA8R

This can't be contained. The global monetary system of infinitely expanding debt based fiat money relies on infinite resources (energy etc). It may last another decade, but I doubt it.

We'll see.

If the whole of the $190,000,000,000 that has been written off balance sheet by Chinese banks was to default entirely, that would cost the Central Bank (should they chose to bail out private investors) less than 10% of its US Dollar reserves leaving more than 90% of its US Dollar reserves entirely intact plus all of their other reserves still in one piece. Hardly a crisis.

Australian citizens have very high levels of debt on average. However, Australia's mines allow the rest of Asia to build the infrastructure they require for a 19th Century economy, let alone that for the 21st Century and her agriculture feeds Asia.

Europe and the US are in a lot of bother due to massive public and private debts combined and unsustainable pensions and welfare policies. The Asian economies (excluding Japan) do not have those problem thankfully. Don't confuse the US and Europe with the whole world.

I'm happy to have given you a laugh. Sadly, I think that your humour comes from you not understanding what is happening and the reasons for it. 'It's the bankers innit' doesn't begin to explain what is going on.0 -

Bullfighter wrote: »I'm bearish on house prices, I can give you dozens of reasons why.

You're bearish on gold but can only show an upward trend on a graph to support your position.

Some believe gold is a bubble. It is not. The price of gold, however, tracks a bubble and that is why it is mistaken for one.

The real bubble is government debt, not gold. Government debt is a bubble that hasn’t yet burst; one that has grown even more rapidly in the last two years as almost all nations went far deeper into debt after the 2007/2008 global collapse.

It tracks a bubble because it is a hedge, so gets more expensive the more likely the hedge is needed.

Good explanation, it is true that gold tracks the bubble because it is a hedge.

In the 1930s gold revalued itself to account for all the currency and the same thing happened in 1980 it caught up with the amount of currency. This time it has to go over $15000 oz to catch up with the amount of currency. As they add more currency to the worlds supply the great that $15k figure will be.

All this fiat currency tries to land on the same small pile of precious metal left in the world.0 -

Housebear51 wrote: »Good explanation, it is true that gold tracks the bubble because it is a hedge.

In the 1930s gold revalued itself to account for all the currency and the same thing happened in 1980 it caught up with the amount of currency. This time it has to go over $15000 oz to catch up with the amount of currency. As they add more currency to the worlds supply the great that $15k figure will be.

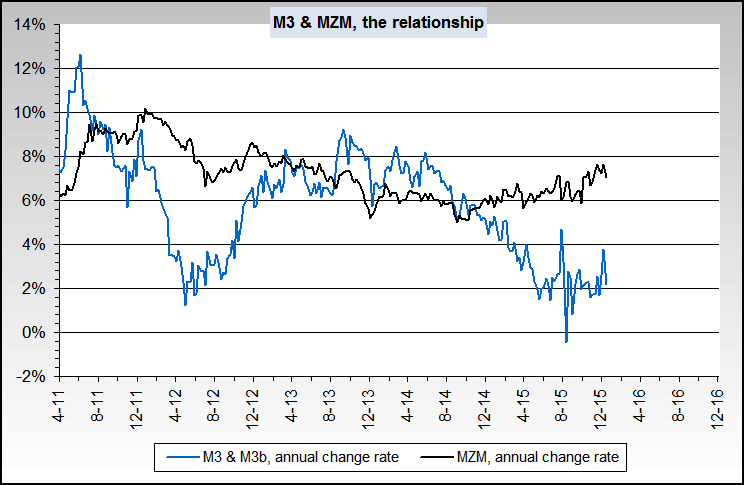

The money supply is falling. US M3 is falling, UK M4 growth is falling, Euro M3 is falling. The money supply is falling. There will be no international inflation while the money supply is falling.

You guys are using words like bubble and hedge with no idea about what they mean as far as I can see.

US M3:

UK M4

Euro M3: 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards