We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Rightmove asking prices - +0.1% for March

Arch-Angel

Posts: 184 Forumite

Rightmove's latest house price index has reported a change of just 0.1% for March:

http://www.rightmove.co.uk/news/hous...se-price-index

Key Points:

Or it could just be another indicator for the usual suspects to argue over! :rotfl:

FWIW I personally think that the next 3 months is the key to understanding what's going to happen over the next 2-3 years. If prices continue to hold their own then the market will generally continue it's recovery. But if prices stall then a -5% drop by 2011 is a real possibility.

(Yes, I did put this in another thread - I'm just curious how the various bulls/bears on here will react).

http://www.rightmove.co.uk/news/hous...se-price-index

Key Points:

- Virtual price standstill as new sellers ask just 0.1% (£216) more – the lowest rise ever recorded in March

- Previously snowbound sellers return, leading to highest new property supply for 18 months

- First quarter of 2010 shows overall asking price gain of 3.7% (£8,151) despite distortions from severe weather

- Potential first-time buyers still struggling to enter home-ownership

Or it could just be another indicator for the usual suspects to argue over! :rotfl:

FWIW I personally think that the next 3 months is the key to understanding what's going to happen over the next 2-3 years. If prices continue to hold their own then the market will generally continue it's recovery. But if prices stall then a -5% drop by 2011 is a real possibility.

(Yes, I did put this in another thread - I'm just curious how the various bulls/bears on here will react).

Never attach your ego to your position....

0

Comments

-

More for sale, less people buying, not enough money in mortgage market to support hosue prices... hence

PRICES TO SKYROCKET (c) Hamish McCheesenob.0 -

Perhaps just noise but

"the lowest rise ever recorded in March"

might be significant. Time will tell.0 -

All don the other other day when it came out.

but what was Feb? = +3.4% (if I remember right)

What has it been for the 1/4 = +3.7%

What is that annualised = Over +11.5%.

It is just a month and asking prices are a poor way of judging the market a sold prices are the best gage.

But if you do like the figures the 1/4 and they year make bad reading currently for those who want to buy IMHO.0 -

There can be no true rise in prices nationally until approvals and transactions are back at normal levels, as what this indicates is it's pure lottery as to whether you sell your house quickly with a single digit drop form peak, or whether it stays on the market for years.

Unfortunately for sellers, those approvals and transactions are a long, long way from normal, and the only thing that will push those figures up is a drop in prices. I think I've said before, you can't have both as the money no longer exists.

What will be interesting over the next couple of years is what happens when the government banks are put back into the private sector, the governmant schemes dry up and IR's climb. IMO, if you can sell now with a single digit drop from peak, snap the buyer's hand off and walk away feeling smug knowing that you've probably got the best deal you will get for a decade or more.0 -

HammerSmashedFace wrote: »There can be no true rise in prices nationally until approvals and transactions are back at normal levels, as what this indicates is it's pure lottery as to whether you sell your house quickly with a single digit drop form peak, or whether it stays on the market for years.

I agree the market will not be normal until overall transactions hit around 80K per month (not mortgage approvals)0 -

I agree the market will not be normal until overall transactions hit around 80K per month (not mortgage approvals)

I think it needs to be higher than that even, weren't there at least 90k per month at the bottom of the housing crash of the 90's ?, with the average near or over 100k for the 1999-07 ?0 -

HammerSmashedFace wrote: »I think it needs to be higher than that even, weren't there at least 90k per month at the bottom of the housing crash of the 90's ?, with the average near or over 100k for the 1999-07 ?

But were 100% mortgages not available then? (so not really a normal market but a boom market)

I believe 80K-85K transactions = around -5%- 0% +5% HPI. (stagnant) 0

0 -

-

HammerSmashedFace wrote: »Yeh I'd go with that. So what are transactions currently ? And have they been rising or falling over the past 3 months ? Genuine questions, as I don't exactly know at this point and can't be arsed to google it.

I think the closest had been 70,000 recently (can't remember the date but think it was a date in the autumn)

Transactions are low for sure at the moment. But their could be a possibility of a nomalish market this summer. So perhaps for the first time in a few years we will see where we actually are.0 -

that's not actually true - you can have 100,000 plus approvals and have house prices fall, so you can have low transaction levels and see prices rise.HammerSmashedFace wrote: »There can be no true rise in prices nationally until approvals and transactions are back at normal levels

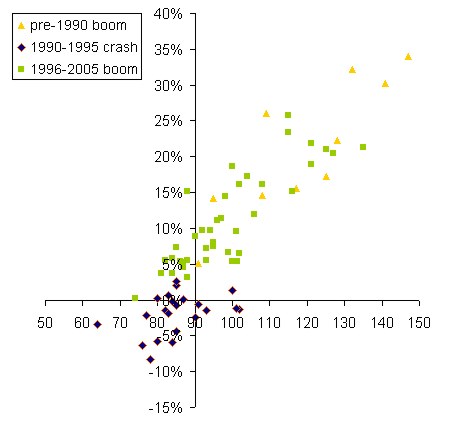

see Really's chart.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards