We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Subject Access Request and Signed Credit Agreement

skylined_gtr

Posts: 43 Forumite

Hi All

Quick question, on my SAR's to the companies I have asked for a

"....copy of the Consumer Credit Agreement allegedly signed by me clearly showing my signature in order to confirm that it is I who obtained this credit from you. "

If they haven't provided a signed consumer credit agreement and only a copy of the terms of the agreement (unsigned) does that mean they are in breach? If so, what are they in breach of - I forget the line to quote!

Thanks very much.

Quick question, on my SAR's to the companies I have asked for a

"....copy of the Consumer Credit Agreement allegedly signed by me clearly showing my signature in order to confirm that it is I who obtained this credit from you. "

If they haven't provided a signed consumer credit agreement and only a copy of the terms of the agreement (unsigned) does that mean they are in breach? If so, what are they in breach of - I forget the line to quote!

Thanks very much.

0

Comments

-

Send them the following:skylined_gtr wrote: »If they haven't provided a signed consumer credit agreement and only a copy of the terms of the agreement (unsigned)

I note that you have replied to the above by sending your companies current Terms and conditions I must inform you that this is not sufficient to comply with the request and that your company is still in default under the act.

To clarify, just sending the Terms and Conditions is a breach of the Act and Regulations as, apart from the information that the Regulations provide that you may exclude, the copy must be a “true copy” of the agreement.

This breach of the agreement can be demonstrated as follows;

As you will know section 180(1) (b) authorises, “the omission from a copy of certain material from the original, or the inclusion of certain material in condensed form.” This refers to statutory instruments made under the heading Copies of document regulations and in this care in particular to SI 1983/1557.

Before leaving section 180 there are two other sections that should be remembered these are:

Section 2(2) (a) A duty imposed by any provision of this Act (except section 35) to supply a copy of any document is not satisfied unless the copy supplied is in the prescribed form and conforms to the prescribed requirements;

And more importantly

Section 2(b) A duty imposed by any provision of this Act (except section 35) to supply a copy of any document is not infringed by the omission of any material, or its inclusion in condensed form, if that is authorised by regulations.

You will see that this quite clearly states that whilst certain items may be left out of the copy document the rest of the document must be in the form and contain all items as prescribed by the regulations.

Turning to the regulations regarding what may be omitted from these copies these are contained with SI 1983/1557.

The regulations state:

(2) There may be omitted from any such copy-

(a) any information included in an executed agreement, security instrument or other document relating to the debtor, hirer or surety or included for the use of the creditor or owner only which is not required to be included therein by the Act or any Regulations thereunder as to the form and content of the document of which it is a copy;

(b) any signature box, signature or date of signature (other than, in the case of a copy of a cancelable executed agreement delivered to the debtor under section 63(1) of the Act, the date of signature by the debtor of an agreement to which section 68(b) of the Act applies);

It is quite clear what can be omitted from the copy document, this again asserts that all other details of the agreement should presented in form and content as required by the regulations.

The requirements of the Agreement regulations 1983/1553 are very explicit in describing the form and content of an agreement and this as I have demonstrated also applies to the copy of any such agreement with the above mentioned proviso.

Nowhere within these regulations does it state that part of the agreement can be presented on a separate document headed terms and conditions.

It does state that all terms and conditions should be within the agreement document and is explicit of the form in which it is presented.

I hope this explains why your reply was unacceptable I await a True copy of my agreement and would remind you again that whilst the request has not been complied with the default continues

Yours faithfullyClick here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Hey 10past6 - you're back!!!!! I was hoping you would reappear as I was trying to figure out how to have the judgement on my CCJ overturned, you might remember you were helping me with the ID fraud situation?

Good to see you're back, stick around I need you! lol0 -

I've been away for sometime due to family bereavement, I not on here as often as I used to be, but will help wherever I can, unfortunately, I don't recall your case, can you link me to it please?skylined_gtr wrote: »you might remember you were helping me with the ID fraud situation? Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Oh I'm very sorry to hear that - please accept my condolences. I can only relate as I have just come back from the funeral of my 21 year old sister who died very suddenly in a car crash in Portugal :-(

Link to the original post below. I have sent off the SAR's to all the companies and have had many different responses but thankfully not one has come back with a signed credit agreement and it has been a few months now!

I am now trying to deal with the CCJ that was obtained and the Charging Order that was placed onto my house as per the thread below. I remember you said to fill out a form N244 (If memory serves me) but I might need some hand holding! More than happy to have a go at filling it out then posting it up here for your review?

http://forums.moneysavingexpert.com/showthread.html?t=17170730 -

PS, here is a later thread I started in your absence in the hope you would come along and see it :-)

http://forums.moneysavingexpert.com/showthread.html?t=1971723&highlight=skylined_gtr0 -

Serving a SAR will allow you to see what paperwork a DCA may have on you . So if there,s no signed CCA . NO ENFORCEABLE DEBT .0

-

Thanks for confirming as well :-)0

-

Hi again everyone... I wrote to them with the following:

"Barclaycard

Customer Relations Department

Barclaycard House

PO Box 5592

Northampton

NN4 1ZY20 Oct 2009

Dear Sir or Madam

REF: Alleged credit obtained by Mr xxxxx of the above address – Response to your letter 6I52/xxxxxxxxxx

Thank you for your letter dated 10 June 2009, however there are matters and particulars that have not been addressed.

1. In my letter to you, I requested a copy of the Consumer Credit Agreement allegedly signed by me clearly showing my signature in order to confirm that it is I who obtained this credit from you. This has not been supplied. Please answer why. I also note that you have replied to the above by sending your companies current Terms and conditions I must inform you that this is not sufficient to comply with the request and that your company is still in default under the act.

To clarify, just sending the Terms and Conditions is a breach of the Act and Regulations as, apart from the information that the Regulations provide that you may exclude, the copy must be a “true copy” of the agreement.

This breach of the agreement can be demonstrated as follows;

As you will know section 180(1) (b) authorises, “the omission from a copy of certain material from the original, or the inclusion of certain material in condensed form.” This refers to statutory instruments made under the heading Copies of document regulations and in this care in particular to SI 1983/1557.

Before leaving section 180 there are two other sections that should be remembered these are:

Section 2(2) (a) A duty imposed by any provision of this Act (except section 35) to supply a copy of any document is not satisfied unless the copy supplied is in the prescribed form and conforms to the prescribed requirements;

And more importantly

Section 2(b) A duty imposed by any provision of this Act (except section 35) to supply a copy of any document is not infringed by the omission of any material, or its inclusion in condensed form, if that is authorised by regulations.

You will see that this quite clearly states that whilst certain items may be left out of the copy document the rest of the document must be in the form and contain all items as prescribed by the regulations.

Turning to the regulations regarding what may be omitted from these copies these are contained with SI 1983/1557.

The regulations state:

(2) There may be omitted from any such copy-

(a) any information included in an executed agreement, security instrument or other document relating to the debtor, hirer or surety or included for the use of the creditor or owner only which is not required to be included therein by the Act or any Regulations thereunder as to the form and content of the document of which it is a copy;

(b) any signature box, signature or date of signature (other than, in the case of a copy of a cancelable executed agreement delivered to the debtor under section 63(1) of the Act, the date of signature by the debtor of an agreement to which section 68(b) of the Act applies);

It is quite clear what can be omitted from the copy document, this again asserts that all other details of the agreement should presented in form and content as required by the regulations.

The requirements of the Agreement regulations 1983/1553 are very explicit in describing the form and content of an agreement and this as I have demonstrated also applies to the copy of any such agreement with the above mentioned proviso.

Nowhere within these regulations does it state that part of the agreement can be presented on a separate document headed terms and conditions.

It does state that all terms and conditions should be within the agreement document and is explicit of the form in which it is presented.

I hope this explains why your reply was unacceptable I await a True copy of my agreement and would remind you again that whilst the request has not been complied with the default continues and I will not hesitate to report you to the FOS/FSA/OFT for this matter if you do not comply within the next 14 days.

2. I have tried to contact you on the number provided on your letter but have been told by call centre staff that there is no way to contact your department by phone that they are aware of. 0844 811 9111 is printed on your response so I assume there is a method to contact you via phone, therefore in your response to me please confirm the correct contact details for the department.

3. I spoke to xxxxxxx on the 22nd of September 2009 at 11:40am who put me through to an internal department where I spoke to ‘xxxxxxxx'. xxxxxxx informs me the cost of the SAR is only £1, therefore please refund the £9 outstanding back to me by way of cheque or Postal Order made out to me.

4. Monument have confirmed that they have forwarded my SAR to them, on to you (please see copy of the letter attached). As the SAR is required once from any one company I request you immediately refund the £10 payment submitted to Monument that they have now passed onto you, by way of cheque or Postal Order made out to me.

**Please remember that if it is discovered that you have collected monies to which you were not entitled, then I shall be reclaiming them and the previously sent Data Protection Act subject access request fee.**

5. I need to make you aware that the details you hold pertaining to me are incorrect and therefore this needs to be addressed. The addresses you hold for me are nothing to do with me (apart from the one at the top of this letter). Please remove the incorrect data as it is causing me significant difficulty with Debt Collection Agencies chasing me for debts I do not owe to you or anyone else.

6. Lastly, I do not acknowledge any debt or any previous trading with you and therefore you should have no history of transactions between you and I or my personal details. Please remove these from your systems immediately.

Yours sincerely

Mr xxxxxxxxx"

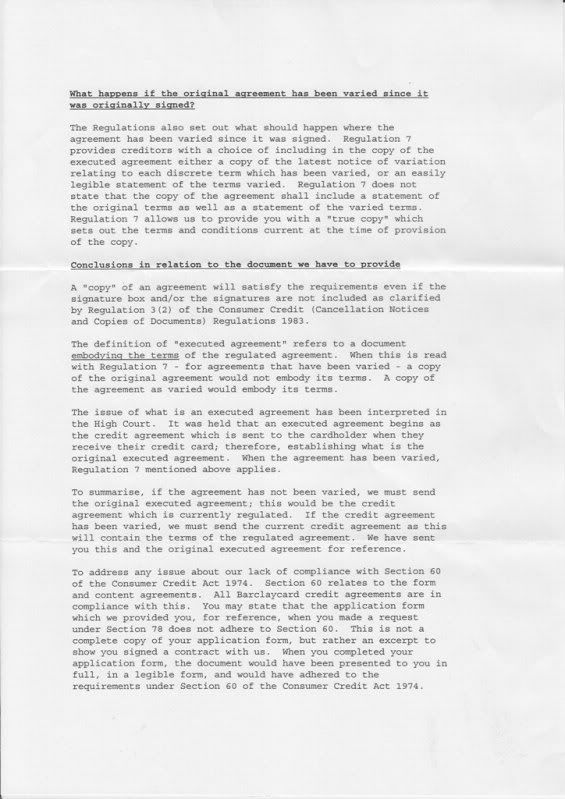

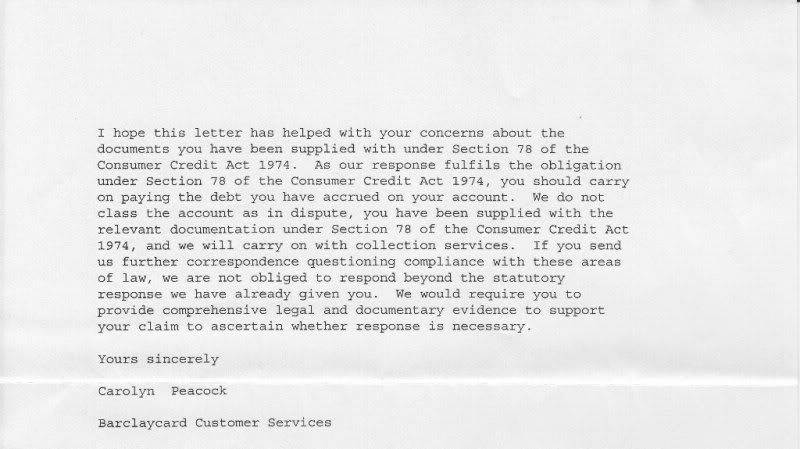

So this is what they have replied with:

They basically ignored everything I said?!!! Help!0 -

[QUOTE=_skylined;discussion/2022287]Hi Allgtr

Quick question, on myto the companies I have asked for aSAR's

"....copy of the Consumer Credit Agreement allegedly signed by me clearly showing my signature in order to confirm that it is I who obtained this credit from you. "

If they haven't provided a signed consumer credit agreement and only a copy of the terms of the agreement (unsigned) does that mean they are in breach? If so, what are they in breach of - I forget the line to quote!

Thanks very much.[/QUOTE]

I should point out that a creditor can prove that credit or goods have been obtained by supplying statements and details of the account , payments etc . The point of a CCA request is to see if they have the correct paperwork to have the debt enforced in a court . If you are disputing that it was not you that obtained the credit /goods etc that is a differant matter.0 -

I would say they have shot themselves in the foot . Towards end of letter they say about the application form . But a CONSUMER CREDIT AGGREMENT should be sent to you for signature, and returnto them, before a card was sent . A copy of this would be needed to be shown in court , if it ever went that far , to have the agreement enforced.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards