We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Swinton Cancellstion fee

Comments

-

if not, I think he's been hard done by.

Does he not have a telephone or email where he can ask??0 -

Yes, someone driving 1mph over the limit would be an honest mistake, hence the 10 per cent plus 2 rule. Missing a 30mph sign would indicate that the driver wasn't paying attention. This brings me back to my earlier point: if the cancellation fee was made explicit, the OP can have no cause for complaint; if not, I think he's been hard done by.

And how do you know it was not explicit? You are assuming it wasn't.

Perhaps you should look at the terms and conditions that custardy posted a few posts ago. Looks pre-contract to me.Best Regards

zppp 0

0 -

Oh look here you are.............that took me about 2 minutes to find

http://www.matthewsguide.co.uk/LIN/swinton.php0 -

Hi Brize,

You and tonyenglish are CONSUMERS

You don't get to dictate to companies how they structure their charges (unless you want to start you own company).

It's NOT your choice.

Get over it.

I don't like the way Ryanair do things, but I think I can live with my choice NOT to fly with them.

It's a FREE COUNTRY providing companies are acting within the law/guidelines.

If you don't like them then DON'T SHOP WITH THEM, but of course that does require a little research.

Kindly stop shouting at me - repeated use of caps is aggressive and unnecessary.

No one's trying to dictate anything. The OP felt unfairly penalised and I felt some sympathy for him. You, along with most of the other contributors to this thread, felt that the OP only had himself to blame.

You're entitled to your opinion, but please don't try to foreclose discussion by telling other forum members to 'get over it'.0 -

Oh look here you are.............that took me about 2 minutes to find

http://www.matthewsguide.co.uk/LIN/swinton.php

Are you suggesting that consumers should be expected to go to a third-party website before buying insurance?0 -

Oh look here you are.............that took me about 2 minutes to find

http://www.matthewsguide.co.uk/LIN/swinton.php

That website is highly amusing, it's worth having a look round to see the inconsistent information they give, generalisations etc etc0 -

And how do you know it was not explicit? You are assuming it wasn't.

Perhaps you should look at the terms and conditions that custardy posted a few posts ago. Looks pre-contract to me.

just to clarify,those T&C's are before you sign up

that page i have posted is page 10 of 14

the 9 pages before relate to the policy you have just set up with regard to car,driver,history etc

page 10 is the first page of general T&C's

at the bottom of every page is a "need help call 0800 107 7156" message0 -

And how do you know it was not explicit? You are assuming it wasn't.

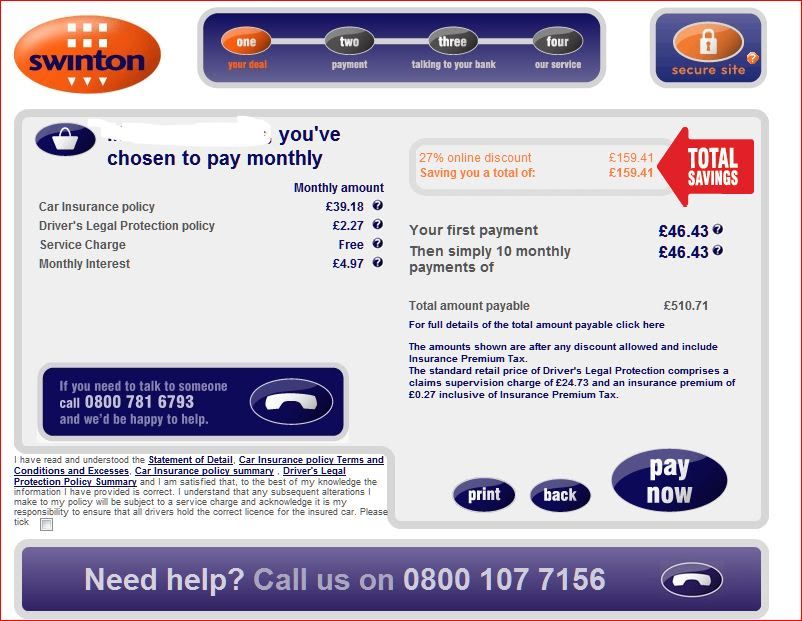

I just ran a car insurance quote through the Swinton site and followed the process through to the point where it asked me to enter my credit card details. At no point was it made explicit that a charge would apply if the policy was cancelled within the cooling-off period.

On the page where I exited the site, there is a paragraph of small print where the purchaser is asked to confirm that they have read and understood six linked multi-page documents. That paragraph includes the following text:I am satisfied that, to the best of my knowledge, the information I have provided is correct. I understand that any subsequent changes I make to my policy will be subject to a service charge...

Would it really be too much to ask for the cancellation charge to be made explicit at this stage?

There are two issues here: First, consumers can't reasonably be expected to read six multi-page documents when buying insurance online. This is why the FSA allow 14 days for cancellation after the policy documents have been received.

Second, most consumers are vaguely aware that they have statutory cooling-off rights, but they won't be familiar with the finer points of the legislation. In my view, companies like Swinton need to make clear to their clients, at the point of sale, that they may still incur a fee if the policy is cancelled within the cooling-off period.0 -

I just ran a car insurance quote through the Swinton site and followed the process through to the point where it asked me to enter my credit card details. At no point was it made explicit that a charge would apply if the policy was cancelled within the cooling-off period.

On the page where I exited the site, there is a paragraph of small print where the purchaser is asked to confirm that they have read and understood six linked multi-page documents. That paragraph includes the following text:I am satisfied that, to the best of my knowledge, the information I have provided is correct. I understand that any subsequent changes I make to my policy will be subject to a service charge...

Would it really be too much to ask for the cancellation charge to be made explicit at this stage?

There are two issues here: First, consumers can't reasonably be expected to read six multi-page documents when buying insurance online. This is why the FSA allow 14 days for cancellation after the policy documents have been received.

Second, most consumers are vaguely aware that they have statutory cooling-off rights, but they won't be familiar with the finer points of the legislation. In my view, companies like Swinton need to make clear to their clients, at the point of sale, that they may still incur a fee if the policy is cancelled within the cooling-off period.

the first link takes you to the page with charges0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards